The 10 Rules for Investing in Memecoins

Alex Mason

Alex Mason

Memecoins made me millions.

But only because I followed these 10 rules.

Here is the full list: 🧵

1. Picture Dogecoin or Shiba Inu—tokens that started as jokes but moved billions.

The memes are loud, but the mechanics matter.

If you understand what drives them, you stop chasing pumps—and start spotting them early:

2. Here’s the truth: Memecoins might start as jokes, but they follow real market rules.

Tokenomics, community strength, and timing drive the gains—or the collapse.

Ignore them, and you’re gambling. Understand them, and you’re early.

3. What separates a one-day chart spike from a long-term runner?

A loyal community, clear tokenomics, and some kind of vision—even if it’s wrapped in memes: ⏬

4 . Community is everything.

A loud, loyal group of holders can send a token flying—no utility needed:

Watch for active Telegrams, nonstop memes, and viral energy.

If the community’s obsessed, the chart usually follows.

5. Tokenomics decide who gets rich—and who gets dumped on.

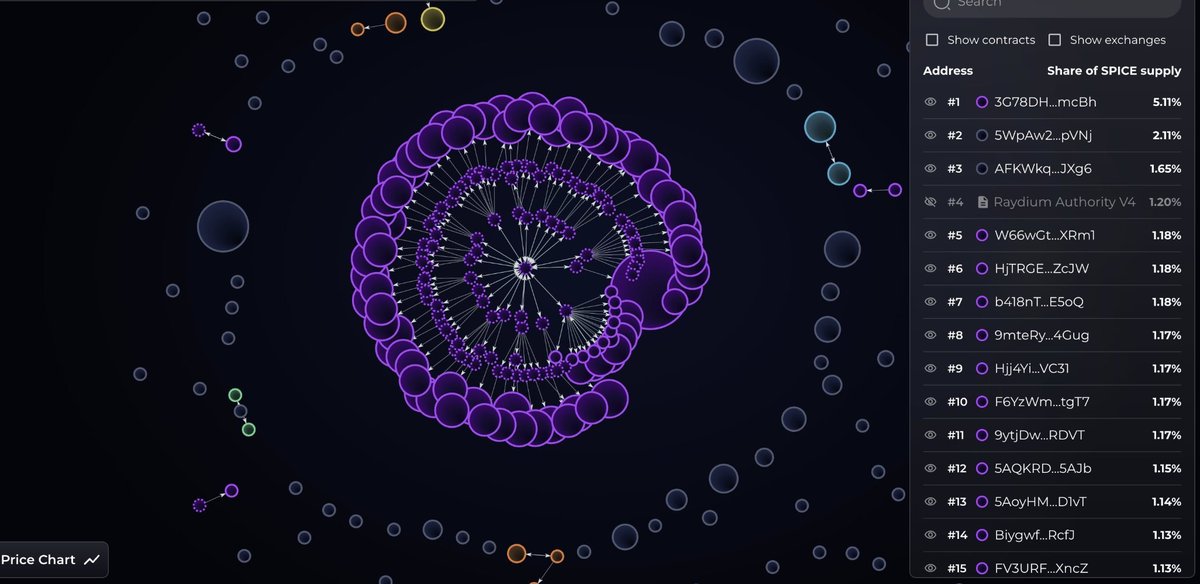

Check total supply, how tokens are distributed, and whether whales can nuke the chart.

If one wallet controls everything, you’re not early—you’re exit liquidity. This is where smart research pays off.

6. Memecoins live and die by the meme.

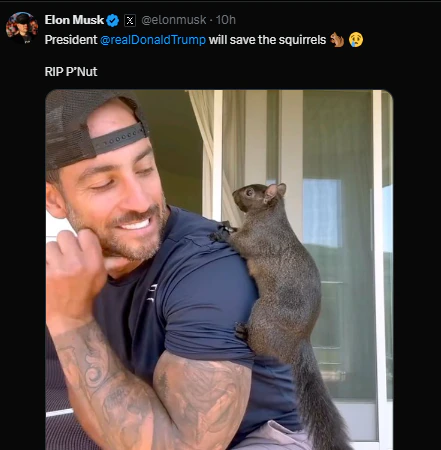

One viral post or influencer mention can light the fuse—but that spark fades fast if there’s nothing behind it.

Ride the wave, but always ask: is this just noise, or is something real brewing underneath?

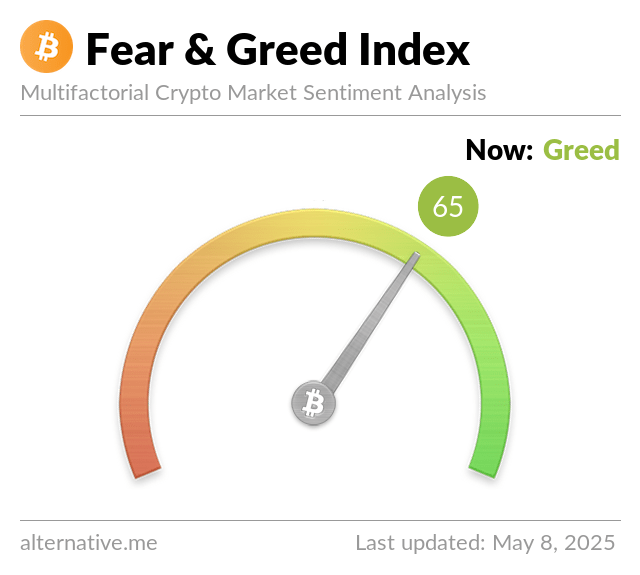

7. Timing is everything:

- Pay attention to Twitter chatter, meme velocity, and market mood.

- Too early, and you're stuck waiting.

- Too late, and you're exit liquidity.

Catch the wave—not the crash.

8. Due diligence is survival:

- Always verify contract addresses.

- Check if the devs are doxxed—or completely silent.

- Look at wallet distribution on Solscan, Etherscan, or BSCScan.

If it smells off or whales run the show, walk away. No meme is worth a rug.

9. Memecoins can 100x overnight—or nuke just as fast.

Set your entry and exit targets before you ape in. Treat every trade like it could go to zero.

If you can’t stomach the downside, you’re not ready for the upside.

10. For every Dogecoin that makes it, there are hundreds that vanish overnight.

Memecoins are pure high-risk, high-reward.

Never let FOMO drown out logic 👇

11. Follow a golden rule: never risk more than 10% of your bankroll on a single trade.

Protect your capital so you’ll always have firepower ready for the next opportunity.

Davinci Jeremie urged people to buy $1 of Bitcoin in 2013 and became a symbol of early conviction. Years later, fame, lifestyle flexing, and token promotions sparked criticism. His journey reflects both crypto foresight and influencer-era controversy.

StarPlatinum/4 days ago

A sweeping narrative ties Jane Street to India’s expiry-day options case, alleged 10AM Bitcoin sell patterns, Terra’s collapse, and ETF plumbing. While none prove misconduct, critics argue a common structure: move spot, monetize derivatives, keep execution opaque.

Bull Theory/2026.02.27

A controversial narrative links Jane Street, ETF mechanics, and Bitcoin’s price behavior, pointing to lawsuit allegations, 10AM volatility patterns, and derivative hedging dynamics. The discussion raises broader questions about liquidity, structure, and price discovery.

Justin Bechler/2026.02.26

A new federal lawsuit alleges Jane Street exploited non-public information tied to Terraform’s liquidity defenses, accelerating UST’s depeg and the Terra collapse. The firm denies the claims. The case may reignite debates on structure, design, and regulation.

Diana/2026.02.25

Mean reversion and on-chain models sit at levels historically linked to bottom formation after capitulation. Realized losses reached record USD values, while deviations from anchor models remain extreme. Price pain may be fading; patience remains key.

Checkmate/2026.02.25

Bitcoin didn’t fail as an asset — it matured into an ETF-driven trade. As institutional ownership rose, correlation with tech risk intensified. Short-term pressure reflects holder structure shifts, not thesis collapse.

Eric Jackson/2026.02.24

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

When Elon Musk tweeted about Moltbook, the meme coin MOLT experienced a short-term 30% price surge, hitting a new all-time high of $114 million.

2026.01.31 18:37:29

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

MoreHot Articles

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

10 promising AI Agent cryptos

2024.12.05

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link