Draining the Bots: How a Trader Made $233K Exploiting Polymarket’s Thin Liquidity

PredictTrader

PredictTrader

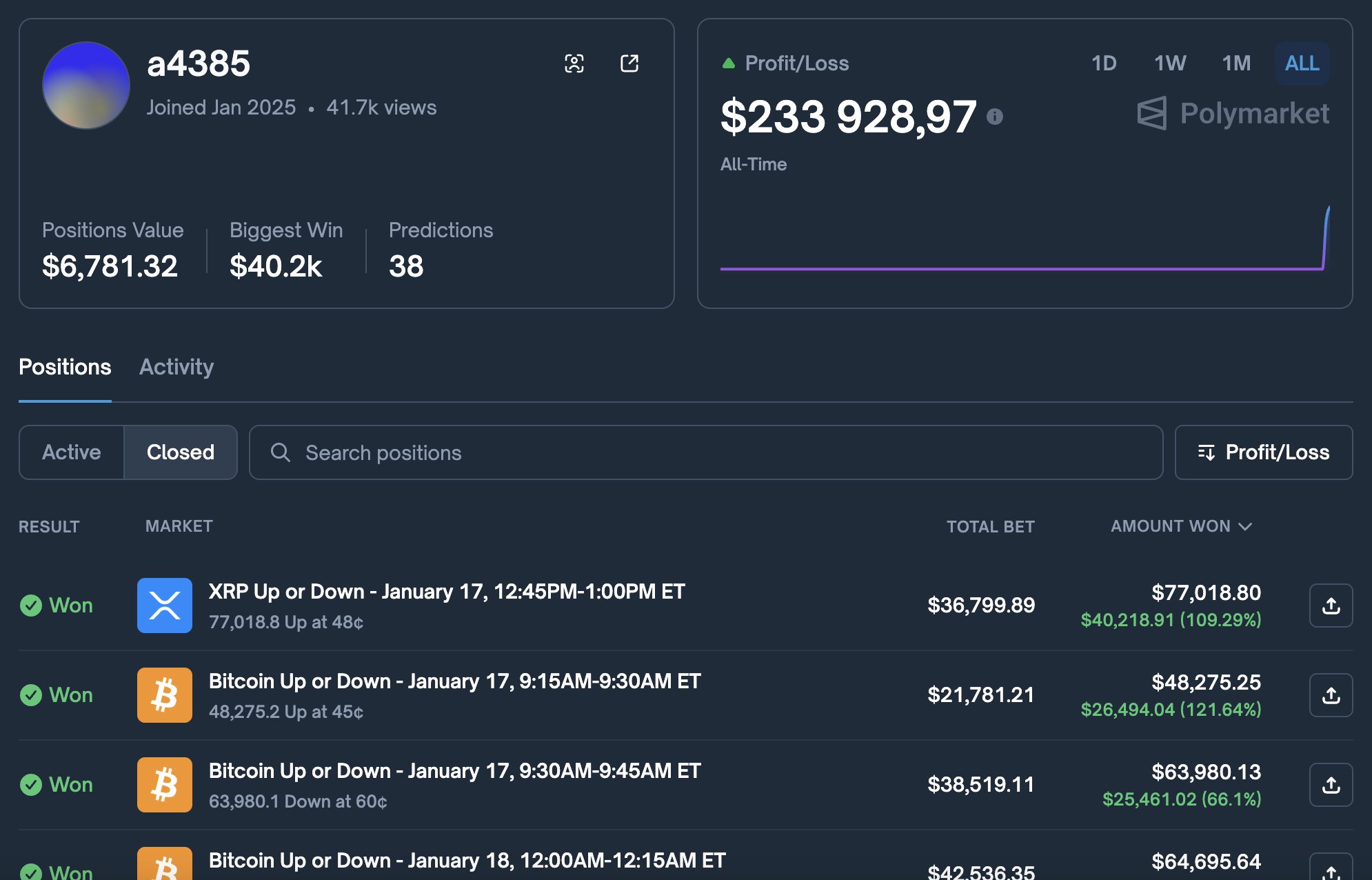

A Polymarket trader ran a Wolf of Wall Street–level play overnight - made $233K by drained liquidity from trading bots and it flew completely under the radar.

The setup was brilliant and extremely simple.

A trader known as @a4385 made $233K overnight exploiting 15-minute Polymarket markets.

Saturday night. Liquidity is thin. Binance spot order books are shallow. On “XRP Up or Down — Jan 17, 12:45–1:00 PM ET” he aggressively bought UP at any price. His counterparties were trading bots. Polymarket market making is relatively straightforward, with low barriers to entry for solo devs and trading bots are now very popular. By the 10th minute of the market - XRP was down ~0.3% from the open yet he had pushed UP shares to 70¢. The bots saw an opportunity and walked straight into the trap selling him even more UP.

~77K UP accumulated at an average price of ~48¢.

Two minutes before settlement, a wallet on Binance bought ~$1M USDT of XRP spot, pushing price ~0.5% higher. Seconds after settlement, the $1M spot buy was sold back.

Cost of the manipulation:

~0.25% slippage each way + fees.

With Binance VIP 4 level (0.06%) (quite easy to obtain) and 0.25% slippage on both sides the total cost was ~$6,200; It may be less.

He ran the same play multiple times, cleaning out bot wallets by exploiting thin weekend liquidity.

@a4385 - https://polymarket.com/profile/0x506bce138df20695c03cd5a59a937499fb00b0fe

Some bots were shut down in time. Others didn’t react fast enough and lost their entire balances - including https://polymarket.com/@aleksandmoney, which gave up a full year of profits.

Davinci Jeremie urged people to buy $1 of Bitcoin in 2013 and became a symbol of early conviction. Years later, fame, lifestyle flexing, and token promotions sparked criticism. His journey reflects both crypto foresight and influencer-era controversy.

StarPlatinum/2 days ago

A sweeping narrative ties Jane Street to India’s expiry-day options case, alleged 10AM Bitcoin sell patterns, Terra’s collapse, and ETF plumbing. While none prove misconduct, critics argue a common structure: move spot, monetize derivatives, keep execution opaque.

Bull Theory/6 days ago

A controversial narrative links Jane Street, ETF mechanics, and Bitcoin’s price behavior, pointing to lawsuit allegations, 10AM volatility patterns, and derivative hedging dynamics. The discussion raises broader questions about liquidity, structure, and price discovery.

Justin Bechler/2026.02.26

A new federal lawsuit alleges Jane Street exploited non-public information tied to Terraform’s liquidity defenses, accelerating UST’s depeg and the Terra collapse. The firm denies the claims. The case may reignite debates on structure, design, and regulation.

Diana/2026.02.25

Mean reversion and on-chain models sit at levels historically linked to bottom formation after capitulation. Realized losses reached record USD values, while deviations from anchor models remain extreme. Price pain may be fading; patience remains key.

Checkmate/2026.02.25

Bitcoin didn’t fail as an asset — it matured into an ETF-driven trade. As institutional ownership rose, correlation with tech risk intensified. Short-term pressure reflects holder structure shifts, not thesis collapse.

Eric Jackson/2026.02.24

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

When Elon Musk tweeted about Moltbook, the meme coin MOLT experienced a short-term 30% price surge, hitting a new all-time high of $114 million.

2026.01.31 18:37:29

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

MoreHot Articles

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

10 promising AI Agent cryptos

2024.12.05

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link