You Are the Yield: The $8 Billion DeFi Time Bomb Thats Only Just Begun

Blockbeats

Blockbeats

You Are the Yield: The $8 Billion DeFi Time Bomb That’s Only Just Begun

In DeFi, there’s an $8 billion ticking time bomb—only $100 million has exploded so far.

But before we talk about collapses and losses, ask yourself:

Do you really know where DeFi’s yield comes from?

If not, you are the yield.

The Return of the “Fund Manager”—Now on Chain

In traditional finance, fund managers once symbolized professionalism and trust. During China’s bull market, investors poured their hopes into these “smart professionals” who promised safer, more rational investing than retail stock trading.

But when markets fell, the illusion shattered. The so-called professionals couldn’t fight systemic risk. They pocketed management fees and performance bonuses when times were good—and blamed “market conditions” when investors lost everything.

Now, that same role has resurfaced in DeFi under a new name: the Curator.

Only this time, it’s far more dangerous.

No license. No regulation. No identity disclosure.

Just a “vault” on a DeFi protocol promising triple-digit APYs—and billions pour in from yield-hungry users who have no idea where their money goes.

The $93 Million Meltdown

On November 3, 2025, DeFi protocol Stream Finance suddenly froze all deposits and withdrawals. The next day, it admitted what many feared: an external fund manager—one of its “Curators”—had been liquidated during the violent October 11 market crash, vaporizing $93 million in user funds.

Its internal stablecoin, xUSD, collapsed from $1 to $0.43 within hours.

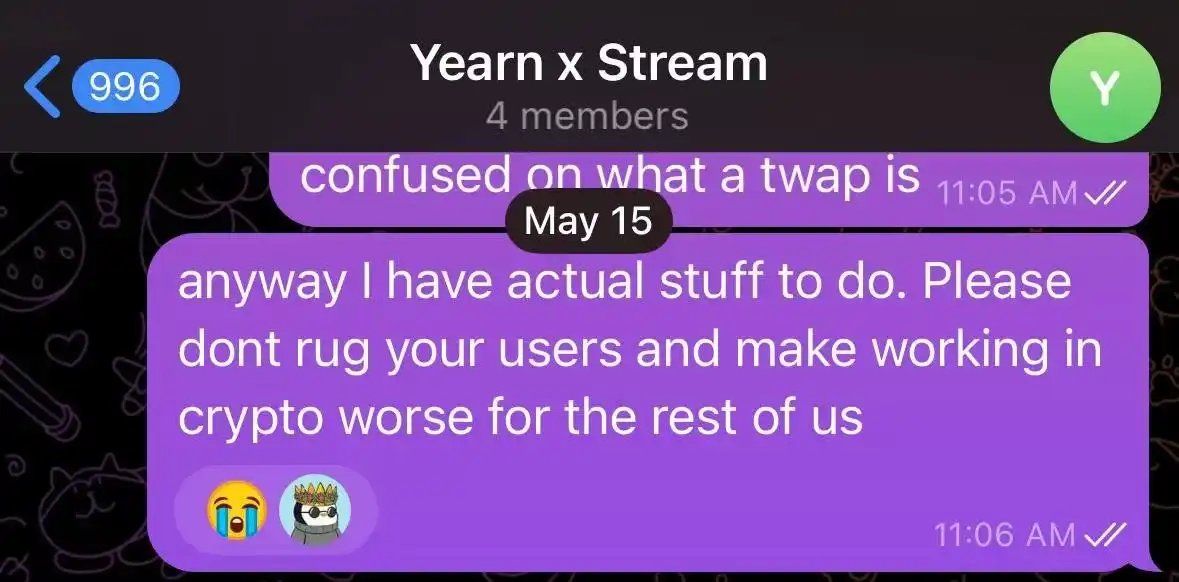

This wasn’t unforeseen. Over 170 days earlier, Yearn Finance core developer Schlag had publicly warned Stream’s team:

“One five-minute conversation and a quick look at their Debank would tell you—this will end badly.”

How It Worked—and Why It Failed

Stream Finance promised users automated yield from curated “vaults,” managed by external curators. These curators supposedly diversified funds across on- and off-chain strategies.

In reality, two fatal flaws killed the system:

- Off-chain trading: Curators took user funds into opaque, high-leverage strategies that collapsed during volatility.

- Recursive leverage: Stream used Elixir Protocol’s deUSD for leveraged lending loops—amplifying systemic risk.

When the storm hit, over $160 million in deposits froze. The total ecosystem faced $285 million in systemic exposure:

- Euler: $137 million bad debt

- Elixir: $68 million of reserves (65% of deUSD’s backing) tied to Stream

- Multiple protocols holding Stream assets as collateral

The Fatal Mutation of DeFi

Classic DeFi—think Aave and Compound—was built on the principle that “code is law.”

Smart contracts governed every loan, every liquidation—transparent, verifiable, trustless.

Curator-driven DeFi flipped that model.

Projects like Morpho and Euler argued that pooled lending was inefficient. Instead, they let users deposit into individual vaults managed by human curators—each promising higher returns.

Today, over $8 billion sits in such curator vaults across protocols. On paper, it’s efficiency. In practice, it’s DeFi’s P2P bubble reborn—where users bet on strangers behind glossy dashboards.

Behind each “vault” page showing double-digit APYs lies a black box.

No leverage data. No exposure metrics. Often, not even a risk disclosure.

As one CEO famously said,

“Aave is a bank. Morpho is banking infrastructure.”

Translation: “We just provide the pipes. The risk is someone else’s problem.”

DeFi’s “decentralization” now ends the moment you deposit. After that, your money is in human hands—and that’s where DeFi’s code-based safety dissolves.

When Curators and Protocols Collude

Curators profit through management and performance fees, giving them every reason to chase high-risk strategies.

Heads I win. Tails—it’s your money.

Worse, protocols themselves enable the behavior.

They need TVL growth and flashy APYs to attract users, so they ignore—or even encourage—risky vaults to boost marketing appeal.

Stream Finance boasted $500 million in “total value locked.”

DeFiLlama showed only $200 million. The rest? Funneled off-chain, managed by anonymous traders with zero transparency.

After the crash, leading curator group RE7 Labs admitted it knew the risks beforehand but listed Stream’s stablecoin anyway—“due to significant user demand.”

That’s not risk management; that’s complicity.

The Domino Effect

On October 11, the crypto market suffered a $20 billion liquidation wave. Many DeFi curators were reportedly “selling volatility” off-chain—a strategy that earns steady yield until a market shock wipes everything out.

Stream Finance was the first domino. Its collapse rippled across the ecosystem:

- Elixir Protocol lost $68 million (65% of reserves)

- RE7 Labs suffered cascading bad debt

- Euler, Silo, Morpho faced exposure via rehypothecated collateral

This isn’t over. Analysts at Yields & More warn that “the risk map is incomplete—more protocols will surface as affected.”

The Death of Transparency

From Aave’s transparent banking to Stream’s opaque asset management, DeFi has mutated into Ce-DeFi—“centralized management disguised as decentralization.”

Without transparency, decentralization is a myth.

Without accountability, “innovation” becomes a con.

DeFi promised trust through code.

Now, it demands blind trust in people you’ll never know.

As Bitwise CIO Matt Hougan once said:

“There’s no such thing as a risk-free double-digit yield.”

So before you click “Deposit” again, ask yourself one question:

Do you really know where the yield comes from?

If not—you are the yield.

Crypto analyst Murad returns with 116 data-backed reasons arguing the bull run is far from over. From strong ETF accumulation and stablecoin inflows to macro liquidity shifts, he predicts Bitcoin could stay in a multi-year uptrend through 2026.

TechFlow/2 days ago

From BONK to TRUMP, 2024–25 was crypto’s most chaotic wealth engine. Airdrops, AI coins, and celebrity rugs fueled the memecoin supercycle before collapse. What began as freedom and fun ended as a PvP casino—proof that chaos built the culture.

Adam/3 days ago

Coinbase Ventures outlines 2026’s top crypto frontiers: RWA perpetuals, prediction market terminals, unsecured onchain credit, privacy DeFi, and AI-robotics intersections. The next breakout startups will merge finance, AI, and onchain innovation.

Coinbase Ventures/5 days ago

From ICOs to NFTs to memes, every crypto cycle birthed an era where “dumb money” got rich fast. But after nine months of stagnation and no new wealth engine, the casino’s gone quiet. Without a new mania, CT isn’t bearish—it’s just bored.

IcoBeast.eth/2025.11.27

By spotting illiquid Harmonix markets on Polymarket, I exploited rebalancing bots chasing USDC rewards. With just $100, I repeatedly trapped their auto-orders between bid-ask spreads—earning $1,500 in two hours, completely risk-free.

toto/2025.11.25

Strategy Inc. controls 3.26% of all Bitcoin but faces a liquidity cliff. With $54M cash, $700M annual dividends, collapsing equity premiums, and potential MSCI index exclusion, it risks forced BTC sales that could shatter both its model and the market.

Shanaka Anslem Perera /2025.11.25

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

A whale exchanged WIF and Bonk positions for Fartcoin!

2024.12.25 11:01:14

MoreHot Articles

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 promising AI Agent cryptos

2024.12.05

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link