Altseason Signals Are Flashing—Are You Ready?

cyclop

cyclop

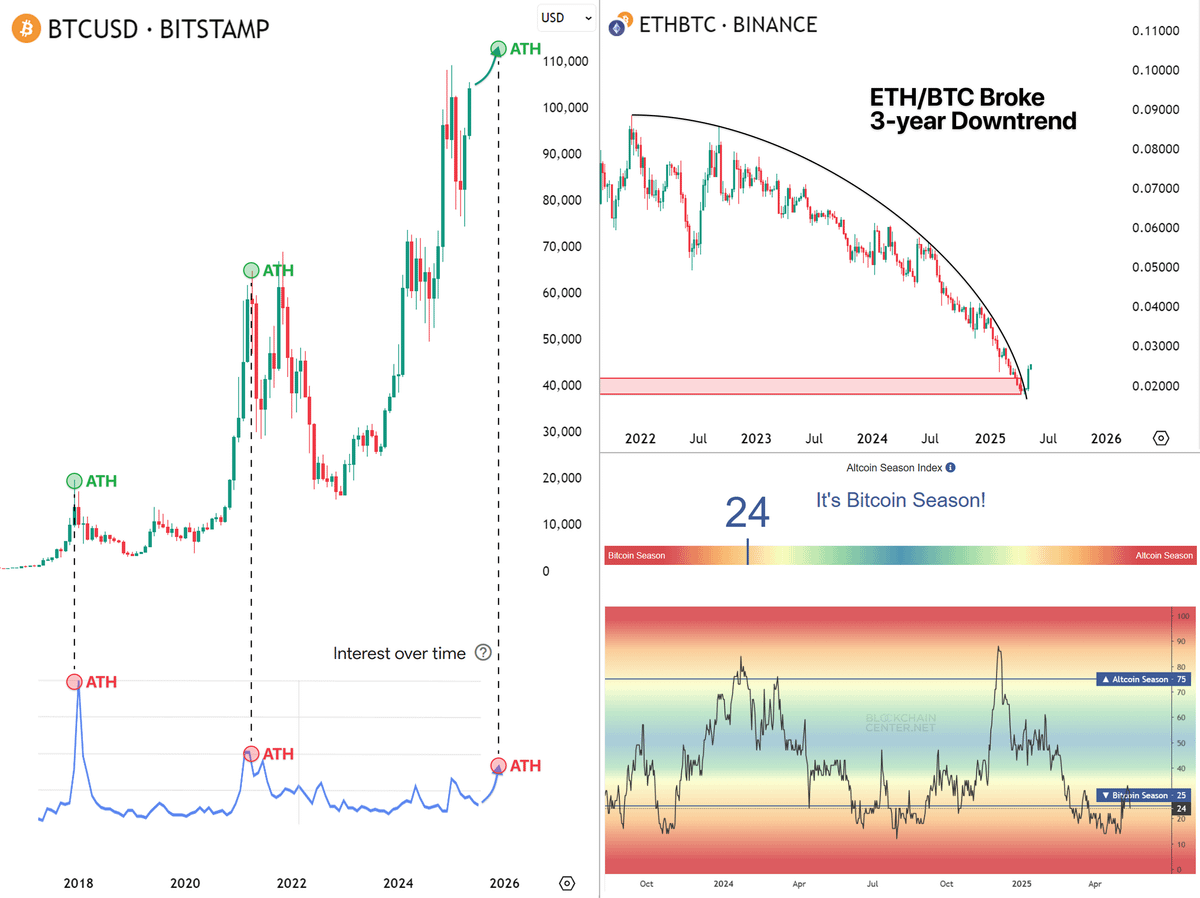

Now is the clearest bull setup in my 7 years in crypto:

- BTC near ATH

- Retail interest near ATL

- ETH/BTC broke 3y downtrend

- Alt index bounced off range low

EACH factor sparked altszn before. Now they ALL align.

🧵: Is this the start of next altszn? 👇

I can’t believe I’m saying this but I genuinely think we’re finally at the start of altseason.

In this mega-thread, I’ll break down:

- how crowd mindset shifted & why it’s bullish

- what has already changed and finally made altszn real

- key upcoming triggers

- top indicators & what they signal

- which alts are likely to pump

- how to build a proper altseason portfolio

- how to research projects that’ll run the hardest

1/➮ I've been in crypto for 7 years and have seen dozens of setups that triggered altszns

Yes, cycles have shifted a bit - I broke down how and why in the quoted thread

However I believe we’re at beginning of more sustained altszn, and it doesn’t require BTC pumping to $150K:

2/➮ Narrative around BTC has fundamentally changed:

✧ From being seen as a Ponzi - to:

- a top-tier investment asset

- a macro hedge

- 6th largest asset by market cap (plus S&P backing)

- strong hedge against inflation

- #1 bet for countries facing isolation or high inflation

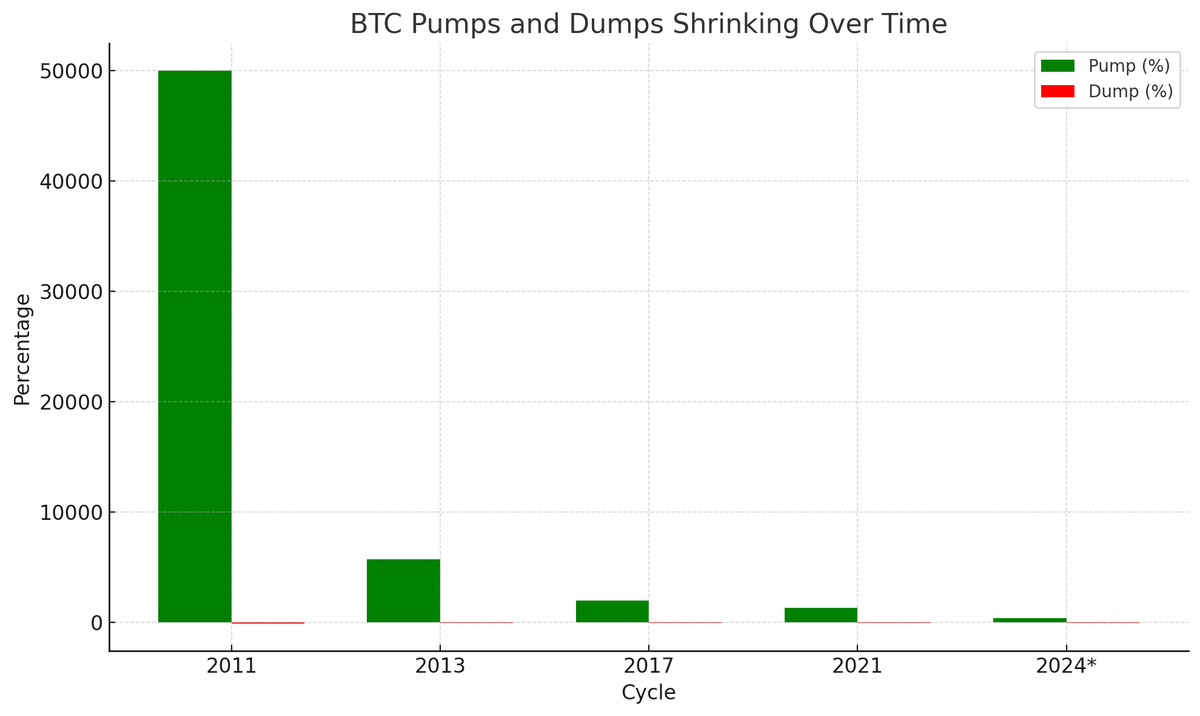

3/➮ BTC pump from here is no longer a requirement for altseason to start.

BTC pumps will be smaller in %, just like the dumps - that’s how it works when cap scales up.

Each year, BTC becomes more of a store-of-value asset - not a speculative one.

That’s what altcoins are for

4/➮ High cap Altcoins, especially blockchains are no longer seen as "Bitcoin alternatives."

They’re now understood as tech companies operating within the broader BTC ecosystem.

Ethereum = like Nvidia

Solana = like high-performance infra

And so on

This shift in perception happened in past cycles too - and every time, it marked the start of an altseason.

5/➮ Now let’s talk about what actually changed - and finally made altseason possible:

After the Pectra upgrade, Ethereum pumped and broke the 3-year ETH/BTC downtrend.

Every fudder turned into a believer.

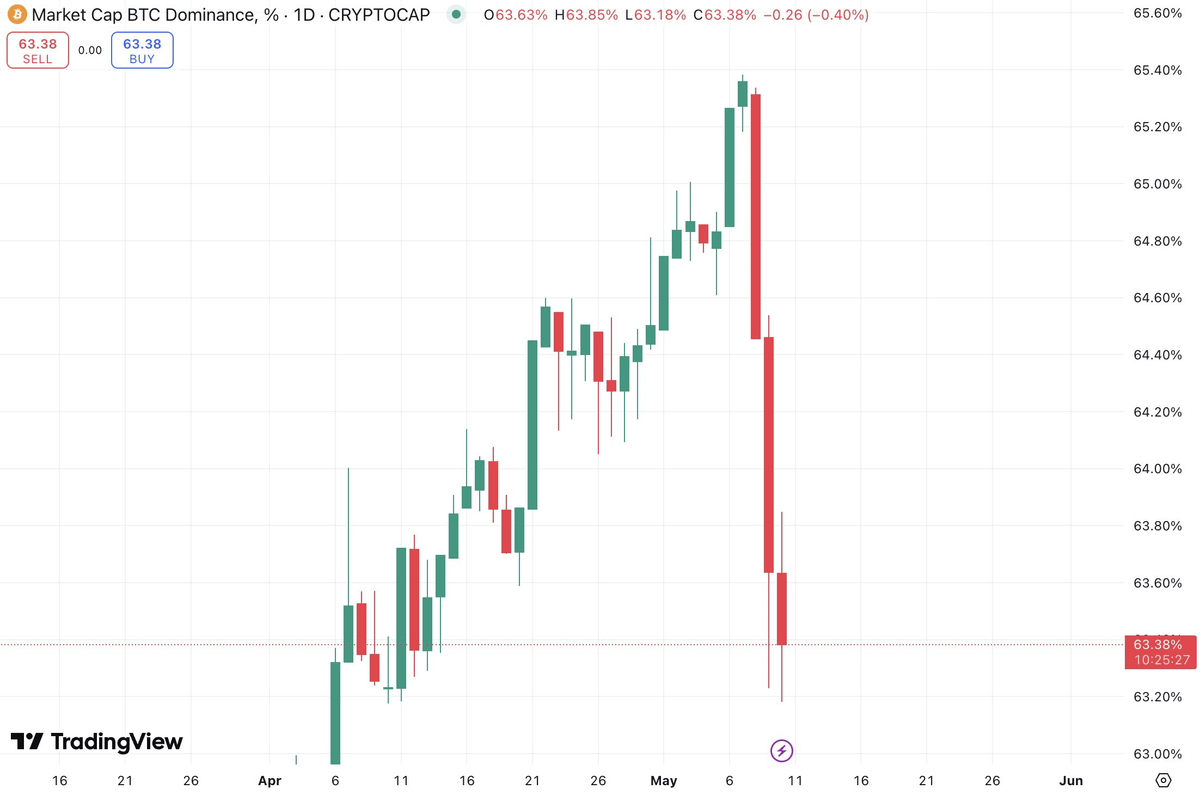

BTC dominance just saw its sharpest 3-day drop since Nov '24.

Alts hit peak disbelief - retail interest is at ATL, even after this mini-pump.

In my view, Pectra upgrade changed the game.

It also solved the biggest blocker for ETH-driven altseasons: the UI/UX layer.

You can read more about that in this thread:

https://x.com/nobrainflip/status/1920143154134548931

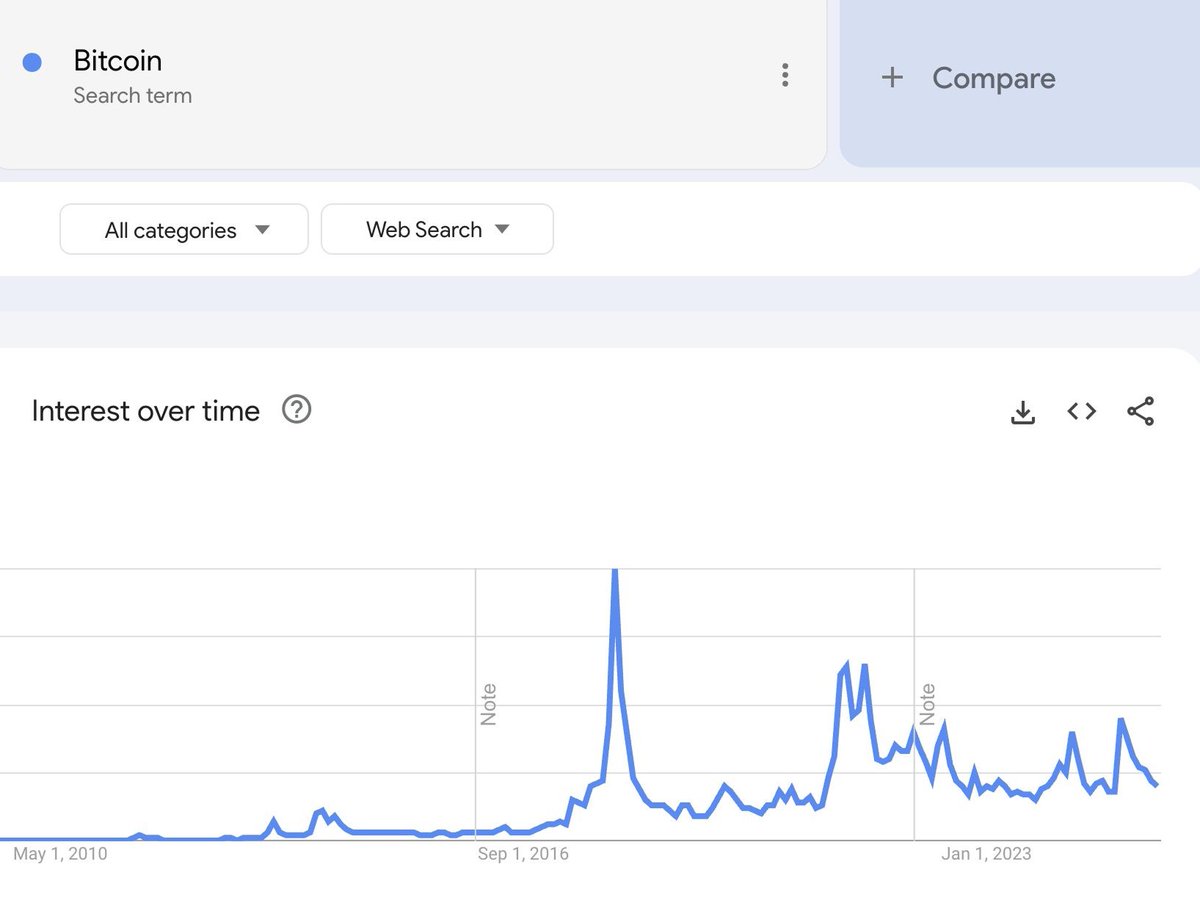

6/➮ Retail Index

✧ Despite such massive mass adoption, the retail index is currently near ATL

✧ This has previously been a key factor at the beginning of past altseasons

✧ Now, it's once again acting as a positive signal

Let me explain more:

7/➮ It’s important to understand a simple truth:

✧ Assets top when they look absolutely best, and bottom when there’s seemingly no worse situation

✧ Alts are still in a terrible state, and from here, the only way out is up

Upside triggers for eth & other alts? MANY.

Downside triggers? 0, disbelief is maxed out.

Even after 2x from the bottom the retail is not here.

So finally it feels like a moment when alts can do another 10x, even after 4x.

8/➮ ETH/BTC chart

✧ ETH/BTC had been in a downtrend for 5 months, which negatively impacted ETH

✧ Both its price and interest declined, making it harder for alts to rise

✧ Now it has been broken, ETH has pumped, sending strong signals for alts to grow

9/➮ Now let's check some indicators that matter, such as:

- global liquidity

- stablecoin index

- altseason index

✧ They ALL signal a potential reversal and inflow of liquidity into crypto, suggesting altseason

But this altseason will look different 👇

9/➮ Last cycle, there were fewer alts - almost everything pumped.

✧ This time it's different: massive oversupply makes it impossible for all alts to run

✧ Likely <10% will see big moves

✧ The key is finding those

Let’s break down how to identify them:

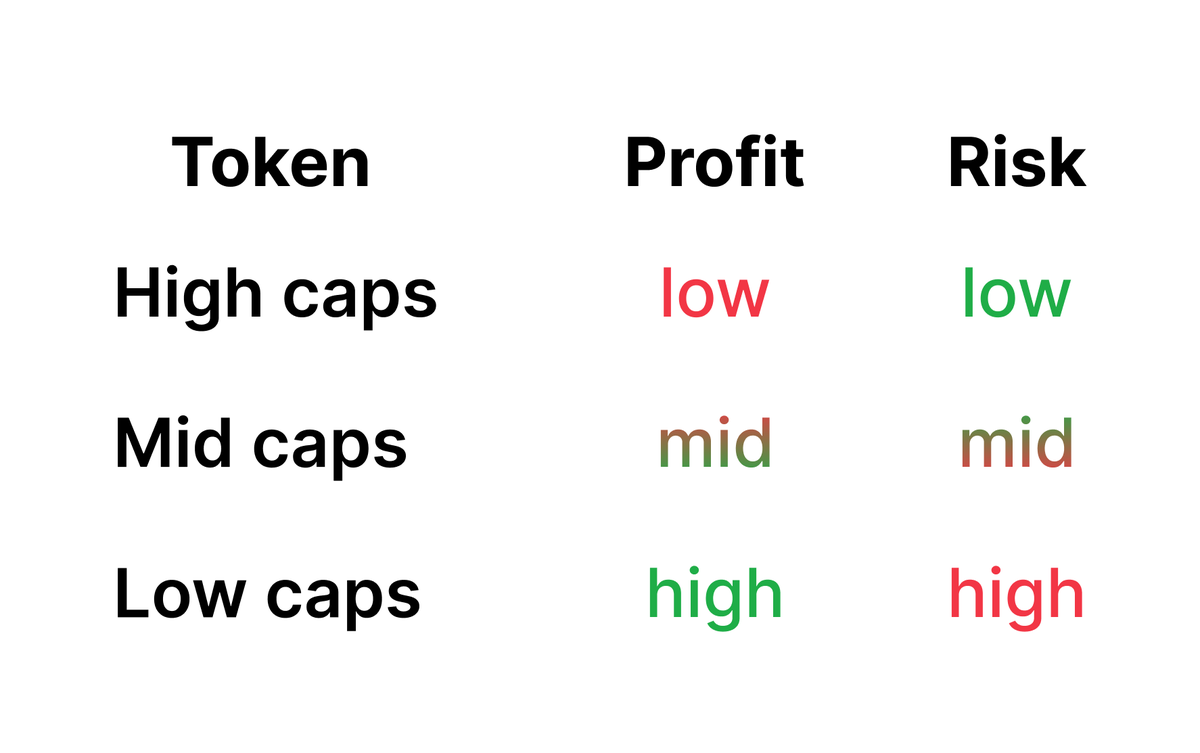

10/➮ Let’s start with this:

Your choice depends on the level of risk you're willing to take and how much profit you aim to make:

1) High caps = low profit + low risk

2) Mid caps = medium profit + medium risk

3) Low caps = high profit + high risk

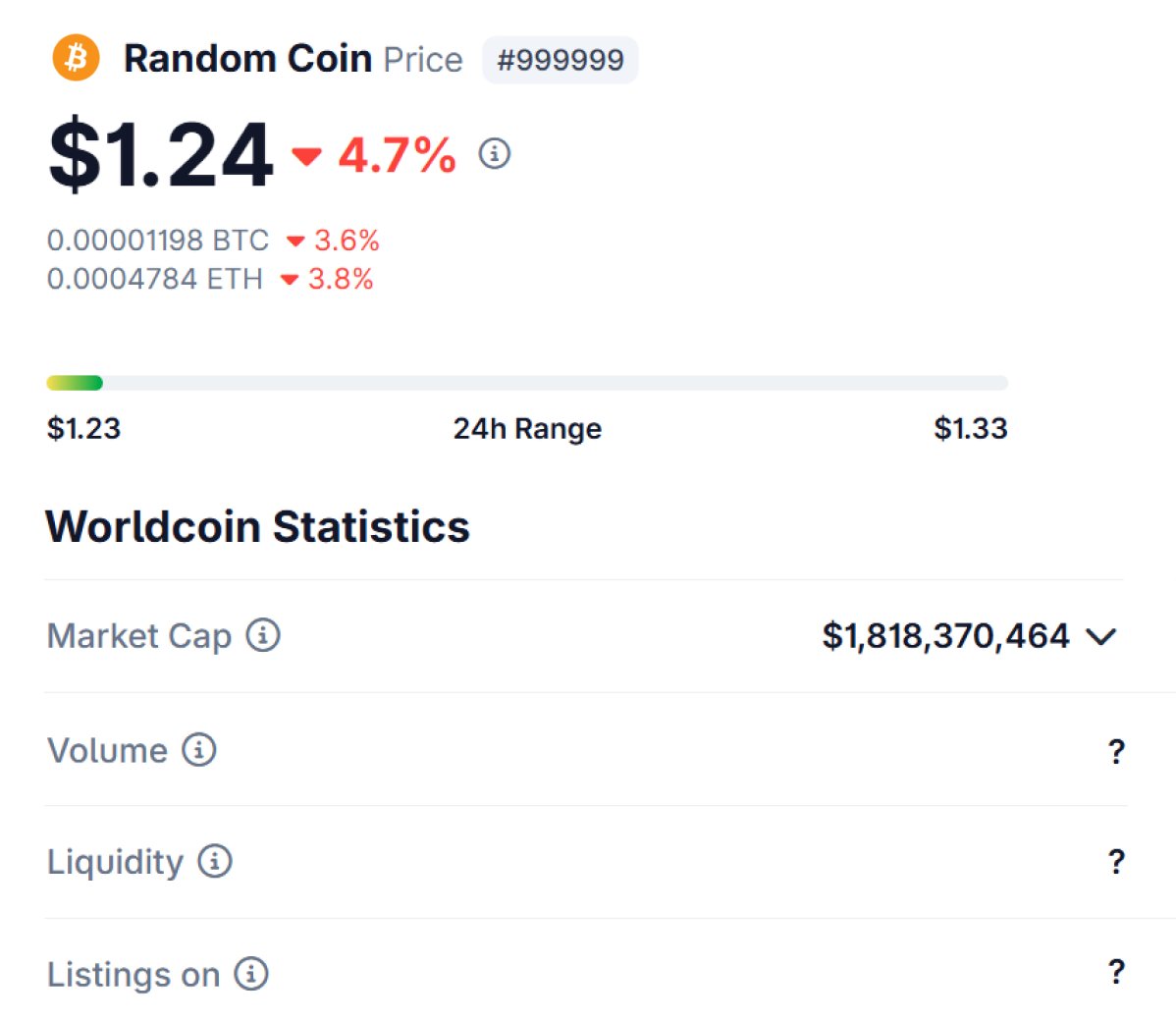

11/➮ Researching Right Alts

If it's highcap/utility coin, not fresh meme - best to look on: @coingecko

✧ This approach lowers the chance of running into scams

Analyze coins based on:

- Mc

- Liquidity

- Volume

- Listings on CEXs and DEXs

Create a list of the alts you like

12/➮ Follow trusted influencers (like me @nobrainflip 😁) and check if they follow or mention the project.

If you're followed to many infls and none of them follow the project - it's probably garbage.

Here's my list of the best crypto influencers:

https://x.com/nobrainflip/status/1769836278848127257

13/➮ Analyzing the Projects

✧ Move on to detailed research of the alts from your list

Check:

1) What’s the project’s idea and is there a demand

2) Product quality, explore the website, socials

3) Are team members public? Who are they and what’s their background?

Here’s a more detailed thread on how to build and manage a portfolio for this cycle - and how to actually pick the right alts.

https://x.com/nobrainflip/status/1859935394667938180

Here’s my detailed thread on finding 100x memes - the game works very differently there:

https://x.com/nobrainflip/status/1858655216054206821

And last the one on how to trade (ultimate-guide):

https://x.com/nobrainflip/status/1902784518794146080

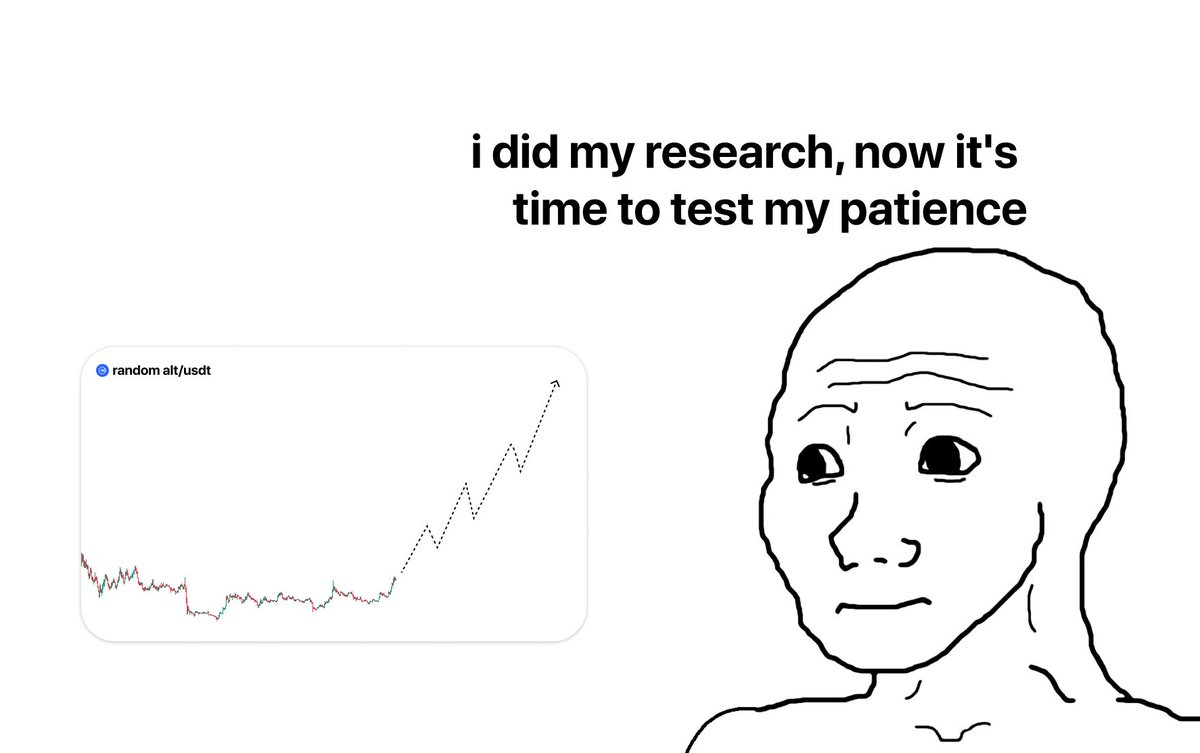

14/➮ Patience + Conviction = 100x

✧ Profits like 100x don’t happen in a day or even within a week or month

✧ With deep research, you identify a project with such potential and hold it long-term

✧ At the same time, following the project's development, updates, and activity

15/➮ Most important:

Don’t hold too many coins.

Don’t buy with borrowed conviction.

Here’s why:

How to stay poor:

Hold 100 coins and keep rotating instead of sticking to <10 alts you truly understand and believe in.

Holding everything means believing in nothing.

Believe in something.

16/➮ Conclusion

✧ Most indicators are clearly signaling an upcoming altseason, and what’s left is to prepare properly

✧ Remember: if you believe in everything, you believe in nothing

✧ Don’t pick dozens of projects, choose up to 5, but do it carefully

✧ Only this way can you find those <10% alts which can make 100x+ gains

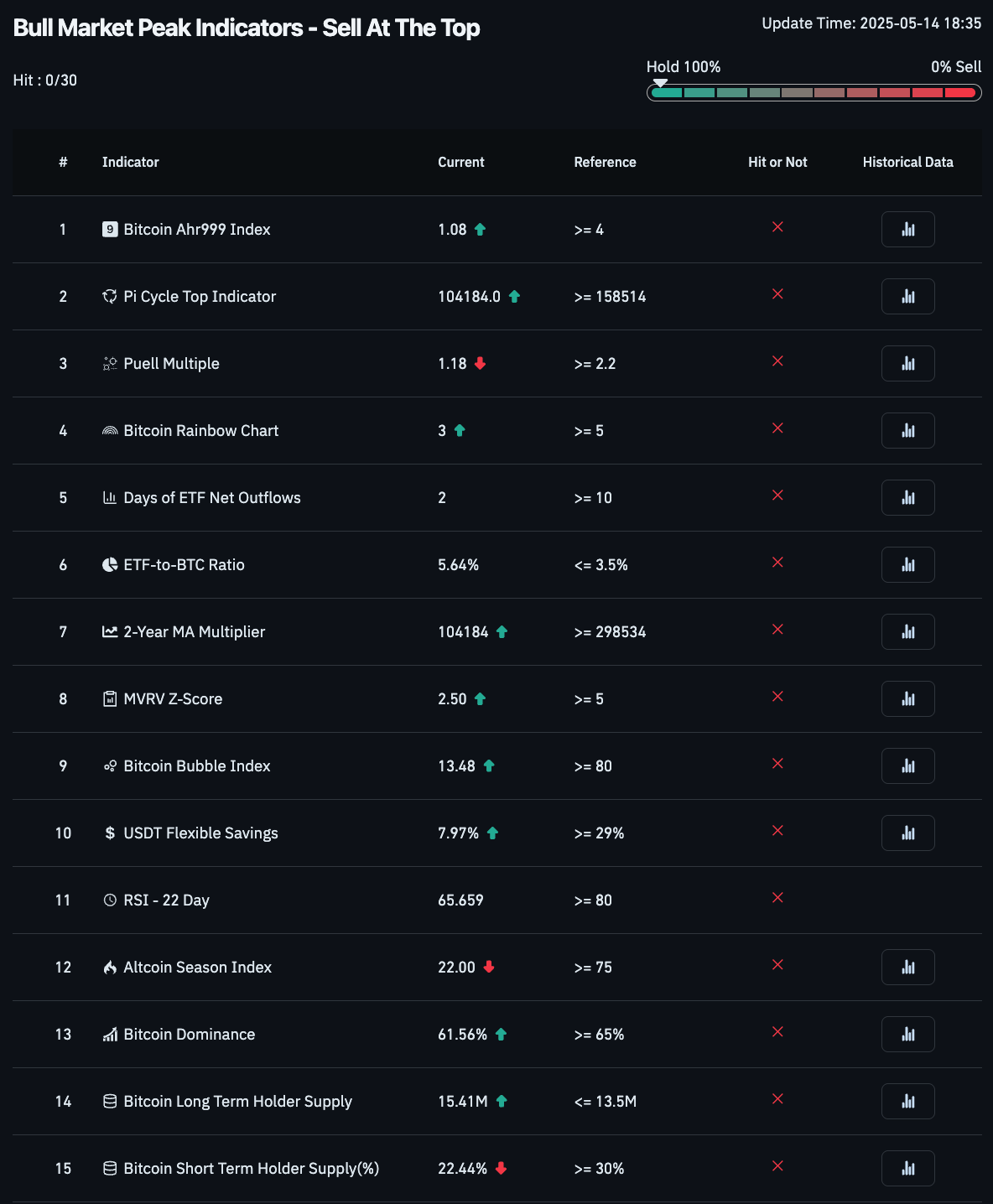

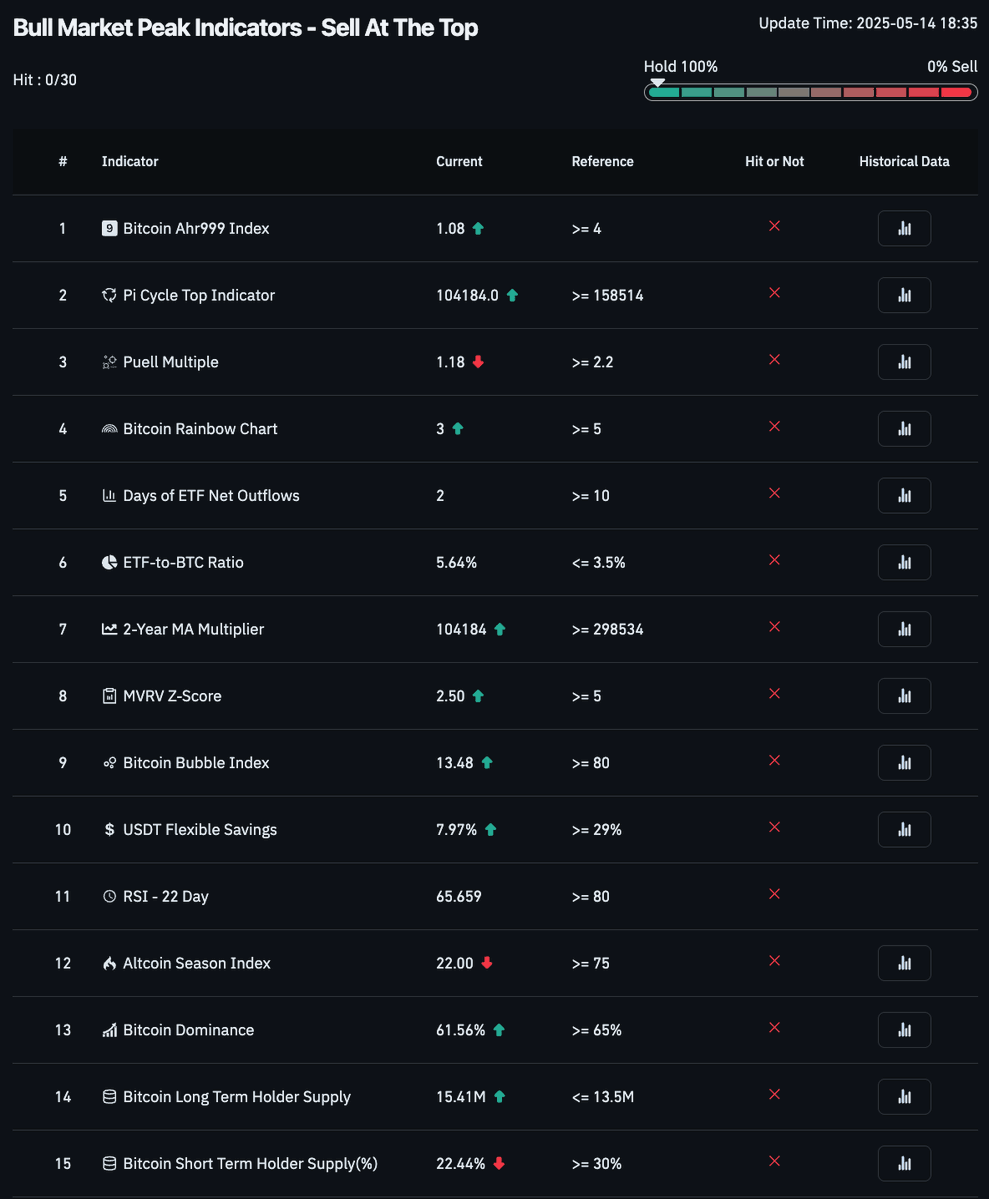

17/➮ And if that’s not enough - just check this pic

0/30 bull market peak indicators triggered

Weird, right?

A network of wallets linked to Faze Banks was found buying tokens like $MLG and $LIBRA before promotion, controlling supply and cashing out after marketing pumps. Evidence shows coordinated accumulation, sales, and Coinbase cashouts.

dethective/11 hours ago

99% of BTC will be mined by 2040, leaving miners reliant on transaction fees. With current fees covering just 7% of costs, Bitcoin faces tough questions on security and incentives post-halving. Can it stay secure without changing its rules?

Leshka.eth/2 days ago

A Satoshi-era whale sold 80,000 BTC ($9B) through Galaxy Digital with barely a 3.5% dip. This historic holder rotation moved decade-old coins to institutional hands, tightening supply and signaling a new phase for Bitcoin’s price discovery.

Swan/2 days ago

Bitcoin shows signs of a short-term downtrend reversal after a strong bounce at $114,700. With supports at $112K and resistances at $121K-$123.25K, targets of $133K-$140K are expected soon. Mid-term top likely in Q4 before a bear market, but long-term outlook remains highly bullish.

Mr. Wall Street/2 days ago

Bitcoin remains range-bound between key liquidation clusters at $121k–$120k and $114.5k–$113.6k. While an upside move to the top cluster is possible first, the $113.8k level and unfilled CME gap at $114.3k suggest the downside cluster is the mid-term target.

CrypNuevo/2 days ago

Every historical Altseason started in August. Bitcoin dominance is slipping, and capital is rotating into alts. This could be the setup for 200x+ lowcap rallies like past cycles. Here’s my 2025 portfolio picks before the bull run kicks off.

0xNobler/5 days ago

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A whale exchanged WIF and Bonk positions for Fartcoin!

2024.12.25 11:01:14

MoreHot Articles

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 promising AI Agent cryptos

2024.12.05

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link