America’s Bitcoin Advantage: Morgan Stanley’s Strategic Signal

Swan

Swan

Something big just happened—and most missed it.

Morgan Stanley says Bitcoin is now large enough to qualify as a strategic reserve asset.

But the real story isn’t the report—it’s the game theory it reveals.

Is the U.S. uniquely incentivized to see Bitcoin win?

Let’s unpack 🧵

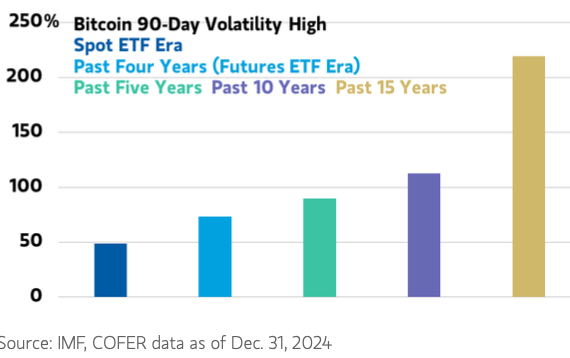

The report claims Bitcoin is still “too volatile” to adopt today.

But here’s the paradox: volatility is dropping—steadily, measurably.

And once it meets their threshold, the price won’t be $97K.

It’ll be much higher.

By then, the opportunity will be priced in.

Morgan Stanley modeled what a proportional reserve allocation to Bitcoin could look like:

• $370B in capital

• 12–17% of total supply

Those figures mirror existing currency reserve proportions.

If that shift happens, one thing’s clear: the repricing would be immediate.

Let's zoom out.

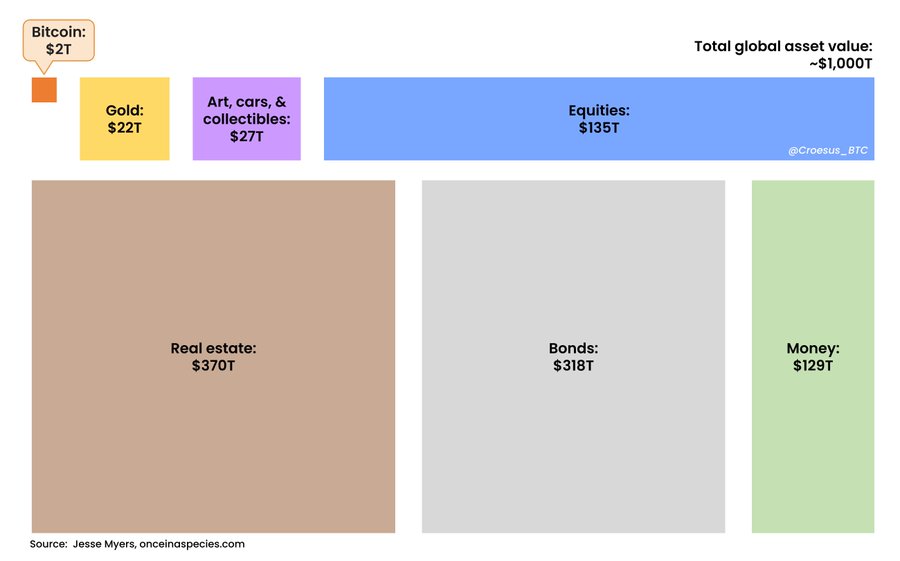

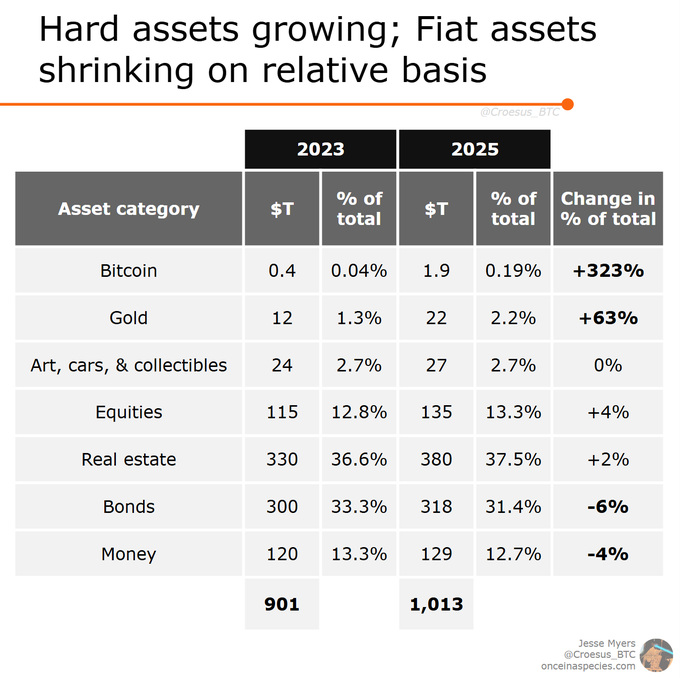

Global assets now exceed $1 quadrillion, growing by $200 trillion in 2 years.

But most of that “growth” is just fiat debasement.

Adjust for money supply expansion, and only two assets gained real ground:

• Gold

• Bitcoin

Bitcoin leads—up 323% in two years.

Here’s where it gets geopolitical.

Americans—via ETFs, public companies, and individual holders—own an estimated 35–40% of Bitcoin’s circulating supply.

Compared to ~8–10% of global gold. (clip: Matthew Pines)

That’s not just exposure.

That’s leverage.

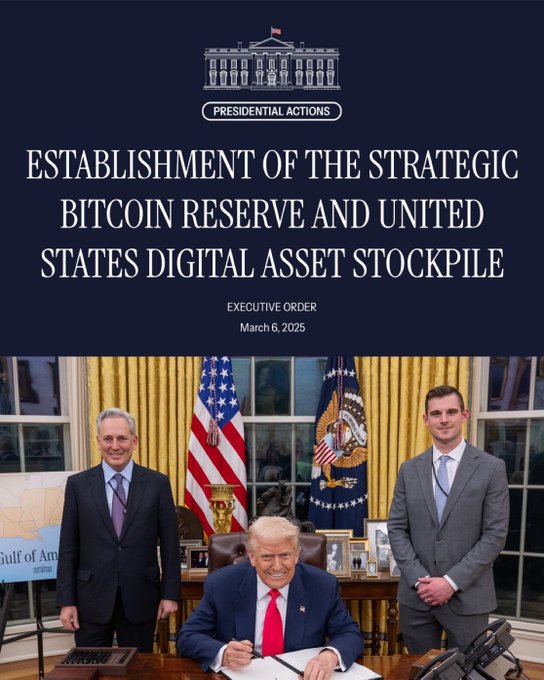

Remember: the U.S. has already created a Strategic Bitcoin Reserve.

The goal? Become the "Bitcoin superpower of the world" by acquiring "as much as possible"—without raising taxes—using tariffs, gold revaluation, and seigniorage.

This isn’t theory. It’s already in motion.

Gold was built for the empires of the past:

• Heavy

• Easy to seize

• Slow to settle

Bitcoin was made for the digital age:

• Portable

• Hard to confiscate

• Instantly verifiable

• Hard-capped by code

Legacy metal vs. protocol money.

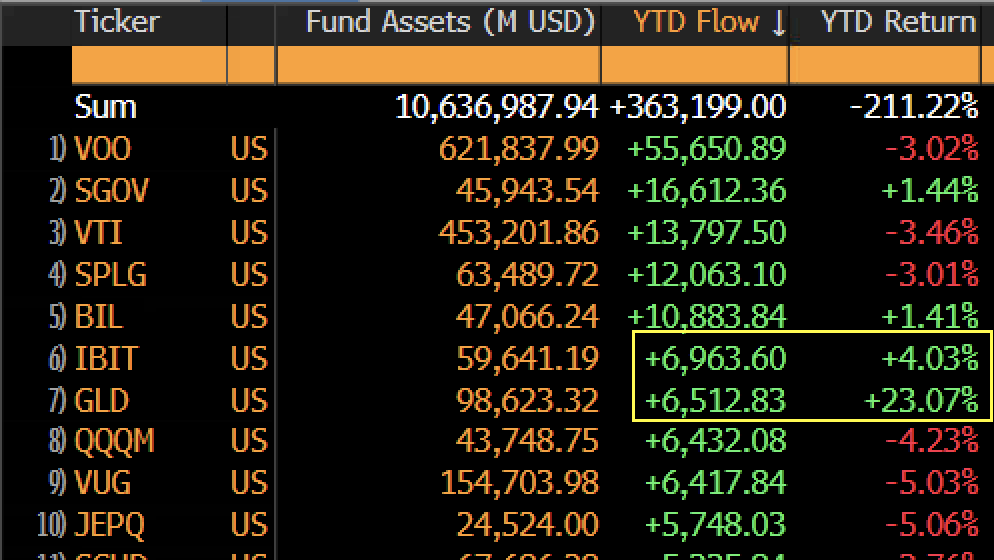

BlackRock’s IBIT just passed GLD in inflows—even while underperforming gold.

And gold is having a historic run.

Capital is rotating.

From legacy safe haven…

To the future of capital.

Bitcoin is decoupling.

From tech. From TradFi. From systemic fragility.

It’s emerging as the global outside money.

And the U.S.—uniquely positioned to benefit—is moving accordingly.

A new federal lawsuit alleges Jane Street exploited non-public information tied to Terraform’s liquidity defenses, accelerating UST’s depeg and the Terra collapse. The firm denies the claims. The case may reignite debates on structure, design, and regulation.

Diana/11 hours ago

Mean reversion and on-chain models sit at levels historically linked to bottom formation after capitulation. Realized losses reached record USD values, while deviations from anchor models remain extreme. Price pain may be fading; patience remains key.

Checkmate/12 hours ago

Bitcoin didn’t fail as an asset — it matured into an ETF-driven trade. As institutional ownership rose, correlation with tech risk intensified. Short-term pressure reflects holder structure shifts, not thesis collapse.

Eric Jackson/1 days ago

This weekly report frames Bitcoin within a six-stage bear market model. With BTC in Stage 4, price stagnation drives exhaustion and weak-hand selling while liquidity builds. The harshest mechanical drop may be over, but fear and capitulation likely remain ahead.

Doctor Profit/3 days ago

Nearly 10% of Bitcoin is now held by Strategy and spot ETFs. With average ETF cost bases above price, $7B+ in unrealized losses and record outflows show normie capital under pressure—leaving BTC dependent on a fresh narrative to reaccelerate.

Jim Bianco/2026.02.03

Bitcoin’s weak year isn’t OG selling or a “silent IPO.” It’s crypto contagion. Illiquid altcoins forced insiders to sell BTC to prop up air-token markets, while disciplined capital (ETFs, MSTR, Wall St) drained volatility and killed alt-season rotations.

Bit Paine/2026.01.28

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

When Elon Musk tweeted about Moltbook, the meme coin MOLT experienced a short-term 30% price surge, hitting a new all-time high of $114 million.

2026.01.31 18:37:29

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

MoreHot Articles

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

10 promising AI Agent cryptos

2024.12.05

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link