The $2 Trillion Whiplash: Inside the Fastest Market Reversal Since “Liberation Day”

The Kobeissi Letter

The Kobeissi Letter

What just happened?

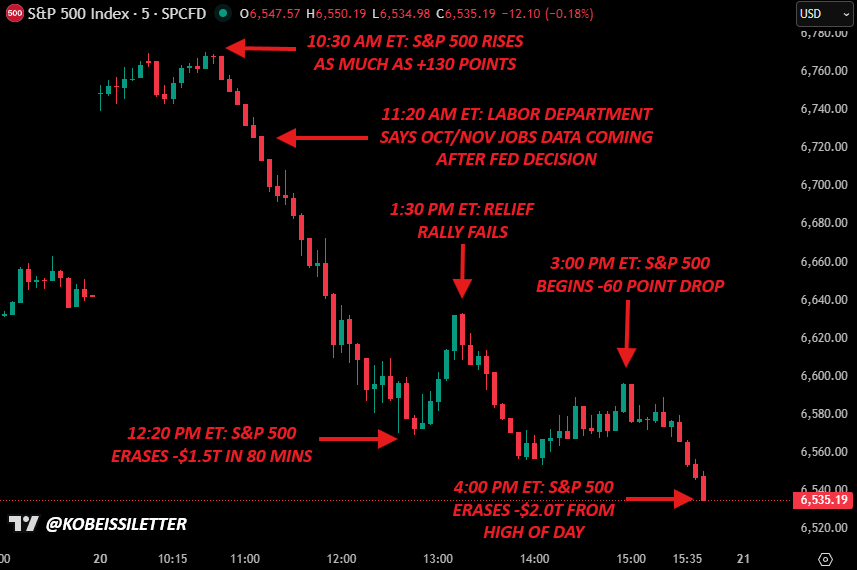

In its fastest reversal since "Liberation Day," the S&P 500 just lost -$2 TRILLION of market cap in 5 hours.

Nvidia went from +6% to -3% after reporting RECORD revenue of $55 billion without ANY new headlines.

Why did this happen?

Let us explain.

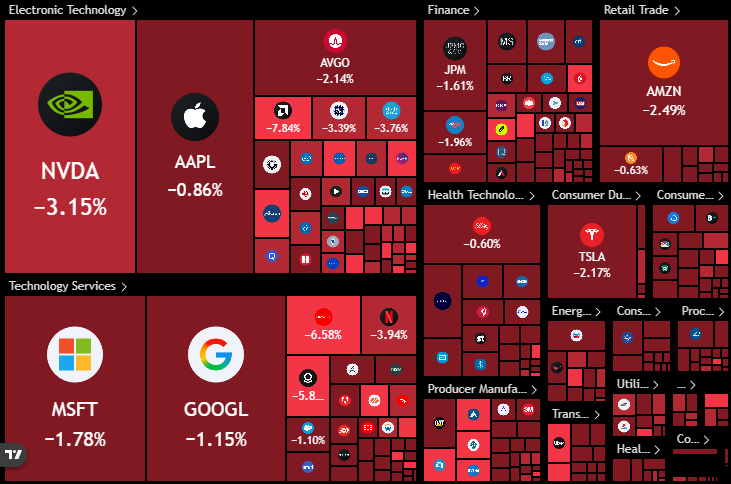

Here was the S&P 500's heat map at the open today.

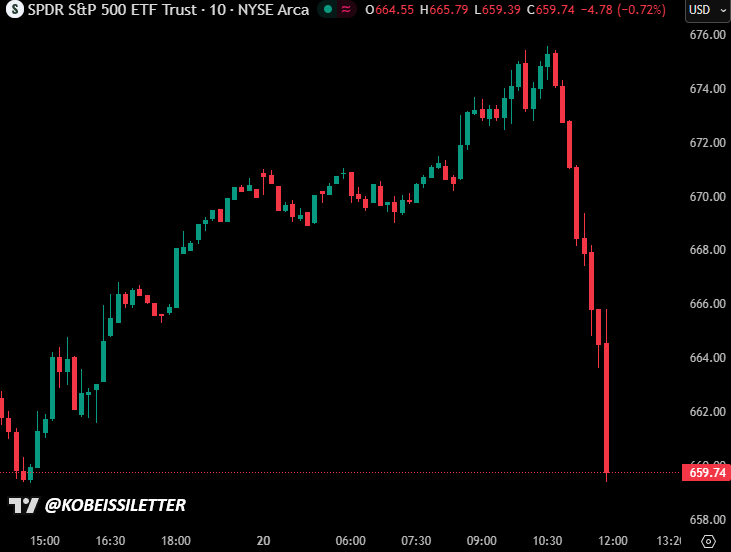

After Nvidia, $NVDA, crushed earnings reporting record quarterly revenue of $55 billion, stocks were deep green.

The Nasdaq 100 was on track for its largest daily gain since May 2025.

Then, at 10:30 AM ET, everything changed.

As shown below, the S&P 500 went from +130 points to down -50 points in a matter of minutes.

One would expect that a market moving headline came out.

But, nothing new happened aside from an 11:20 AM headline that the BLS is releasing the November jobs report on December 16.

Prior to this headline coming out, the S&P 500 had already started to reverse its rally.

Between 10:30 AM ET and the 11:20 AM ET news, the S&P 500 gave up ~80 points of its gain.

However, after this report came out, the decline only intensified.

So, was this the trigger?

In our view, this headline was, AT BEST, partially to blame.

Rather, we view the decline as a mechanical move and a broader indication of shifting market dynamics.

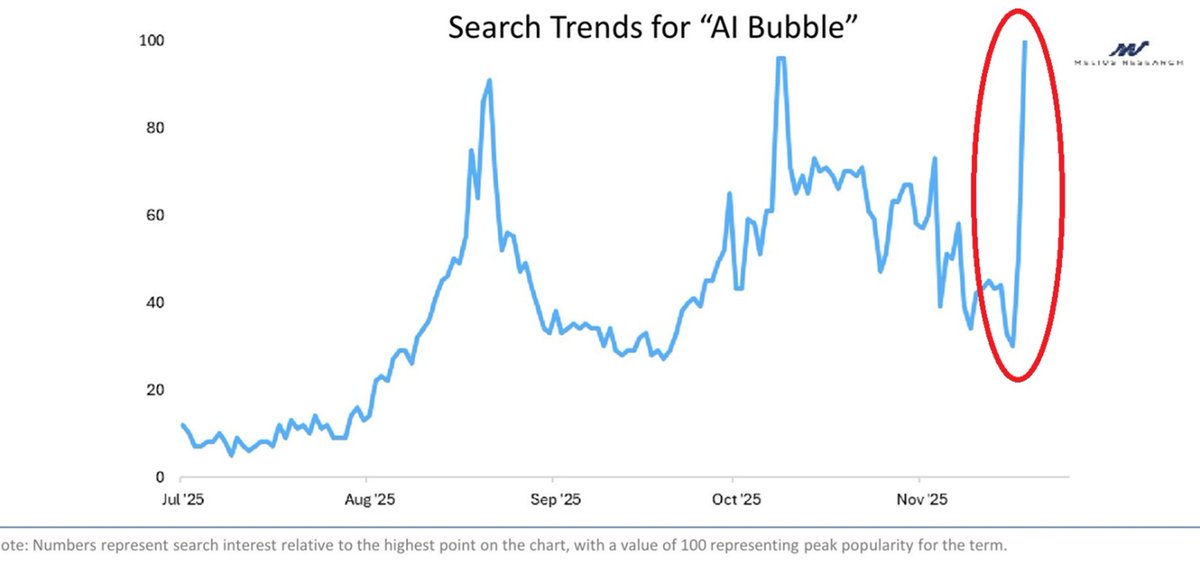

As AI continues to scale, sentiment has become highly polarized.

Market sentiment is binary in nature right now.

What do we mean by this?

When the market begins to decline, investors are afraid to be the "last one out."

This also works in the opposite direction as we have seen since the April bottom.

Rallies gain momentum quickly as investors are afraid of missing the "next big thing."

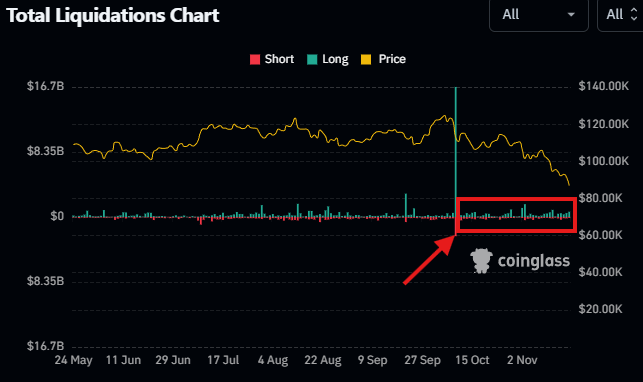

On top of this, there are record levels of leverage, particularly in crypto.

For a while, this was an isolated downturn in crypto, but today it was not.

Crypto is now running close to $1 billion worth of liquidations PER DAY.

This only amplifies the polarity in sentiment.

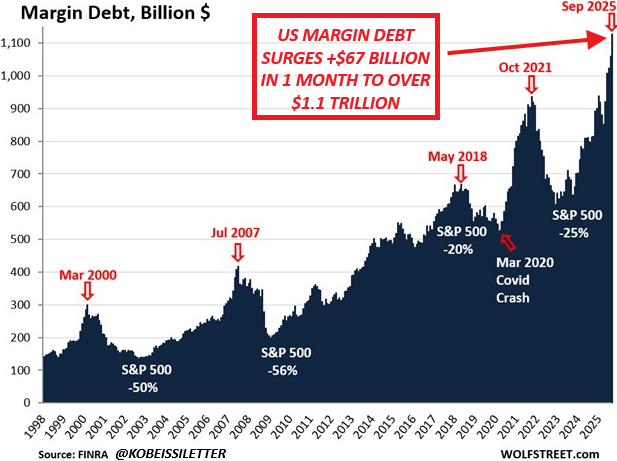

Similar trends can be seen in equity markets.

In September 2025, US investors took on another +$67 billion in margin debt bringing the total to a record $1.13 trillion.

Meanwhile, 5 TIMES levered ETFs have just been proposed to the SEC.

Leverage is catalyzing more volatility.

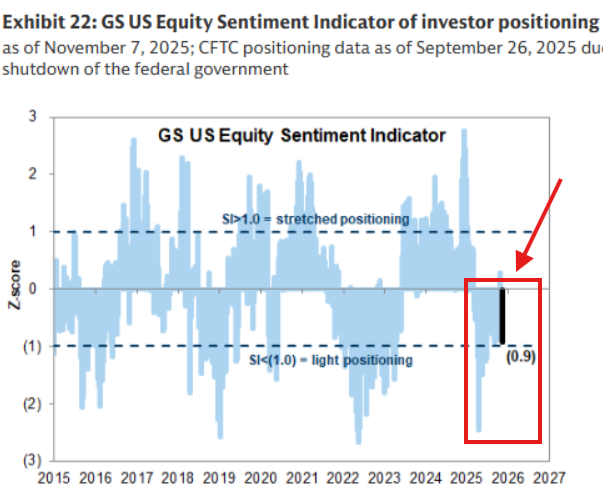

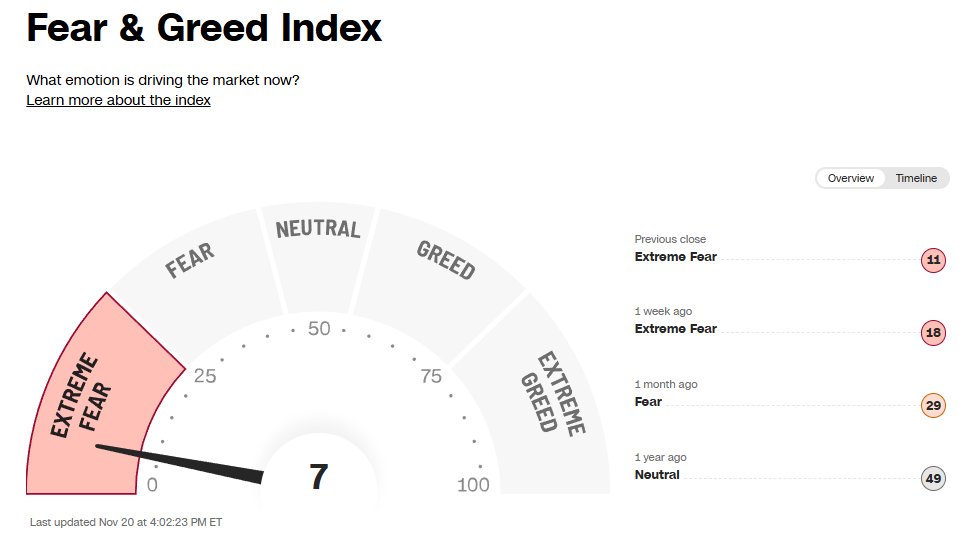

Further supporting our view is "Extreme Fear" in the market.

With the S&P 500 just 5% away from a record high, the Fear & Greed Index is down to 7.

This is in-line with levels seen at the April 2025 bottom, despite the S&P 500 being ~35% higher now.

It's all about sentiment.

As we look ahead, we believe markets will stabilize with more information.

Even as the US shutdown is over, we are still dealing with a data blackout.

Markets do NOT like uncertainty, even as earnings have supported AI valuations.

We believe the market will iron itself out.

Furthermore, we believe more volatility is the inevitable byproduct of AI disruption.

This is redefining the way markets are moving.

Lastly, we continue to emphasize the importance of "zooming out."

While the S&P 500 was deep red today, it's still up +11% YTD and +35% since April.

We think we are in a brief correction before more upside.

A sweeping narrative ties Jane Street to India’s expiry-day options case, alleged 10AM Bitcoin sell patterns, Terra’s collapse, and ETF plumbing. While none prove misconduct, critics argue a common structure: move spot, monetize derivatives, keep execution opaque.

Bull Theory/4 days ago

A controversial narrative links Jane Street, ETF mechanics, and Bitcoin’s price behavior, pointing to lawsuit allegations, 10AM volatility patterns, and derivative hedging dynamics. The discussion raises broader questions about liquidity, structure, and price discovery.

Justin Bechler/5 days ago

A new federal lawsuit alleges Jane Street exploited non-public information tied to Terraform’s liquidity defenses, accelerating UST’s depeg and the Terra collapse. The firm denies the claims. The case may reignite debates on structure, design, and regulation.

Diana/6 days ago

Mean reversion and on-chain models sit at levels historically linked to bottom formation after capitulation. Realized losses reached record USD values, while deviations from anchor models remain extreme. Price pain may be fading; patience remains key.

Checkmate/6 days ago

Bitcoin didn’t fail as an asset — it matured into an ETF-driven trade. As institutional ownership rose, correlation with tech risk intensified. Short-term pressure reflects holder structure shifts, not thesis collapse.

Eric Jackson/7 days ago

This weekly report frames Bitcoin within a six-stage bear market model. With BTC in Stage 4, price stagnation drives exhaustion and weak-hand selling while liquidity builds. The harshest mechanical drop may be over, but fear and capitulation likely remain ahead.

Doctor Profit/2026.02.23

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

When Elon Musk tweeted about Moltbook, the meme coin MOLT experienced a short-term 30% price surge, hitting a new all-time high of $114 million.

2026.01.31 18:37:29

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

MoreHot Articles

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

10 promising AI Agent cryptos

2024.12.05

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link