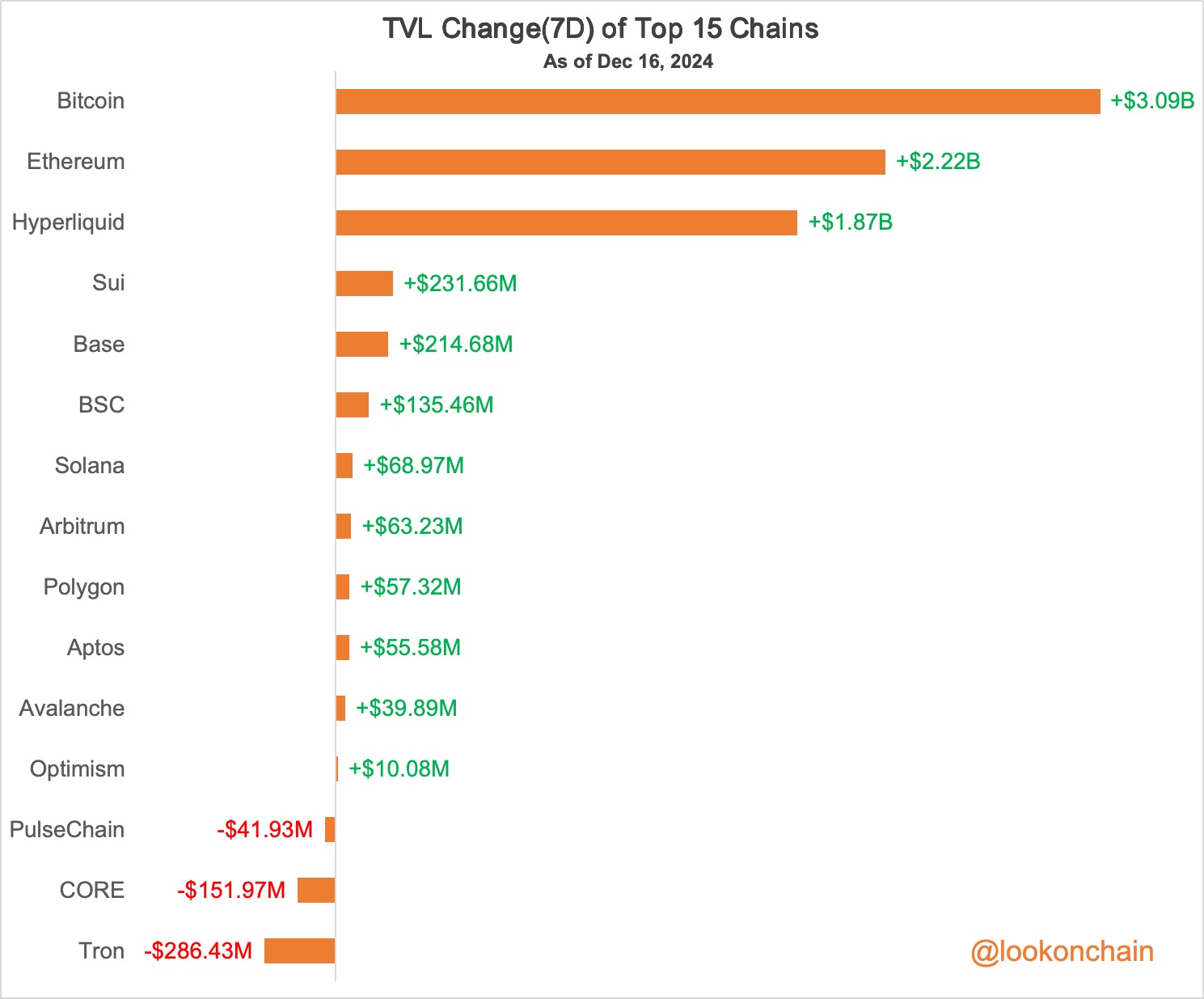

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

In the past 7 days, #Bitcoin's TVL increased by $3.09B, #Etherum's TVL increased by $2.22B, and #Hyperliquid's TVL increased by $1.87B.

Funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

A Silver Long Whale with a $29M Long Position Gets Fully Liquidated, Losing Over $4M

6 minutes ago

The U.S. Department of the Treasury sanctions the cryptocurrency exchanges Zedcex Exchange and Zedxion Exchange

6 minutes ago

Judge Denies Motion to Dismiss, Coinbase Directors' Insider Trading Lawsuit to Proceed

6 minutes ago

Partial Government Shutdown Officially Begins

6 minutes ago

「Battle King」 went short 136.15 BTC with 40x leverage, with an average entry price of $83,469.3

6 minutes ago

Coinbase: Argument that "Bitcoin Will Rebound After Gold Strengthens" Is Flawed, Investors Should Be Cautious About This Narrative

6 minutes ago

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

A whale exchanged WIF and Bonk positions for Fartcoin!

2024.12.25 11:01:14

MoreHot Articles

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

10 promising AI Agent cryptos

2024.12.05

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store

Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link