BNB Chain at a Crossroads: From Retail Liquidity to Institutional Coexistence in 2026

Biteye

Biteye

2026 Outlook: After Retail Traffic and Institutional Entry, Where Is BNB Chain Headed Next?

In recent days, Twitter has been buzzing with talk of integrated trading features, sparking a new round of discussion around “entry-point narratives.” Yet amid increasingly fierce competition for user entry points, BNB Chain has quietly charted a different path—and is set to continue pushing forward in 2026.

Looking back over the past few years, BNB Chain has consistently been a hotspot for retail trading. Low fees, fast speeds, smooth UX, and the built-in user traffic from Binance made it the starting point for countless users entering crypto. In 2025, the meme-coin cycle on BSC heated up again. But after the noise faded, BNB Chain did not cool off—instead, it attracted more traditional institutions. BlackRock, Franklin Templeton, CMB International, Circle, and others successively deployed assets on BNB Chain, forming a new pattern in which institutions, retail users, and projects coexist within the same ecosystem.

Next, we will reconstruct this process from multiple dimensions and break down how BNB Chain has become a key platform for the coexistence of TradFi and crypto.

In 2025, BNB Chain Was No Longer Just a Retail Playground

If we look only at the data, BNB Chain delivered across-the-board growth in 2025:

Total unique addresses surpassed 700 million, with daily active users exceeding 4 million

Average daily transactions peaked at 31 million in October

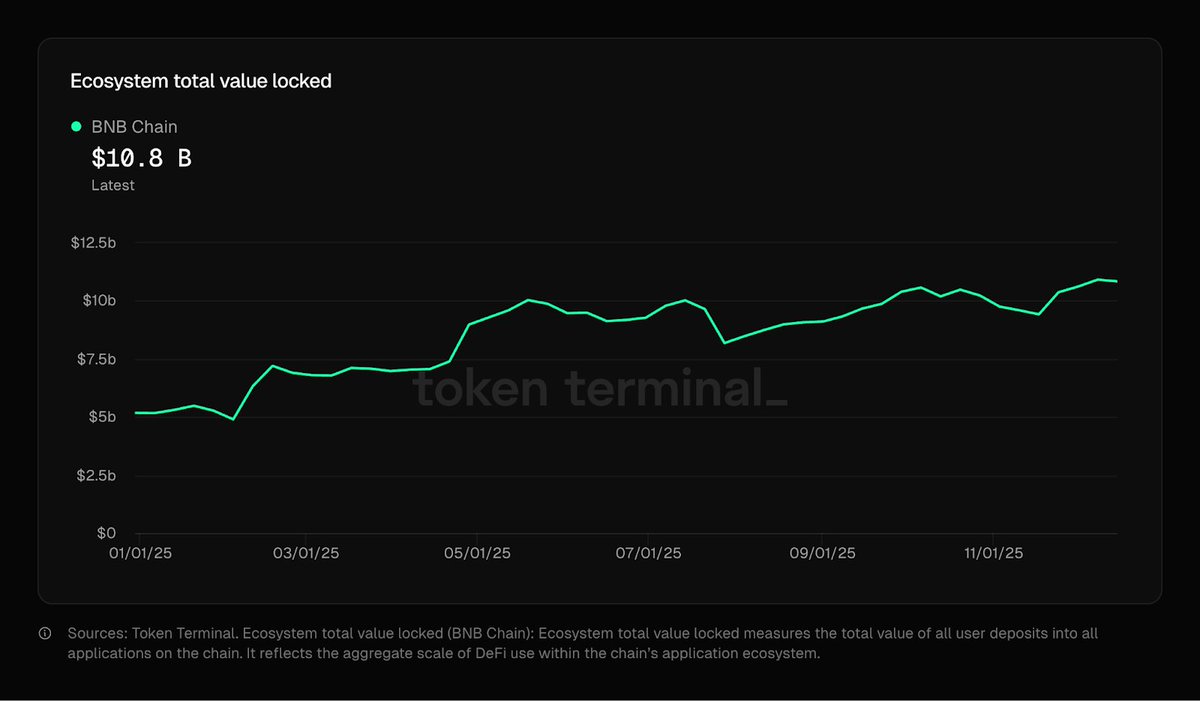

TVL grew 40.5% year over year

Total stablecoin market cap doubled to $14 billion

On-chain compliant RWA assets reached $1.8 billion

These figures show that across stablecoin transfers, asset circulation, and high-frequency interaction, BNB Chain has withstood long-term real-world usage.

Beyond the data, users more directly felt the renewed on-chain vibrancy. In the first half of 2025, multiple meme cycles emerged under the push of the @Four_FORM_ platform. Tokens such as $FLOKI, $Cheems, and $BROCCOLI exploded rapidly, once again making BNB Chain a retail hotspot. In the second half of the year, a new wave led by Chinese-language meme coins such as $币安人生 fully ignited enthusiasm within the Chinese community.

After the hype returned, meme trading volumes eased, but stablecoin activity continued to rise. Stablecoins such as $USDC, $USDT, $USD1, and $U became widely used across payments, lending, and yield products. Meanwhile, institutions like Circle and BlackRock brought stablecoins and money market funds on-chain, with BNB Chain among the first hosting platforms—showing that assets are increasingly settling and staying on-chain for the long term.

In 2025, BNB Chain experienced growth on two fronts simultaneously: cyclical meme-driven traffic surges on one side, and steady onboarding of traditional financial assets, with expanding use of stablecoins and real-yield products on the other. This marked the ecosystem’s transition toward supporting long-term capital use cases.

Why BNB Chain? Three Reasons Institutions Chose It

In 2025, several heavyweight financial institutions deployed on BNB Chain, spanning stablecoins, money market funds, and yield-bearing assets:

BlackRock: Tokenized its USD cash management fund BUIDL via Securitize and launched it on BNB Chain.

CMB International (CMBI): Issued the $3.8B money market fund token CMBMINT, allowing qualified investors to subscribe and redeem on-chain.

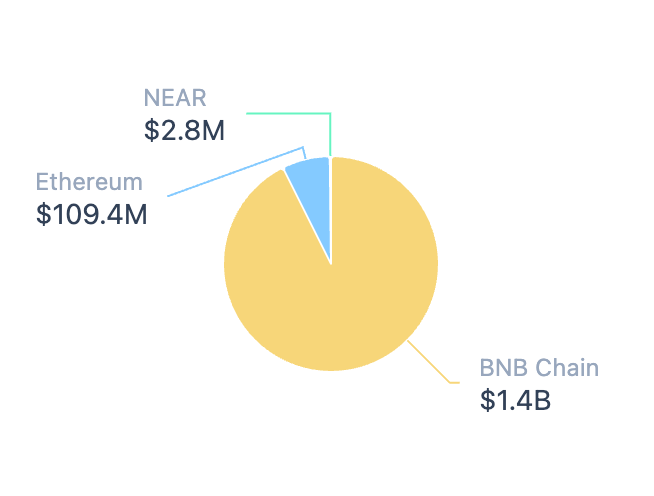

Circle: Deployed its yield-bearing stablecoin USYC on BNB Chain. According to RWA.xyz, USYC’s on-chain supply exceeded $1.5B, with over $1.4B on BNB Chain.

Why do traditional institutions favor BNB Chain? These cases point to three main reasons:

Low cost, high performance: BNB Chain is known for strong performance and low gas fees, making it ideal for high-frequency financial applications. Compared with Ethereum mainnet’s high fees and congestion, BNB Chain offers a more efficient on-chain operating environment.

Massive user base: Leveraging Binance’s long-term accumulation, BNB Chain has one of the most diverse global user bases, especially across Asia and emerging markets. Once institutional assets are deployed, they gain immediate audience reach. For example, BUIDL can be used as trading collateral within Binance, accessing tens of millions of CEX users.

Mature infrastructure and capital flow paths: After years of development, BNB Chain’s DeFi stack is comprehensive—stablecoins, DEXs, lending, derivatives—allowing institutional tokens to plug directly into on-chain use cases. For instance, CMBMINT can be used as collateral in protocols like @VenusProtocol and @lista_dao.

BNB Chain combines technical strength with ecosystem depth, meeting TradFi requirements for performance and compliance while offering broad user and scenario support—naturally making it a top choice for institutions entering blockchain in 2025.

A Coexisting Ecosystem: Retail, Institutions, and Builders

As TradFi institutions entered, BNB Chain’s user structure became more compl

ex. In 2025, an interesting dynamic emerged: retail users, institutions, and project teams operated independently yet concurrently on the same chain.

Retail: Still Active, Still Chasing Alpha

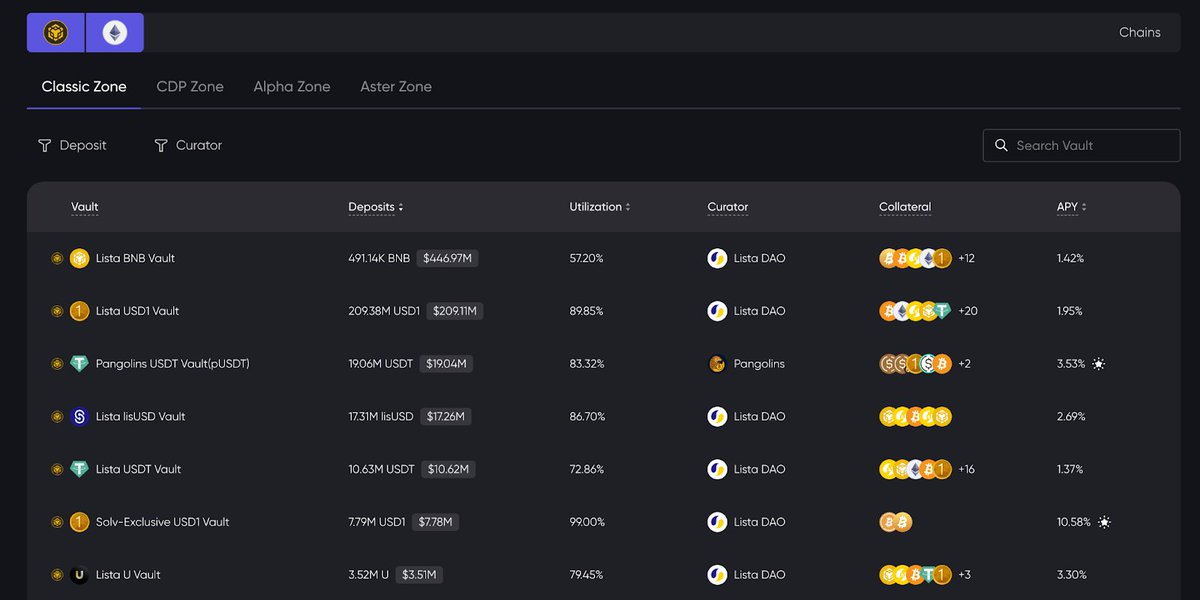

Despite institutional inflows, retail activity remained strong. Multiple meme cycles on platforms like Four.meme boosted on-chain volume and even helped drive BNB to a new ATH near $1,300. Perp DEX Aster offered high leverage, while low gas and high TPS enabled frequent intraday trading. Beyond trading, retail users also earned passive yield through on-chain vaults—ListaDAO alone launched over a dozen vaults including BNB, USD1, and USDT.

Institutional products did not degrade the retail experience; deeper asset bases and liquidity pools instead expanded portfolio strategy possibilities.

Institutions: Issuing Assets, Anchoring Yield

On BNB Chain, TradFi institutions mainly act as issuers and capital providers, bringing real-world assets such as fund shares, bonds, and stablecoins on-chain. Protocols like Venus allow RWAs and stablecoins as collateral for on-chain lending, reducing idle capital. Automated liquidation, real-time settlement, and disintermediation significantly compress costs and timelines compared with traditional finance.

Builders: Bridging Retail Flow and Institutional Assets

Native projects such as PancakeSwap, ListaDAO, and Venus continue serving retail users with DEX, lending, and yield aggregation, while actively integrating institutional RWAs and yield-bearing stablecoins. Venus quickly supported CMBMINT as collateral, while ListaDAO deeply integrated USD1. This fusion does not conflict with retail users; it expands the ecosystem pie.

Overall, BNB Chain is among the few ecosystems where retail users, institutions, and builders can each get what they need—without interference and with synergy:

Retail brings activity and usage

Institutions bring capital scale and asset diversity

Builders design yield structures to connect both

This coexistence is enabled by BNB Chain’s openness and compatibility—it is not a chain for a single user type, but an open platform for multiple roles.

Project Transformation: From Traffic Games to Real Revenue

As meme hype cooled, projects on BNB Chain introduced more real-yield models:

ListaDAO: Built a collateral–lending–yield loop around USD1 and U, with TVL exceeding $2B.

Aster: Expanded from perps to on-chain U.S. equity derivatives and launched the USDF stablecoin series, shifting toward a diversified financial platform.

PancakeSwap: Reduced CAKE inflation, retired legacy staking products, launched stock perps, and announced an AI-driven prediction market, Probable.

These shifts signal three trends in ecosystem restructuring:

Meme-driven traffic is weakening; users care more about sustainable yield.

Integration with real-world assets to build resilient product structures.

Protocols collaborating toward organic symbiosis.

Looking Ahead to 2026: BNB Chain’s Next Role

As 2026 approaches, deeper challenges emerge beyond fading meme hype. User growth may plateau as meme-driven inflows become harder to replicate and institutional yield strategies mature.

Against this backdrop, BNB Chain’s 2026 path is clearer:

Preferred on-chain gateway for real-world assets

Testbed for new sectors: prediction markets and privacy modules

Continuous protocol optimization to lower barriers

When retail capital meets long-term institutional capital, and on-chain native yield meets real off-chain cash flow, what sparks will fly? BNB Chain’s 2025 performance offers a positive answer.

As 2026 unfolds, a new chapter begins.

Coexistence may become the next crypto keyword—and BNB Chain is one of the most watched proving grounds.

Davinci Jeremie urged people to buy $1 of Bitcoin in 2013 and became a symbol of early conviction. Years later, fame, lifestyle flexing, and token promotions sparked criticism. His journey reflects both crypto foresight and influencer-era controversy.

StarPlatinum/12 hours ago

A sweeping narrative ties Jane Street to India’s expiry-day options case, alleged 10AM Bitcoin sell patterns, Terra’s collapse, and ETF plumbing. While none prove misconduct, critics argue a common structure: move spot, monetize derivatives, keep execution opaque.

Bull Theory/5 days ago

A controversial narrative links Jane Street, ETF mechanics, and Bitcoin’s price behavior, pointing to lawsuit allegations, 10AM volatility patterns, and derivative hedging dynamics. The discussion raises broader questions about liquidity, structure, and price discovery.

Justin Bechler/6 days ago

A new federal lawsuit alleges Jane Street exploited non-public information tied to Terraform’s liquidity defenses, accelerating UST’s depeg and the Terra collapse. The firm denies the claims. The case may reignite debates on structure, design, and regulation.

Diana/7 days ago

Mean reversion and on-chain models sit at levels historically linked to bottom formation after capitulation. Realized losses reached record USD values, while deviations from anchor models remain extreme. Price pain may be fading; patience remains key.

Checkmate/7 days ago

Bitcoin didn’t fail as an asset — it matured into an ETF-driven trade. As institutional ownership rose, correlation with tech risk intensified. Short-term pressure reflects holder structure shifts, not thesis collapse.

Eric Jackson/2026.02.24

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

When Elon Musk tweeted about Moltbook, the meme coin MOLT experienced a short-term 30% price surge, hitting a new all-time high of $114 million.

2026.01.31 18:37:29

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

MoreHot Articles

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

10 promising AI Agent cryptos

2024.12.05

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link