BNB Chain and Binance Alpha Synergy Thrives: BSC Accounts for 40% of Alpha Trading Volume with Weekly Surge of 122.5%

Lookonchain

Lookonchain

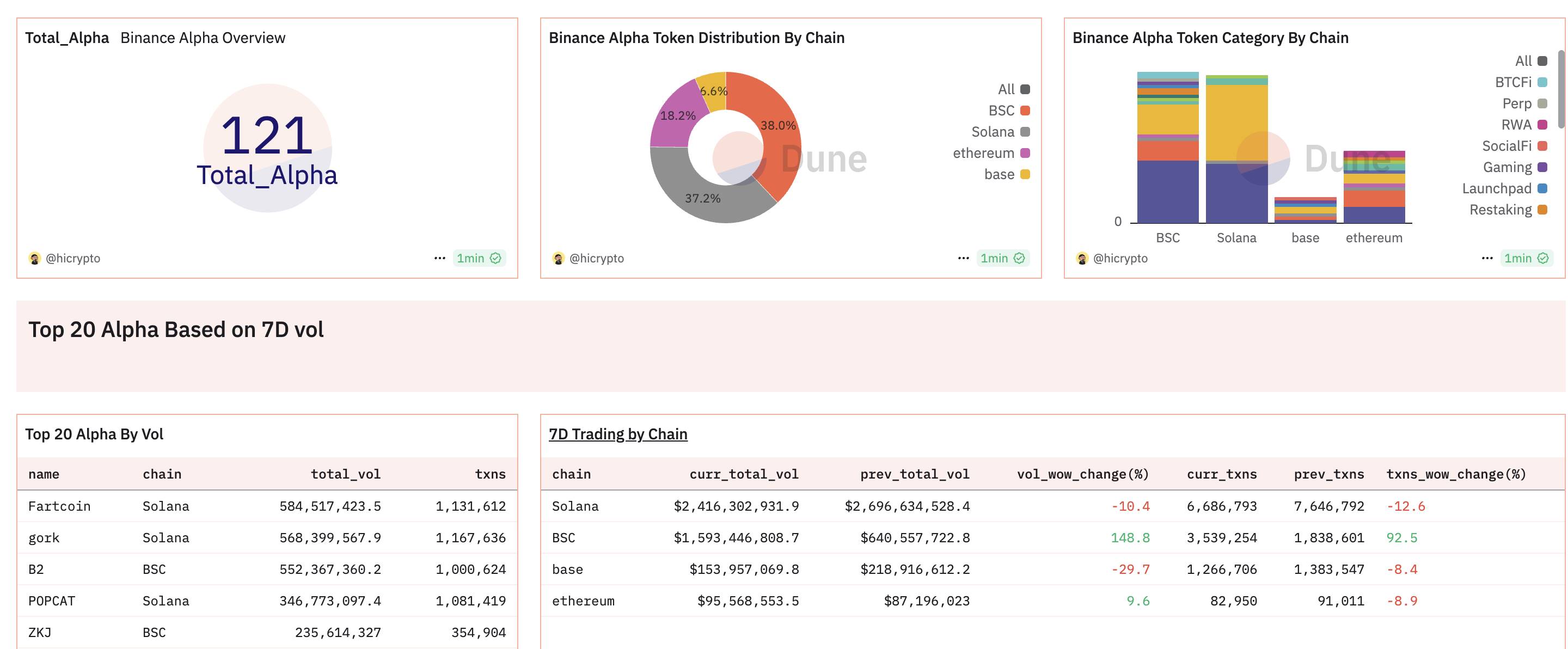

According to data from Dune and BscScan as of May 9, BNB Chain’s tokens in Binance Alpha has demonstrated remarkable growth:

Dominance in Alpha Projects: Over 70% of the 121 Alpha projects are BSC-based tokens, with 38% being BSC-native projects across trending sectors like AI, Meme, and DeFi.

Trading Volume Leadership: BSC tokens account for ~40% of total Alpha trading volume, with weekly trading volume surging 122.5% and weekly transaction value rising 78%, underscoring robust ecosystem momentum.

Key Highlights:

Top Alpha Tokens: Half of the top 20 Alpha tokens by 7-day trading volume are BSC-native.

User Growth Surge: Among the top 10 Alpha tokens by new active users, 90% are BSC-based, with 6 projects seeing over 20% new user adoption.

On-Chain Metrics: BSC added ~4.3 million new addresses last week, hitting 1 million+ daily new addresses for two consecutive days. Active addresses exceeded 2 million daily, while total unique addresses reached 552 million.

12 BSC projects have launched on Binance Spot via Alpha; Incentive Programs: The ongoing BSC Alpha Trading Competition offers rewards, with BSC token trading volumes double-counted toward Alpha Points for IDO eligibility. Binance also announced airdrops for holders of several BSC-native Meme tokens.

Powered by ultra-low gas fees (now 0.1 gwei), high throughput, and massive user base, BNB Chain has emerged as the go-to hub for project launches, user acquisition, and wealth creation. Its deep integration with Binance Wallet and the Alpha Program continues to drive cross-chain innovation and value capture.

A sweeping narrative ties Jane Street to India’s expiry-day options case, alleged 10AM Bitcoin sell patterns, Terra’s collapse, and ETF plumbing. While none prove misconduct, critics argue a common structure: move spot, monetize derivatives, keep execution opaque.

Bull Theory/2 days ago

A controversial narrative links Jane Street, ETF mechanics, and Bitcoin’s price behavior, pointing to lawsuit allegations, 10AM volatility patterns, and derivative hedging dynamics. The discussion raises broader questions about liquidity, structure, and price discovery.

Justin Bechler/3 days ago

A new federal lawsuit alleges Jane Street exploited non-public information tied to Terraform’s liquidity defenses, accelerating UST’s depeg and the Terra collapse. The firm denies the claims. The case may reignite debates on structure, design, and regulation.

Diana/4 days ago

Mean reversion and on-chain models sit at levels historically linked to bottom formation after capitulation. Realized losses reached record USD values, while deviations from anchor models remain extreme. Price pain may be fading; patience remains key.

Checkmate/4 days ago

Bitcoin didn’t fail as an asset — it matured into an ETF-driven trade. As institutional ownership rose, correlation with tech risk intensified. Short-term pressure reflects holder structure shifts, not thesis collapse.

Eric Jackson/5 days ago

This weekly report frames Bitcoin within a six-stage bear market model. With BTC in Stage 4, price stagnation drives exhaustion and weak-hand selling while liquidity builds. The harshest mechanical drop may be over, but fear and capitulation likely remain ahead.

Doctor Profit/6 days ago

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

When Elon Musk tweeted about Moltbook, the meme coin MOLT experienced a short-term 30% price surge, hitting a new all-time high of $114 million.

2026.01.31 18:37:29

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

MoreHot Articles

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

10 promising AI Agent cryptos

2024.12.05

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link