Declining Crypto Trading Volumes: Binance Gains Market Share Amid Uncertainty

Crypto Revolution Masters

Crypto Revolution Masters

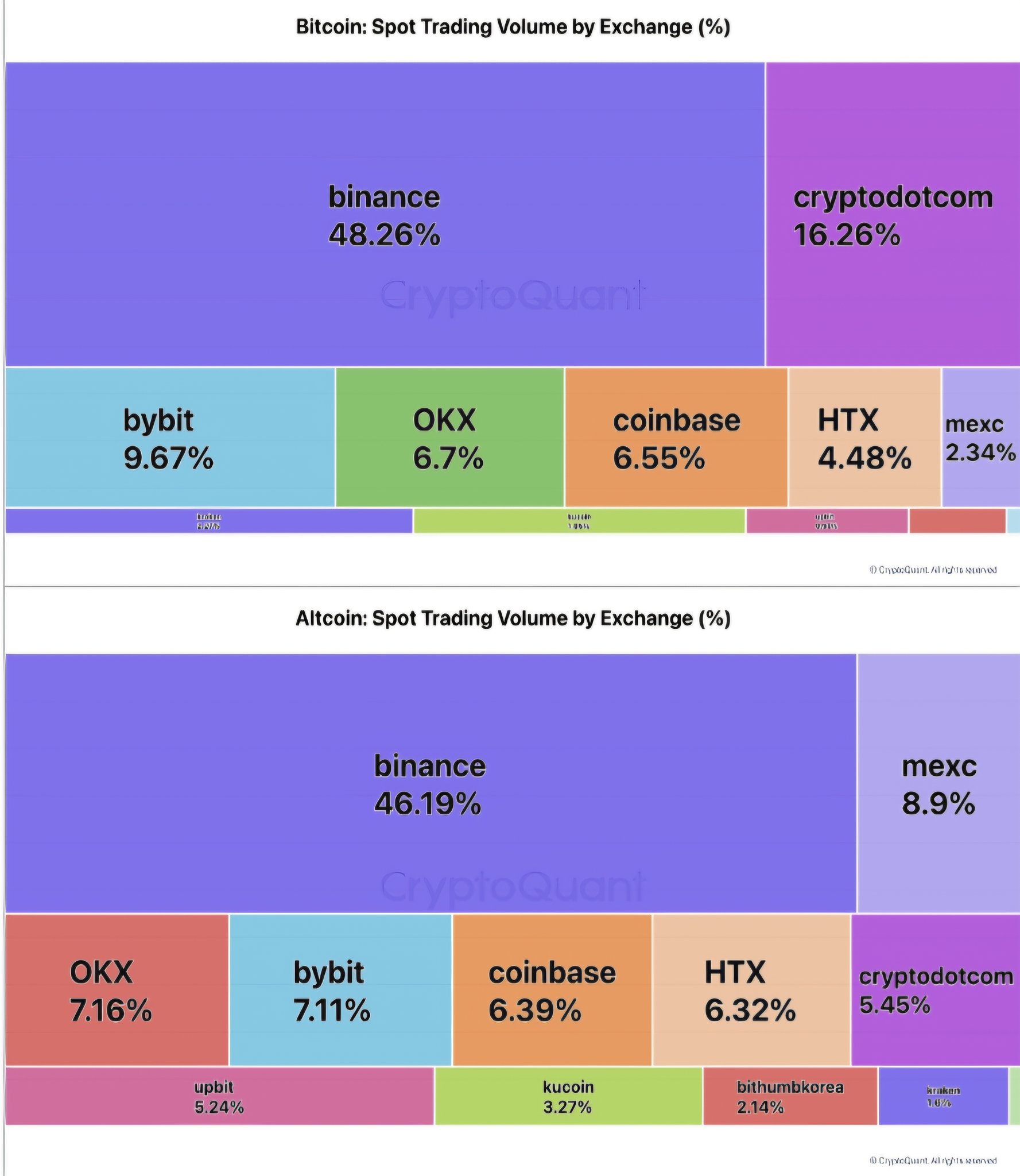

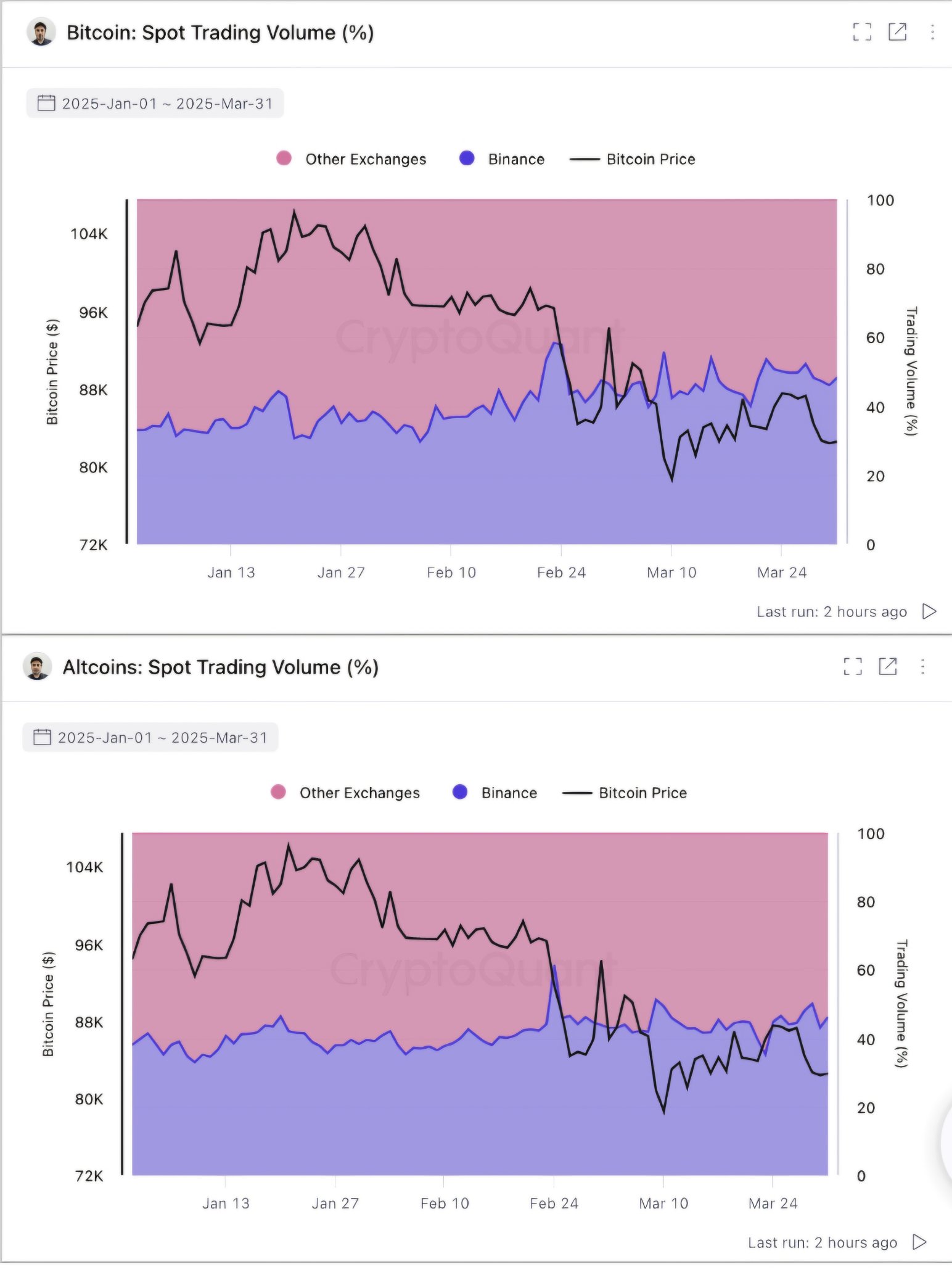

Based on an analysis by CryptoQuant, altcoin and Bitcoin (BTC) spot trading volumes have fallen over the last two months, after recent price corrections in the cryptocurrency market, with exchange Binance emerging as the trading channel of choice.

Bitcoin spot trading on crypto exchanges plummeted from an eye-popping $44 billion on February 3 to just $10 billion at the end of Q1—a 77% estimated drop, reports the analytics firm. At the same time, total altcoin spot trading on these exchanges dropped precipitously from an all-time high of $122 billion on Feb. 3 to $23 billion on the final day of Q1, an 80%-plus drop.

👉What does that dramatic decrease mean?

The dramatic decrease in volume indicates that investors and traders are losing interest or confidence, which is usually based on fear or uncertainty. Falling prices reflect the depreciation in the value of the currency and cryptocurrencies, which will discourage others from participating in trading.

As evidenced by the study, this will lead to a downward cycle through decreased trading volume and subsequent price drops.

🔥The market's loss is Binance's gain

Meanwhile, Binance entrenched its leadership among the other crypto exchanges with its control approaching 50% of the entire market trade. Towards the conclusion of the first quarter, Binance's share of total daily bitcoin spot trading jumped from 33% on 3rd February to an astonishing 49%.

This means that alternative exchange trading volumes dropped more sharply than on Binance, reaffirming the exchange's role as the liquidity source of choice amid increased market volatility.

👉Additionally, the proportion of Binance's daily trading volume in cryptocurrencies jumped from 38% on February 3rd to 44% when the first quarter came to an end.

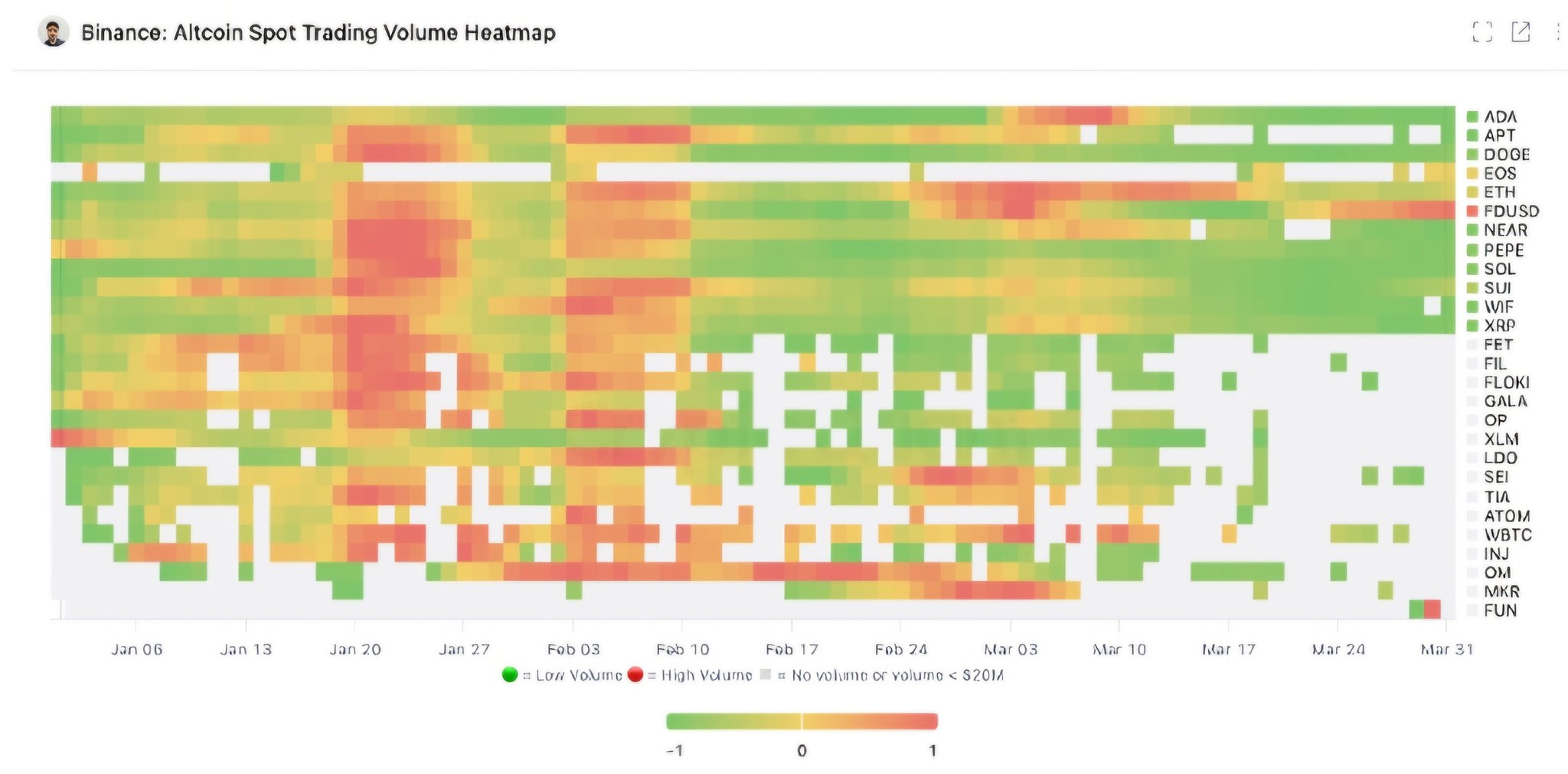

Even with the general decrease in trading volumes, some altcoins still reflect strong spot trading on Binance. Some of the major altcoins like BNB, TON, and EOS continue to see strong trading levels despite the general dip in trading volumes among cryptocurrencies.

Independent CryptoQuant analyst Martuun reported that inflows to Binance had increased in the past week.

👉In an April 9 post, CryptoQuant writer Maarten Regterschot stated that Binance's Bitcoin (BTC) reserve climbed by 22,106 BTC, worth $1.82 billion, during the last 12 days, totaling 590,874 BTC.

🔥This represents an incredible influx of BTC to Binance. Regterschot is convinced that investors are actively moving their funds to Binance with the current macroeconomic uncertainty and the upcoming CPI release on their minds.

Bitcoin’s price increase

According to CoinMarketCap, Bitcoin is trading at $81.578, up about 8% in the past days following Trump's 90-day tariff moratorium on all countries except China.

During periods of uncertainty, investors will transfer their cryptocurrency to exchanges to cash out, increasing volatility as confidence starts to disappear.

However, Pav Hundal, Swyftx's chief analyst, informed Cointelegraph that this is not necessarily an indication of a bearish signal.

"Although huge inflows may be an indication of selling pressure, the nature of this market suggests that Binance is probably just sending funds to hot wallets because of the increased demand."

👉The upcoming days will be crucial for the market.

He further stated that the upcoming days would be critical in assessing the appetite of the market for cryptocurrencies in the wake of Trump's tariffs pullback.

🔥Trump had already implemented on April 9 a 90-day pause on his administration's "reciprocal tariffs," reducing the rate to 10% on everyone else and increasing the rate on China to an unbelievable 125% , citing the country's countervailing tariffs levied against America.

Hundal briefed the journalists that tensions with the US stood ominously in the backdrop.

Andrew Kang, co-founder of Mechanism Capital with $300M AUM, shares six key predictions. He highlights Bitcoins potential surge to $125,000 by year-end, backed by Trumps supportive policies. Kang warns of Ethereums vulnerabilities, predicts a downturn to sub-$1,000. His interest in humanoid robotics aligns with a tech boom, marking a new frontier. He advises caution amidst tariff uncertainties and emphasizes studying historical cycles for informed crypto trading strategies.

Nonzee/21 hours ago

The $BTC market is experiencing volatility due to tariffs and manipulation, but liquidity levels and price action remain key. The $90k-$91.5k range is crucial for potential liquidations, with a focus on the 1D50EMA and 1W50EMA for compression and possible breakout. A third retest of the 1W50EMA could lead to an aggressive move, but manipulation often influences price action, so strategic positioning is essential.

CrypNuevo/2 days ago

Global M2 Money Supply has remained at an all-time high for three consecutive days, signaling bullish potential for risk assets in about 108 days. Although theres a slight dip in M2 in the short term, it could present a dip-buying opportunity around mid-April. The analysis emphasizes patience, as short-term fluctuations dont necessarily invalidate the 108-day offset correlation between M2 and Bitcoin.

Colin Talks Crypto/2 days ago

Michael Saylor, CEO of MicroStrategy, holds 528,185 $BTC worth $44 billion. Having previously lost $6 billion in a single day during a 2000 financial setback, Saylor faces potential bankruptcy if Bitcoin drops below $60,000. Despite the risks, his commitment to Bitcoin remains firm. MicroStrategy’s strategy could either make it a crypto market leader or trigger a massive sell-off if forced to liquidate.

0xNobler/2 days ago

The $OM token crash resulted in over $6B being wiped out in 30 minutes. It began with a large deposit of 3.9M $OM tokens from a wallet tied to @MANTRA_Chain, triggering fears of a sell-off. Rumors of OTC deals with massive discounts escalated the situation, causing panic. The crash highlighted risks in tokens controlled by a small group, lacking transparency, and with delayed promises.

Sjuul | AltCryptoGems/2 days ago

If you invested $100K in BTC vs ETH in 2017, BTC would now be worth $2M, while ETH just $375K—a 7x difference. While Bitcoin stayed true to its vision, Ethereum pivoted multiple times and faced deeper drawdowns. The conclusion? BTC delivered higher returns, less drama, and stronger long-term certainty.

Alec Bakhouch/6 days ago

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A whale exchanged WIF and Bonk positions for Fartcoin!

2024.12.25 11:01:14

MoreHot Articles

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

10 promising AI Agent cryptos

2024.12.05

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link