Where Did FTX’s $138 Billion Go? The Shocking Math Behind the Bankruptcy

Lookonchain

Lookonchain

FTX: Where Did the Money Go — And Who Took Control

When FTX collapsed in November 2022, over seven million users had deposited roughly $20 billion. The exchange froze withdrawals and filed for bankruptcy, leaving an $8 billion customer hole. For years, creditors waited—until 2025, when the estate announced full repayments of 119-143% of claims.

Ironically, the company was never truly insolvent; it suffered a liquidity crisis, not a balance-sheet failure.

The Missed Path

Court filings show that as of the bankruptcy date, FTX still held $14.6 billion in assets—enough to repay users in-kind.

These included:

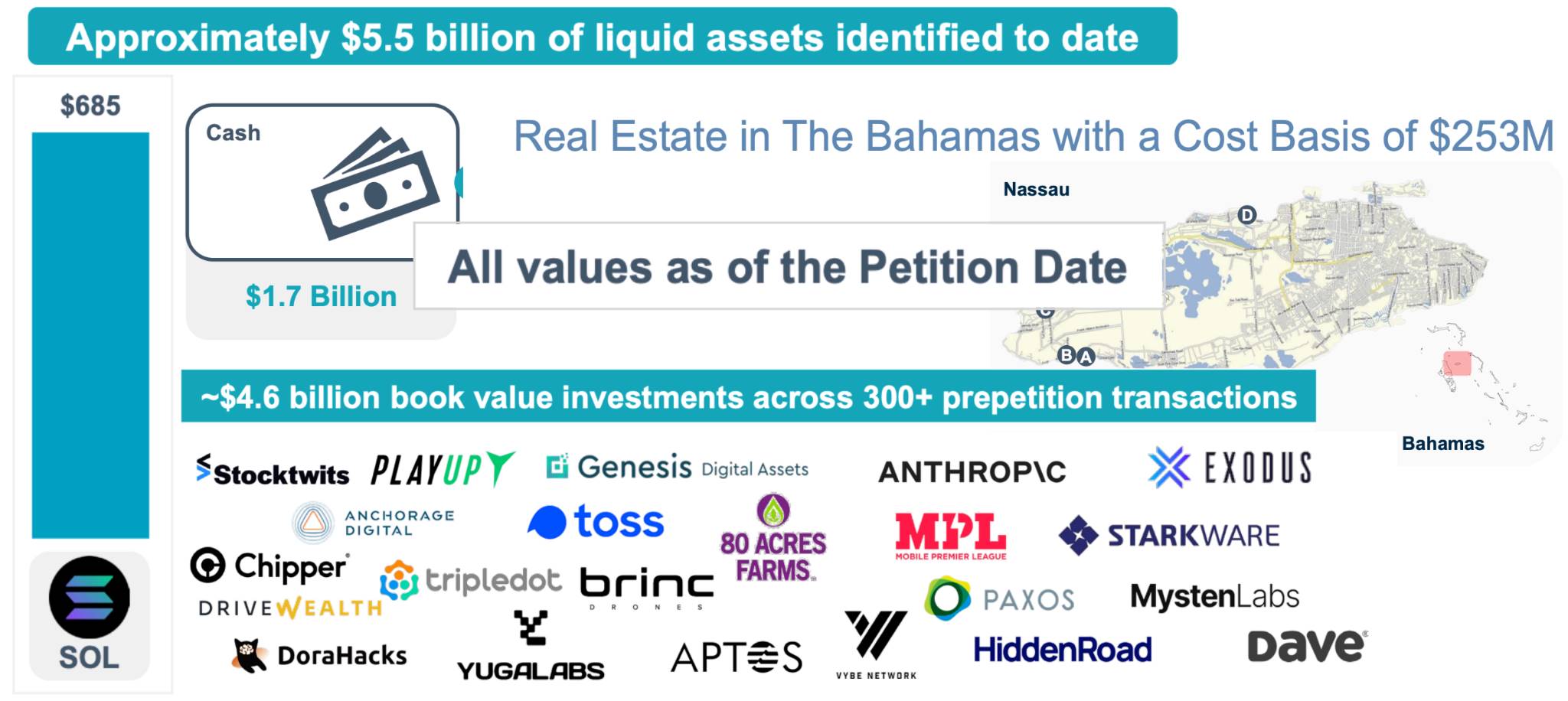

$5.5 B in cash & liquid crypto

$4.6 B in venture investments

$3.7 B in illiquid tokens

Real estate + subsidiaries worth ≈ $0.4 B

Had withdrawals resumed and assets not been seized, customers could have been made whole by late 2022.

By September 2025 valuations, those same holdings would exceed $136 billion—with massive exposure to winners like Anthropic ($14.3 B), Solana ($12.4 B), FTT ($21.9 B), and Robinhood ($7.6 B). In short, the estate that’s now distributing ~$18 B could have been worth nearly eight times that.

What Went Wrong

According to the document, once external counsel Sullivan & Cromwell (S&C) and attorney John J. Ray III took control on Nov 11 2022, the company was placed into a Delaware bankruptcy—despite FTX still processing withdrawals and negotiating liquidity deals.

Within hours, the exchange was shut down, staff fired, and S&C retained as bankruptcy counsel.

The report alleges that these lawyers had incentives to push for bankruptcy because fees would then be paid directly from the estate.

To date, nearly $950 million in legal and consulting fees have been approved, with another $450 million reserved—making the FTX case one of the costliest since Lehman.

Narrative Control

Publicly, Ray and S&C portrayed FTX as “hopelessly insolvent,” using early statements that allegedly misrepresented its balance sheet.

Prosecutors in Sam Bankman-Fried’s trial echoed that framing, citing liabilities while ignoring offsetting assets.

Documents show that even in 2022, Alameda and FTX together held $25 B in assets against $13 B in liabilities, remaining solvent on paper.

The report suggests that calling it a “dumpster fire” justified shutting down operations and liquidating holdings at depressed prices—often to insiders or below market value.

Value Erosion

If Ray’s team had simply frozen operations and waited, the estate might now hold $136 B in assets and $111 B in net value. Instead, after sales, fees, and settlements, less than $18 B remains.

Key losses cited:

FTX Equity: $66.4 B

FTT Token: $21.9 B

Anthropic Stake: $12.9 B

Solana: $9.1 B

Robinhood: $7.0 B

Sui: $2.8 B

Legal & Consultancy Fees: $1.4 B

Government Claims & Settlements: $16.9 B

Total Losses ≈ $138 B of value destroyed

The Core Argument

The 25-page document—authored by Sam Bankman-Fried and team—asserts that FTX was solvent throughout, and that its collapse was worsened by the lawyers’ intervention, asset fire sales, and self-serving incentives.

Critics note that this framing may absolve FTX leadership of negligence, yet the underlying math shows something undeniable: the assets were real, the prices recovered, and the bankruptcy process itself may have consumed most of the potential upside.

Today

Customers are finally being repaid—but in USD, not crypto. A user owed 1 BTC in 2022 will receive ~$17 K, even though Bitcoin now trades near $114 K. Equity investors who put in $1.95 B get back ~$230 M.

So yes, everyone’s “made whole,” but only in a narrow legal sense. In real terms, the FTX estate may have burned over $120 B in potential value.

Crypto analyst Murad returns with 116 data-backed reasons arguing the bull run is far from over. From strong ETF accumulation and stablecoin inflows to macro liquidity shifts, he predicts Bitcoin could stay in a multi-year uptrend through 2026.

TechFlow/2 days ago

From BONK to TRUMP, 2024–25 was crypto’s most chaotic wealth engine. Airdrops, AI coins, and celebrity rugs fueled the memecoin supercycle before collapse. What began as freedom and fun ended as a PvP casino—proof that chaos built the culture.

Adam/3 days ago

Coinbase Ventures outlines 2026’s top crypto frontiers: RWA perpetuals, prediction market terminals, unsecured onchain credit, privacy DeFi, and AI-robotics intersections. The next breakout startups will merge finance, AI, and onchain innovation.

Coinbase Ventures/5 days ago

From ICOs to NFTs to memes, every crypto cycle birthed an era where “dumb money” got rich fast. But after nine months of stagnation and no new wealth engine, the casino’s gone quiet. Without a new mania, CT isn’t bearish—it’s just bored.

IcoBeast.eth/2025.11.27

By spotting illiquid Harmonix markets on Polymarket, I exploited rebalancing bots chasing USDC rewards. With just $100, I repeatedly trapped their auto-orders between bid-ask spreads—earning $1,500 in two hours, completely risk-free.

toto/2025.11.25

Strategy Inc. controls 3.26% of all Bitcoin but faces a liquidity cliff. With $54M cash, $700M annual dividends, collapsing equity premiums, and potential MSCI index exclusion, it risks forced BTC sales that could shatter both its model and the market.

Shanaka Anslem Perera /2025.11.25

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

A whale exchanged WIF and Bonk positions for Fartcoin!

2024.12.25 11:01:14

MoreHot Articles

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 promising AI Agent cryptos

2024.12.05

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link