Gold at $5,000 Is Not Bitcoin’s Failure—It’s the First Act

Swan

Swan

This is wild.

Gold just ripped above $5,000/oz and the chart looks like a 2017 Bitcoin cycle.

Parabolic. Vertical. Relentless.

Instead of feeling defeated, Bitcoiners should be ecstatic about this move.

Here’s why 🧵👇

Everyone’s framing this as gold vs Bitcoin.

That’s the mistake.

Gold ripping isn’t Bitcoin failing.

It’s the same trade expressing itself through a different vehicle.

Same pressure. Different release valve.

Zoom out and actually look at the gold chart.

Years of dead money.

Ignored. Mocked. Written off.

Then suddenly it moves like something snapped.

That shape should feel familiar to anyone who’s lived through a Bitcoin cycle.

Gold moves first because of who owns it.

Central banks. Treasuries. Sovereigns staring at debt they can’t unwind.

Gold is the hedge when nation states need to buy time.

Bitcoin doesn’t serve that audience. Yet.

Bitcoin is the hedge for families.

For companies.

For balance sheets that don’t get a printing press.

That’s why gold and Bitcoin are positively correlated over the long run.

And why, in the short run, they often move opposite.

They trend together.

They cycle apart.

We’ve seen this movie before.

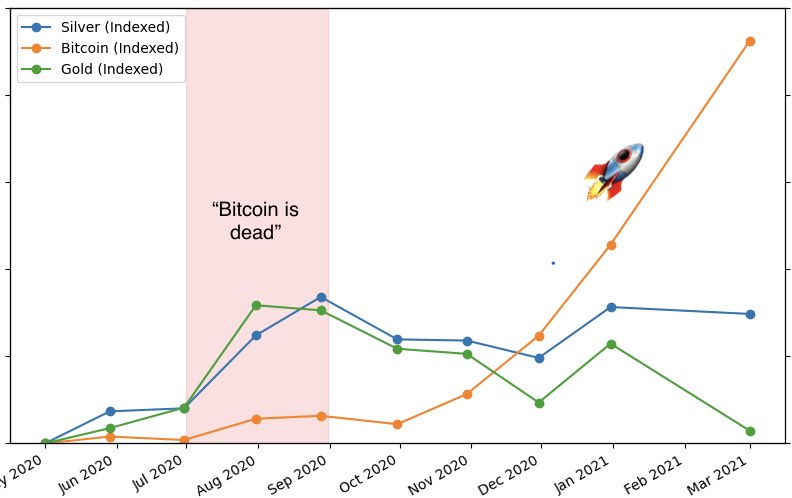

In 2020, gold and silver moved first.

Bitcoin went sideways for months.

Then Bitcoin repriced violently once the signal was undeniable.

Markets don’t move on fairness.

They move on positioning.

Here’s the part people get emotional about.

A shiny rock acting as the global monetary anchor in the age of the internet is non-sensical.

But markets don’t resolve nonsense immediately.

They stretch it.

Then they break it.

This is the debasement trade playing out in phases.

Gold is the early warning system.

Bitcoin is the endgame.

If you bail because the first phase isn’t Bitcoin-shaped yet, you miss the second.

The goal isn’t to win every quarter.

It’s to stay solvent longer than the market stays illogical.

Gold buys time for the system.

Bitcoin buys an exit from it.

Confusing those roles leads to bad decisions.

Bitcoin may enter a prolonged sideways phase between $57K and $87K as markets enter a relief period following a 52% drop from ATH. This consolidation could mirror the 2022 fractal, creating liquidity before a potential breakdown toward the $44K–$50K range.

Doctor Profit/3 days ago

Davinci Jeremie urged people to buy $1 of Bitcoin in 2013 and became a symbol of early conviction. Years later, fame, lifestyle flexing, and token promotions sparked criticism. His journey reflects both crypto foresight and influencer-era controversy.

StarPlatinum/2026.03.04

A sweeping narrative ties Jane Street to India’s expiry-day options case, alleged 10AM Bitcoin sell patterns, Terra’s collapse, and ETF plumbing. While none prove misconduct, critics argue a common structure: move spot, monetize derivatives, keep execution opaque.

Bull Theory/2026.02.27

A controversial narrative links Jane Street, ETF mechanics, and Bitcoin’s price behavior, pointing to lawsuit allegations, 10AM volatility patterns, and derivative hedging dynamics. The discussion raises broader questions about liquidity, structure, and price discovery.

Justin Bechler/2026.02.26

A new federal lawsuit alleges Jane Street exploited non-public information tied to Terraform’s liquidity defenses, accelerating UST’s depeg and the Terra collapse. The firm denies the claims. The case may reignite debates on structure, design, and regulation.

Diana/2026.02.25

Mean reversion and on-chain models sit at levels historically linked to bottom formation after capitulation. Realized losses reached record USD values, while deviations from anchor models remain extreme. Price pain may be fading; patience remains key.

Checkmate/2026.02.25

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

When Elon Musk tweeted about Moltbook, the meme coin MOLT experienced a short-term 30% price surge, hitting a new all-time high of $114 million.

2026.01.31 18:37:29

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

MoreHot Articles

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

10 promising AI Agent cryptos

2024.12.05

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link