Why Bitcoin Fell While “Crypto” Bled: The Contagion Trade Explained

Bit Paine

Bit Paine

Why has bitcoin had a down year?

Two words: crypto contagion 🧵

it’s not “a silent IPO”

it’s not “OG selling*”

it’s because “crypto” is dying, and bitcoin is a correlated asset.

this hasn’t been obvious because the “crypto market cap” has not fallen as much as you might naively expect, and shitcoin:BTC pairs (including ETH:BTC) have been somewhat resilient.

but you must understand two critical facts:

> (1) most of the “crypto market cap” is froth, and it is buoyed by a multiplicity of tokens and a minuscule float for most of these tokens. margin calls and portfolio contagion means forced BTC-sales because the shitcoin markets are too illiquid to handle selling in any kind of volume, and the owners need to keep these air markets propped up.

> (2) the people who hold the majority of these air-tokens were also “bitcoin OGs*” so they have a lot of BTC to sell (100s-1000s)

you see, the game for many years among crypto insiders (I have the misfortune of knowing many of these folks) has been this:

>> (1) come up with some halfway plausible idea for a new air token.

>> (2) reserve massive quantities of said air token for yourself and your friends, who sell off some of their $BTC* to buy your air token

>> (3) these friends often include fake “crypto VCs” who serve as aggregators for air tokens.

>> (4) get your air token listed on casino exchanges (Coinbase / Binance)

>> (5) wait for BTC to pump

>> (6) immediately start astro-turfing hype campaigns for your air tokens as “the next bitcoin,” that fixes some BTC flaw:

$BTC lacks transaction throughput? $BCH $BSV

$BTC lacks “utility?” world computers! $ETH, $ADA, $SOL, etc.

$BTC lacks privacy? $XMR, $ZEC, etc.

$BTC lacks quantum resilience?…

(It’s all so fucking tiresome. The same goddamn thing over and over. Each time a new class of retards lining up to get fleeced.)

Okay, so you set up some telegram/discord groups, coordinate and pay off the cryptogipsies, chart traders, etc. and engineering a pump…

>> (7) air tokens pump to ungodly market caps on TINY floats, because retail are degenerate, retarded gamblers.

>> (8) sell off as much of your stake as you can for an ungodly multiple.

>> (9) rebuy BTC at the bottom of the next bear

but three things have happened in the last few years that breaks this cycle:

(1) bitcoin maximalism

(2) wall st.

(3) $MSTR

the net effect is that the “smart money” (1+2+3) is buying $BTC in a patient, disciplined way, and *that wealth* does not “rotate” into shitcoin gambling, and they also don’t chase pumps into parabolas, preventing the kind of froth that leads to “alt season”

simultaneously, speculative “dumb money” day-traders looking for $BTC beta have been redirected into $MSTR / options trading, which @saylor and @phongle can immediately redirect back to into long term $BTC accumulation (NB: I am talking about day-trading here which is distinct from buy-and-hold long term investing in $MSTR which is all you should be doing in a long vol investment).

this sucked the vol from crypto, and put the grift on life support. you can see the desperation. “Quantum” is their latest gambit.

this is where the “OG selling*” is both true and misleading. It’s not that OG’s aren’t selling. It’s that they aren’t divesting per se, they’re repositioning into shitcoins for a shitcoin pump that is never going to come back, rinse and repeat.

when you hear “bitcoin OG” you might naively think disciplined investors, but most of these people are degenerate gamblers who were early to bitcoin by chance, made themselves millions, then became deeply invested in the “crypto” grift

their portfolios are heavily altcoin-skewed (just ask @udiWertheimer and his poll results)

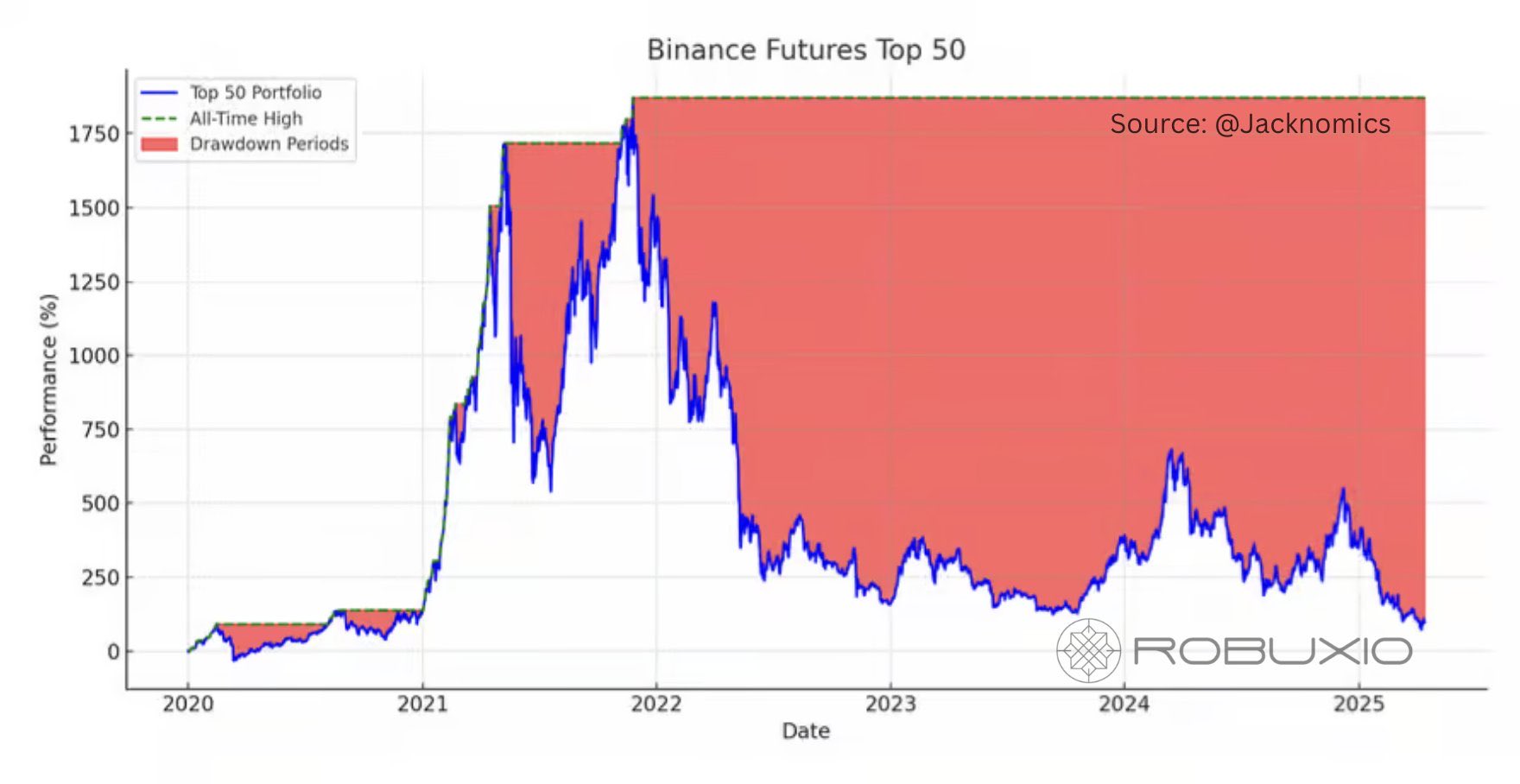

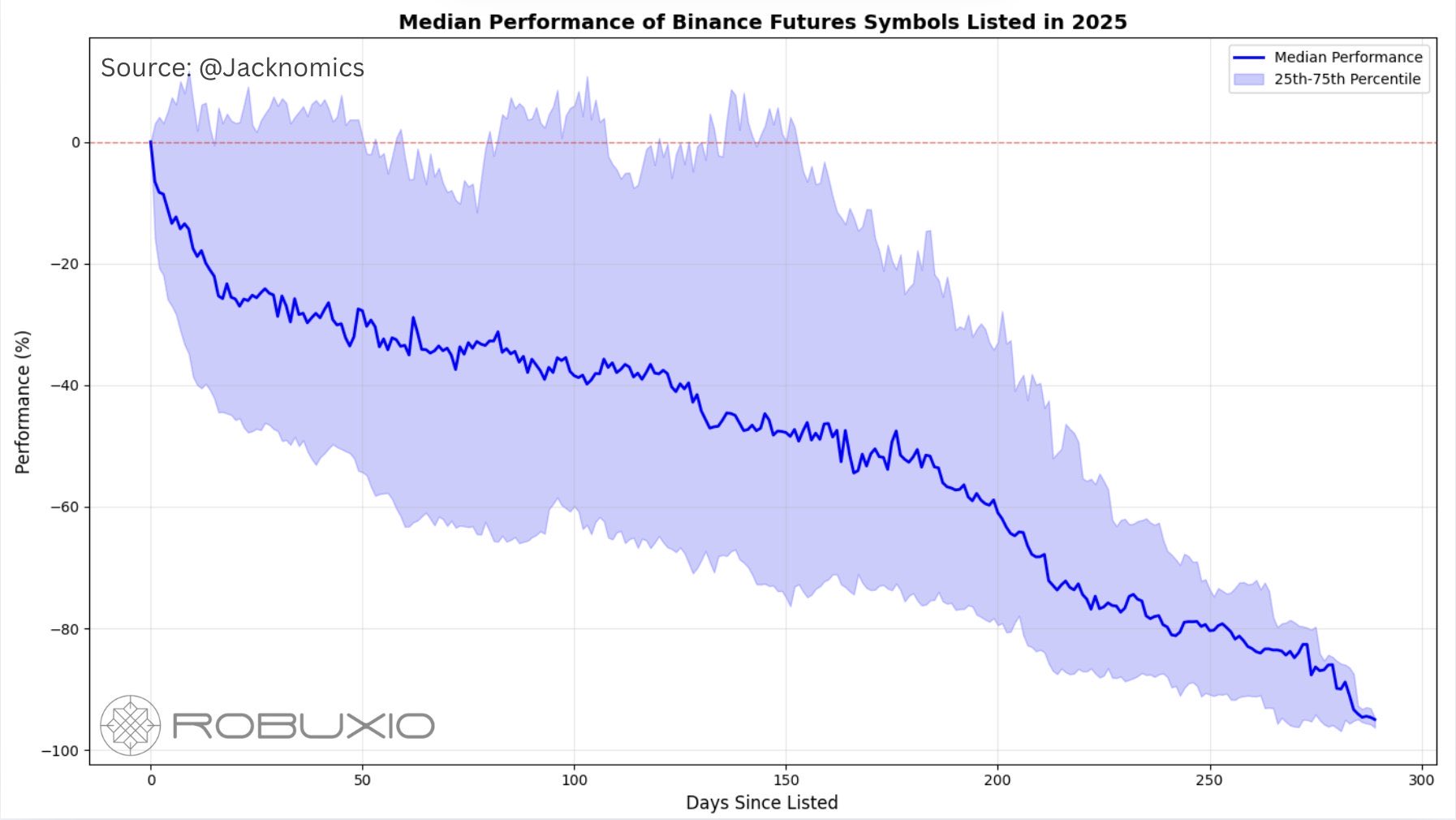

look at the graphs below from @Jacknomics

the median shitcoin is down >90% over the last year

they are bleeding capital; but they can’t sell their illiquid air tokens without a dumb money frenzy to buy them. so instead they just bleed their $BTC to Saylor.

Nearly 10% of Bitcoin is now held by Strategy and spot ETFs. With average ETF cost bases above price, $7B+ in unrealized losses and record outflows show normie capital under pressure—leaving BTC dependent on a fresh narrative to reaccelerate.

Jim Bianco/2026.02.03

Gold’s parabolic breakout isn’t a Bitcoin defeat but the same debasement trade unfolding in phases. Gold moves first as the hedge for states; Bitcoin follows as the hedge for people. They trend together long term, but cycle apart short term.

Swan/2026.01.27

100 gains didn’t disappear—they changed form. In a hyper-diluted market, winners stack gains by rotating early between narratives, not holding forever. This playbook explains how to spot rotations, size positions, take profits, and compound phases in 2026.

cyclop/2026.01.22

A veteran trader distills seven hard-earned lessons that prevent blown accounts and emotional spirals. From market context and risk control to playbooks, journaling, and process-first thinking, this guide shows how consistency—not signals—builds long-term trading edge.

Morin/2026.01.21

A trader pulled off a $233K overnight play on Polymarket by exploiting thin weekend liquidity. By baiting market-making bots in 15-minute markets and briefly nudging spot price, he forced mispricing and cashed out risk-efficiently.

PredictTrader/2026.01.19

After years as a retail trading hub, BNB Chain is evolving into a rare ecosystem where retail users, institutions, and builders coexist. With RWAs, stablecoins, and real yield products expanding, 2026 positions BNB Chain as a key bridge between TradFi and crypto.

Biteye/2026.01.15

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

When Elon Musk tweeted about Moltbook, the meme coin MOLT experienced a short-term 30% price surge, hitting a new all-time high of $114 million.

2026.01.31 18:37:29

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

MoreHot Articles

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

10 promising AI Agent cryptos

2024.12.05

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link