Introducing $RAVE: The Pulse Behind a Decentralized Cultural Movement

RaveDAO

RaveDAO

Introducing $RAVE: The Pulse Behind a Decentralized Cultural Movement

Every cultural movement begins with rhythm, a pulse that carries people toward something bigger than themselves. In the 90s, that rhythm moved through warehouses and dancefloors. Today, it moves through networks and code. What has always stayed constant is the human desire to connect.

RaveDAO exists for that connection. What began as a global series of live gatherings in cities like Singapore, Dubai, Seoul, Miami, Hong Kong, Brussels, Bangkok, and Amsterdam has grown into a network where entertainment meets infrastructure. RaveDAO connects artists, organizers, and fans through a shared system that blends cultural experience with on-chain participation.

Now, with the launch of $RAVE, that network gains its own economy. $RAVE is the coordination layer that links every chapter, event, and creator within the ecosystem. It powers governance, rewards, and real-world activity such as payment, turning culture itself into an active protocol.

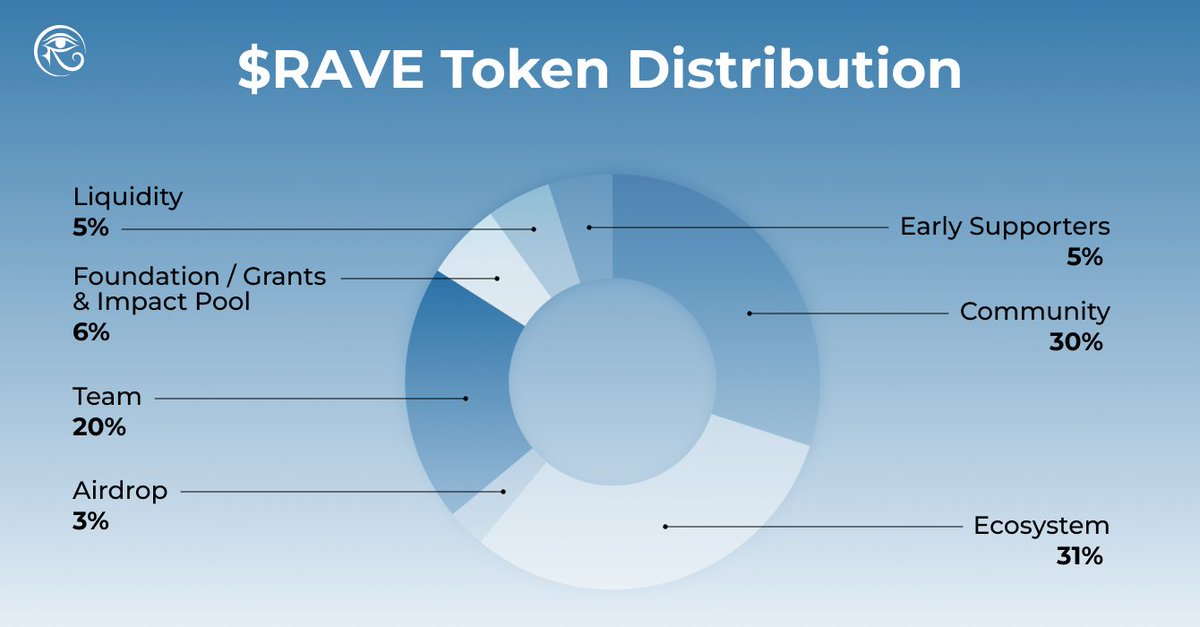

Token Allocation

The total supply of 1 billion $RAVE tokens forms the foundation of RaveDAO’s cultural economy. The allocation is structured to support long-term sustainability, rewarding real participation and ensuring growth is distributed across the community.

- Community (30%): Empower local chapters, builders, and loyal fans to grow the global community through governance grants, incentives, and rewards.

- Ecosystem (31%): Drive brand/ecosystem integrations, partner activations, and technology infrastructure for global user acquisition and onboarding.

- Initial Airdrop (3%): Initial Airdrop to previous RaveDAO event attendees and contributors.

- Foundation / Impact Pool (6%): Long-term reserves for philanthropy (e.g. Rave for Light) and other initiatives governed by the DAO.

- Team & Co-Builders (20%): Incentivize founding team, core contributors, strategic advisors and long-term collaborators who power the ecosystem’s evolution.

- Early Supporters (5%): Recognize and reward early believers and partners who helped bootstrap the movement.

- Liquidity (5%): Ensure smooth market access and stability for participants across exchanges.

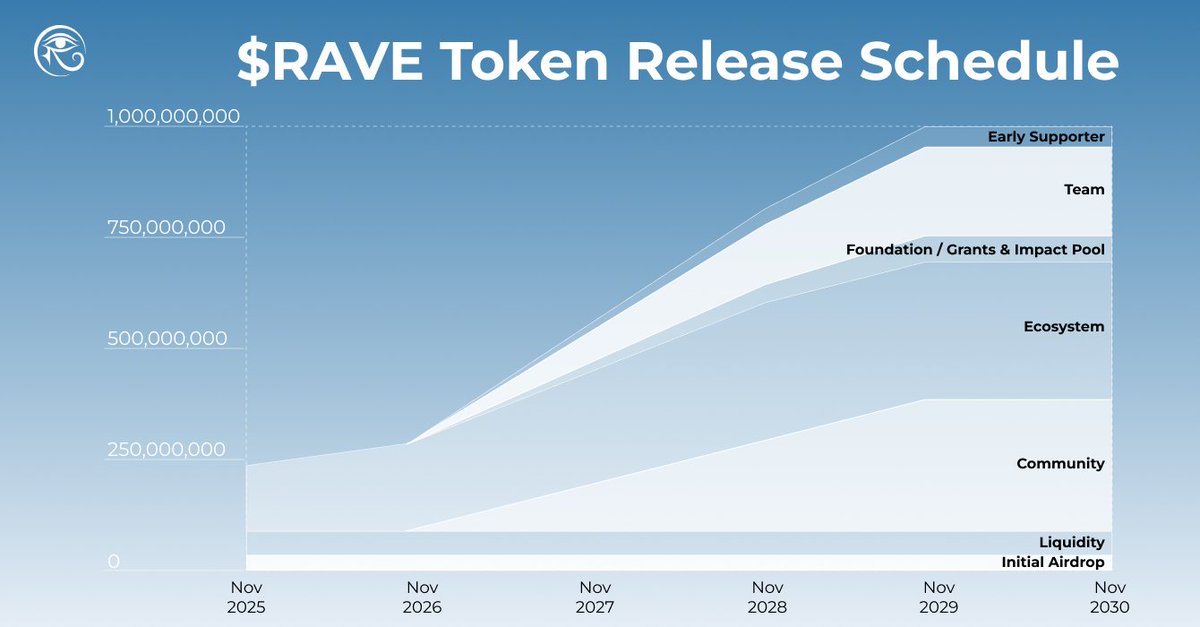

Token Distribution Schedule

At the Token Generation Event, approximately 23.03% of the total supply will enter circulation, primarily allocated toward ecosystem, initial airdrop, and liquidity purposes.

The remaining tokens will follow a 12-month cliff and 36-month linear vesting schedule. This gradual approach ensures stability and keeps incentives aligned with long-term participation and growth.

The vesting structure by category is as follows:

- Community (30%) – 12-month cliff, 36-month vesting.

- Ecosystem (31%) – 15.03% unlocked at TGE; remaining 15.97% with 12-month cliff, 36-month vesting.

- Initial Airdrop (3%) – 100% unlocked at TGE.

- Foundation / Impact Pool (6%) – 12-month cliff, 36-month vesting.

- Team & Co-Builders (20%) – 12-month cliff, 36-month vesting.

- Early Supporters (5%) – 12-month cliff, 36-month vesting.

- Liquidity (5%) – 100% unlocked at TGE.

Token Utilities

$RAVE is designed for participation. $RAVE allows every participant to play a role in building and owning the culture they support. Its utilities are structured across three key layers: B2B, B2C, and DAO Governance.

B2B Utilities: IP, Licensing & Staking

- Stake-to-License: Event organizers stake $RAVE to franchise RaveDAO’s IP, operating under a global standard inspired by Ultra Music’s model.

- Local Chapter Activation: Launch new “Road to RaveDAO” chapters through DAO-approved grants.

- Vendor Qualification: Production, beverage, and experience partners stake $RAVE to qualify as verified providers.

- Artist & Label Collaborations: Artists stake $RAVE to co-launch digital collectibles, remix rights, or Web3 collaborations under the RaveDAO brand.

B2C Utilities: Experience & Engagement

- Exclusive Access: Stake $RAVE to unlock VIP tiers, artist meet-and-greets, and early event access.

- Digital Collectibles: Participate in limited artist drops, collaborations, and NFT releases.

- Payments: Use $RAVE for tickets, tables, and on-site purchases at flagship events and chapters.

- Community Rewards: Earn $RAVE by engaging in content creation, referrals, and participation.

DAO Governance: The Community Decision Layer

- Voting Rights: Decide on event locations, artist lineups, venue selections, and philanthropic allocations.

- Chapter Proposals: Submit and vote on new “Road to RaveDAO” chapter activations.

- Ecosystem Grants: Direct funding toward artists, community builders, and partner projects.

Value Accrual & Deflationary Design

RaveDAO’s ecosystem naturally strengthens $RAVE through continuous use and reinvestment.

- IP Expansion Flywheel: Every festival, chapter, and collaboration reinforces token demand and cultural visibility.

- Event Revenue Loop: Real-world utilities such as ticketing, NFTs, and sponsorships continually drive token circulation.

- Buyback & Burn: A portion of event profits is used to repurchase and permanently remove $RAVE from supply.

- Stake-to-Earn Utility: Organizers, artists, and vendors earn yield, discounts, or benefits by staking.

The result is an economy that grows through real activity and cultural reach, not short-term speculation.

The Future of $RAVE

$RAVE represents more than access. It represents a sense of belonging and a shared stake in the culture being built. It gives communities the tools to co-create, capture value, and channel impact back into the world.

From flagship festivals that unite thousands to local chapters that spotlight emerging talent, every use of $RAVE strengthens the network. As RaveDAO expands from Asia to Europe and the Americas, the token becomes both a medium of participation and a store of cultural capital - proof that creativity and value can grow together.

By 2027, RaveDAO aims to host over 50 decentralized chapters, welcome 300,000+ annual attendees, and channel a portion of every event’s proceeds toward causes like Tilganga Eye Center in Nepal and Nalanda West in Seattle.

$RAVE is not just a token. It’s a testament to what happens when music, technology, and humanity move in sync, a rhythm that doesn’t stop when the music fades. Let’s $RAVE and have fun with it.

About RaveDAO

RaveDAO is a global community uniting music, technology, and purpose. Since their first sold-out event at Dubai 2024, they have expanded across Europe, the Middle East, North America, and Asia, hosting world-class experiences with over 100,000 total attendees and 3,000+ attendees for each event.

RaveDAO has worked with top-tier artists like Vintage Culture, Don Diablo, Chris Avantgarde, Lilly Palmer, MORTEN, Bassjackers, and GENESI and has support from WLFI, Binance, OKX, Bybit, Bitget, and Polygon.

RaveDAO is redefining live entertainment in Web3 and has active partnerships with 1001Tracklists, AMF, and Warner Music.

Beyond the dance floor, RaveDAO channels energy and attention toward impact. In 2025 alone, proceeds from its events helped restore sight to 400+ cataract patients in Nepal and fund over 150 meditation programs across the U.S.

Crypto analyst Murad returns with 116 data-backed reasons arguing the bull run is far from over. From strong ETF accumulation and stablecoin inflows to macro liquidity shifts, he predicts Bitcoin could stay in a multi-year uptrend through 2026.

TechFlow/2 days ago

From BONK to TRUMP, 2024–25 was crypto’s most chaotic wealth engine. Airdrops, AI coins, and celebrity rugs fueled the memecoin supercycle before collapse. What began as freedom and fun ended as a PvP casino—proof that chaos built the culture.

Adam/3 days ago

Coinbase Ventures outlines 2026’s top crypto frontiers: RWA perpetuals, prediction market terminals, unsecured onchain credit, privacy DeFi, and AI-robotics intersections. The next breakout startups will merge finance, AI, and onchain innovation.

Coinbase Ventures/5 days ago

From ICOs to NFTs to memes, every crypto cycle birthed an era where “dumb money” got rich fast. But after nine months of stagnation and no new wealth engine, the casino’s gone quiet. Without a new mania, CT isn’t bearish—it’s just bored.

IcoBeast.eth/2025.11.27

By spotting illiquid Harmonix markets on Polymarket, I exploited rebalancing bots chasing USDC rewards. With just $100, I repeatedly trapped their auto-orders between bid-ask spreads—earning $1,500 in two hours, completely risk-free.

toto/2025.11.25

Strategy Inc. controls 3.26% of all Bitcoin but faces a liquidity cliff. With $54M cash, $700M annual dividends, collapsing equity premiums, and potential MSCI index exclusion, it risks forced BTC sales that could shatter both its model and the market.

Shanaka Anslem Perera /2025.11.25

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

A whale exchanged WIF and Bonk positions for Fartcoin!

2024.12.25 11:01:14

MoreHot Articles

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 promising AI Agent cryptos

2024.12.05

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link