Michael Saylors $44B Bitcoin Bet: Risks and Potential Rewards

0xNobler

0xNobler

This is Michael Saylor, and he owns 500,000 $BTC worth $44 billion.

Back in 2000, he lost $6 billion in 1 day and went bankrupt.

If #Bitcoin falls below $60,000, he'll face bankruptcy once again.

Here’s how he plans to avoid liquidation during the tariff wars 👇🧵

The world of financial markets is a fierce competition, and at the moment, Michael Saylor is leading the charge.

He is the executive chairman and co-founder of MicroStrategy, a company that raises equity and debt to acquire $BTC.

His journey started in 1983 when he enrolled at MIT with aspirations of becoming a pilot.

However, a medical condition prevented him from pursuing that dream, leading him to join The Federal Group in 1987, where he worked on computer simulation modeling for a software company.

In 1988, Saylor took on the role of internal consultant at DuPont, developing computer models to help the company anticipate shifts in its key markets.

These simulations forecasted a recession in many of DuPont's major markets by 1990.

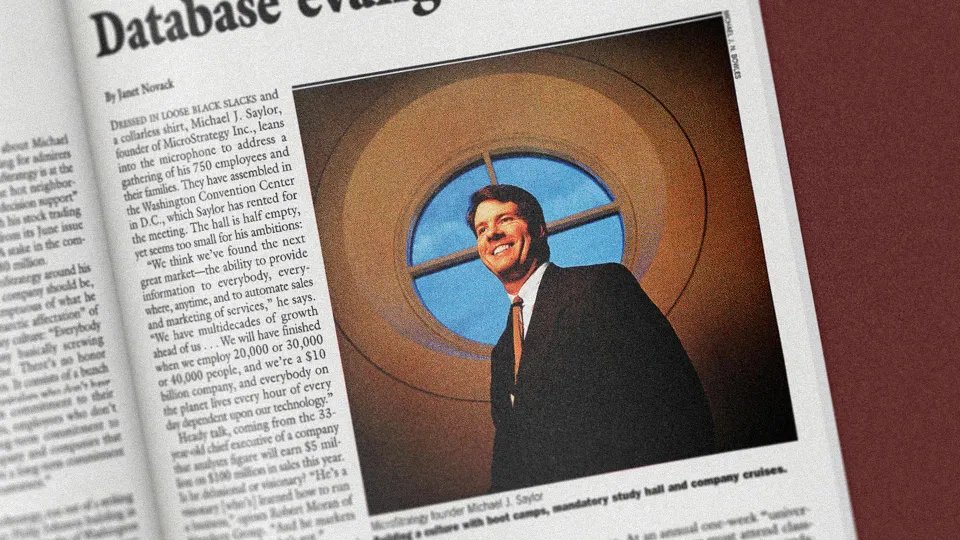

In 1989, using funds from DuPont, Saylor founded MicroStrategy, initially developing software for data mining before shifting to business intelligence.

In 1992, the company secured a $10M contract with McDonald's to develop tools for analyzing promotional efficiency.

Saylor took MicroStrategy public in June 1998 with an initial offering of 4 million shares at $12 each.

The stock doubled on its first day, and by early 2000, Saylor’s net worth hit $7 billion, making him the wealthiest man in the D.C. area.

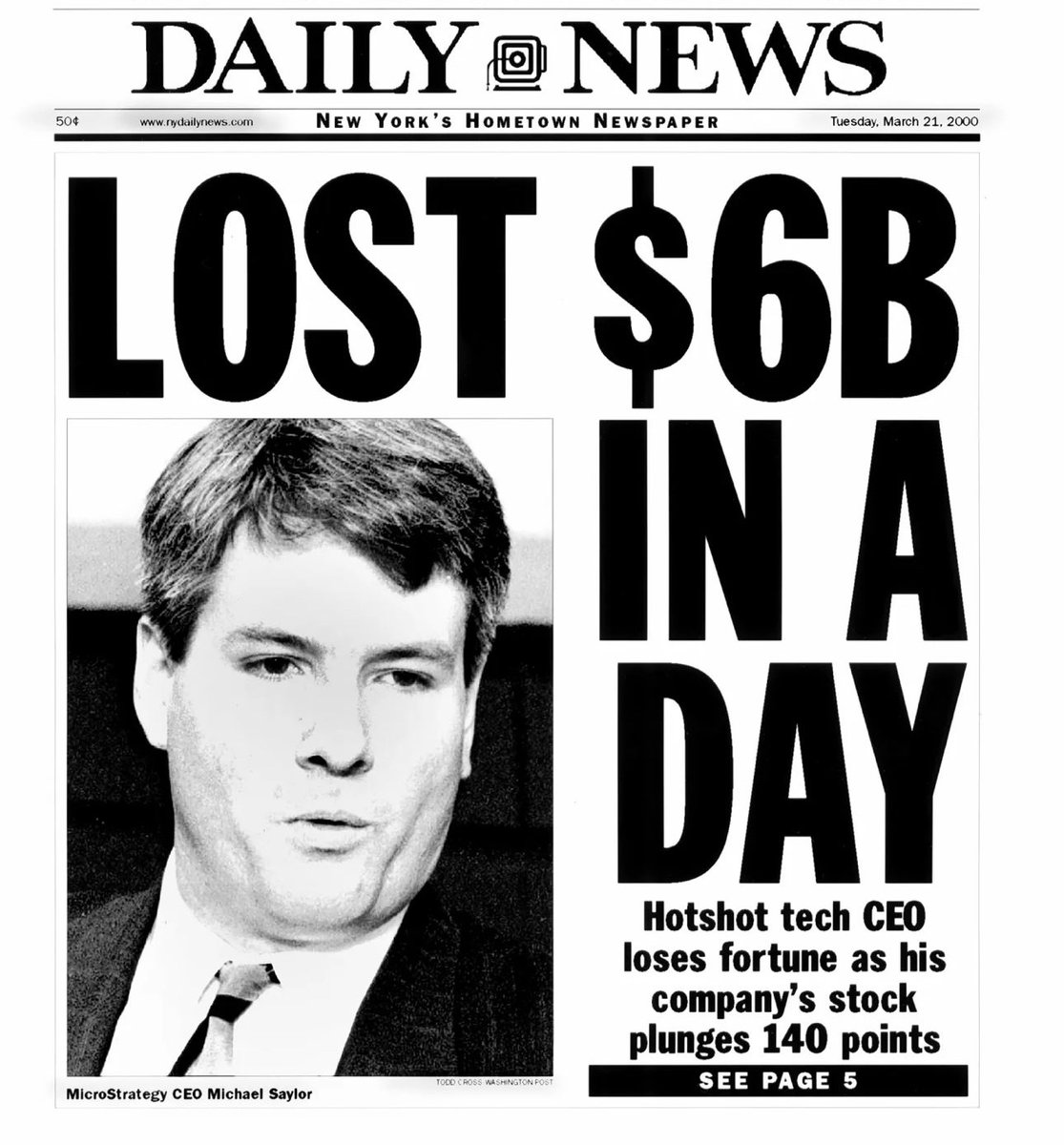

Saylor’s first major setback came in March 2000 when MicroStrategy announced it would restate its financial results.

The company’s shares dropped 62% after revealing its 1999 revenues were 25% lower than reported, and its profit was actually a loss.

On March 20, 2000, Michael Saylor lost $6 billion, the largest single-day loss ever recorded by an individual.

In December 2000, the SEC filed fraud charges against MicroStrategy and its executives, which were eventually settled.

Saylor has always been tech-savvy and recognized digital scarcity long before Bitcoin’s first block was mined.

In the '90s, he had the foresight to start acquiring "premium" domain names: simple, one-word domains with broad potential appeal.

MicroStrategy spent $2M on premium domains like Angel[.]com, Alarm[.]com, and Wisdom[.]com, later making over $130M by selling them in the late '00s and early '10s.

Today, Saylor still owns his personal Michael[.]com and Mike[.]com domains.

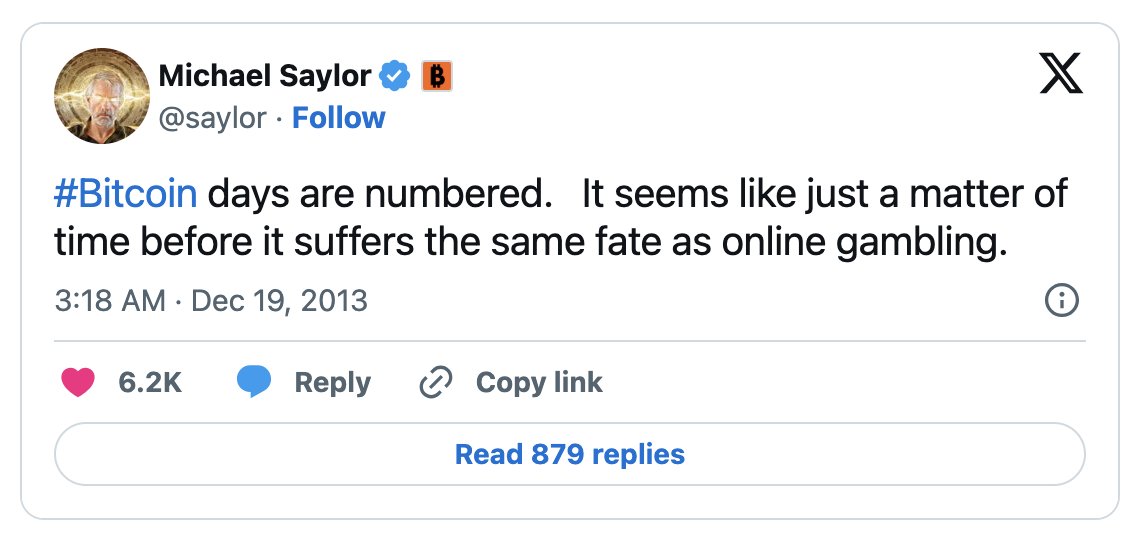

In December 2013, Saylor made his first public comment on Bitcoin, tweeting, “Without a credible sponsor, Bitcoin is at risk of being regulated out of existence”.

A week later, after Bitcoin had dropped by as much as two-thirds from its ATH of $1,242, he tweeted again.

Saylor returned to Bitcoin in mid-2020, announcing that MicroStrategy would start buying $BTC as part of a new capital strategy.

They allocated $250 million, completing the purchase of 21,454 $BTC at around $12,000 in just two weeks.

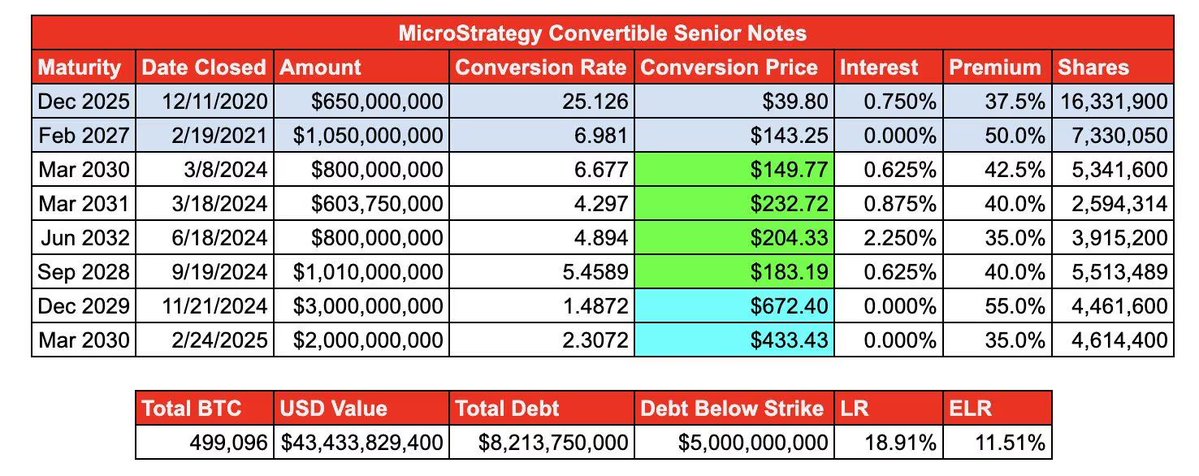

By December 2020, MicroStrategy launched its first debt sale since adopting Bitcoin - $400 million at 0.75% interest and committing the funds to purchase more Bitcoin.

This was followed by a second raise two months later and a third just four months after that.

Since then, MicroStrategy has invested nearly $27.8 billion to acquire an additional 340,860 BTC, bringing the total to $28.7 billion.

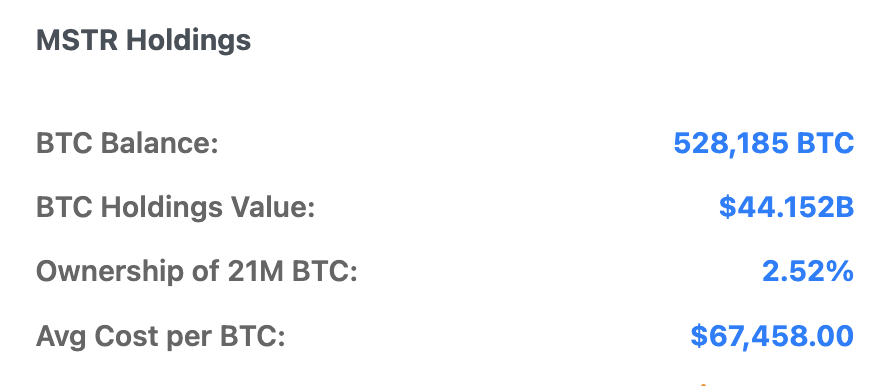

As of April 1, 2025, MicroStrategy holds 528,185 BTC which is 2.5% of the total circulating supply.

With an average purchase price of $67,458 per coin, the company's position is one of the largest and most influential in the crypto market.

While such a massive accumulation signals strong conviction in Bitcoin’s long-term potential, it also raises important concerns.

If the company were ever forced to liquidate a portion of its holdings, whether due to financial distress, margin calls, or broader economic pressures, it could trigger extreme volatility.

This could lead to rapid price declines and widespread panic across the crypto space.

If Bitcoin falls well below MicroStrategy’s average buy-in, the company could struggle to meet its debt obligations and be forced to sell at depressed prices.

This selling could trigger a downward spiral, driving Bitcoin lower and pushing MicroStrategy closer to insolvency.

Given Michael Saylor’s commitment to $BTC, he’s unlikely to sell unless forced by extreme financial pressure.

However, if Bitcoin’s adoption continues to grow, MicroStrategy’s massive bet could prove to be one of the boldest and most successful moves in corporate history.

Andrew Kang, co-founder of Mechanism Capital with $300M AUM, shares six key predictions. He highlights Bitcoins potential surge to $125,000 by year-end, backed by Trumps supportive policies. Kang warns of Ethereums vulnerabilities, predicts a downturn to sub-$1,000. His interest in humanoid robotics aligns with a tech boom, marking a new frontier. He advises caution amidst tariff uncertainties and emphasizes studying historical cycles for informed crypto trading strategies.

Nonzee/21 hours ago

The $BTC market is experiencing volatility due to tariffs and manipulation, but liquidity levels and price action remain key. The $90k-$91.5k range is crucial for potential liquidations, with a focus on the 1D50EMA and 1W50EMA for compression and possible breakout. A third retest of the 1W50EMA could lead to an aggressive move, but manipulation often influences price action, so strategic positioning is essential.

CrypNuevo/2 days ago

Global M2 Money Supply has remained at an all-time high for three consecutive days, signaling bullish potential for risk assets in about 108 days. Although theres a slight dip in M2 in the short term, it could present a dip-buying opportunity around mid-April. The analysis emphasizes patience, as short-term fluctuations dont necessarily invalidate the 108-day offset correlation between M2 and Bitcoin.

Colin Talks Crypto/2 days ago

The $OM token crash resulted in over $6B being wiped out in 30 minutes. It began with a large deposit of 3.9M $OM tokens from a wallet tied to @MANTRA_Chain, triggering fears of a sell-off. Rumors of OTC deals with massive discounts escalated the situation, causing panic. The crash highlighted risks in tokens controlled by a small group, lacking transparency, and with delayed promises.

Sjuul | AltCryptoGems/2 days ago

CryptoQuant reports a significant drop in both Bitcoin and altcoin spot trading volumes in Q1 2025, with Bitcoins volume falling 77% and altcoins seeing an 80% drop. This suggests waning investor confidence. Despite the market downturn, Binances dominance rose, capturing nearly 50% of Bitcoin spot trading. Binance also saw increased inflows, with 22,106 BTC added to its reserves, highlighting its role as a major liquidity hub amid market volatility.

Crypto Revolution Masters/5 days ago

If you invested $100K in BTC vs ETH in 2017, BTC would now be worth $2M, while ETH just $375K—a 7x difference. While Bitcoin stayed true to its vision, Ethereum pivoted multiple times and faced deeper drawdowns. The conclusion? BTC delivered higher returns, less drama, and stronger long-term certainty.

Alec Bakhouch/6 days ago

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A whale exchanged WIF and Bonk positions for Fartcoin!

2024.12.25 11:01:14

MoreHot Articles

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

10 promising AI Agent cryptos

2024.12.05

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link