Bitcoin’s Long-Term Security Challenge: What Happens After the 21M Cap?

Leshka.eth

Leshka.eth

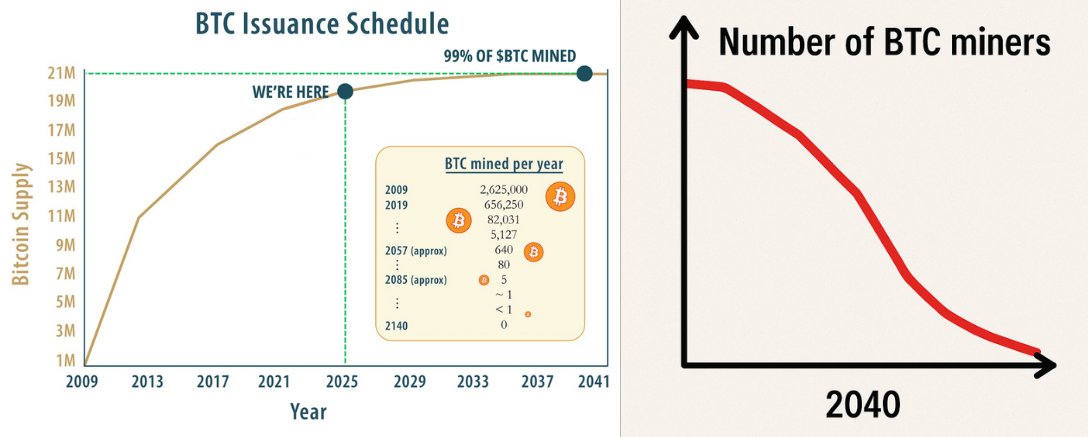

99% of all $BTC will be mined by 2040

What happens after when there's no incentives for miners?

The answer makes me doubt the future of #Bitcoin

a thread 🧵

What’s the future of Bitcoin once the 21 million cap is reached?

Many believe it’s a distant concern - something for the next century

But here’s the reality:

Bitcoin’s biggest challenge won’t wait until 2140

Let’s unpack the issues with its long-term security model

Currently, Bitcoin miners secure the network in exchange for rewards

To mine just one block, they burn through roughly 1.8M KWH of energy

At $0.05 per kWh, that’s nearly $92,000 in electricity costs alone

So what keeps them going?

Simple: the incentives are still aligned

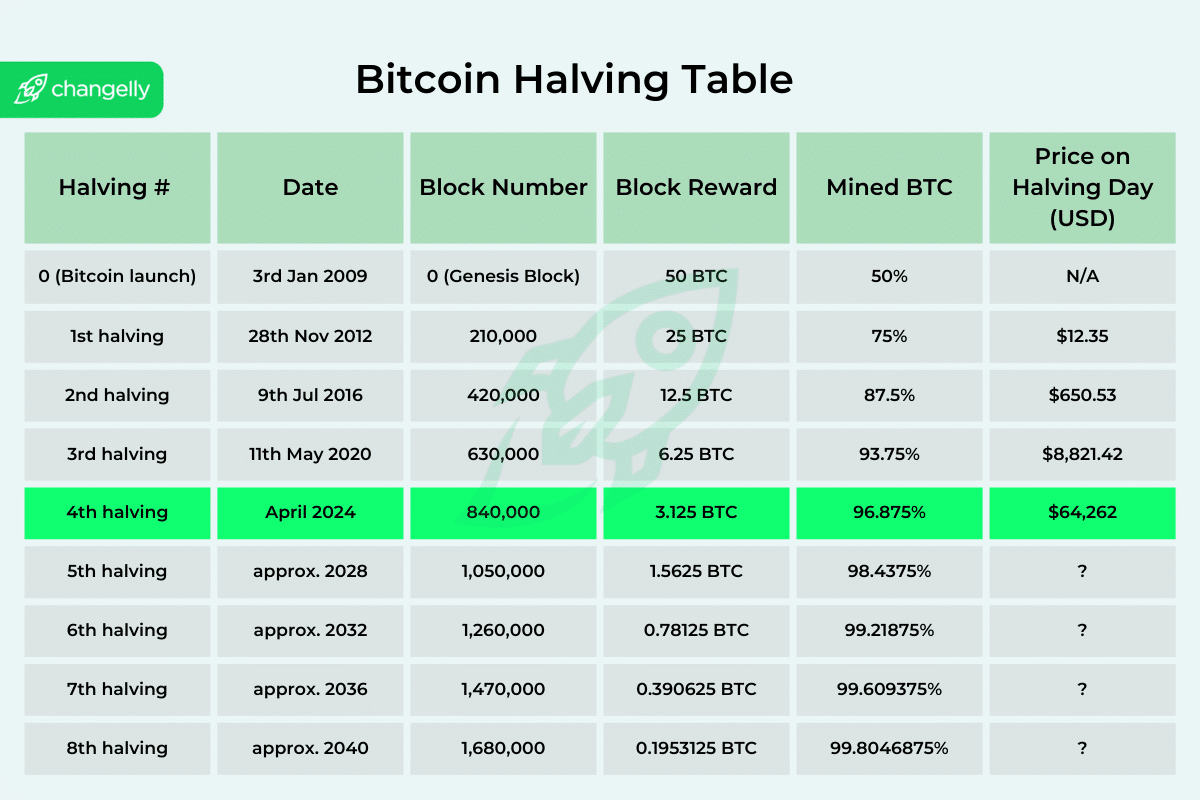

Right now, miners receive 3.125 BTC for each block they mine

With BTC current value, that’s about $370K

On top of that, transaction fees add roughly $25K bringing their total earnings to around $395K

This keeps mining profitable & the network secure

However, there’s a catch…

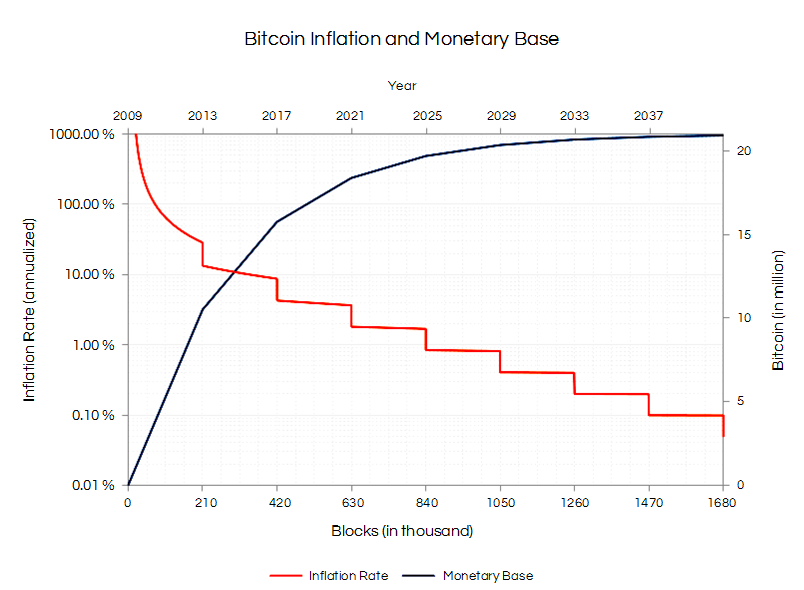

Every four years, Bitcoin’s reward for miners gets cut in half

By 2032, miners will earn less than 1 BTC per block

By 2040, almost all Bitcoins will be mined

Eventually, miners won’t get any new Bitcoins as rewards

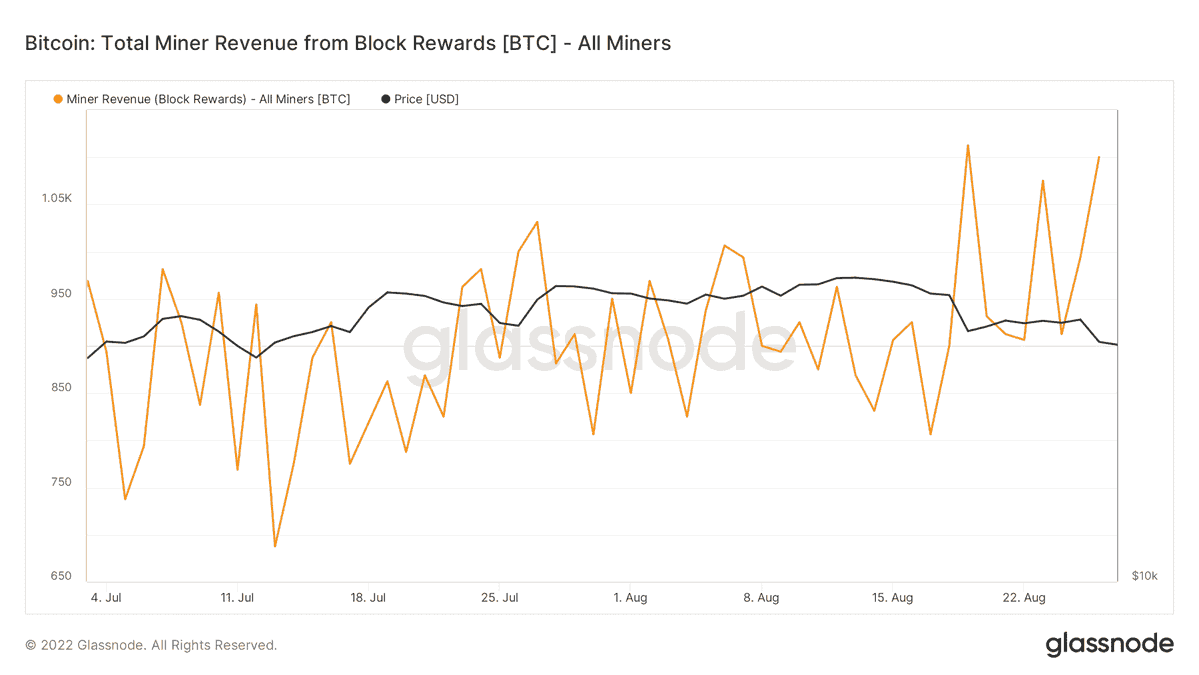

After that, they will make money only from transaction fees

Right now, fees are only about 7% of what miners earn

That’s not enough to cover their electricity bills

Fees would need to be 4 times higher just to pay for power

To cover equipment, risks & make a profit, fees need to be 6 to 10 times higher

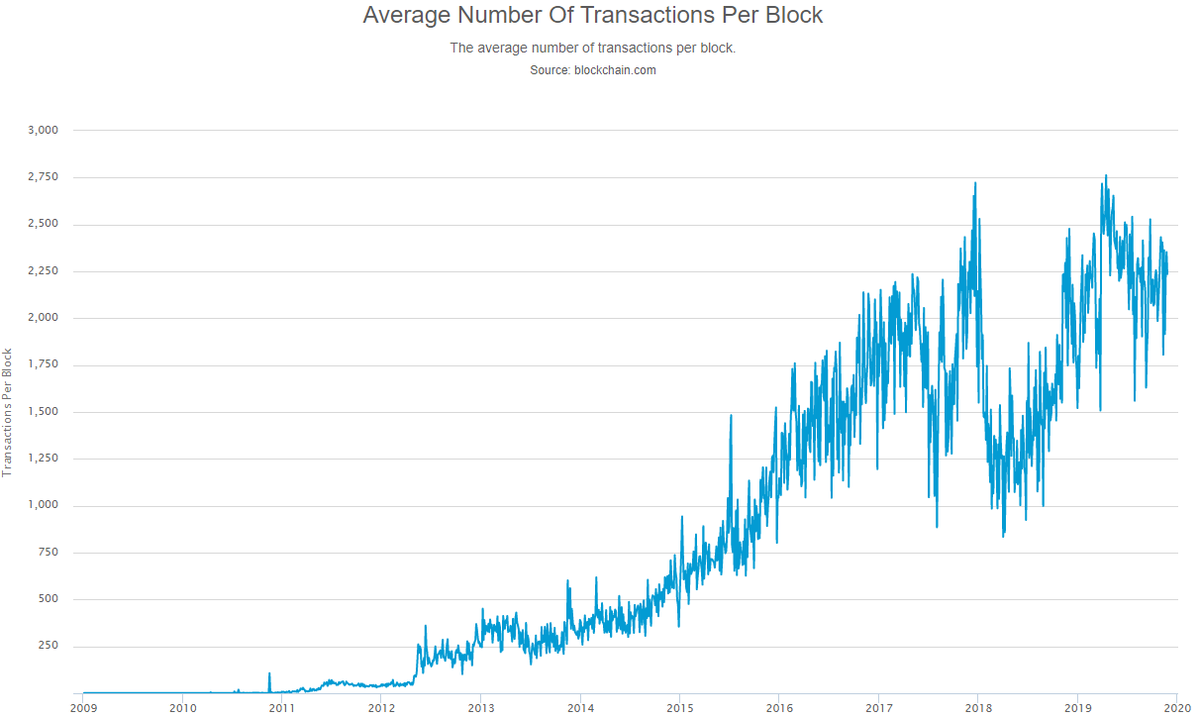

People say, “Fees will go up as more people use Bitcoin”

Maybe, but so far, fees only spike during short events like:

Bull market booms

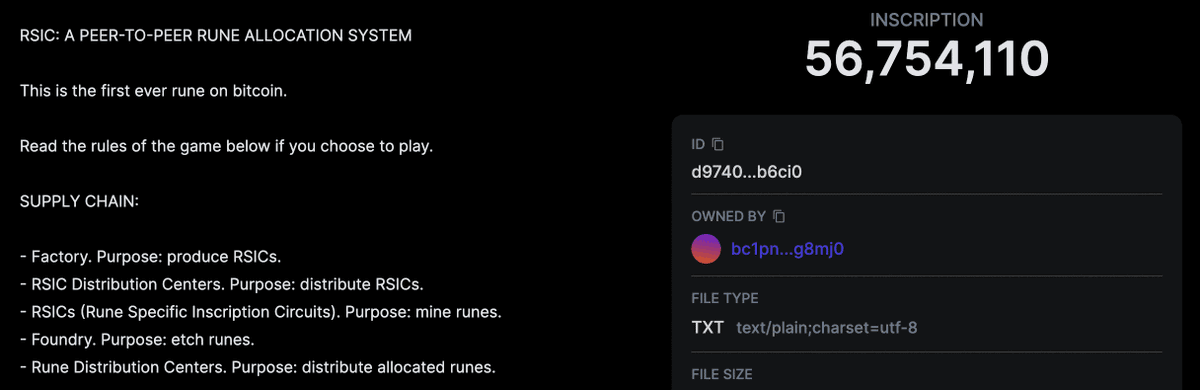

NFT crazes (like Ordinals & Runes)

Times when the network is busy

These spikes don’t last - they’re temporary, not steady increases

Bitcoin can only handle 4MB of data every 10 minutes

If miners rely only on fees, then every block must be:

Completely full & filled with expensive transactions

Every single block, all the time

That’s a tough challenge.

Some suggest moving most Bitcoin activity to Layer 2 to save space

That helps Bitcoin handle more users

But it means fewer transactions on the main chain, so miners earn less in fees

This creates a conflict between scaling and keeping the network secure

There is another problem: the security budget

Bitcoin stays safe because attacking it costs a lot

If miners earn less, the network becomes less secure

Experts say Bitcoin needs at least $100,000 in revenue per block to stay safe from attacks

So, what can be done?

Tail emission: Always give miners a small reward, even after most coins are mined (like Monero)

MEV: Let miners make extra money by doing trades & arbitrage on the blockchain

BTC as a global settlement layer: Use BTC mainly for big, important payments

Tail emission breaks Bitcoin’s 21 million coin limit, which many people see as a sacred rule

MEV is tricky because it could lead to miners having too much control

Using BTC mainly for big transactions sounds good, but it only works if lots of people keep needing it for that

Here’s the hard truth:

Bitcoin’s security isn’t automatic

It depends on outside incentives - mostly money

If those incentives fail, Bitcoin becomes weak

Not due to bugs or code problems, but because of economics

The question isn’t “Will Bitcoin run out of coins?”

It’s now:

Can a system with limited coins last long without giving up:

• Security

• Decentralization

• Monetary rules

That’s the real discussion

This doesn’t mean Bitcoin will fail

It just means we haven’t figured out how to keep it strong forever

We need more:

• Users

• Important ways to use it

• Demand that pays fees

Without these, Bitcoin’s security might slowly get weaker

Bitcoin is the safest blockchain ever

But its future depends on keeping incentives right

No miners means no security = No security means no Bitcoin...

Now it's not about enthusiasm, it's about money.

An investor shares his rules for profiting from memecoins, arguing that success comes from understanding key market mechanics, not gambling. He highlights the importance of analyzing a token’s community strength and tokenomics, along with proper due diligence to avoid scams. The core advice is to manage risk, never risking more than 10% of your capital on a single trade.

Alex Mason/3 days ago

World Liberty Financial ($WLFI) is set to launch on Sept 1. Unlike a meme coin, it’s an official token tied to a stablecoin backed by U.S. Treasuries. The project has attracted massive institutional investment, with the author of the article holding a 7-figure position.

VirtualBacon/3 days ago

After 12 years in crypto, I’ve made every mistake — from selling too early and trusting the wrong people to chasing hype and misjudging risk. Each loss became a lesson. Here are the hard-earned insights so you don’t have to repeat them.

Volt/5 days ago

After 8 years and 3 crypto cycles, I’ve tracked 30 key indicators that historically signal bull market tops. So far, 0 have triggered. From MACD to retail mania, these signals can help spot when euphoria turns to exit.

cyclop/6 days ago

Bitcoin’s 9.7% pullback and Strategy’s equity guidance rattled markets, sparking fears of a fragile model. But with $73B in BTC and long-term positioning, some see this as preparation for SP 500 inflows—not collapse. Optionality is strategy, not betrayal.

Swan/2025.08.21

Michael Saylor turned MicroStrategy into a $33B Bitcoin vault, fueled by debt and equity dilution. The model depends on Bitcoin’s relentless rise—if BTC stalls below $40K, the structure could collapse, forcing the company to sell its core holdings.

StarPlatinum/2025.08.20

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A whale exchanged WIF and Bonk positions for Fartcoin!

2024.12.25 11:01:14

MoreHot Articles

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 promising AI Agent cryptos

2024.12.05

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link