The Fed Holds Rates — Why September Could Be the Real Altseason Catalyst

VirtualBacon

VirtualBacon

The Fed Held Rates Again - What It Means for Altseason🚨

No cuts. No pivot. But don’t panic. The real macro pivot could still be just around the corner.

Here’s why I’m staying patient and focused on September for altcoin👇

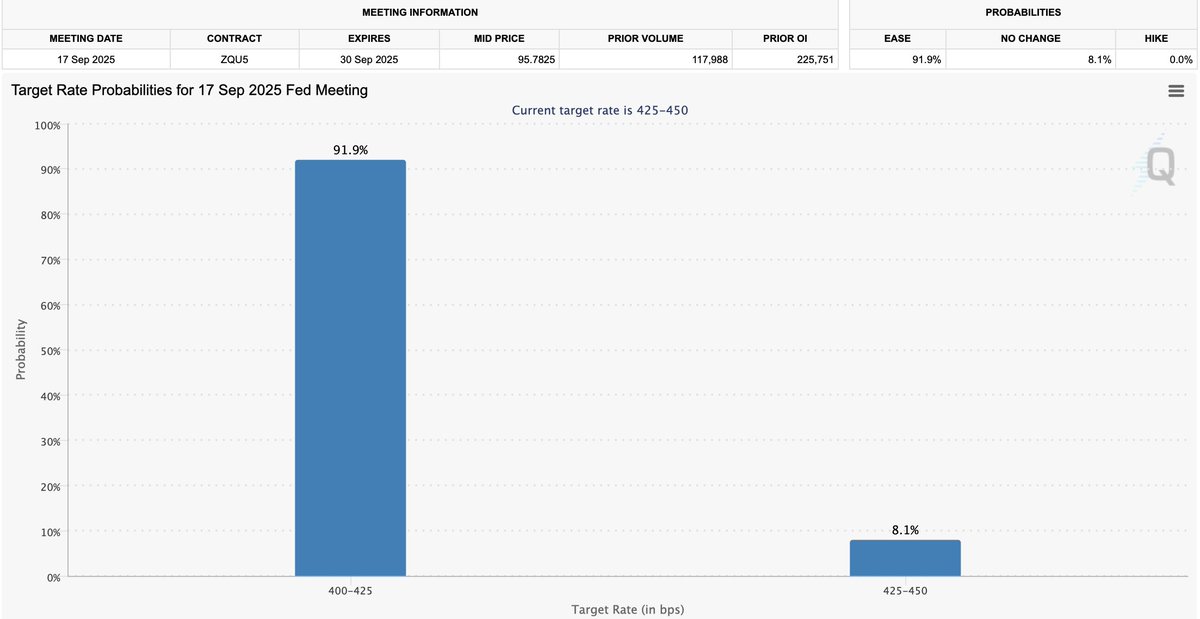

The July FOMC meeting was a non-event.

❌ No rate cut.

❌ No end to QT.

❌ No liquidity injection.

But none of this was surprising, markets had already priced it in. The real game begins in September.

Why September? That’s when:

🔹 The next FOMC meeting happens.

🔹 The Fed may ease SLR rules for banks.

🔹 The Treasury may refill its TGA, draining liquidity.

🔹 Liquidity conditions could shift drastically.

It’s the real pivot window I’m watching.

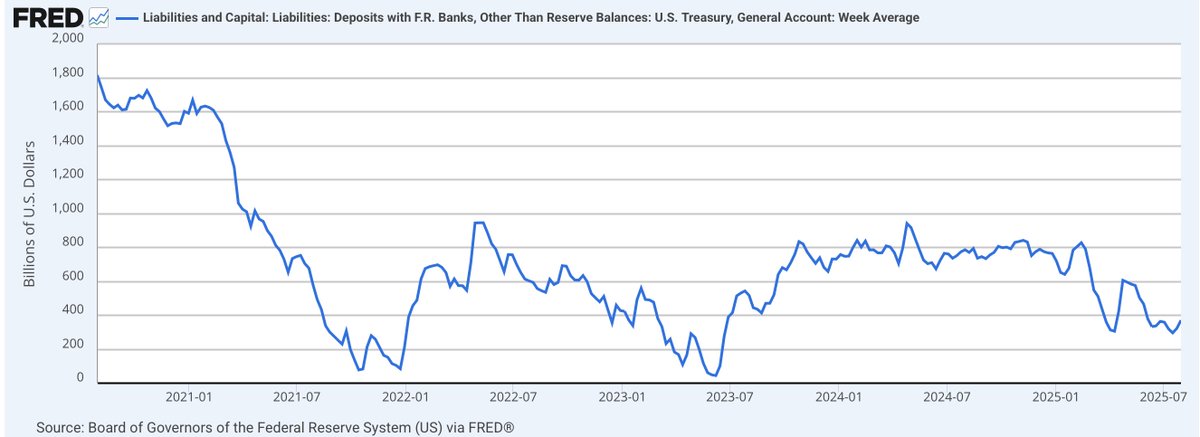

Until now, the US Treasury has been draining its TGA to fund operations.

That injected $500B+ into the market this year.

But now that the debt ceiling is raised, that trend is reversing. And it could suck liquidity out gradually over 4–5 months.

What does that mean? Liquidity may fall from ~$29.5T to ~$29T.

📉 Not a collapse.

📉 Not a bear market trigger.

✅ Just a slowdown.

Think of it as a healthy pullback before another liquidity leg up. But it slows down risk-on assets like altcoins.

There’s one potential offset: SLR reform.

The Fed is considering easing the Supplementary Leverage Ratio for major banks, basically allowing them to buy more treasuries with less collateral.

More treasury demand = more liquidity.

Decision expected August 26.

If approved, this could act as a liquidity booster right when it’s needed most.

It would perfectly coincide with the September FOMC.

So yes, TGA refill may slow things but SLR reform might reignite risk appetite, especially for alts.

Now let’s talk #Bitcoin dominance.

BTC dominance dropped for 5 weeks but just hit support at the 50-week SMA (around 60.6%).

This level has stopped altcoin momentum every time since Trump’s election.

If $BTC dominance bounces here and breaks above 64.5%, altcoins are in trouble.

But if dominance rolls over and makes a lower low, that could open the floodgates for altseason.

It all lines up with the liquidity pivot window in September.

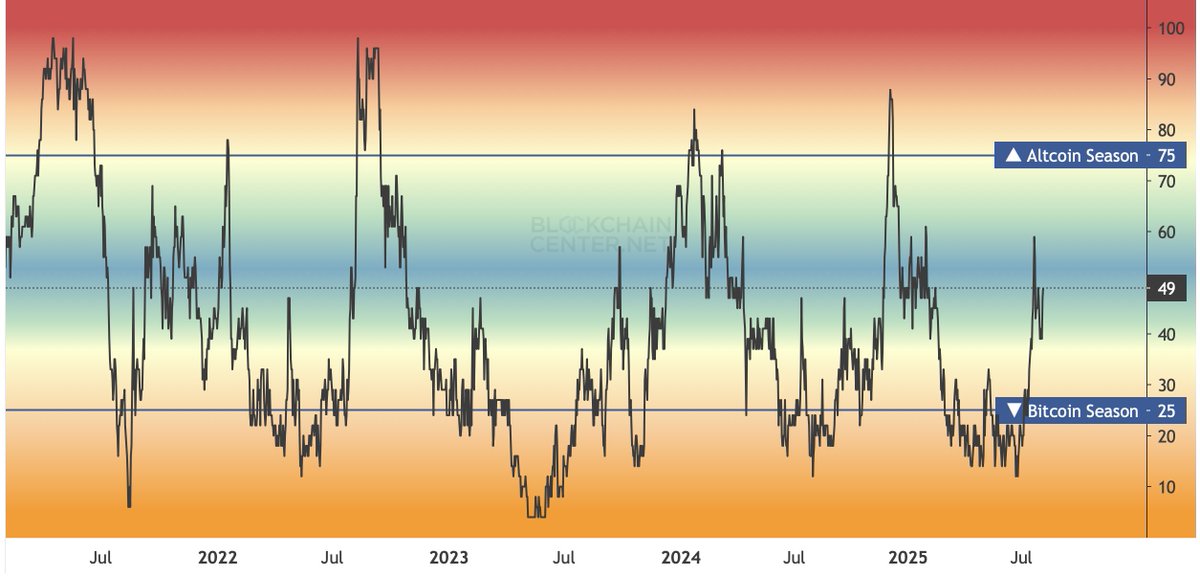

Don’t confuse an “altcoin month” with a real altseason.

We’ve had brief rallies before. They always faded.

What you really want is an “altcoin quarter” or, better yet, an “altcoin year” where 75%+ of top coins outperform $BTC for months.

We’re not there yet.

My current approach:

🔹 Focus on $ETH, $SOL, $XRP, $BNB.

🔹 Let bots compound in the background.

🔹 Stay out of microcaps.

🔹 Wait for confirmation, not hope

Altseason is a trend, not a moment. And that trend hasn’t begun.

If you feel FOMO right now, zoom out.

Even if you're 3 months late to the real altcoin year, you can still ride 9 months of upside. That’s how the 100x runs happened in 2021 not by being early, but by being positioned with patience.

Don’t chase noise. Wait for confirmation. The signs I’m watching:

✅ BTC dominance breakdown.

✅ Liquidity higher low.

✅ September Fed pivot.

✅ SLR easing.

✅ Altcoin season index crossing and sustaining.

Share this thread with someone who’s feeling FOMO too early.

We’re close but not there yet. Until then, accumulate, rotate, and chill 🧠

An investor shares his rules for profiting from memecoins, arguing that success comes from understanding key market mechanics, not gambling. He highlights the importance of analyzing a token’s community strength and tokenomics, along with proper due diligence to avoid scams. The core advice is to manage risk, never risking more than 10% of your capital on a single trade.

Alex Mason/3 days ago

World Liberty Financial ($WLFI) is set to launch on Sept 1. Unlike a meme coin, it’s an official token tied to a stablecoin backed by U.S. Treasuries. The project has attracted massive institutional investment, with the author of the article holding a 7-figure position.

VirtualBacon/3 days ago

After 12 years in crypto, I’ve made every mistake — from selling too early and trusting the wrong people to chasing hype and misjudging risk. Each loss became a lesson. Here are the hard-earned insights so you don’t have to repeat them.

Volt/4 days ago

After 8 years and 3 crypto cycles, I’ve tracked 30 key indicators that historically signal bull market tops. So far, 0 have triggered. From MACD to retail mania, these signals can help spot when euphoria turns to exit.

cyclop/5 days ago

Bitcoin’s 9.7% pullback and Strategy’s equity guidance rattled markets, sparking fears of a fragile model. But with $73B in BTC and long-term positioning, some see this as preparation for SP 500 inflows—not collapse. Optionality is strategy, not betrayal.

Swan/2025.08.21

Michael Saylor turned MicroStrategy into a $33B Bitcoin vault, fueled by debt and equity dilution. The model depends on Bitcoin’s relentless rise—if BTC stalls below $40K, the structure could collapse, forcing the company to sell its core holdings.

StarPlatinum/2025.08.20

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A whale exchanged WIF and Bonk positions for Fartcoin!

2024.12.25 11:01:14

MoreHot Articles

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 promising AI Agent cryptos

2024.12.05

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link