Will China Bend the Knee Tonight?? SP500, Bitcoin...

10x Research

10x Research

1-13) The White House appeared to panic on Monday, releasing a flurry of headlines suggesting an emergency Fed meeting, a potential 90-day truce in tariff negotiations, and progress with talks involving 50—later revised to 70—countries, with deals like Japan’s expected to be announced soon. But those headlines appeared primarily aimed at halting the stock market’s sharp decline.

2-13) Treasury Secretary Bessent was positioned as the calm macroeconomic voice, while Trump's aggressive tariff spokesperson, Lutnick, was noticeably dialed back. Behind the scenes, Bessent reportedly flew to Florida on Sunday to urge Trump to address the tariff endgame publicly, fearing that without reassurance, the stock market could plunge even further.

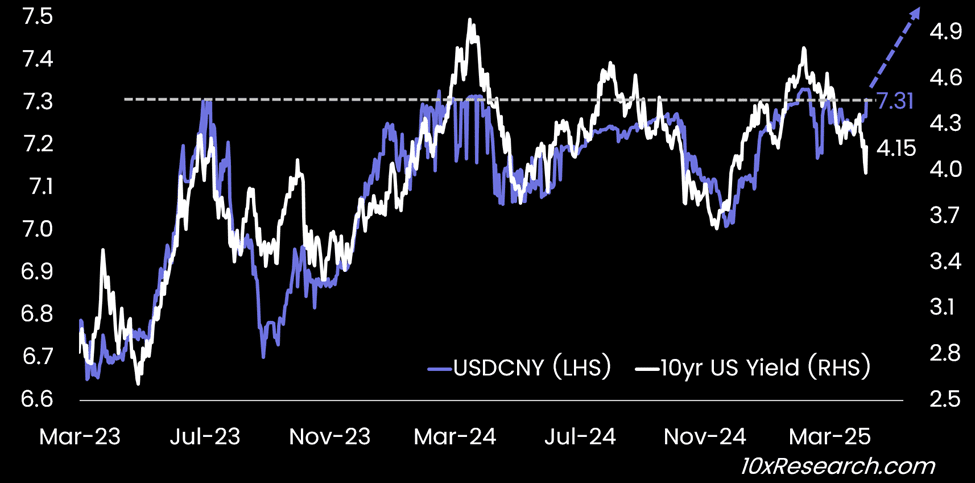

There’s only one question that truly matters: Will China bend the knee and cave in—or escalate the fight?

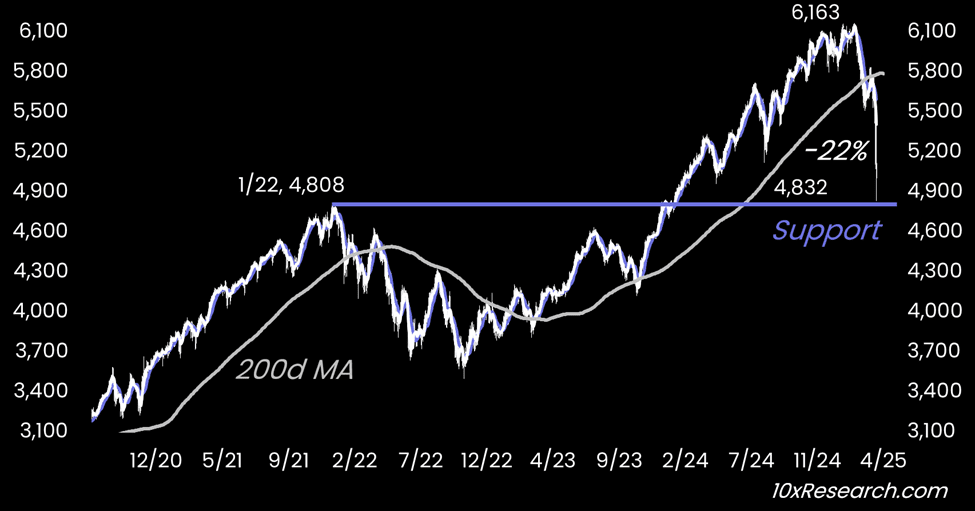

SP500 - hitting major support levels after a -22% decline

3-13) Bessent has not yet followed Musk’s lead in openly criticizing the administration’s increasingly radical approach—but that may only be a matter of time. Trump, Navarro, and U.S. Trade Representative Jamieson Greer are pursuing an aggressive strategy targeting Europe’s value-added taxes (VAT) and demanding structural concessions from China, despite the low likelihood that Beijing will yield.

4-13) Unlike Europe, which appears to be preparing a relatively measured response by signaling openness to dialogue and delaying any immediate retaliatory tariffs, China is holding firm. This reinforces the notion that the real showdown is not global, but a direct and intensifying battle between the U.S. and China.

5-13) China’s firm stance is already clear through its swift retaliatory tariffs, and there are early indications it may begin offloading portions of its U.S. Treasury holdings or allow the yuan to weaken further—driving USDCNY higher. Unlike during Trump’s first term, China appears more prepared and less caught off guard. This time, closely monitoring the USDCNY exchange rate and the 10-year U.S. Treasury yield will be critical, as rising yields could further tighten corporate credit spreads and amplify financial stress.

USDCNY (LHS) vs. 10-year US Treasury Yield (RHS)

6-13) As a result, the USDCNY exchange rate is already testing a key resistance level, and a further depreciation of the yuan could help restore some of China's export competitiveness amid rising trade tensions. Given that the USDCNY and 10-year U.S. Treasury yield have been closely aligned, the unexpected spike in yields last night caught many off guard—mainly as BlackRock CEO Larry Fink floated the possibility of the Fed hiking rates. Such a move would represent a significant negative shock for both financial markets and Bitcoin.

7-13) Both Bessent and Musk have roles in Trump’s broader strategy. Still, they remain outside the core decision-making circle—unlike Peter Navarro, one of the few trusted figures returning to Trump’s inner circle this term. While Bessent may attempt to calm markets and manage the optics of the stock market decline, Navarro’s influence suggests that genuine negotiations are NOT taking place.

8-13) Despite appearances, this is not a diplomatic dance—it’s a confrontation. As long as Trump’s base continues to support the tariffs in the polls, the administration is likely to press forward. This is shaping up as an all-in economic showdown between the U.S. and China, with only one clear winner in the end.

VIX 3 months - VIX (spread in volatility points)

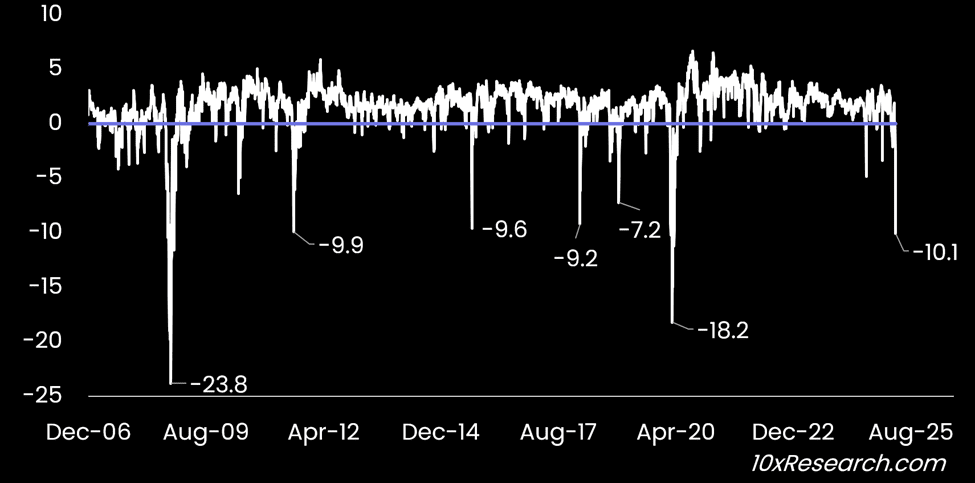

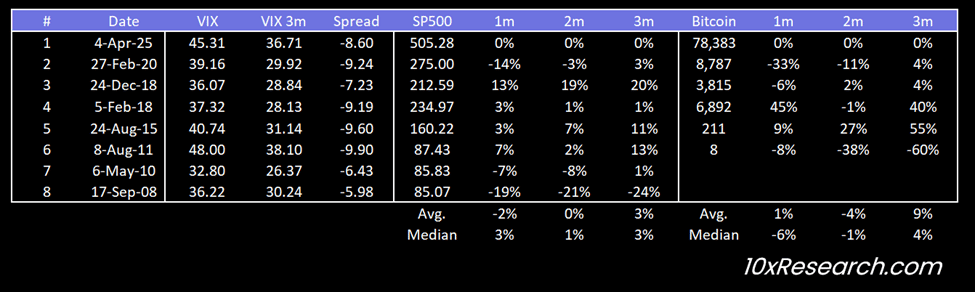

9-13) The VIX inversion—measured as the spread between 3-month implied volatility and the front-month VIX—has reached extreme levels, with the spread hitting -10 volatility points. This marks the third-deepest inversion on record, surpassed only during the Global Financial Crisis and the COVID crash, signaling heightened near-term fear.

10-13) While conventional wisdom suggests such extremes often precede market bottoms, the data tells a different story. Historically, when the VIX inversion crosses (below) -5 for the first time in three months, forward returns for both the S&P 500 and Bitcoin over 1, 2, and 3 months are statistically underwhelming. Instead, these periods tend to be characterized by continued market turbulence.

Then the VIX-3m VIX spread (-5 vol points) first time

11-13) Despite the S&P 500 correcting to levels last seen in early 2022—wiping out three years of gains in just two months—markets remain on edge. With Trump now threatening an additional 50% tariff on China in response to Beijing's matching of last week’s 34% U.S. tariffs, Tuesday could bring another wave of volatility. Investors must assess who is truly steering policy: market-minded figures like Scott Bessent or hard-line trade hawks like Peter Navarro. We believe it’s the latter—hence our preference to stay on the sidelines.

12-13) Crucially, Trump has warned that if China doesn’t roll back its 34% tariffs by Tuesday, all negotiations will be off. In response, China’s commerce ministry vowed to “fight to the end.” Keep a close eye on the USDCNY exchange rate—it may offer the earliest signal of how this standoff unfolds.

13-13) We expect the USDCNY to continue rising (latest USDCNY rate here) and volatility to return across financial markets, as the U.S.-China standoff shows no signs of resolution. Unfortunately, holders of financial assets, including Bitcoin, are likely to be collateral damage in this confrontation. With the Fed unlikely to intervene anytime soon, as Chair Powell made clear last Friday, market participants should brace for continued turbulence.

As foreign capital exits U.S. markets and the dollar weakens, Bitcoin may face continued short-term pressure. Rising credit spreads, fading Chinese demand, and shifting global capital flows reduce immediate bullish momentum. U.S. investors could become marginal BTC buyers, but a sustained recovery likely depends on renewed fiat inflows into crypto.

10x Research/2025.04.11

Despite bullish sentiment, Bitcoin remains vulnerable as the U.S.-China trade war intensifies and global credit markets flash warning signs. CNY devaluation risks, rising bond yields, and widening credit spreads point to continued volatility. With no coordinated support from central banks, BTC may test key support at $73K or drop further. Markets could be entering a prolonged downturn, not a quick rebound.

10x Research/2025.04.11

Bitcoin is showing strength versus U.S. tech stocks and may be emerging as a safe-haven asset. With rising trade tensions, expected Fed rate cuts, and dollar weakness, Bitcoin’s appeal is growing—especially compared to struggling altcoins. In a volatile macro environment, a long BTC vs. short altcoins trade could be the most compelling strategy.

10x Research/2025.04.11

Trump has called for Jerome Powell’s removal, slamming the Fed’s slow rate cuts amid global easing. He plans a 2% cut next FOMC and aims to reshape the Fed via the Supreme Court. Markets are bracing for potential upheaval, with Trump’s bold pro-crypto stance fueling $BTC $ETH $SOL price targets. A clash of economic visions may redefine U.S. monetary policy.

DanteX/22 hours ago

Owning 1 BTC isn’t just an investment—it’s a hedge against fiat collapse and a front-row seat to a new monetary system. With only 21M BTC and growing global demand, scarcity will soon exclude most. As fiat trust erodes and institutions buy in, Bitcoin becomes the ultimate store of value. Be early. Be whole.

Alec Bakhouch/3 days ago

Crypto’s biggest bull run may just be starting. As Bitcoin enters its acceleration phase, altseason is around the corner. Historical election-year patterns, pro-crypto policies, and major Bitcoin accumulation point to a massive market shift. Six low-cap altcoins—$ARC, $ATH, $VIRTUAL, $ZKJ, $SNX, $SONIC—show strong upside potential for 2025.

Wimar.X/3 days ago

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A whale exchanged WIF and Bonk positions for Fartcoin!

2024.12.25 11:01:14

MoreHot Articles

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

10 promising AI Agent cryptos

2024.12.05

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link