Why is Bonk winning?

Adam

Adam

PUMP DOT FUN ...

One of the fastest growing crypto apps in history, the undisputed winner of this cycle, and the foundation of the MEMECOIN SUPERCYCLE.

Battle tested and undefeated for 1.5 years.

Yet somehow, here we are:

PumpFun has officially been dethroned and the dashboard guy is writing another article.

https://x.com/Adam_Tehc/status/1941756581475164495

This is my attempt to make sense of the chaos.

Where It All Began

If you're unfamiliar with the lore, there are three major players in this story: @RaydiumProtocol & @bonk_fun vs. @pumpdotfun

Their rivalry started 5 months ago when PumpFun first introduced PumpSwap, Pump's own native DEX. Little did they know what they'd started.

https://x.com/pumpdotfun/status/1902762309950292010

Before PumpSwap every PumpFun token reaching $69K marketcap migrated to Raydium, earning Raydium swap fees.

By the end of 2024, Raydium’s annual swap revenue was $159.5M, with 39% being attributed to Pump tokens, according to Blockworks data.

Raydium retaliated in less than a month by launching their own token launchpad & PumpFun competitor: LaunchLab.

https://x.com/RaydiumProtocol/status/1912496080383799632

I believe most people (myself included) overlooked LaunchLab as a desperate attempt to get back at PumpFun. And rightly so; this was the hundredth token launchpad trying to eat at the PumpFun monopoly. On the face of it, innovative but nothing special.

Or was it?

The real innovation wasn't the launchpad itself, it was what happened under the hood.

LaunchLab is a plug & play SDK, meaning anyone can build their own token launchpad on top of it. This is exactly how BonkFun came to be.

Give the biggest memecoin community on Solana (with 960K holders) its own token launchpad and suddenly PumpFun wasn't untouchable.

https://x.com/bonk_fun/status/1915831339221164537

The Memecoin War

Bonk & Raydium had both the clout and the resources to take the fight to PumpFun and, at the time of writing, they're winning. So how did they do it?

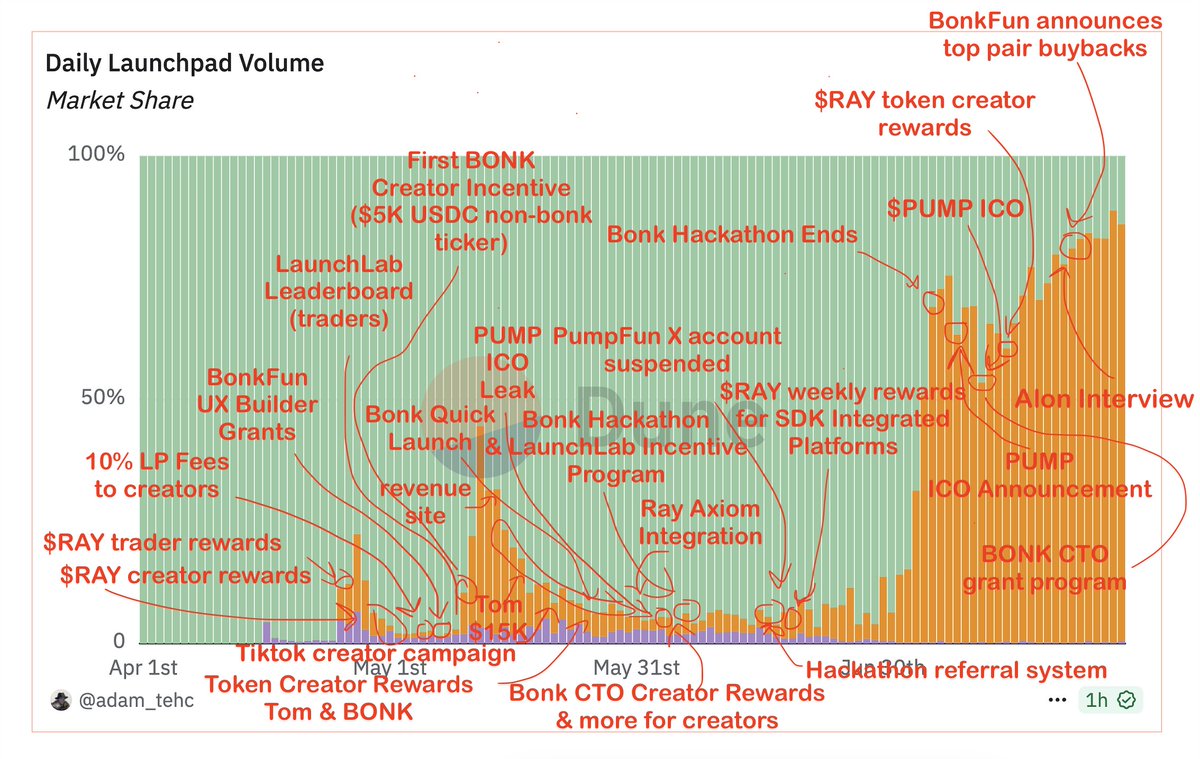

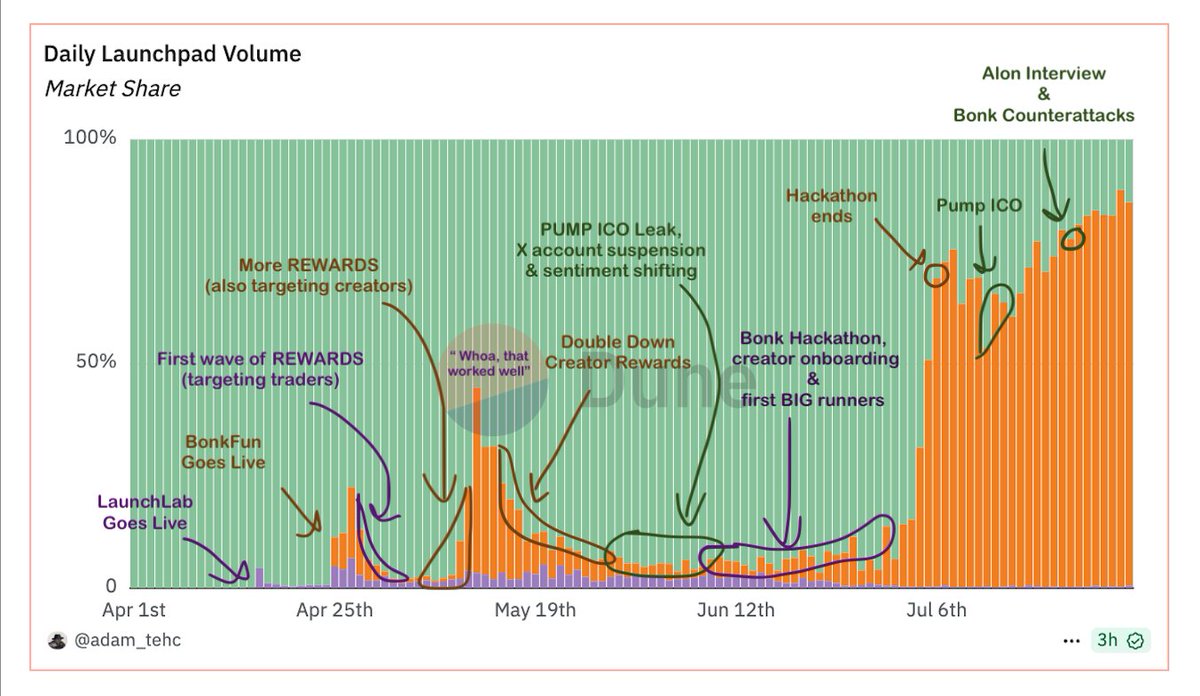

I analyzed every major event relating to these players over the course of the last few months and how they correlate with the chart.

Bear with me here...

Let's break that clusterfuck down a bit...

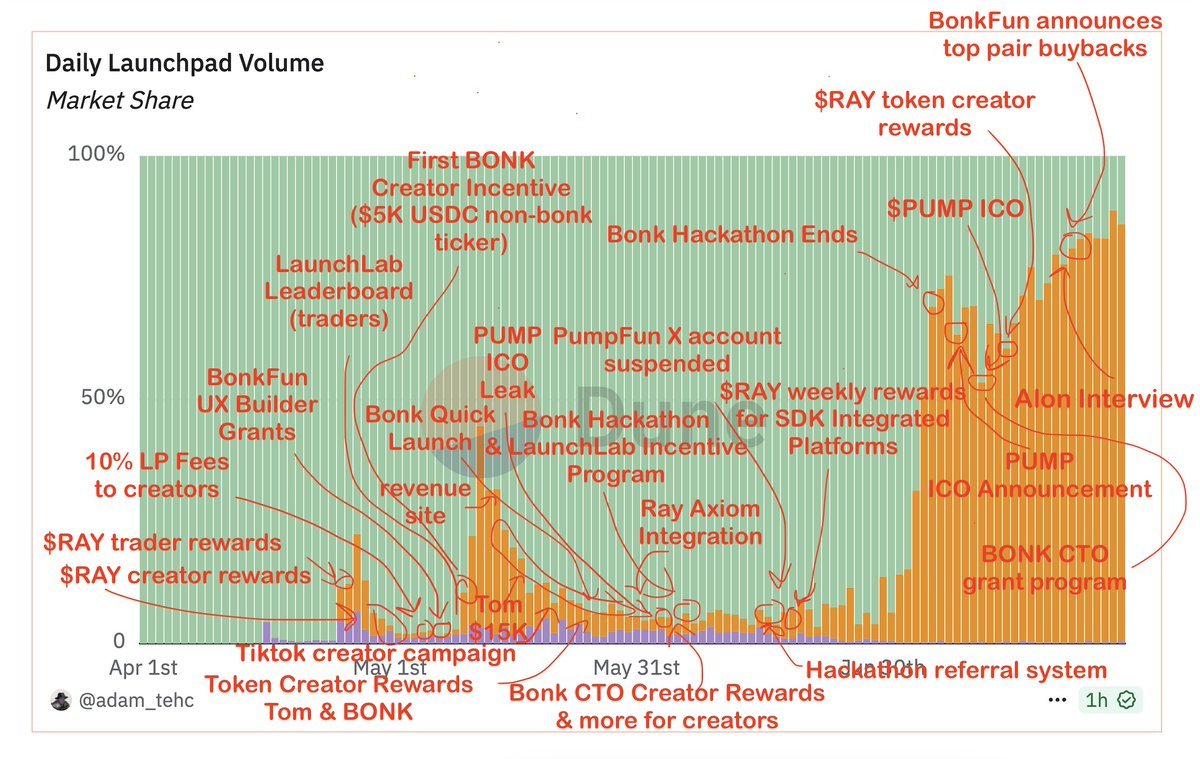

The "memecoin war" is a user rewards war.

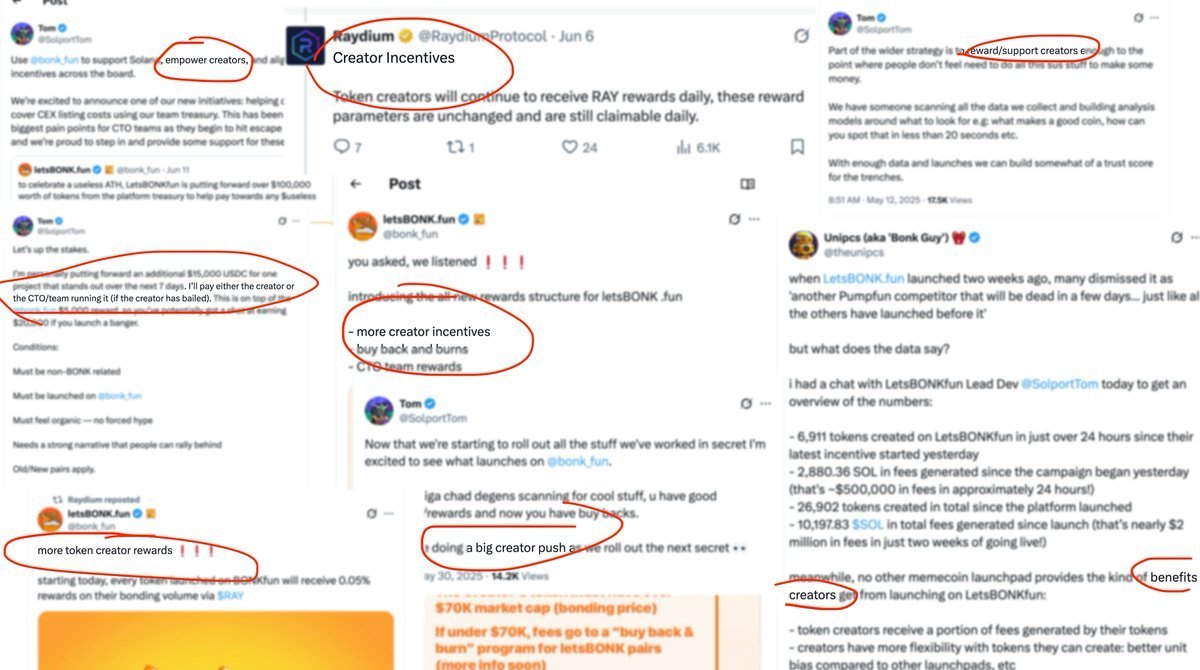

LaunchLab came out swinging with $2.8M in RAY rewards for traders. But somewhere early on they realised rewards for traders only went so far.

https://x.com/RaydiumProtocol/status/1922055224237424659

It all comes down to creators.

Pump has focused on this as well, e.g. through creator earnings. BonkFun took it further by focusing on building an entire ecosystem around creator success.

At the end of the day, token creators facilitate the markets traders play on. Most trench warriors stare at the same interface day in and day out playing whatever narrative is hot. Token creators create that narrative.

BonkFun took this to heart. In the two weeks following their initial hype, they launched an unprecedented amount of creator acquisition campaigns: cash rewards, fee sharing, CEX listing support, VC connections. I count over 10 different incentives, laser-focused on incentivising CREATORS.

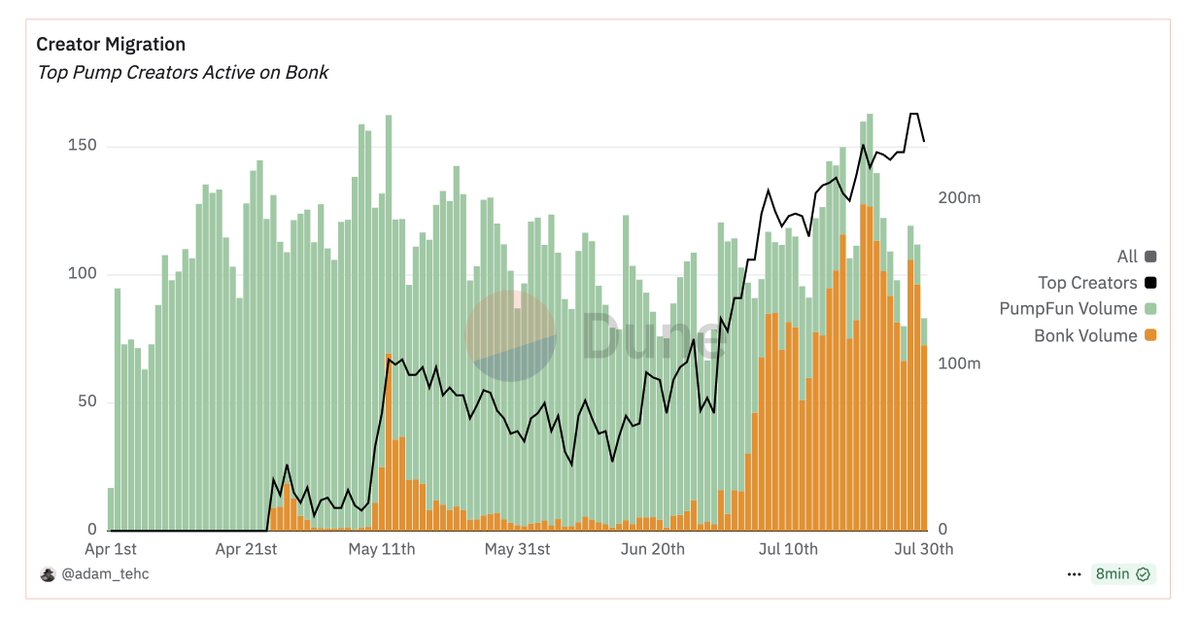

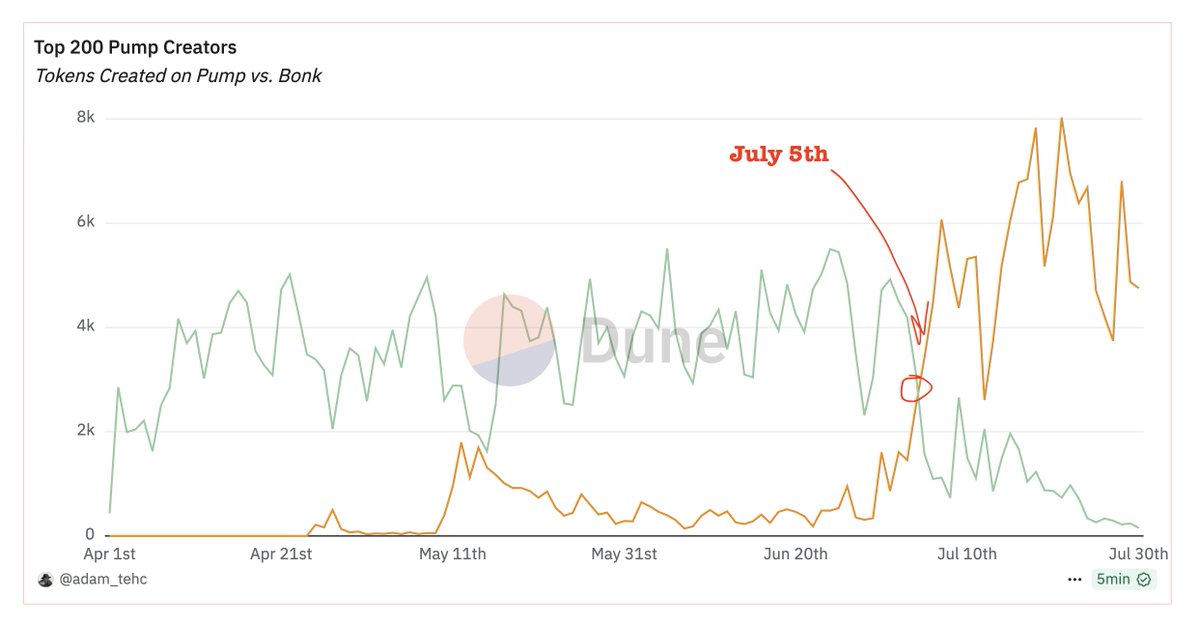

And it worked. Leading up to BonkFun flipping Pump in every single metric available, we see top PumpFun creators migrating to the Bonk Launchpad.

By July 5th the top 200 PumpFun creators were creating MORE TOKENS on the Bonk launchpad than on PumpFun itself.

Among many creator incentives, BonkFun's hackathon seems to have been the final push, incentivising real tech teams to launch tokens. The hackathon deadline created a spike in token launches that spilled over into days, then weeks of sustained activity.

But there's more to the story, BonkFun needed something else...

The runners

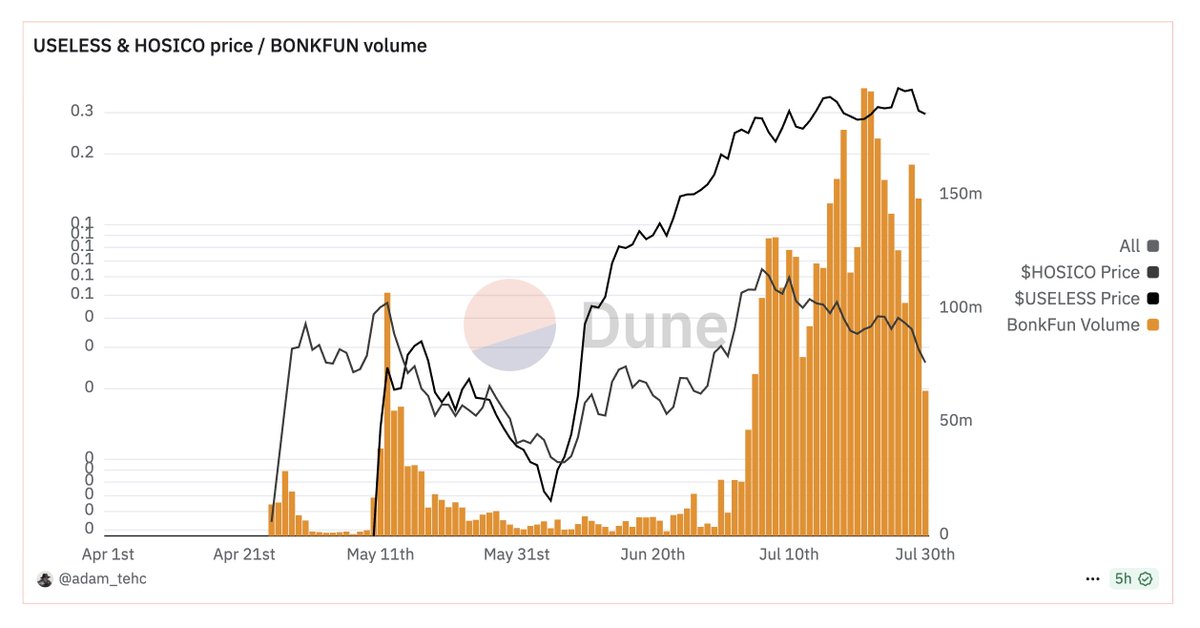

In the days leading up to July 6th, USELESS & HOSICO exploded to $250M & $50M market cap respectively, with USELESS becoming the first coin ending in '...bonk' to reach $100M+.

There's simply no better marketing than prices going up.

BonkFun & Tom went above and beyond for their runners. BonkFun even funded USELESS's Gateio listing.

And with the help of CT's greatest bag-worker & main character @theunipcs aka. The 'Bonk Guy' tokens had room to run.

https://x.com/bonk_fun/status/1943373393195127167

July 6th: The Flip

https://x.com/Adam_Tehc/status/1942838325309759508

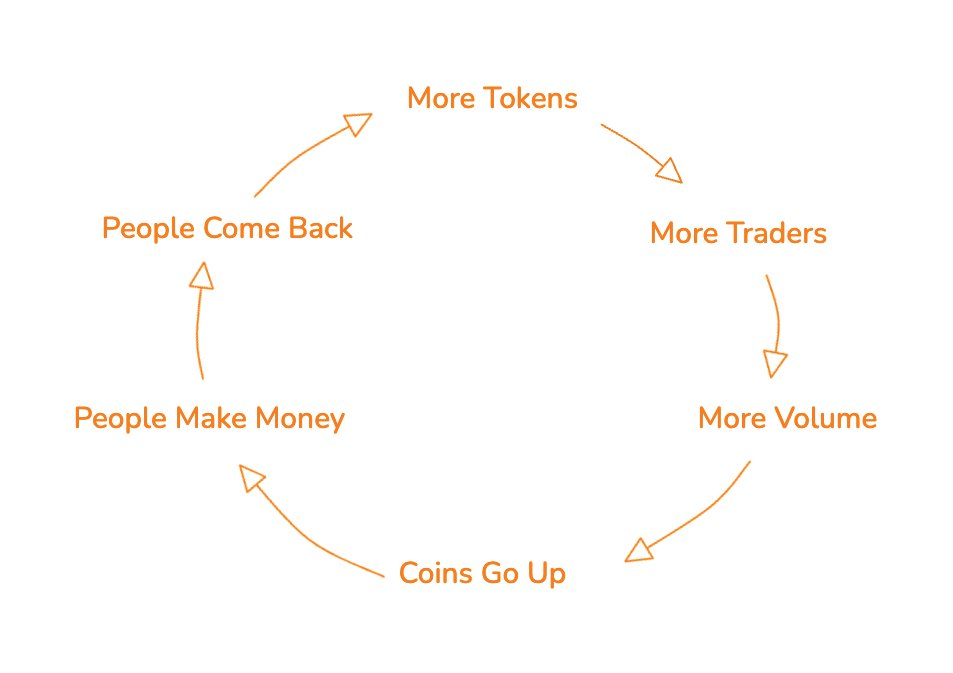

What followed was the craziest user/volume/mindshare migration I've ever seen. Once the flywheel started, it couldn't be stopped.

More tokens create more volume, which makes coins go up, which makes people money, which creates more believers, which makes people come back to create more tokens and so on...

The avalanche had begun.

But that's only half the story:

"F*ck PumpFun"

Something deeper was driving BonkFun's rise, a growing frustration with Pump itself.

https://x.com/PumpAirdrop/status/1940909117587313033

The trenches were primed for a competitor to rise, and Bonk capitalized on that opening.

BonkFun had something I believe Pump had lost: human connection.

The Human Factor

Tom (@SolportTom)

Even in a world of anon communities and monkey pictures, humans still resonate with humans. Tom mastered the sacred art of SHOWING UP: listening, buying memes, explaining what's happening in real time.

Scroll through Tom's feed for 30 minutes and you get the complete BonkFun origin story and thought process.

Unipcs - aka 'Bonk Guy.' (@theunipcs)

Every era needs its main character. We had Ansem in the early memecoin supercycle, Mitch during PumpFun's rise, Murad when memecoins were going to flip the stock market.

The Bonk era belongs to Unipcs - aka 'Bonk Guy.'

Relentless bag worker and humble to the bones. If you can convince Bonk Guy to buy your coin, you've got yourself a runner. And what better champion for BonkFun than the guy holding a $10M+ BONK long.

https://x.com/theunipcs/status/1764652259932078312

Wen Airdrop

Following Bonk's meteoric rise culminating with flipping Pump on July 6th, Pump seemed ready to fight back.

On July 9th, they announced a public sale and teased an airdrop to follow.

https://x.com/pumpdotfun/status/1942947267436056740

On July 12th (the day of the ICO) Pump had its best day since the flip, but didn't manage to flip the market back. Their losses have only increased in the weeks since.

Whether justified or not, everything about Pump has been criticized recently.

The ICO, the airdrop that never came, the PUMP token plummeting, their seeming lack of media strategy.

Over time the Bonk movement became as much about opposing Pump's extraction as building their own ecosystem.

BONK is the biggest memecoin community on Solana, and BonkFun provided even more reasons to rally:

The BONK Burn

As of Jun 10th, HALF of BonkFun's revenue goes toward buying and burning BONK tokens, nearly $1M worth daily at todays numbers.

Let's play with the hypothetical idea that BonkFun maintains $2M daily revenue & the BONK price stays the same that's 35B BONK burned per day, or roughly 1% of the BONK supply monthly.

That's a good strategy to incentivize community rally, and others seem to agree:

The Buyback War

It's worth noting that we're now in a buyback meta where protocols return accruing value to token holders through buying back their token.

BonkFun burns 50% of revenue buying back BONK tokens, $20M worth so far. They've also bought back $2.5M worth of GP (Tom's NFT collection token). Raydium has allocated a total of $190M to RAY buybacks.

https://x.com/0xINFRA/status/1945495609634390040

Nothing formal has been announced from Pump, but as of the time of writing they've pivoted from what seemed to be 25% revenue buyback to 100% for a few days.

https://x.com/Adam_Tehc/status/1950704210099777800

TL;DR

BonkFun overtaking one of the fastest growing crypto apps in history may seem like an overnight success, but a lot went into it. Growing frustration with Pump's broken promises and a community ready to rally against extraction left them an opening. Massive creator acquisition, a few proven runners, and daily BONK burns worth $1M finished the job.

Bottom line: give creators real incentives, support your winners, and share the upside with your community... and they'll move mountains for you.

— The Dashboard Guy

Source: The Memecoin War Dashboard

A sweeping narrative ties Jane Street to India’s expiry-day options case, alleged 10AM Bitcoin sell patterns, Terra’s collapse, and ETF plumbing. While none prove misconduct, critics argue a common structure: move spot, monetize derivatives, keep execution opaque.

Bull Theory/2 days ago

A controversial narrative links Jane Street, ETF mechanics, and Bitcoin’s price behavior, pointing to lawsuit allegations, 10AM volatility patterns, and derivative hedging dynamics. The discussion raises broader questions about liquidity, structure, and price discovery.

Justin Bechler/3 days ago

A new federal lawsuit alleges Jane Street exploited non-public information tied to Terraform’s liquidity defenses, accelerating UST’s depeg and the Terra collapse. The firm denies the claims. The case may reignite debates on structure, design, and regulation.

Diana/4 days ago

Mean reversion and on-chain models sit at levels historically linked to bottom formation after capitulation. Realized losses reached record USD values, while deviations from anchor models remain extreme. Price pain may be fading; patience remains key.

Checkmate/4 days ago

Bitcoin didn’t fail as an asset — it matured into an ETF-driven trade. As institutional ownership rose, correlation with tech risk intensified. Short-term pressure reflects holder structure shifts, not thesis collapse.

Eric Jackson/5 days ago

This weekly report frames Bitcoin within a six-stage bear market model. With BTC in Stage 4, price stagnation drives exhaustion and weak-hand selling while liquidity builds. The harshest mechanical drop may be over, but fear and capitulation likely remain ahead.

Doctor Profit/6 days ago

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

When Elon Musk tweeted about Moltbook, the meme coin MOLT experienced a short-term 30% price surge, hitting a new all-time high of $114 million.

2026.01.31 18:37:29

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

MoreHot Articles

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

10 promising AI Agent cryptos

2024.12.05

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link