Stables Are Not Stable: How the Stream Finance Collapse Exposed DeFi’s Structural Illusion of Safety

YQ

YQ

Stables are not Stable

The first two weeks of November 2025 exposed fundamental flaws in decentralized finance that academics have warned about for years. The collapse of Stream Finance's xUSD, followed by cascading failures of Elixir's deUSD and numerous other synthetic stablecoins, represents more than isolated incidents of poor management. These events reveal structural problems in how the DeFi ecosystem approaches risk, transparency, and trust.

What I observed in the Stream Finance collapse was not a sophisticated exploit of smart contract vulnerabilities or an oracle manipulation attack in the traditional sense. Rather, it was something far more troubling: a failure of basic financial transparency wrapped in the language of decentralization. When an external fund manager loses $93 million with zero meaningful oversight and triggers $285 million in cross-protocol contagion, when the entire "stablecoin" ecosystem loses 40-50% of TVL in a week despite maintaining pegs, we must acknowledge a fundamental truth about the current state of decentralized finance. The industry has learned nothing.

More precisely, the incentive structures reward those who ignore the lessons, punish those who act conservatively, and socialize the losses when the inevitable failures occur. There is an old saying in finance that applies here with painful accuracy: if you don't know where yield comes from, you are the yield. When protocols promise 18% returns through undisclosed strategies while established lending markets offer 3-5%, the source of that yield is the depositors' principal.

Stream Finance mechanics and contagion

Stream Finance positioned itself as a yield optimization protocol, offering users an 18% annual return on USDC deposits through its yield-bearing stablecoin, xUSD. The stated strategy involved "delta-neutral trading" and "hedged market making," terminology that sounds sophisticated but provides little insight into actual operations. For comparison, established protocols like Aave offered 4.8% APY on USDC deposits at the time, while Compound offered just over 3%. When basic financial literacy would dictate skepticism about returns triple the market rate, users instead deposited hundreds of millions. Before the collapse, 1 xUSD traded at 1.23 USDC, reflecting purported compounded returns. At its peak, xUSD claimed $382 million in assets under management, though DeFiLlama data showed peak TVL of only $200 million, suggesting more than 60% of claimed assets existed in unverifiable off-chain positions.

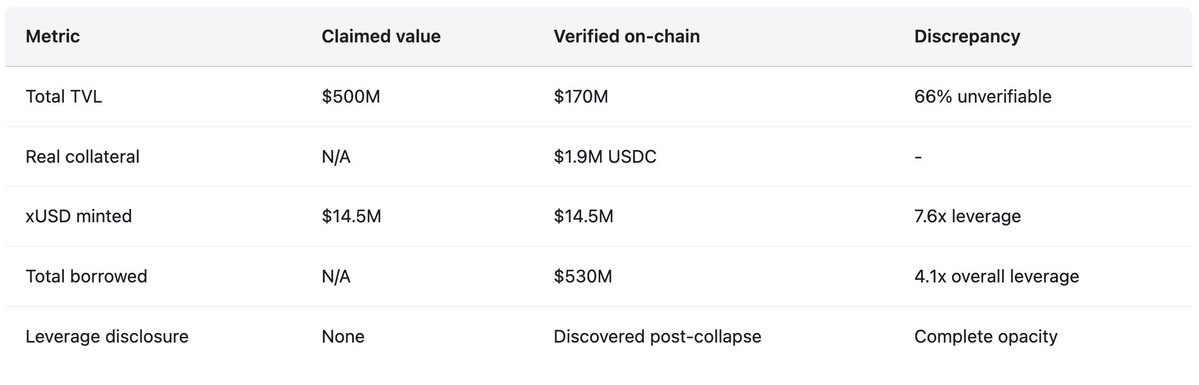

The actual mechanism, uncovered by Yearn Finance developer Schlagonia after the collapse, revealed systematic fraud disguised as financial engineering. Stream implemented recursive lending that created unbacked synthetic assets through the following process. Users deposited USDC, which Stream swapped to USDT via CowSwap. The USDT was used to mint deUSD from Elixir, chosen specifically for its high yield incentives. This deUSD was bridged to chains like Avalanche and deposited into lending markets to borrow USDC, completing one loop. Up to this point, the strategy resembled standard collateralized lending, albeit with concerning complexity and cross-chain dependencies. But Stream did not stop there. Instead of using borrowed USDC solely for additional collateral loops, Stream re-minted xUSD through its StreamVault contract, inflating the xUSD supply far beyond any actual collateral backing. With only $1.9 million in verifiable USDC collateral, Stream minted $14.5 million xUSD, a 7.6x expansion of synthetic assets relative to underlying reserves. This is fractional reserve banking without reserves, regulatory oversight, or lender of last resort.

The circular dependency with Elixir made the structure even more unstable. During the looping process that inflated xUSD supply, Stream deposited $10 million USDT into Elixir, expanding deUSD supply. Elixir swapped that USDT for USDC and deposited it into Morpho's lending markets. By early November, over $70 million USDC was supplied and more than $65 million borrowed on Morpho, with Elixir and Stream as the two dominant actors. Stream held roughly 90% of deUSD's total supply (approximately $75 million), while Elixir's backing consisted primarily of a Morpho loan to Stream. The stablecoins were mutually collateralized, guaranteeing both would collapse together. This is financial incest producing systemic fragility.

Industry analyst CBB flagged these problems publicly on October 28, writing: "xUSD has ~$170M backing it on-chain. They're borrowing ~$530M from lending protocols. That's 4.1x leverage. On many illiquid positions. This isn't yield farming. This is degen gambling." Schlagonia had warned the Stream team 172 days before the collapse, stating that five minutes examining their positions revealed inevitable failure. These warnings were public, specific, and accurate. They were ignored by users chasing yield, by curators seeking fee revenue, and by protocols enabling the entire structure. When Stream announced on November 4 that an external fund manager had lost approximately $93 million in fund assets, the platform immediately suspended all withdrawals. With no redemption mechanism available, panic spread immediately. Holders rushed to sell xUSD on secondary markets where liquidity was thin. Within hours, xUSD crashed 77% to approximately $0.23. The stablecoin that promised stability and high yields had evaporated three-quarters of its value in a single trading session.

Contagion by the numbers

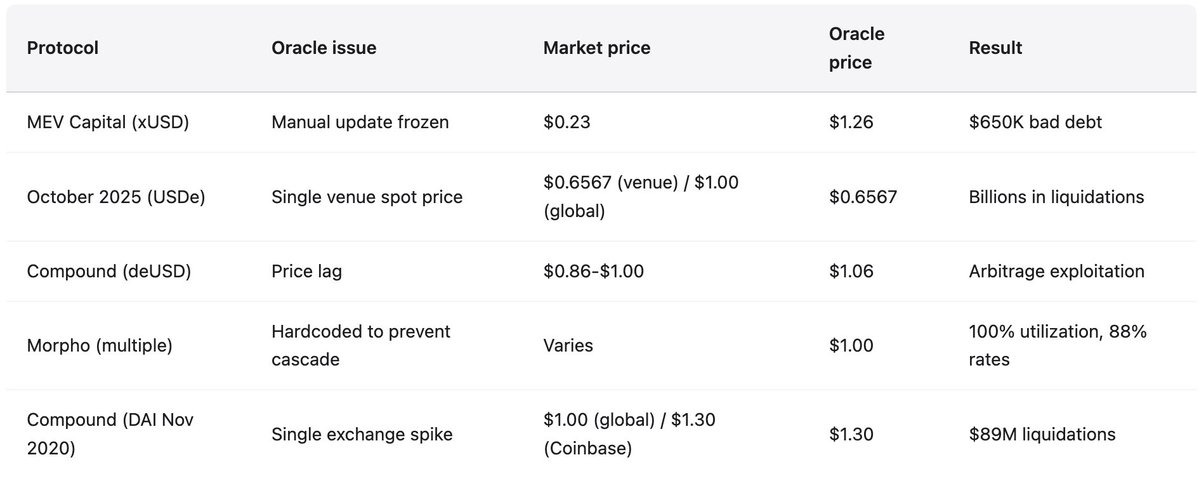

According to DeFi research group Yields and More (YAM), direct debt exposure related to Stream reached $285 million across the ecosystem. The exposures included: TelosC with $123.64 million in loans secured by Stream assets (the single largest curator exposure), Elixir Network with $68 million lent via private Morpho vaults (representing 65% of deUSD backing), MEV Capital with $25.42 million including approximately $650,000 in bad debt when oracles froze xUSD price at $1.26 while real market prices collapsed to $0.23, Varlamore with $19.17 million, Re7 Labs with $14.65 million in one vault and $12.75 million in another, Enclabs, Mithras, TiD, and Invariant Group with smaller positions. Euler faced approximately $137 million in bad debt. Over $160 million was frozen across various protocols. The researchers noted this list was incomplete, warning that "there likely are more stables/vaults affected" as the full extent of interconnected exposures remained unclear weeks after the initial collapse.

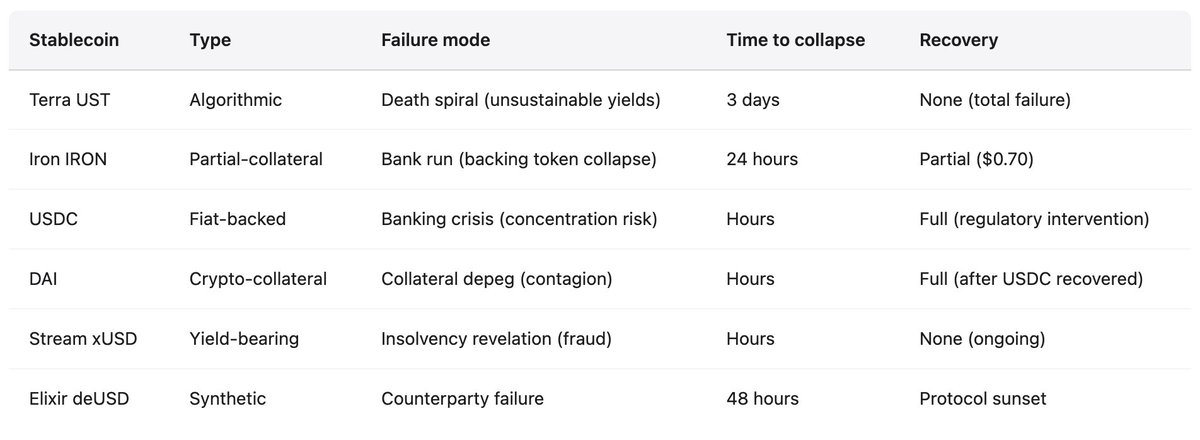

Elixir's deUSD, having concentrated 65% of its reserves in loans to Stream via private Morpho vaults, collapsed 98% from $1.00 to $0.015 within 48 hours, marking the fastest major stablecoin collapse since Terra's UST in 2022. Elixir processed redemptions for roughly 80% of deUSD holders not including Stream, protecting most of its community by allowing redemption at $1.00 for USDC, but this protection came at enormous cost socialized across Euler, Morpho, and Compound. Elixir then announced it would sunset all stablecoin products entirely, acknowledging that trust had been irreparably destroyed. The broader market reaction demonstrated systemic loss of confidence. According to Stablewatch data, yield-bearing stablecoins lost 40-50% of their TVL in the week following Stream's collapse, despite most maintaining their dollar pegs. This represents approximately $1 billion in outflows from protocols that had not failed and showed no technical problems. Users could not distinguish between sound projects and fraudulent ones, so they fled everything. DeFi's total TVL fell by $20 billion in early November. The market was pricing in general contagion risk rather than responding to specific protocol failures.

October 2025: when $60 million triggered cascading liquidations

Less than a month before the Stream Finance collapse, the cryptocurrency market experienced what on-chain forensic analysis reveals was not a market crash but a precision attack exploiting known vulnerabilities at institutional scale. On October 10-11, 2025, a carefully timed $60 million market dump triggered oracle failures that cascaded into massive liquidations across the DeFi ecosystem. This was not overleveraging on legitimately impaired positions. This was oracle design failure at institutional scale, repeating attack patterns documented and published since February 2020.

The attack began at 5:43 AM UTC on October 10 when $60 million of USDe was dumped into spot markets on a single exchange. In a properly designed oracle system, this would have minimal impact, absorbed by multiple independent price sources with time-weighting to prevent manipulation. Instead, the oracle system marked down collateral values (wBETH, BNSOL, and USDe) in real-time based on spot prices from the manipulated venue. Mass liquidations triggered immediately. Infrastructure overloaded as millions of simultaneous liquidation requests overwhelmed system capacity. Market makers could not place bids fast enough because API feeds were down and withdrawals were stuck in queues. Liquidity vanished. The cascade became self-reinforcing.

Attack methodology and precedent

The oracle faithfully reported manipulated prices that existed on one venue while prices remained stable across all other markets. Primary exchange prices showed USDe at $0.6567 and wBETH at $430. Other venues showed less than 30 basis point deviations from normal prices. On-chain pools were minimally affected. As Ethena's founder Guy Young noted, "$9 billion+ of on-demand stablecoin collateral was available for immediate redemption" throughout the event, proving the underlying assets were not impaired. Yet the oracle reported the manipulated prices, the system liquidated based on those prices, and positions were destroyed based on valuations that existed nowhere else in the market.

This is the exact pattern that destroyed Compound in November 2020 when DAI spiked to $1.30 on Coinbase Pro for one hour while trading at $1.00 everywhere else, causing $89 million in liquidations. The venue changed but the vulnerability did not. The attack methodology was identical to what destroyed bZx in February 2020 ($980,000 stolen via Uniswap oracle manipulation), Harvest Finance in October 2020 ($24 million stolen plus $570 million bank run via Curve manipulation), and Mango Markets in October 2022 ($117 million extracted via multi-venue manipulation). From 2020-2022, 41 oracle manipulation attacks stole $403.2 million. The industry response was slow and fragmented. Most platforms continued using spot-heavy oracles with insufficient redundancy. The amplification factor demonstrates why these lessons matter more as markets scale. Mango Markets in 2022 saw $5 million manipulation extract $117 million, a 23x amplification. October 2025 saw $60 million manipulation trigger a cascade with massive amplification. The attack pattern did not become more sophisticated. The underlying system scaled up while keeping the same fundamental vulnerabilities.

Historical pattern: failures from 2020-2025

The collapse of Stream Finance is neither novel nor unprecedented. The DeFi ecosystem has experienced repeated stablecoin failures, each exposing similar structural vulnerabilities. Yet the industry continues to repeat the same mistakes at increasing scale. The pattern is consistent across five years of documented failures. Algorithmic or partially-collateralized stablecoins offer unsustainable yields to attract deposits. The yields are subsidized by token emissions or new deposits rather than actual revenue. The protocol operates with excessive leverage, opacity about true collateral ratios, and circular dependencies where Protocol A backs Protocol B which backs Protocol A. When any shock reveals the underlying insolvency or when subsidies become unsustainable, a bank run begins. Users race to exit, collateral values collapse, liquidations cascade, and the entire structure implodes within days or hours. Contagion spreads to protocols that accepted the failed stablecoin as collateral or held positions in the ecosystem.

May 2022: Terra (UST/LUNA)

Loss: $45 billion market capitalization wiped out over three days. UST was an algorithmic stablecoin backed by LUNA through a mint-burn mechanism. The Anchor Protocol offered unsustainable 19.5% yield on UST deposits, with approximately 75% of all UST deposited there to earn rewards. The system relied on continuous capital inflows to maintain the peg. Trigger: $375 million withdrawal from Anchor on May 7, followed by large UST sales that depegged the token. As users exchanged UST for LUNA to exit, LUNA supply exploded from 346 million tokens to over 6.5 trillion tokens in three days, causing a death spiral where both tokens collapsed to near zero. The crash wiped out individual investors and contributed to the collapse of multiple major crypto lending platforms including Celsius, Three Arrows Capital, and Voyager Digital. Do Kwon, Terra's founder, was arrested in March 2023 and faces multiple fraud charges.

June 2021: Iron Finance (IRON/TITAN)

Loss: $2 billion TVL collapsed to near zero in 24 hours. IRON was partially collateralized with 75% USDC and 25% TITAN. Unsustainable yield farming incentives offered up to 1700% APR to attract deposits. When large holders began redeeming IRON for USDC, selling pressure on TITAN became self-reinforcing. TITAN price collapsed from $64 to $0.00000006, destroying the collateral backing IRON. Lesson: Partial collateralization is insufficient during stress. Arbitrage mechanisms fail under extreme pressure when the backing token itself is subject to death spiral dynamics.

March 2023: USDC

Depeg: Fell to $0.87 (13% loss) when $3.3 billion reserves were stuck in failing Silicon Valley Bank. This was supposed to be impossible for a "fully backed" fiat stablecoin with regular attestations. The peg was restored only when FDIC invoked systemic risk exception, guaranteeing SVB deposits. Contagion: Triggered depeg of DAI, which had over 50% collateral as USDC, causing 3,400+ automatic liquidations on Aave totaling $24 million. Demonstrated that even well-intentioned, regulated stablecoins face concentration risk and dependency on traditional banking system stability.

November 2025: Stream Finance (xUSD)

Loss: $93 million direct loss, $285 million total exposure across ecosystem. Mechanism: Recursive lending creating unbacked synthetic assets (7.6x expansion of real collateral). 70% of funds in opaque off-chain strategies managed by anonymous external managers. No proof of reserves. Current Status: xUSD trading at $0.07-0.14 (87-93% below peg) with virtually no liquidity. Withdrawals frozen indefinitely. Multiple lawsuits filed. Elixir sunsetted entirely. Industry-wide flight from yield-bearing stablecoins.

Common failure patterns emerge across all cases. Unsustainable yields: Terra (19.5%), Iron (1700% APR), Stream (18%) all offered returns disconnected from actual revenue generation. Circular dependencies: UST-LUNA, IRON-TITAN, xUSD-deUSD all had mutually reinforcing failure modes where the collapse of one guaranteed the collapse of the other. Opacity: Terra concealed Anchor subsidy costs, Stream hid 70% of operations off-chain, Tether has faced repeated questions about reserve composition. Partial collateralization or self-issued backing: Relying on volatile or self-issued tokens creates death spirals under stress because the collateral value falls precisely when it needs to provide support. Oracle manipulation: Frozen or manipulated price feeds prevent proper liquidations, converting price discovery into trust discovery and accumulating bad debt until the system is insolvent. The message is clear: stables are not stable. They are stable until they are not, and the transition happens in hours.

Oracle failures and infrastructure collapse

When the Stream collapse began, the oracle problem became immediately apparent. As xUSD's actual market price fell to $0.23, many lending protocols had hardcoded the oracle price at $1.00 or higher to prevent cascading liquidations. This decision, while intended to provide stability, created a fundamental disconnect between market reality and protocol behavior. The hardcoding was deliberate policy, not technical failure.

Many protocols use manual oracle updates to avoid triggering liquidations during temporary volatility. But this approach fails catastrophically when price declines reflect actual insolvency rather than momentary market stress.

Protocols face an impossible choice. Use real-time prices: risk manipulation and cascading liquidations during volatility, as October 2025 demonstrated at massive cost. Use delayed prices or Time-Weighted Average Price (TWAP): cannot respond to genuine insolvency, accumulate bad debt, as Stream Finance demonstrated when oracles showed $1.26 while real price was $0.23, resulting in $650,000 bad debt for MEV Capital alone. Use manual updates: introduce centralization, discretionary intervention, and the ability to hide insolvency by simply freezing the oracle. All three approaches have destroyed hundreds of millions or billions.

Infrastructure capacity during stress

After Harvest Finance's October 2020 infrastructure collapse where TVL dropped from $1 billion to $599 million as users fled following a $24 million attack, the lesson was obvious. Oracle systems must account for infrastructure capacity during stress events. Liquidation mechanisms must have rate limits and circuit breakers. Exchanges must maintain excess capacity for 10x normal load. Yet October 2025 proved this lesson remained unlearned at institutional scale. When millions of accounts face simultaneous liquidation, when billions in positions are closed in under one hour, when order books go blank because all bids are consumed and no new bids can be placed due to system overload, the infrastructure has failed as completely as the oracle. The technical solutions exist but remain unimplemented because they reduce normal-case efficiency and cost money that could be earned as profit instead.

If you cannot identify where yield comes from, you are not earning yield. You are the cost of someone else's yield. This principle is not complex. Yet billions are deposited into black-box strategies because people prefer comfortable lies to uncomfortable truths. The next Stream Finance is operating right now.

Stables are not stable. Decentralized finance is neither decentralized nor safe. Yield without identifiable source is not profit; it is theft with a countdown timer. These are not opinions; they are documented empirical facts proven at enormous cost. The only question is whe

A sweeping narrative ties Jane Street to India’s expiry-day options case, alleged 10AM Bitcoin sell patterns, Terra’s collapse, and ETF plumbing. While none prove misconduct, critics argue a common structure: move spot, monetize derivatives, keep execution opaque.

Bull Theory/4 days ago

A controversial narrative links Jane Street, ETF mechanics, and Bitcoin’s price behavior, pointing to lawsuit allegations, 10AM volatility patterns, and derivative hedging dynamics. The discussion raises broader questions about liquidity, structure, and price discovery.

Justin Bechler/5 days ago

A new federal lawsuit alleges Jane Street exploited non-public information tied to Terraform’s liquidity defenses, accelerating UST’s depeg and the Terra collapse. The firm denies the claims. The case may reignite debates on structure, design, and regulation.

Diana/6 days ago

Mean reversion and on-chain models sit at levels historically linked to bottom formation after capitulation. Realized losses reached record USD values, while deviations from anchor models remain extreme. Price pain may be fading; patience remains key.

Checkmate/6 days ago

Bitcoin didn’t fail as an asset — it matured into an ETF-driven trade. As institutional ownership rose, correlation with tech risk intensified. Short-term pressure reflects holder structure shifts, not thesis collapse.

Eric Jackson/7 days ago

This weekly report frames Bitcoin within a six-stage bear market model. With BTC in Stage 4, price stagnation drives exhaustion and weak-hand selling while liquidity builds. The harshest mechanical drop may be over, but fear and capitulation likely remain ahead.

Doctor Profit/2026.02.23

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

When Elon Musk tweeted about Moltbook, the meme coin MOLT experienced a short-term 30% price surge, hitting a new all-time high of $114 million.

2026.01.31 18:37:29

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

MoreHot Articles

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

10 promising AI Agent cryptos

2024.12.05

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link