Bitcoin Faces Mounting Pressure Amid U.S.-China Standoff and Global Liquidity Stress

10x Research

10x Research

1-20) In yesterday’s report, we warned that it was too early to buy the dip, flagging the overly optimistic China headlines as a potential trap for investors. Going against the crowd is never easy—especially when sentiment remained upbeat just a day ago—but we emphasized this was not the moment to step in.

2-20) Our analysis of the VIX inversion further supported this view, signaling that more downside volatility was likely still ahead. It was easy to be caught off guard by last week’s tariff announcement—especially given Trump’s past pattern of postponing tariffs on Mexico and Canada and media reports suggesting any new measures would be narrowly targeted.

3-20) The White House may have deliberately planted these misleading signals to keep investors unhedged and maximize (global) stock market damage. While many still view this as a short-term risk, we warned yesterday that a deal with China was unlikely—and this now carries major implications for Bitcoin.

4-20) On Monday, the administration likely floated a fake “90-day truce”. It claimed China’s willingness to negotiate to stem the sell-off as margin calls escalated and funds faced potential blow-ups. This was the narrative Treasury Secretary Bessent pushed to soothe markets—arguing that China had no option but to accept Trump’s demands. However, contrary to popular belief, significant risks remain for Bitcoin. To understand those risks, its essential to understand what is going on.

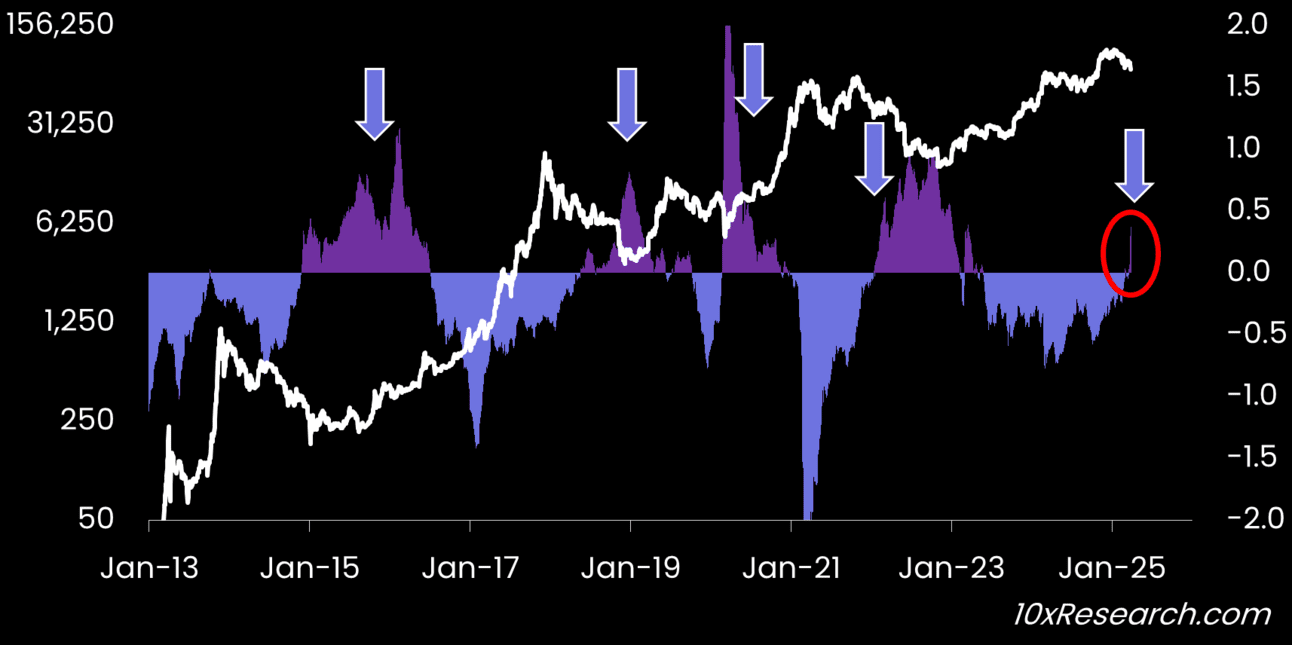

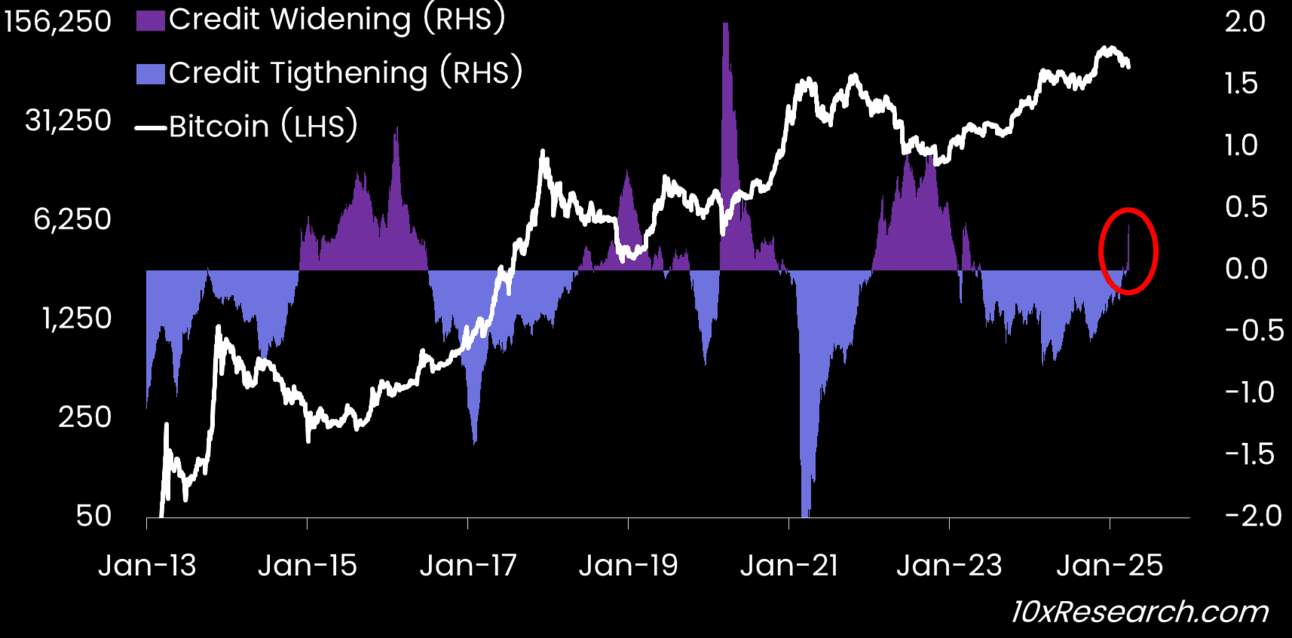

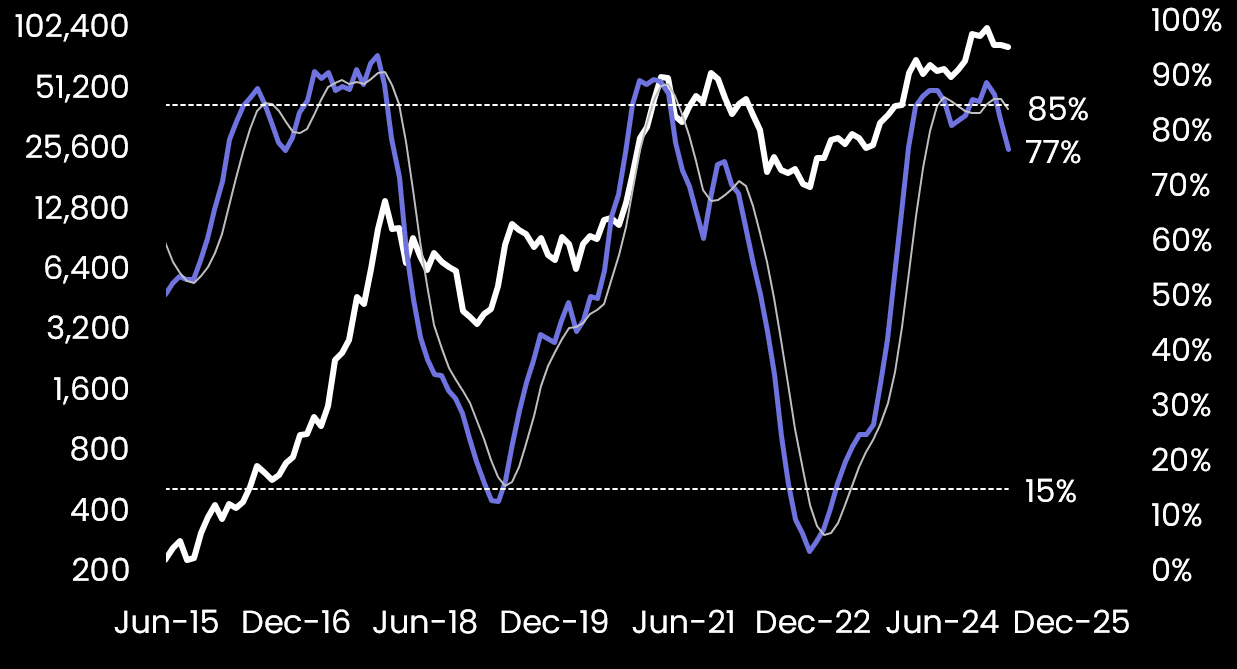

This indicator has captured all the Bitcoin bear markets…

5-20) Bitcoin had already cleared out excess leverage and short-term holders in February—setting the stage for a different trajectory. There is currently no forced liquidation pressure for Bitcoin, hence why its holding up better than stocks, even though it is trading near MicroStrategy’s average purchase cost across all its Bitcoin holdings.

6-20) Both the U.S. and China face mounting debt burdens that they’ll likely attempt to inflate away—meaning China may soon have no choice but to loosen its tightly managed currency regime, weakening the CNY. This contradicts the overly optimistic view of a potential “Mar-a-Lago Accord” resolving U.S. dollar overvaluation. Historically, similar moments—like the 1985 Plaza Accord—signaled the end of Japan’s rise as it threatened U.S. dominance, while the Soviet Union collapsed under the weight of unproductive military spending.

7-20) While the U.S. initially believed it could wait out the China threat due to its demographic challenges, China’s rapid advancements in AI and robotics have the potential to offset those issues, creating a renewed sense of urgency in Washington. This confrontation is no longer just about reshoring basic manufacturing or building T-shirt factories in Kentucky; it’s about countering a technological and strategic rival before it's too late.

8-20) Despite maintaining a mercantilist exchange rate regime, China’s central bank balance sheet isn’t expanding, corporate profits remain weak, and the country grapples with soaring debt, a collapsing real estate sector, and record youth unemployment. To stabilize its economy, China may have no choice but to weaken its currency—directly countering the pressure applied by U.S. tariffs. The conflicting forces at play suggest we’re rapidly approaching a breaking point.

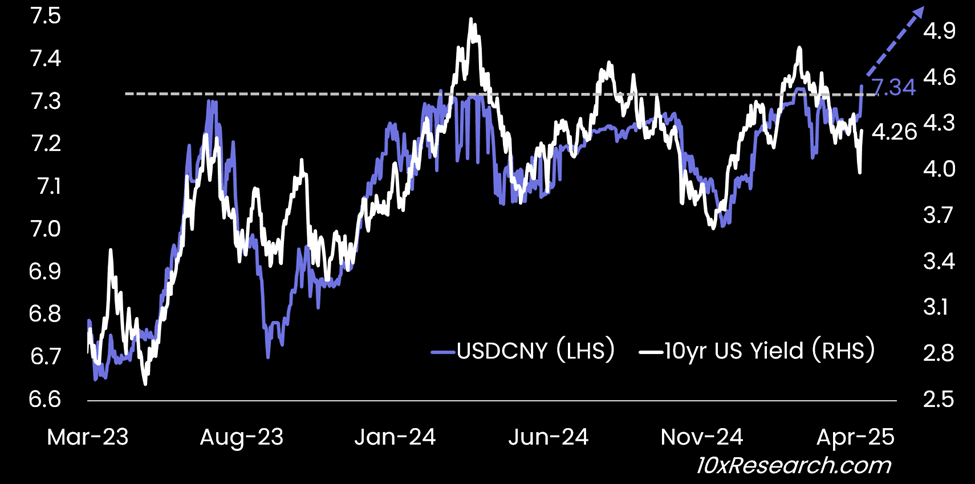

USDCNY (LHS) moving above resistance (dotted) vs. 10yr US Yields (RHS)

9-20) Today, China’s deflationary spiral demands currency devaluation, but its managed FX system limits flexibility. A weaker CNY and its close correlation with rising 10-year U.S. Treasury yields suggest higher global inflation and bond yields—not the rate cuts markets are hoping for. Fed Chair Powell has already dismissed near-term easing, and even BlackRock’s Larry Fink sees the potential for hikes if inflation pressures persist and the labor market stays firm—a scenario that may take at least two more job reports to change.

10-20) We’re clearly seeing the breakdown of 10-year U.S. Treasury bonds—and the U.S. dollar—as traditional safe havens during this equity market selloff. The rise in U.S. bond yields is no longer a neutral signal; it’s flashing a clear warning. This pressure is now spilling over into corporate credit markets.

11-20) The upcoming U.S. corporate earnings season, beginning this Friday, is likely to intensify the uncertainty, as many executives are expected to withhold forward guidance—leaving investors without the information needed to make rational decisions. Meanwhile, the World Container Index (East-West composite for a 40-foot container) has dropped sharply from $4,000 in early January to just $2,100, signaling a significant decline in shipping demand—likely a direct result of tariff-related uncertainty and halted trade flows.

Bitcoin (LHS, log) vs. BBB US Corporate Credit Spreads YoY (RHS)

12-20) When credit spreads begin to widen—as they are now—it’s typically a signal that the correction in risk assets is far from over. The year-on-year change in the ICE BofA BBB U.S. Corporate Index Option-Adjusted Spread has now turned positive (credit spreads widening)—a signal historically linked to the onset of Bitcoin bear markets. This shift suggests we're entering a more serious downturn, rather than just another instance of Trump’s usual “art of the deal” negotiation theatrics.

13-20) It’s also why, even after a -20% correction in U.S. equities, this may not present a clear buying opportunity. A swift V-shaped recovery looks increasingly unlikely under the current conditions. That’s why it’s essential to recognize that U.S. stocks didn’t peak with DeepSeek’s January release, as Bessent suggested, nor solely on Trump’s tariff threats.

14-20) The real turning point came when Walmart warned (February 20) of shifting consumer behavior in anticipation of tariffs, followed by a sharp drop in consumer confidence (February 21). This shift won’t be easily or quickly reversed. Beyond disrupted supply chains, growing uncertainty around corporate capex is now threatening the labor market. Until consumers feel confident that their jobs are secure, a meaningful recovery in sentiment, spending—and by extension, the broader market—will remain elusive.

15-20) This is why it's critical to monitor not just the USDCNY exchange rate—given its implications for inflation and U.S. 10-year Treasury yields—but also the widening of corporate credit spreads, which could be a warning sign of an impending wave of corporate bankruptcies. If so, volatility will persist, and further equity (and crypto) market declines are possible.

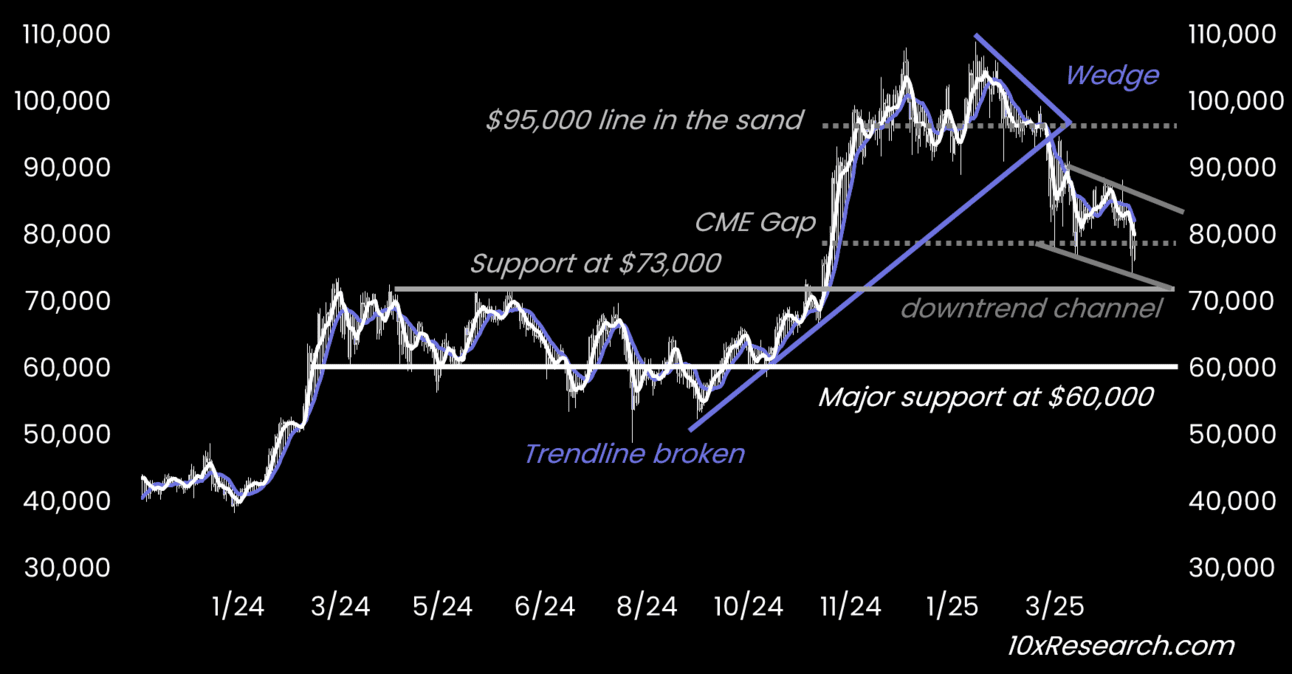

16-20) Bitcoin could test key support at $73,000 in this environment or even drop toward $60,000. Bitcoin has broken below its 21-week moving average near $89,000—one of the most reliable indicators historically for managing downside risk, as we frequently pointed out. There’s no urgency to buy, as coordinated fiscal or monetary support has yet to materialize.

Bitcoin (LHS, log) targets $73,000 with next major support at $60,000

17-20) While a CNY devaluation triggered a Bitcoin rally in 2015, it was preceded by an immediate 22% decline—and the context has changed. Chinese retail had more capital then, regulatory pressure was lighter, and stablecoins weren’t yet a factor—today, those tailwinds are gone. Bitcoin risks becoming collateral damage as investors scramble to raise cash amid growing margin calls.

18-20) The sharp decline in 3-year SOFR swap spreads signals rising stress in bank funding markets, with Treasury yields climbing as liquidity dries up and counterparty risk surges. Interbank trust is deteriorating, and banks demand higher premiums to lend to one another. What began with cautious consumers and corporate credit concerns is now spreading into the financial system’s core—bank funding.

19-20) Many investors were lured into buying the dip over the past two days, placing too much faith in reassuring statements from Trump and Bessent—a move that can only be repeated so many times. Trump may believe that China’s deflationary pressures leave it with no choice but to strike a deal, while China likely sees this as an existential battle.

20-20) Rather than backing down, Beijing appears to be playing the long game, aiming to ride out the storm until U.S. sentiment potentially shifts against Trump in the midterm elections. A deepening negative wealth effect in the U.S. may be China’s most effective lever. With neither Trump nor Xi showing signs of backing down, we may be inching toward a 2008-style crisis.

Bitcoin (LHS, log) vs. Monthly Stochastics (cycles)

As foreign capital exits U.S. markets and the dollar weakens, Bitcoin may face continued short-term pressure. Rising credit spreads, fading Chinese demand, and shifting global capital flows reduce immediate bullish momentum. U.S. investors could become marginal BTC buyers, but a sustained recovery likely depends on renewed fiat inflows into crypto.

10x Research/2025.04.11

Amid market turmoil, the White House attempts to calm investors while the U.S.-China trade war intensifies. China resists U.S. tariff demands and may respond by weakening the yuan or selling U.S. Treasuries. With deep VIX inversion and threats of more tariffs, volatility is expected to rise. The USDCNY rate remains a key signal in this escalating showdown, while markets brace for continued turbulence.

10x Research/2025.04.11

Bitcoin is showing strength versus U.S. tech stocks and may be emerging as a safe-haven asset. With rising trade tensions, expected Fed rate cuts, and dollar weakness, Bitcoin’s appeal is growing—especially compared to struggling altcoins. In a volatile macro environment, a long BTC vs. short altcoins trade could be the most compelling strategy.

10x Research/2025.04.11

Trump has called for Jerome Powell’s removal, slamming the Fed’s slow rate cuts amid global easing. He plans a 2% cut next FOMC and aims to reshape the Fed via the Supreme Court. Markets are bracing for potential upheaval, with Trump’s bold pro-crypto stance fueling $BTC $ETH $SOL price targets. A clash of economic visions may redefine U.S. monetary policy.

DanteX/22 hours ago

Owning 1 BTC isn’t just an investment—it’s a hedge against fiat collapse and a front-row seat to a new monetary system. With only 21M BTC and growing global demand, scarcity will soon exclude most. As fiat trust erodes and institutions buy in, Bitcoin becomes the ultimate store of value. Be early. Be whole.

Alec Bakhouch/3 days ago

Crypto’s biggest bull run may just be starting. As Bitcoin enters its acceleration phase, altseason is around the corner. Historical election-year patterns, pro-crypto policies, and major Bitcoin accumulation point to a massive market shift. Six low-cap altcoins—$ARC, $ATH, $VIRTUAL, $ZKJ, $SNX, $SONIC—show strong upside potential for 2025.

Wimar.X/3 days ago

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A whale exchanged WIF and Bonk positions for Fartcoin!

2024.12.25 11:01:14

MoreHot Articles

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

10 promising AI Agent cryptos

2024.12.05

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link