Tom Lees Ethereum Bet Falters as Corporate Crypto Dream Unwinds

Bloomberg

Bloomberg

Tom Lee’s Big Crypto Bet Buckles Under Mounting Market Strain

Ethereum’s corporate-buying experiment is unraveling in real time.

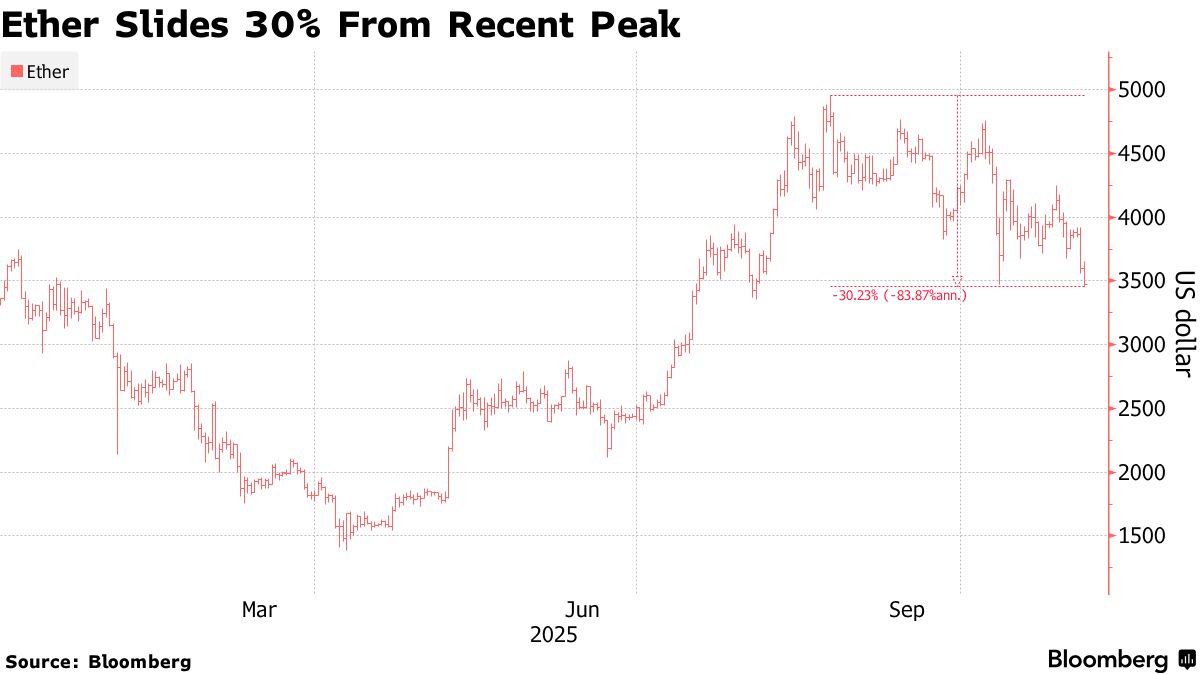

The world’s second-largest cryptocurrency dropped below $3,400 on Tuesday, sliding in tandem with market bellwether Bitcoin and tech stocks as Wall Street’s AI-fueled exuberance fades. The move has pushed Ether 30% below its August peak, returning prices to levels last seen before a wave of corporate buying and holding, further cementing the token’s entry into a bear market.

That reversal has left Bitmine Immersion Technologies Inc., Ethereum’s most aggressive corporate backer, facing more than $1.3 billion in paper losses, according to research firm 10x Research. The publicly traded company, backed by billionaire Peter Thiel and headed by Wall Street forecaster Tom Lee, modeled its strategy on Michael Saylor’s Bitcoin-treasury playbook, acquiring 3.4 million Ether at an average of $3,909. With its war chest fully deployed, Bitmine is now under mounting pressure.

“For months, Bitmine drove the narrative and the flow,” 10x wrote in a report. “Now it’s fully deployed, sitting on over $1.3 billion in unrealized losses with no dry powder left.”

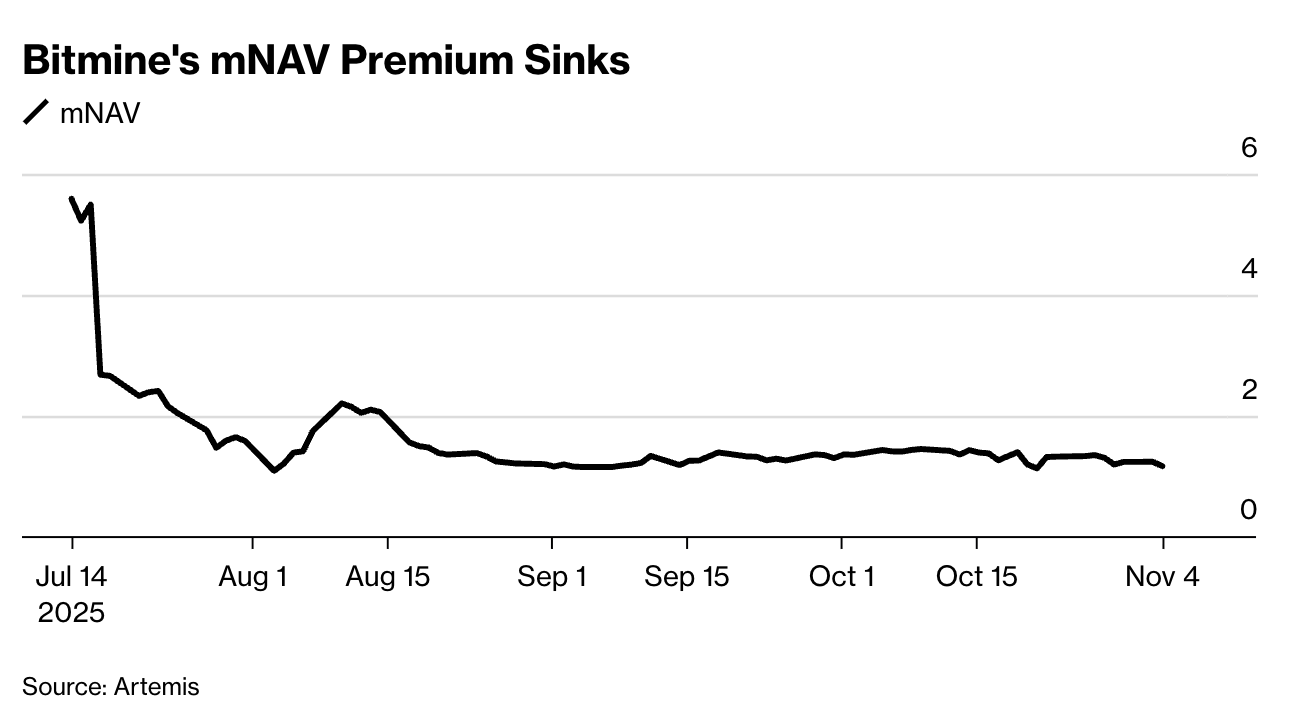

Retail investors who bought Bitmine shares at a premium to its net asset value (NAV) have been hit even harder, the report noted, with limited appetite to “catch a falling knife.”

Lee, the co-founder and managing partner of Fundstrat Global Advisors who also serves as chairman of Bitmine, didn’t immediately respond to a request for comment. Representatives of Bitmine also didn’t immediately respond.

Bitmine’s wager was never just a balance-sheet trade. The company’s accumulation embodied a bigger idea that digital assets could move from speculation to corporate finance infrastructure, cementing Ethereum’s place in the financial mainstream. By locking Ether into public-company treasuries, believers argued, firms would help bootstrap a new decentralized economy where code replaces contracts and tokens function as assets.

That thesis helped power a summer rally, lifting Ether to nearly $5,000 while Ethereum ETFs drew more than $9 billion in inflows in July and August alone. But since an Oct. 10 crypto market wipeout, the tide has turned: $850 million has exited Ethereum ETFs since, and open interest in Ether futures has fallen by $16 billion, according to Coinglass and data compiled by Bloomberg.

Lee has predicted Ether would reach $16,000 by the end of this year.

Bitmine’s market-cap-to-net-asset-value multiple has plunged from 5.6 in July to 1.2, according to data from Artemis, while its stock has dropped 70% from its peak. Like Bitcoin-linked companies before it, Bitmine’s equity now trades closer to its underlying holdings, as the market re-rates the once-lofty multiples attached to balance-sheet crypto.

Last week ETHZilla, another publicly-listed Ether treasury firm, sold $40 million of its holdings to buy back its shares in order to normalize its mNAV ratio. “ETHZilla plans to use the remaining proceeds of its ETH sale for additional share repurchases and intends to continue to sell ETH to repurchase its shares until the discount to NAV is normalized,” the company said in a press release at the time.

Even with the price decline, Ethereum’s long-term fundamentals still appear robust: it continues to process more on-chain value than any rival smart-contract network, and its staking mechanism has made the token both yield-bearing and deflationary. Yet with competitors like Solana gaining traction, ETF flows reversing, and retail interest fading, the narrative that corporations could stabilize crypto prices is faltering.

Crypto analyst Murad returns with 116 data-backed reasons arguing the bull run is far from over. From strong ETF accumulation and stablecoin inflows to macro liquidity shifts, he predicts Bitcoin could stay in a multi-year uptrend through 2026.

TechFlow/2 days ago

From BONK to TRUMP, 2024–25 was crypto’s most chaotic wealth engine. Airdrops, AI coins, and celebrity rugs fueled the memecoin supercycle before collapse. What began as freedom and fun ended as a PvP casino—proof that chaos built the culture.

Adam/3 days ago

Coinbase Ventures outlines 2026’s top crypto frontiers: RWA perpetuals, prediction market terminals, unsecured onchain credit, privacy DeFi, and AI-robotics intersections. The next breakout startups will merge finance, AI, and onchain innovation.

Coinbase Ventures/5 days ago

From ICOs to NFTs to memes, every crypto cycle birthed an era where “dumb money” got rich fast. But after nine months of stagnation and no new wealth engine, the casino’s gone quiet. Without a new mania, CT isn’t bearish—it’s just bored.

IcoBeast.eth/2025.11.27

By spotting illiquid Harmonix markets on Polymarket, I exploited rebalancing bots chasing USDC rewards. With just $100, I repeatedly trapped their auto-orders between bid-ask spreads—earning $1,500 in two hours, completely risk-free.

toto/2025.11.25

Strategy Inc. controls 3.26% of all Bitcoin but faces a liquidity cliff. With $54M cash, $700M annual dividends, collapsing equity premiums, and potential MSCI index exclusion, it risks forced BTC sales that could shatter both its model and the market.

Shanaka Anslem Perera /2025.11.25

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

A whale exchanged WIF and Bonk positions for Fartcoin!

2024.12.25 11:01:14

MoreHot Articles

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 promising AI Agent cryptos

2024.12.05

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link