What Widening U.S. Credit Spreads Mean for Bitcoin: Risk or Opportunity?

10x Research

10x Research

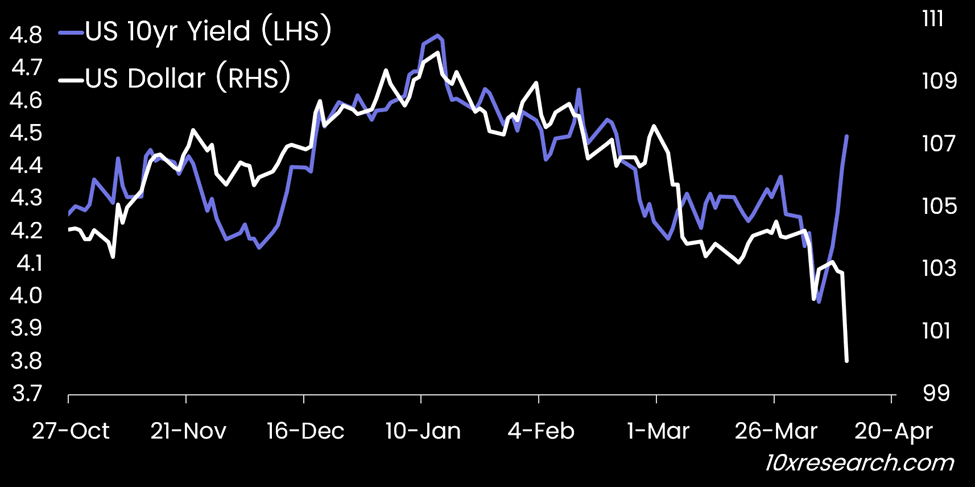

1-15) The marginal buyer of Bitcoin may increasingly be U.S. investors concerned about a sharply weakening dollar as global capital continues to exit U.S. financial markets. This dynamic is the flip side of running (and attempting to reverse) a persistent trade deficit—its consequences now becoming evident not just in the declining value of the dollar and rising bond yields but also through stress in the credit markets and continued pressure on U.S. equities.

Both, U.S. dollar and U.S. bonds selling off (higher yields)

2-15) As we highlighted in yesterday’s report, it remains premature to adopt a bullish stance. With capital flowing out of the U.S., the euro appears to be emerging as a relatively safer haven in the current environment. The 90-day tariff truce was a clear attempt to stabilize spiking U.S. Treasury yields—but with yields now threatening to retest their recent highs, the move seems to have backfired, highlighting the market’s skepticism and the limits of such short-term interventions.

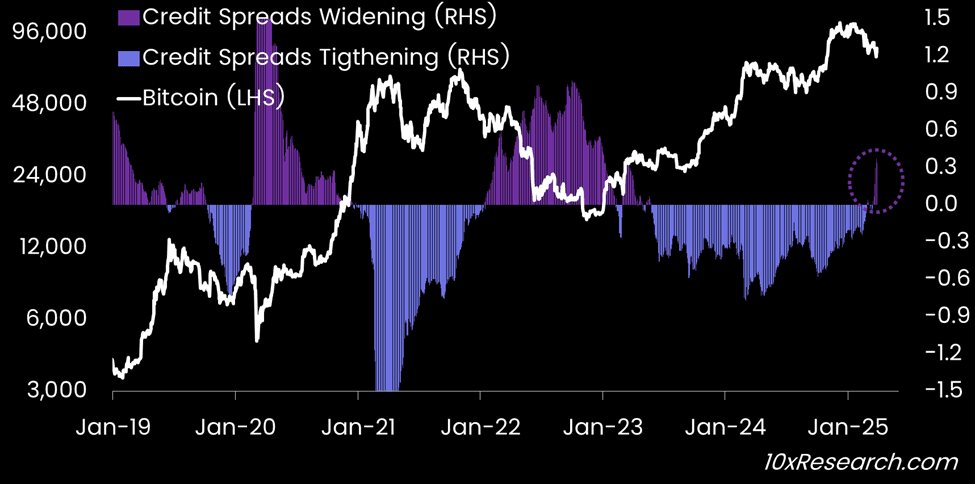

3-15) As measured by the ICE BofA BBB US Corporate Index Option-Adjusted Spread, credit spreads continue to widen, indicating that recessionary concerns may be seeping deeper into the economy. Historically, this has posed a headwind for Bitcoin. Short-term risks remain elevated, while the longer-term implications can be bullish—especially as Bitcoin has tended to benefit from the monetary easing that typically follows Fed rate cuts. But expecting a bullish impulse is too early.

Bitcoin (LHS) tends to sell off when Credit Spreads starts to widen YoY (RHS)

4-15) If we look at the last two instances when the year-over-year change in credit spreads began to widen, as it is now, Bitcoin tended to struggle both in terms of time (with recoveries taking 4–6 months) and price (with further downside before a bottom was reached). This pattern suggests that while a longer-term opportunity may emerge, Bitcoin could still face pressure in the near term.

5-15) Similarly, while we anticipate the Chinese yuan (CNY) gradually weakening by approximately 3–5% in the coming weeks—targeting a USDCNY range of 7.5 to 7.7—it's important to note that currency devaluations have historically been bearish for markets in the short term before turning bullish later on.

6-15) However, today’s environment is markedly different from 2015, when China last undertook a significant devaluation. Back then, Bitcoin was one of the few accessible crypto assets, making it a primary vehicle for capital outflows. Now, stablecoins like USDT (Tether) offer a more convenient and less volatile on-ramp, reducing the need for Chinese investors to turn to Bitcoin directly.

7-15) Additionally, there appears to be less disposable capital in the Chinese economy today compared to 2015. As a result, even if the yuan weakens, we do not expect Chinese investors to be the marginal buyers of Bitcoin, as they were during previous cycles dating back to 2013.

8-15) U.S.-based investors may need to step in as the marginal buyers of domestic assets, as the latest confidence crisis appears to be driven by foreign investors losing faith in the U.S. economy/financial markets. Notably, the recent stock market decline has been accompanied by a weakening U.S. dollar and a sell-off in the U.S. bond market—an unusual and concerning combination.

9-15) As we highlighted yesterday, there’s a growing shift toward home bias among international investors, with the euro emerging as a key beneficiary. In fact, with a +3.1% gain over the past 24 hours, the euro experienced one of its strongest single-day moves in recent history.

10-15) It's important to understand that the U.S. not only runs a trade deficit in goods with the rest of the world but also maintains a capital account surplus. Foreign capital flows into the U.S. to finance this imbalance. These inflows come from foreign purchases of U.S. Treasury bonds, equities, real estate, and direct investments.

11-15) The trade and capital accounts are inherently interconnected: if the U.S. imports fewer goods, it naturally receives less foreign capital. We are witnessing the unwinding of years of global overexposure to U.S. assets—a shift that puts pressure on stocks and bonds. As foreign investors repatriate capital, the U.S. dollar weakens, amplifying the impact across financial markets.

12-15) While much of the recent attention has been on the unwinding of the Treasury basis trade, a deeper concern is emerging: that rising inflation driven by tariffs could prompt the Fed to scale back the four rate cuts currently priced in for this year. At the same time, foreign investors—particularly the Japanese—appear to be reducing their exposure to U.S. Treasuries. This concern came to a head earlier this week when 10-year yields briefly spiked to 4.5%, prompting Treasury Secretary Bessent to urge President Trump to shift the narrative around the tariff endgame.

13-15) Although Bessent has downplayed the sell-off as an “orderly” adjustment driven by hedge fund unwinding, broader signals suggest fiscal risks are growing. Elon Musk’s likely exit from DOGE hints that any fiscal savings may have already peaked. Meanwhile, the House of Representatives has passed a budget proposal that paves the way to extend the 2017 Trump tax cuts, which are set to expire at the end of this year. The extension could add an estimated $5.5 trillion to the federal debt over the next decade if enacted.

14-15) If the economy slips into recession, the fiscal burden could increase significantly, creating major headwinds for traditional financial markets and Bitcoin. This underscores the importance of closely monitoring credit markets, not just for equity investors but also for crypto traders.

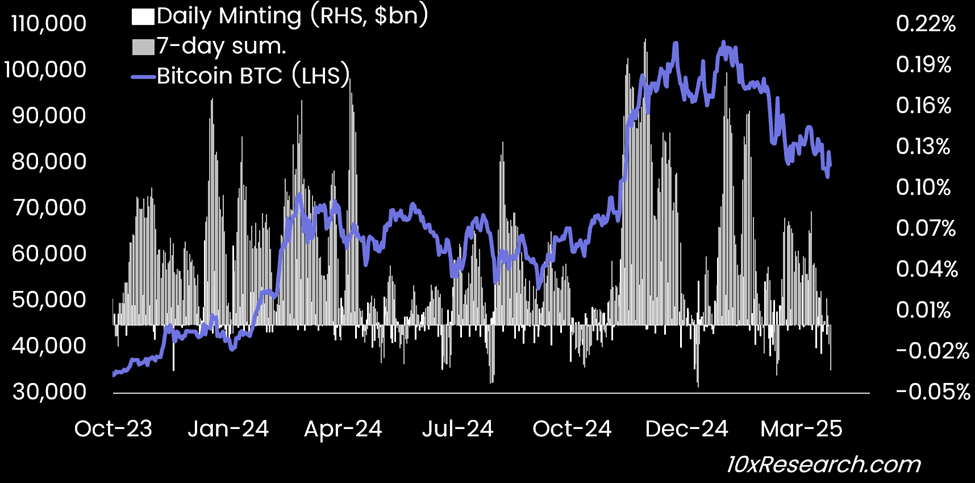

15-15) In the near term, Bitcoin will likely stay under pressure as global trade flows shift and capital reallocates. A weakening U.S. dollar could prompt more American investors to turn to Bitcoin as an alternative store of value. However, downside risks for Bitcoin persist until our minting indicator shows a meaningful pickup in fiat inflows into the crypto space. This is not yet the case.

Bitcoin (LHS) vs. Stablecoin inflows relative to crypto market cap (RHS)

Despite bullish sentiment, Bitcoin remains vulnerable as the U.S.-China trade war intensifies and global credit markets flash warning signs. CNY devaluation risks, rising bond yields, and widening credit spreads point to continued volatility. With no coordinated support from central banks, BTC may test key support at $73K or drop further. Markets could be entering a prolonged downturn, not a quick rebound.

10x Research/6 days ago

Amid market turmoil, the White House attempts to calm investors while the U.S.-China trade war intensifies. China resists U.S. tariff demands and may respond by weakening the yuan or selling U.S. Treasuries. With deep VIX inversion and threats of more tariffs, volatility is expected to rise. The USDCNY rate remains a key signal in this escalating showdown, while markets brace for continued turbulence.

10x Research/6 days ago

Bitcoin is showing strength versus U.S. tech stocks and may be emerging as a safe-haven asset. With rising trade tensions, expected Fed rate cuts, and dollar weakness, Bitcoin’s appeal is growing—especially compared to struggling altcoins. In a volatile macro environment, a long BTC vs. short altcoins trade could be the most compelling strategy.

10x Research/6 days ago

Owning 1 BTC isn’t just an investment—it’s a hedge against fiat collapse and a front-row seat to a new monetary system. With only 21M BTC and growing global demand, scarcity will soon exclude most. As fiat trust erodes and institutions buy in, Bitcoin becomes the ultimate store of value. Be early. Be whole.

Alec Bakhouch/12 hours ago

Crypto’s biggest bull run may just be starting. As Bitcoin enters its acceleration phase, altseason is around the corner. Historical election-year patterns, pro-crypto policies, and major Bitcoin accumulation point to a massive market shift. Six low-cap altcoins—$ARC, $ATH, $VIRTUAL, $ZKJ, $SNX, $SONIC—show strong upside potential for 2025.

Wimar.X/12 hours ago

Andrew Kang, co-founder of Mechanism Capital with $300M AUM, shares six key predictions. He highlights Bitcoins potential surge to $125,000 by year-end, backed by Trumps supportive policies. Kang warns of Ethereums vulnerabilities, predicts a downturn to sub-$1,000. His interest in humanoid robotics aligns with a tech boom, marking a new frontier. He advises caution amidst tariff uncertainties and emphasizes studying historical cycles for informed crypto trading strategies.

Nonzee/1 days ago

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A whale exchanged WIF and Bonk positions for Fartcoin!

2024.12.25 11:01:14

MoreHot Articles

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

10 promising AI Agent cryptos

2024.12.05

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link