The Ultimate Q4 2025 Airdrop Farming Guide

Miles Deutscher

Miles Deutscher

Missed $ASTER, $XPL & $APEX?

The good news is - we're seeing an airdrop renaissance (and it's never been easier to capitalise).

Over the past week, I've been building a watchlist of the biggest airdrop farming opportunities.

🧵: My Ultimate Q4 2025 Airdrop Farming Guide.👇

I've been refining my personal strategy to capitalise on these upcoming opportunities, and today, I'm sharing the full playbook with you.

In this thread, I'll break down:

• My Top 5 airdrops to farm

• The different strategies to use

• How to find big airdrops yourself

1. @Plasma

Probably one of the best ecosystems to farm in crypto right now, especially if you're stablecoin heavy.

This video from @phtevenstrong does a great job at summarising the best strategies.

https://x.com/phtevenstrong/status/1971401942090871132

2. @Lighter_xyz

The analysts in @mileshighclub_ have been farming this one since April (ggs to everyone who caught it).

You can earn points by directly trading on the Lighter DEX.

They're already estimated to be worth $50+ per point!

Points are now harder to come by (so the opportunity isn't as big as it was), but there is still an interesting strategy coming from Lighter<>HyperEVM, which can help you double up.

3. @edgeX_exchange

I've been seeing this one everywhere on CT, and it's already doing huge volume.

I see a lot of people talking about farming volume, but there's another interesting aspect, which is parking cash (and using it as trade collateral):

• Park idle cash for points.

• Capital can still be used as trade collateral.

• Vaults are yielding 11% APR + points.

4. @tradeparadex

This could be one of the best R/R farms right now:

• 20% of the supply is confirmed for an airdrop.

• TGE is before Jan 31st (<4 months away).

• It has low farming mindshare right now.

The focus is on exotic markets (perp options), so it stands out. Vaults are capped, so the main play is volume on their exotic markets.

5. @extendedapp

This airdrop opportunity is in its early stages, but it has strong future growth potential.

What you need to know now:

• Built by an ex-Revolut team & strongly supported by Starkware.

• Bringing TradFi asset trading to DeFi.

• It's illiquid now because it's still early (that's the opportunity).

Vaults have a high APR but are currently capped- keep an eye on it.

6. @Aster_DEX

Everyone saw the massive run on this one and thinks they're too late.

You're not.

Here's why farming on Aster is still worth adding to your watchlist:

• Season 2 is live right now.

• 4% of the total supply is being awarded.

• The valuation is huge, so the S2 pie is still massive.

The play is simple: Open delta-neutral positions to farm points risk-free.

@AzFlin has an excellent breakdown of S2 on @Aster_DEX below:

https://x.com/AzFlin/status/1971075515705589880

If you're looking for even more upcoming opportunities, you'll want to bookmark this post from @ahboyash below.

I'm personally looking to farm multiple TGEs on his list.

We're in an abundant period for new launches; it's your job to capitalise.

https://x.com/ahboyash/status/1971443203690856598

Pro tip to find new airdrop opportunities before anyone else:

I use this two-step system often:

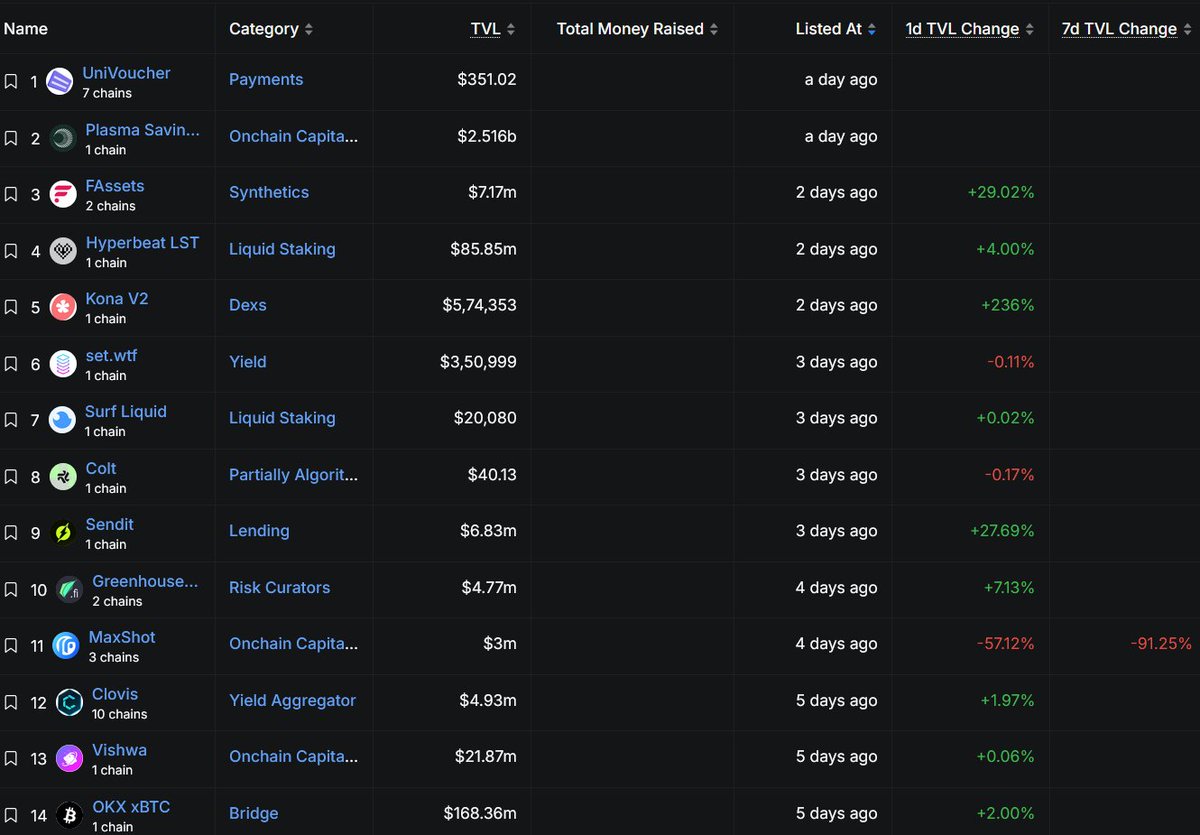

1. Scan @DefiLlama "airdrops" tab daily (do a quick scan to work out if the project is interesting/legitimate.

2. If a protocol looks interesting, search it on @CryptoRank_io to see who's backing it.

The reason this works so well is simple: The biggest airdrops are always those with the most funding.

Along with the simple system above, you can use the new SuperGrok models to see exactly what airdrops people are talking about on 𝕏.

I like to prompt for daily/weekly research reports, and it's way easier/faster than manually scanning 𝕏 yourself.

A general tip for airdrop farming:

Organisation is key.

Use Notion/Spreadsheets/Obsidian (anything that works for you) to keep track of all TGE events and regular protocol interactions.

Pick regular slots each week where you tick off certain tasks. That way you

You can only farm so many projects at once - your focus needs to be on the ones with the highest upside.

BTC has already dropped 10% since the short call, targeting 106K in the near term before pushing towards 90–94K. Despite bullish distractions, markets show signs of stress—retail euphoria, insider selling, and global economic strain point to deeper downside.

Doctor Profit/3 days ago

BTC is holding strong support, with R:R favoring longs unless $98K (1W50EMA) gets retested. Liquidations lean upside, with $106.9K a key liquidity zone. Sentiment is bearish, but setup favors recovery. Watching alts like $ASTER, $XPL, $APEX, $AVNT.

CrypNuevo/3 days ago

BTC is approaching a pivotal Q4. Price action near EMA200/MA200 could set the stage for another leg higher, with targets at $117.5K–$125K. No cycle top yet, but history shows major moves often land in Oct–Dec. Watch $112K–$118.8K as critical levels.

Honey/3 days ago

The current crypto market dump is driven by the quarterly $23 billion options expiry, rising US government shutdown risks, and the mass liquidation of excessive retail leverage. Ultimately, this downturn is viewed as a strategic whale setup designed to panic-sell retail holdings before the anticipated Q4 rally begins.

Ash Crypto/7 days ago

This article dismantles Tom Lees bullish thesis on Ethereum ($ETH), arguing he fundamentally misunderstands value accrual. Despite soaring RWA activity, network fees are flat due to competition and efficiency. The analysis concludes that ETH technicals are bearish, predicting indefinite underperformance.

Andrew Kang/2025.09.25

An Argentine scammer exploited a crypto charity token, $CANCER, by using a malicious Steam game to drain a streamers wallet of $32,000, funds intended for his cancer treatment. The attacker, part of a group that has stolen over $150,000 from more than 260 victims, used an advanced malware that stole private keys from browser wallets. While the streamer eventually recovered his funds with the communitys help, the attacker remains at large and highlights the ongoing threat of crypto-related malware.

StarPlatinum/2025.09.23

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A whale exchanged WIF and Bonk positions for Fartcoin!

2024.12.25 11:01:14

MoreHot Articles

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 promising AI Agent cryptos

2024.12.05

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link