How a Polymarket Trader Lost $2M in 35 Days: A Case Study in Negative Expectancy

Lookonchain

Lookonchain

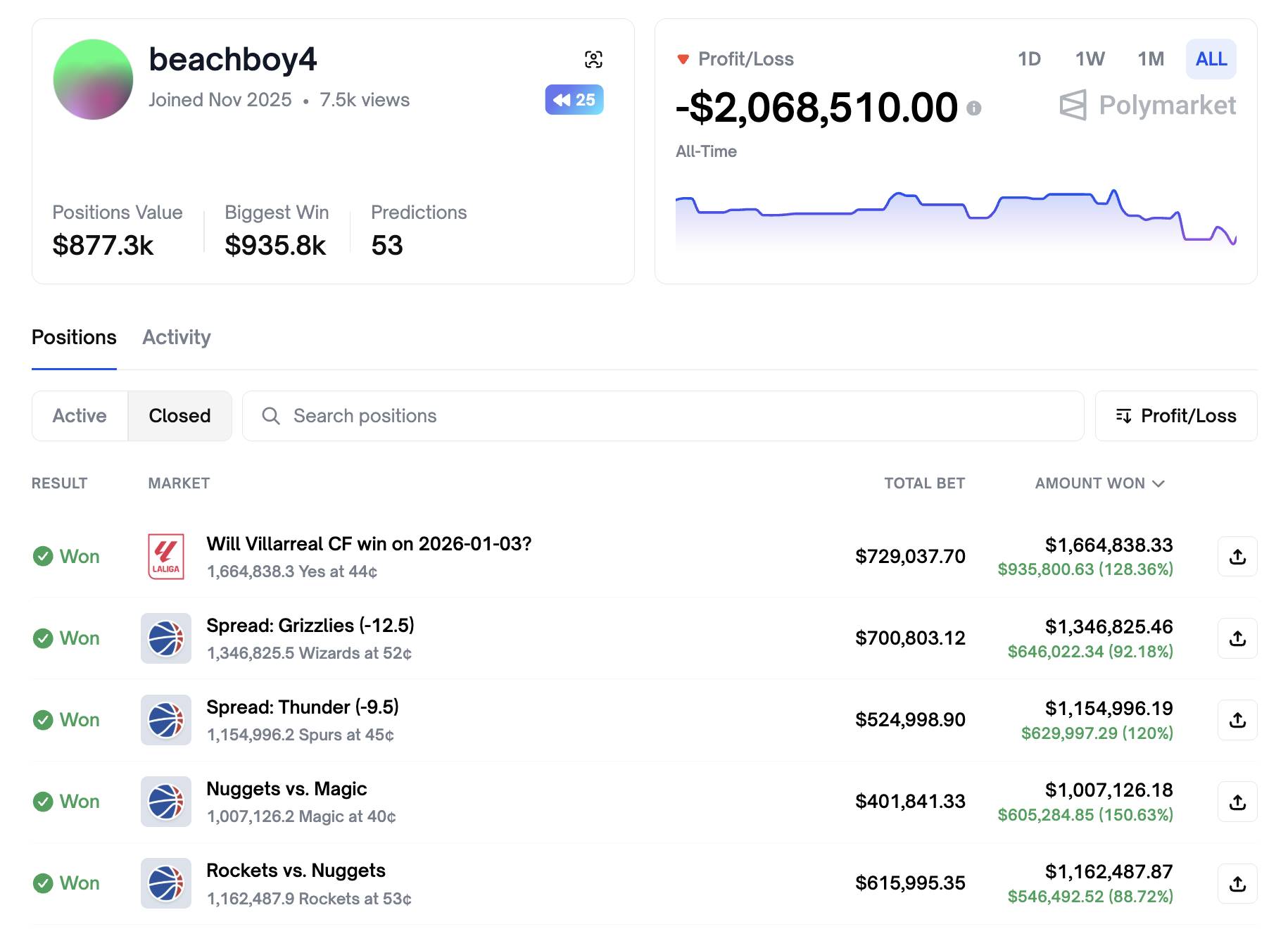

1/ Trader "beachboy4" lost over $2M in just 35 days on Polymarket.

Let's dig into his trades to see how he lost money and what lessons we can learn.

2/ First, the key stats:

Trading period: 35 days

Total predictions: 53

Wins: 27

Win rate: 51%

Biggest win: $935.8K

Biggest loss: $1.58M

Avg bet per event: ~$400K

Max bet per event: ~$1.58M

This isn't trading, this is gambling.

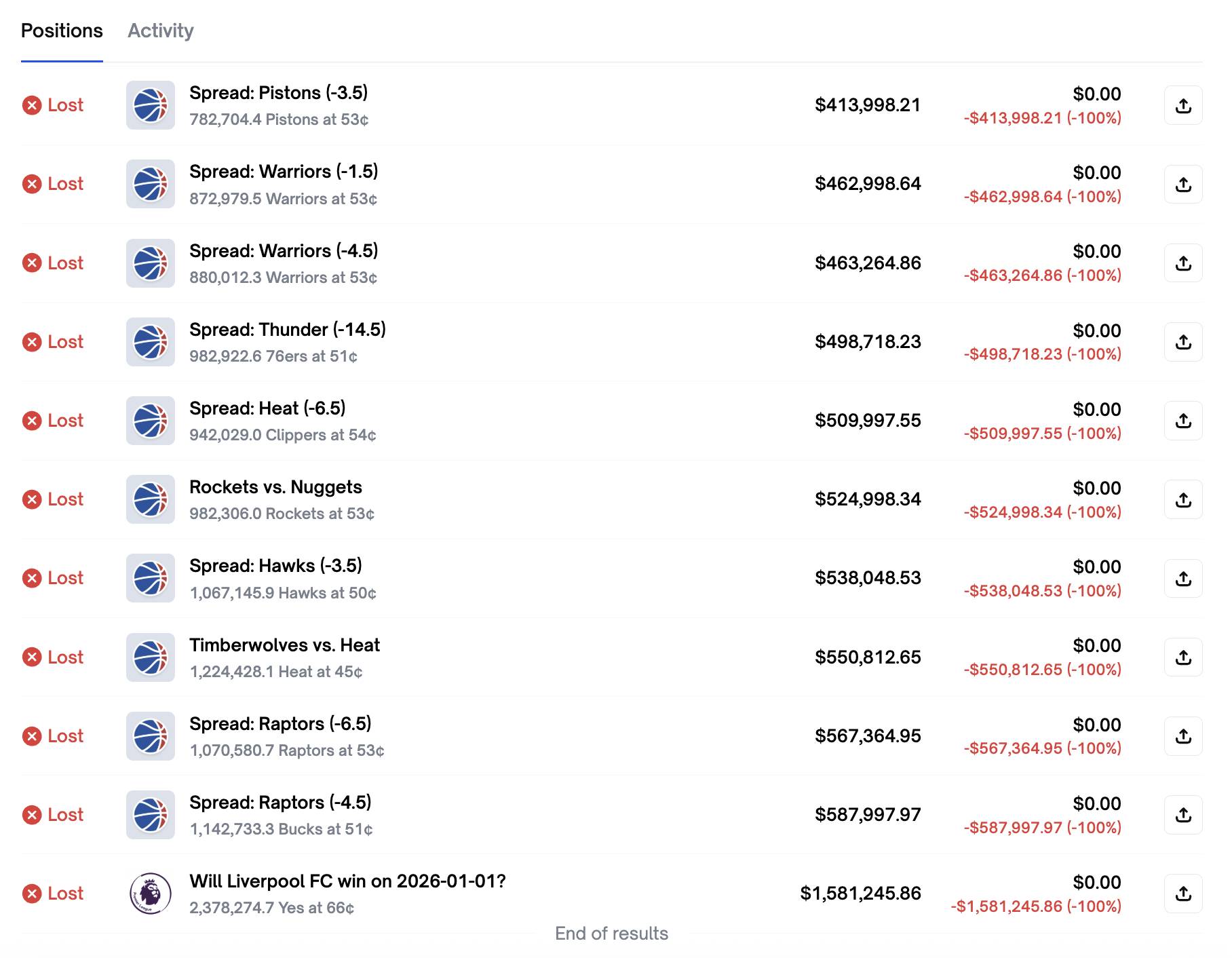

3/ The Biggest loss:

Liverpool to win (buy at $0.66): –$1.58M

Buying "YES" at $0.66 does not mean:

"Liverpool is likely to win"

It means:

"I believe the true probability is higher than 66%"

Polymarket is a probability market, not a bookmaker.

This trader consistently treated Polymarket like binary sports betting, not probability trading.

This single mistake is enough to explain most of the losses.

4/ This wallet repeatedly paid a premium for consensus

Across major losses:

Buy prices clustered at 0.51 – 0.67

Most positions had:

Upside: +50% to +90%

Downside: –100%

This is the worst payoff structure in Polymarket:

capped upside + total loss downside

5/ No exits. No hedging. No damage control.

Polymarket allows:

Early exits

Partial profit-taking

Probability-based stop losses

This trader used none of them.

Most losing positions were held all the way to zero, even when prices collapsed long before resolution.

That's not trading — that’s waiting for a verdict.

6/ Repeated all-in behavior

This wallet repeatedly placed extremely large single-position bets on:

NBA spreads

Soccer favorites

"High confidence" outcomes

In markets where:

Information is public

Pricing is efficient

Upside is capped

Downside is total loss

High confidence ≠ positive expected value.

7/ Hidden truth: the trader wasn’t unlucky

This wasn’t bad luck.

This wallet had:

Negative payoff asymmetry

No defined max loss per position

No edge in efficient markets

No probability discipline

Loss was inevitable.

8/ How to avoid repeating this mistake (practical rules)

Rule 1: Avoid high-price entries

Be extremely cautious above 0.55

Especially avoid 0.65+ unless you have strong informational edge

Rule 2: Cap single-event risk

Max 3–5% of total capital per event

One outcome should never decide your account

Rule 3: Trade price movement, not just resolution

Take partial profits

Cut losses when probability collapses

Don’t wait for “yes or zero”

Rule 4: Track win rate vs break-even rate

If your win rate < break-even → stop and reassess

Volume won’t fix a negative expectancy

Rule 5: Kill losing markets early

Persistent underperformance = no edge

Remove those markets entirely

A firsthand guide to swing trading built on extreme focus, volume analysis, and catalysts. By going all-in on one high-conviction stock at a time, this strategy shows how attention, patience, and discipline can outperform diversification.

Kevin Xu/3 days ago

Crypto in 2026 will be driven by new narratives forming early today—from prediction markets and community ICOs to privacy-first apps, neo-banking wallets, DePINs, perp DEXs, and AI as core infrastructure shaping on-chain finance.

HEADBOY/6 days ago

I built and backtested a Polymarket trading bot for BTC 15-minute markets, replaying high-frequency data to test multiple parameter sets. Results show strong profits with disciplined settings—and heavy losses when parameters are misaligned.

The Smart Ape/6 days ago

A deep dive into how on-chain data flagged $WHITEWHALE before its 100x move—tracking top holder shifts, smart money inflows, LP supply drains, and rising volume that revealed accumulation and conviction well before price went vertical.

Cryptor/2025.12.30

Galaxy Research outlines 26 predictions for 2026, spanning BTC’s path toward $250K, stablecoins overtaking ACH, DEXs reaching 25%+ spot volume, tokenized securities entering DeFi, and institutions driving ETFs, lending, and onchain settlement.

DeFi Warhol/2025.12.30

After five years in crypto, these are the lessons that matter most: avoid perps, don’t trust CT narratives, manage risk, take profits, keep stables, build real skills, and simplify. Survival and consistency beat chasing every trend.

fabiano.sol/2025.12.27

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

A whale exchanged WIF and Bonk positions for Fartcoin!

2024.12.25 11:01:14

MoreHot Articles

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

10 promising AI Agent cryptos

2024.12.05

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link