Insights from Andrew Kang: Crypto Predictions and Investments

Nonzee

Nonzee

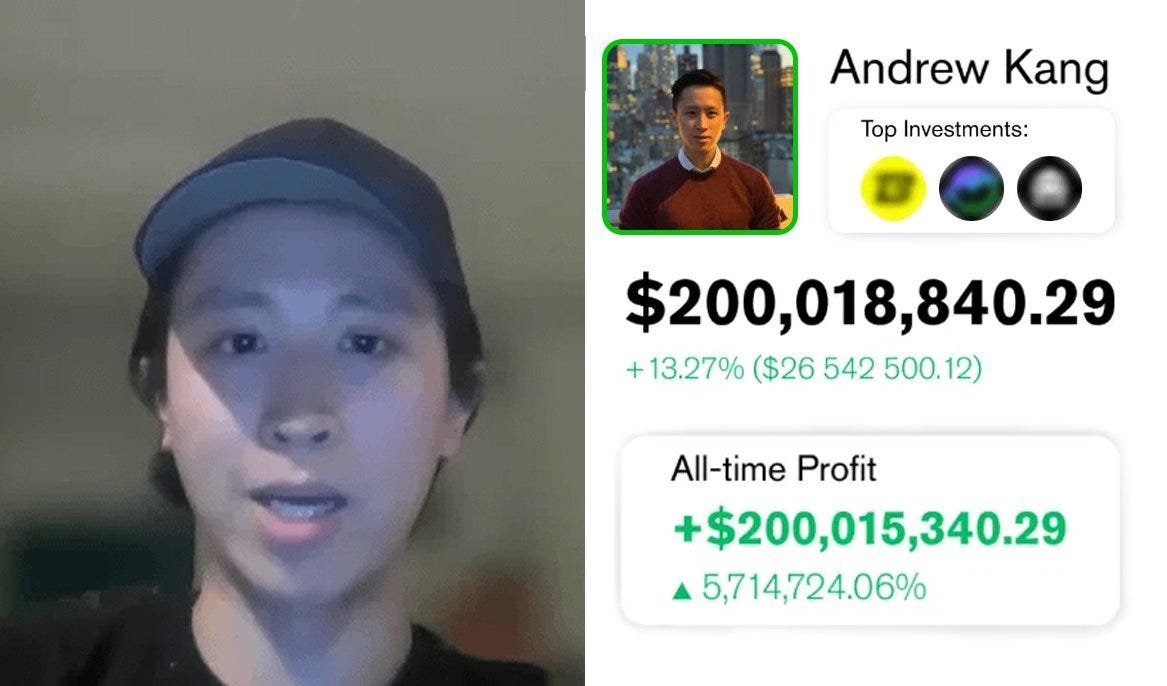

Andrew Kang, Forbes #1 crypto trader:

- Co-founder of Mechanism Capital ($300M AUM)

- Turned $0 into $200M in just 3 years

- $200M $BTC long

Here are 6 predictions from Kang you should know👇🧵

Andrew Kang, founder of Mechanism Capital, returns to crypto after a long break.

From California roots to a $500 million net worth, his journey is one of grit and brilliance.

This move reflects his confidence in Bitcoin, supported by Trump's pro-crypto policies, including the U.S. strategic reserve announced in March 2025 with $BTC, $ETH, $XRP, $SOL, and $ADA.

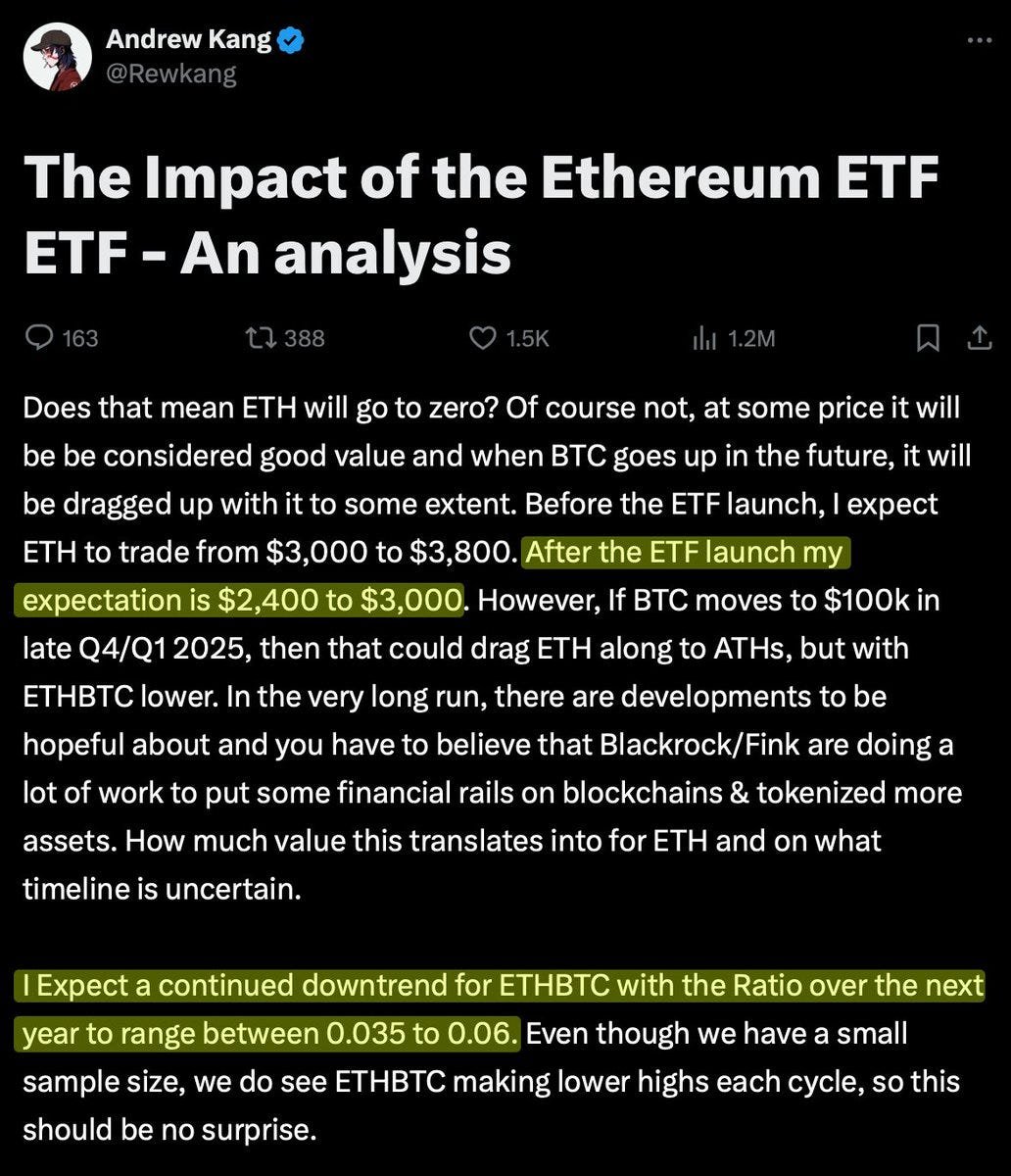

Kang’s predictions have a history of precision. When the Ethereum #ETF launched in 2024, $ETH was at $3,900, and most were bullish. Kang wasn’t

He claimed ETH was overvalued, predicting it would lag behind Bitcoin with only 15% of Bitcoin's institutional inflows

Today, the ETH/BTC ratio is at multi-year lows, proving him right

He predicted the meme coin trend, foreseeing Trump’s token, $TRUMP, which launched in late 2024 and crashed by early 2025 as he warned

His insight comes from his grasp of market psychology and cultural trends, honed at Digital Capital Management

https://x.com/Rewkang/status/1754644977777258637

1/ Bitcoin Surge

Kang is optimistic about Bitcoin, citing Trump's April 2025 post as a potential "Trump put" that could push $BTC to $125,000 by year's end, especially with possible Federal Reserve rate cuts

Analysts like Standard Chartered’s Geoff Kendrick predict #BTC could reach $500,000 by 2029

2/ Ethereum collapse

Andrew warns $ETH could drop below $1,000 due to a 30% decline in Ethereum transactions since 2023, indicating weakness

Institutional investors preferring Bitcoin ETFs, up 20% in Q4 2024, worsen ETH's outlook

https://x.com/Rewkang/status/1909472292377067987

3/ Future in humanoid robotics

He is investing heavily in humanoid robotics after a big $15 million to $200 million win.

This aligns with a tech boom, as the humanoid market is projected to reach $13.25B by 2029 with a 45.5% CAGR

Companies like Agility Robotics are expanding, and Kang's investment could mark a new crypto-tech crossover frontier

https://x.com/Rewkang/status/1912084678867370229

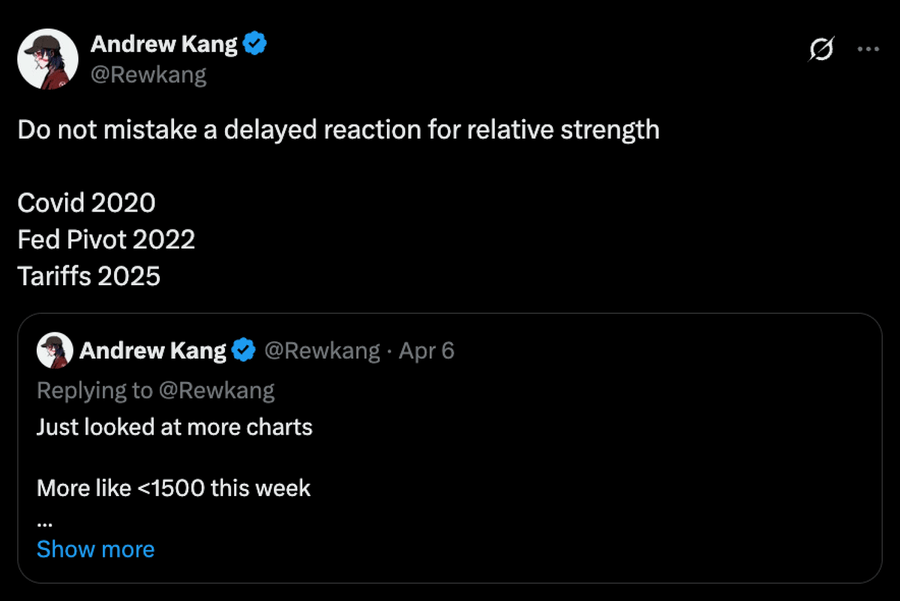

4/ Warns about tariffs

Trump's April 2025 tariff pause, which caused a 2% Bitcoin swing, led Senate Democrats to urge an SEC insider trading probe

Kang notes that market reactions might be delayed but will be significant, as seen in 2020's trade war

Expect volatility if tariffs return

5/ Kang Forecasts

Also, Kang urges skepticism of media hype, predicting crypto regulatory clarity by 2025 through the U.S. Treasury’s Exchange Stabilization Fund, bypassing Congress.

He advises traders to rely on primary sources over headlines to stay informed

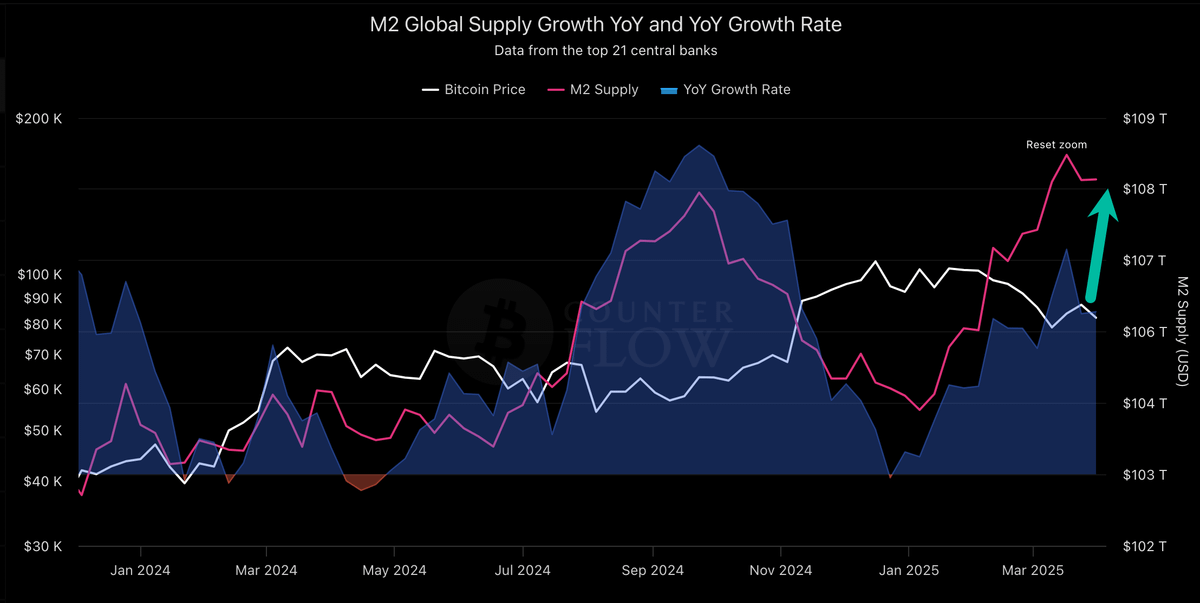

6/ Kang’s final tip: study history

He notes Bitcoin’s 2017-2021 cycles often followed global liquidity trends, a pattern reemerging with 2025 economic shifts

Pair this with his tariff and regulatory insights, and you’ve got a roadmap for navigating the year

Bitcoin may enter a prolonged sideways phase between $57K and $87K as markets enter a relief period following a 52% drop from ATH. This consolidation could mirror the 2022 fractal, creating liquidity before a potential breakdown toward the $44K–$50K range.

Doctor Profit/2 days ago

Davinci Jeremie urged people to buy $1 of Bitcoin in 2013 and became a symbol of early conviction. Years later, fame, lifestyle flexing, and token promotions sparked criticism. His journey reflects both crypto foresight and influencer-era controversy.

StarPlatinum/2026.03.04

A sweeping narrative ties Jane Street to India’s expiry-day options case, alleged 10AM Bitcoin sell patterns, Terra’s collapse, and ETF plumbing. While none prove misconduct, critics argue a common structure: move spot, monetize derivatives, keep execution opaque.

Bull Theory/2026.02.27

A controversial narrative links Jane Street, ETF mechanics, and Bitcoin’s price behavior, pointing to lawsuit allegations, 10AM volatility patterns, and derivative hedging dynamics. The discussion raises broader questions about liquidity, structure, and price discovery.

Justin Bechler/2026.02.26

A new federal lawsuit alleges Jane Street exploited non-public information tied to Terraform’s liquidity defenses, accelerating UST’s depeg and the Terra collapse. The firm denies the claims. The case may reignite debates on structure, design, and regulation.

Diana/2026.02.25

Mean reversion and on-chain models sit at levels historically linked to bottom formation after capitulation. Realized losses reached record USD values, while deviations from anchor models remain extreme. Price pain may be fading; patience remains key.

Checkmate/2026.02.25

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

When Elon Musk tweeted about Moltbook, the meme coin MOLT experienced a short-term 30% price surge, hitting a new all-time high of $114 million.

2026.01.31 18:37:29

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

MoreHot Articles

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

10 promising AI Agent cryptos

2024.12.05

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link