The Flawed Ethereum Thesis: Why Tom Lees Bull Case Falls Apart

Andrew Kang

Andrew Kang

Tom Lee's ETH thesis is one of the most retarded combinations of financially illiterate arguments I've seen from a well known analyst I've seen in a while. Let's break them down. Tom's thesis is predicated on the following points

(1) Stablecoin & RWA Adoption

(2) Digital oil comparison

(3) Institutions will buy and stake ETH to contribute to the security of the network in which they are tokenizing their assets & as operating capital

(4) ETH will be equal to the value of all financial infrastructure companies

(5) Technical Analysis

(1) Stablecoin & RWA Adoption

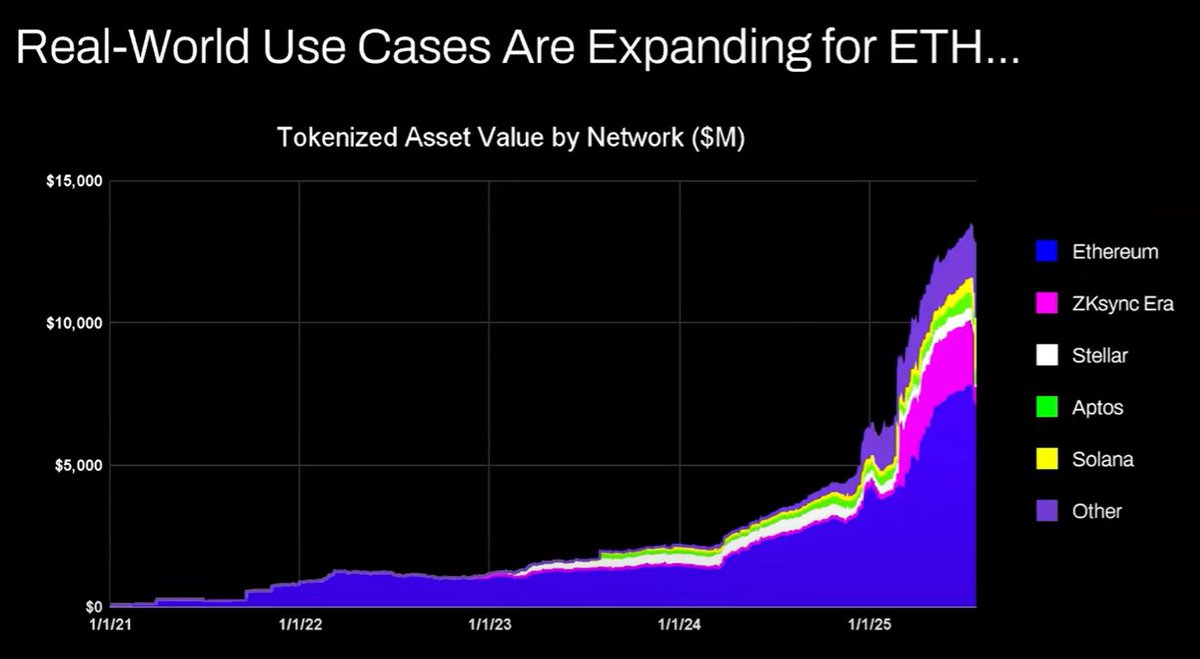

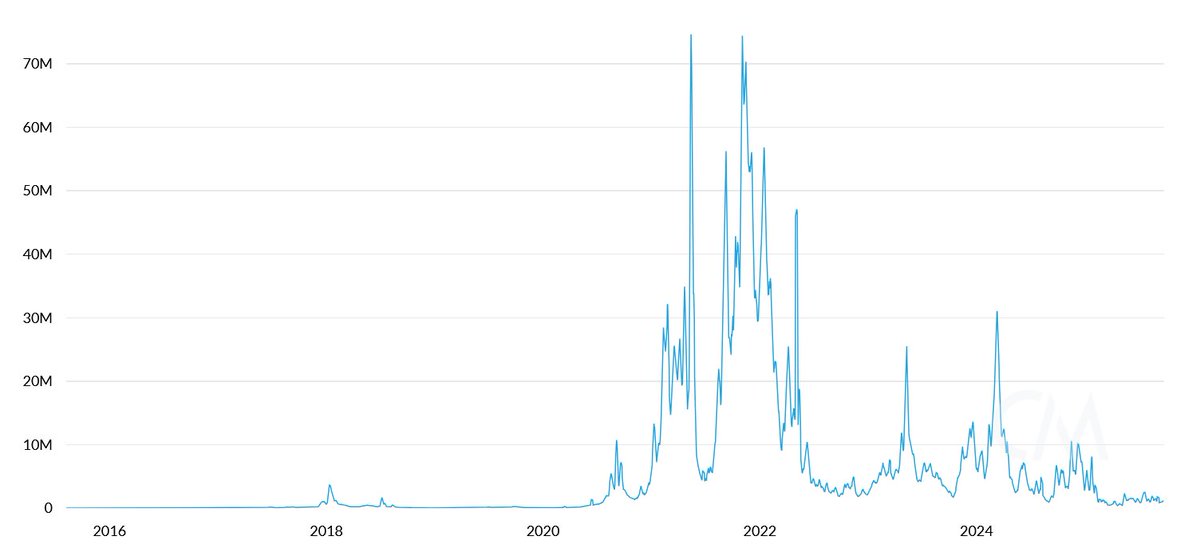

The argument goes like this - stablecoin and tokenized asset activity is increasing and that should drive transaction volume which should drive fees/revenue for ETH. On the surface, makes sense, but if you use a few minutes and a few brain cells, to check the data, you'll find that this is not the case.

Since 2020, tokenized asset value and stablecoin transaction volumes have increased 100-1000x. Tom's argument fundamentally misunderstands how value accrual works and may lead you to believe that fees would scale proportionally, but in fact, they are practically at the same level of 2020.

There are a few reasons why:

- Ethereum network upgrades making tx's more efficient

- Stablecoin & tokenized asset activity going to other chains

- Tokenizing low velocity assets doesn't drive much fees. Value tokenized is not directly proportional to revenue to ETH. Someone could tokenize a $100m bond and if it trades once every 2 years how much fees does that generate for ETH - $0.10? A single USDT would generate more fees

You could tokenize a trillion dollars worth of assets but if that's not moving around much then it maybe would only add $100k worth of value to ETH.

Will tx volumes and fees generated by blockchains grow? Yes, but most of the fees will be captured by other blockchains with stronger business development teams. When it comes to bringing traditional financial transactions on chain, others see the opportunity and are aggressively taking over. Solana, Arbitrum, and Tempo are seeing most of the early big wins. Even Tether is supporting two new Tether chains, Plasma and Stable both of which have the intent to move USDT tx volume to their own chains.

(2) Digital oil comparison

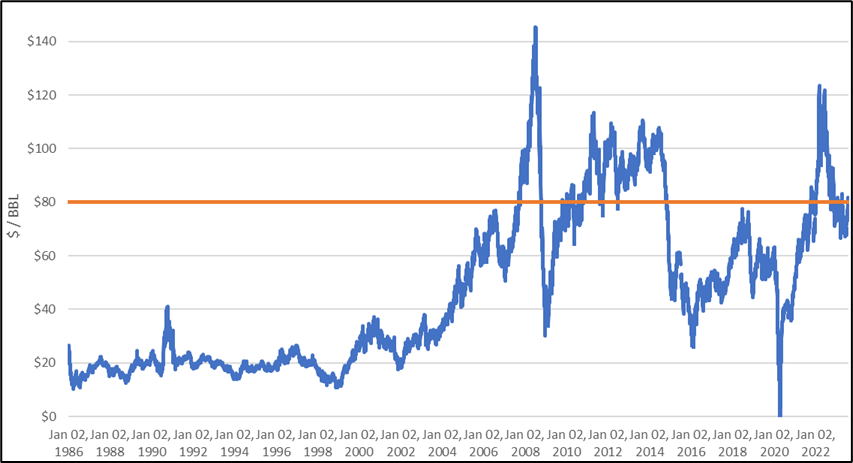

Oil is a commodity. Real oil prices adjusted for inflation have been trading in the same range for over a century with periodic spikes that revert. I agree with Tom that ETH could be viewed as a commodity, but that's not bullish. Not sure what Tom's trying to do here!

(3) Institutions will buy and stake ETH to contribute to the security of the network in which they are tokenizing their assets & as operating capital

Have large banks and other financial institutions bought ETH on their balance sheet yet? No.

Have any of them announced plans to? also no.

Do banks stock up on barrels of gasoline because they continually pay for energy? No, its not significant enough, they just pay for it when they need to

Do banks buy stocks of asset custodians they use? No

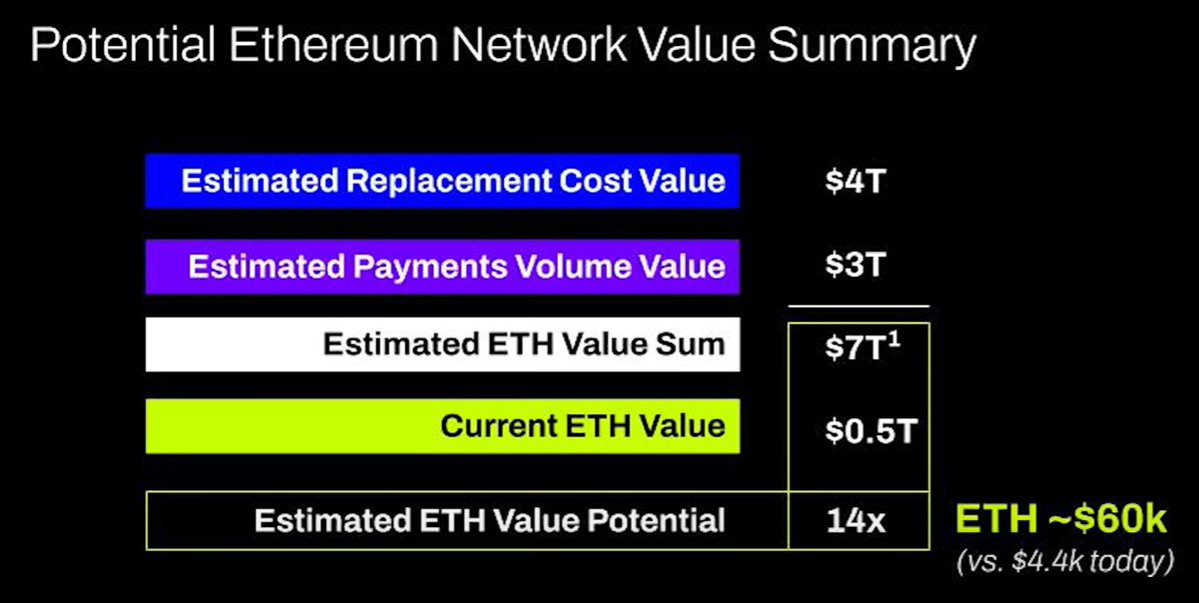

(4) ETH will be equal to the value of all financial infrastructure companies

I mean, come on. Again, a fundamental misunderstanding of value accrual and just pure delusion.

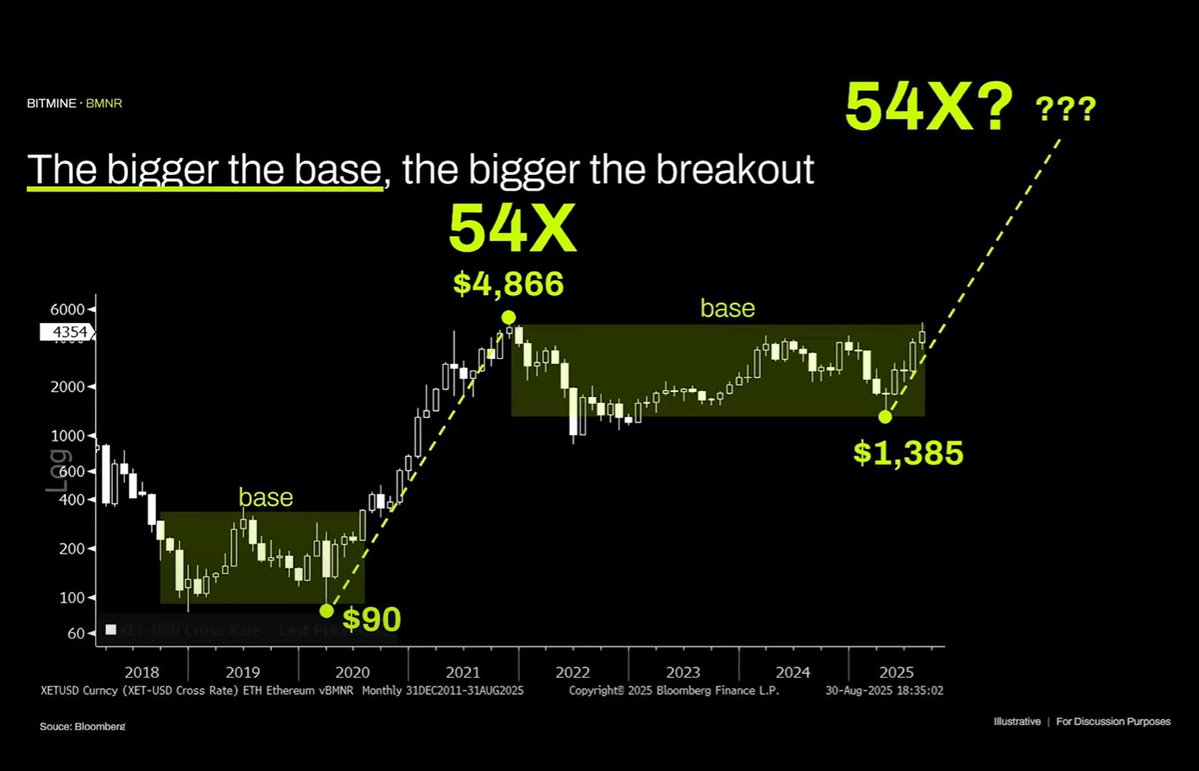

(5) Technical analysis

I am actually a big fan of technical analysis and believe it can be very valuable when viewed objectively. Unfortunately, Tom seems to be using TA to draw random lines to support his bias.

Looking at this chart, objectively, the strongest observation is that Ethereum is in a multi year range. Not too dissimilar from the price of Crude Oil which has also traded in a wide range over the past 3 decades. Not only are we in a range, but we recently tapped the top of the range, failing to break resistance. If anything, the technicals for Ethereum are bearish. I would not discount the possibility of a much longer $1,000-4,800 range. Just because an asset had a parabolic rally previously, does not mean it will continue to indefinitely.

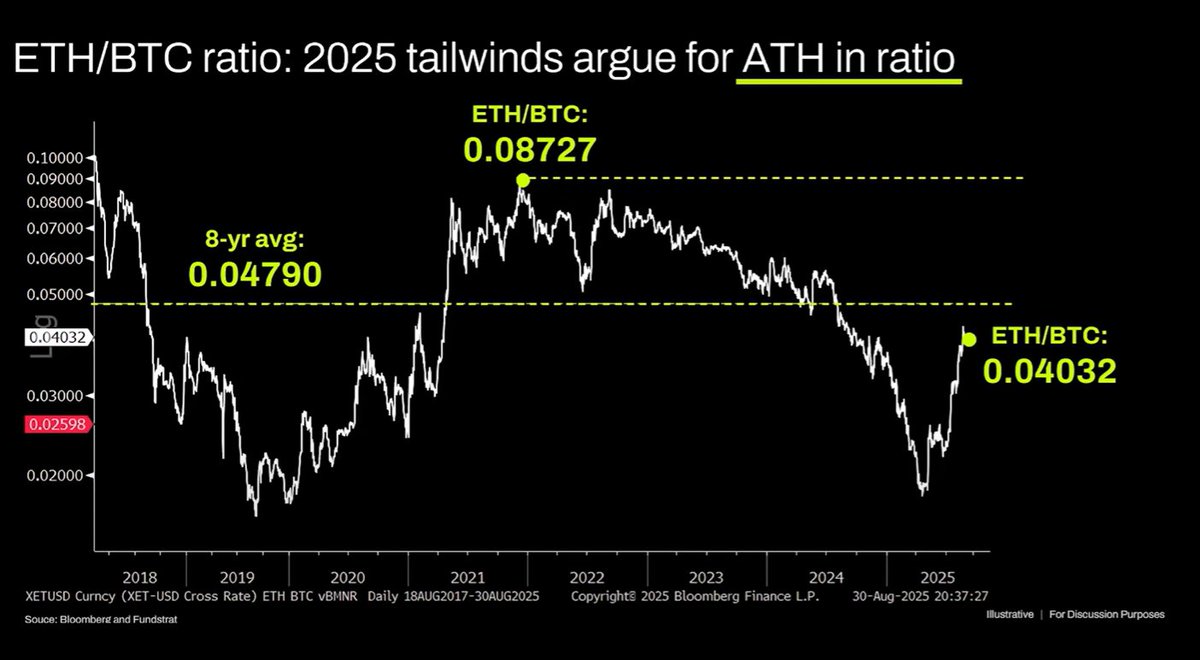

Long term ETHBTC chart also miscontrued. It is indeed in a multi year range, but the last few years have mostly been dictated by a downtrend with a recent bounce at long term support. The downtrend was driven by the fact that the ethereum narrative is saturated and fundamentals do not justify valuation growth. These fundamentals have not changed.

Ethereum's valuation comes primarily from financial illiteracy. Which to be fair, can create a decently large market cap. Look at XRP. But the valuation that can be derived from financial illiteracy is not infinite. Broader macro liquidity has kept ETH market cap afloat, but unless there is major organizational change it is likely destined to indefinite underperformance.

Missed $ASTER, $XPL, or $APEX? Don’t worry—an airdrop renaissance is here. This guide breaks down the top 5 projects to farm, strategies to maximise points, and a system to spot future airdrops before the crowd.

Miles Deutscher/2 days ago

BTC has already dropped 10% since the short call, targeting 106K in the near term before pushing towards 90–94K. Despite bullish distractions, markets show signs of stress—retail euphoria, insider selling, and global economic strain point to deeper downside.

Doctor Profit/3 days ago

BTC is holding strong support, with R:R favoring longs unless $98K (1W50EMA) gets retested. Liquidations lean upside, with $106.9K a key liquidity zone. Sentiment is bearish, but setup favors recovery. Watching alts like $ASTER, $XPL, $APEX, $AVNT.

CrypNuevo/3 days ago

BTC is approaching a pivotal Q4. Price action near EMA200/MA200 could set the stage for another leg higher, with targets at $117.5K–$125K. No cycle top yet, but history shows major moves often land in Oct–Dec. Watch $112K–$118.8K as critical levels.

Honey/3 days ago

The current crypto market dump is driven by the quarterly $23 billion options expiry, rising US government shutdown risks, and the mass liquidation of excessive retail leverage. Ultimately, this downturn is viewed as a strategic whale setup designed to panic-sell retail holdings before the anticipated Q4 rally begins.

Ash Crypto/7 days ago

An Argentine scammer exploited a crypto charity token, $CANCER, by using a malicious Steam game to drain a streamers wallet of $32,000, funds intended for his cancer treatment. The attacker, part of a group that has stolen over $150,000 from more than 260 victims, used an advanced malware that stole private keys from browser wallets. While the streamer eventually recovered his funds with the communitys help, the attacker remains at large and highlights the ongoing threat of crypto-related malware.

StarPlatinum/2025.09.23

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A whale exchanged WIF and Bonk positions for Fartcoin!

2024.12.25 11:01:14

MoreHot Articles

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 promising AI Agent cryptos

2024.12.05

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link