Bitcoin Is the Real Safe Haven as the Dollar System Cracks

Justin Bechler

Justin Bechler

Bitcoin was made for exactly what we’re seeing right now.

Gold is ripping, Treasuries are buckling, and central banks are slipping out the back door of the dollar system. The safe haven is failing.

What happens next? 🧵👇

Gold just broke $3,300. That’s a 39% rise in a year.

U.S. Treasuries are starting to behave more like junk debt than a safe haven, and central banks aren’t waiting around to see how it ends. They’re unloading bonds and shifting into gold.

This is a fracture in the system. The dollar was weaponized through sanctions, reserve freezes and SWIFT blacklisting and the message to the rest of the world was loud and clear. Now 30 countries are repatriating gold and 45 are trading outside USD.

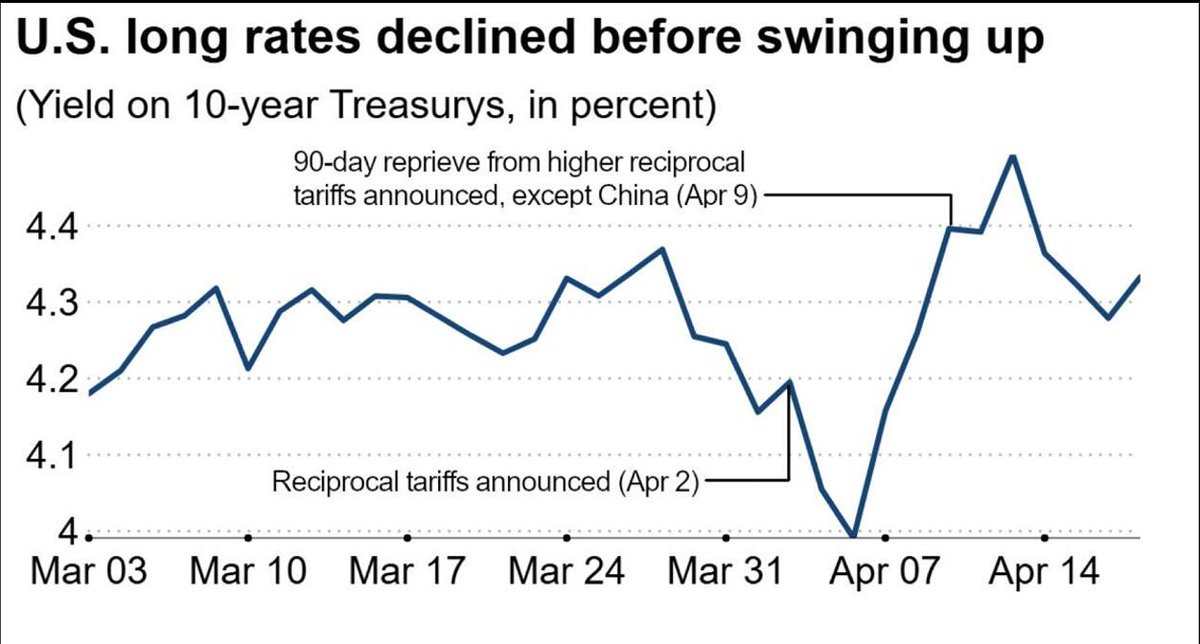

When the US announced tariffs on April 2, yields dropped like you’d expect during stress. Then the carve-out for China was added and suddenly yields spiked. If Treasuries were a safe haven, that wouldn’t happen. That’s a credibility crisis.

BRICS don’t trust each other’s fiat and they definitely don’t trust the dollar, so they’re settling in gold for now. But that’s not a long-term solution. Gold clears slowly, custody is a nightmare and settlement isn’t scalable. China and Russia are already using Bitcoin.

Central banks are still clinging to the idea that they can exit the dollar without leaving the legacy system, which is why they’re buying gold instead of Bitcoin. But gold still needs everything Bitcoin doesn't: clearing, physical storage and intermediaries.

No audit for Fort Knox in over 60 years while Bitcoin is fully auditable in real time.

China might be hiding more gold than the US owns, but if a monetary system relies on who holds the most gold, then it’s just another version of the old game. Bitcoin doesn’t care.

Gold helps governments step away from the dollar but it doesn’t solve the problem, it just delays it.

Bitcoin completely removes trust, politics and permission from the equation and that’s why it's the replacement.

If you understand why gold is rising and why the dollar is breaking, then you’re already halfway to understanding Bitcoin. Study it. Own it.

The system is losing legitimacy and there won’t be a second chance to front-run what’s coming.

Vitalik Buterin, the creator of Ethereum, turned his passion for programming into a $1.3B fortune. Despite his odd persona and recent public skepticism, he remains deeply committed to $ETH and plans a major upgrade to the Ethereum Virtual Machine. His beliefs in crypto, regulation, and AI show his vision for the future of Web3.

Tracer/6 hours ago

Crypto Twitter is buzzing: Trump eyes Bitcoin, Solana leads in staking, ETH gas fees hit record lows, and institutions ramp up BTC buys. From token burns to ETF filings and global adoption, the past week has been packed with major developments.

Sjuul | AltCryptoGems/6 hours ago

From rejecting 50,000 BTC for a house in 2015 to Germany selling billions in Bitcoin early, the crypto world is full of brutal mistakes. Devs accidentally burned $10M in tokens, Otherside mint wasted $200M in gas, and early Punk holders sold too soon. Even pros like Murad and Alex Becker had costly fumbles.

StarPlatinum/1 days ago

Christian Langalis, once dismissed as a “Bitcoin kid,” rose to fame after holding a “Buy Bitcoin” sign behind Fed Chair Janet Yellen in 2017. A committed libertarian and early BTC believer, he held 99% of his net worth in Bitcoin and helped promote it in Washington. He now runs a stealth Lightning startup and continues to push Bitcoin forward.

The Bitcoin Historian/1 days ago

Bitcoin is trading in a tight range between key EMAs. The 1D50EMA acts as resistance, while the mid-range holds as short-term support. Increased upside liquidations hint at a bullish breakout toward $92K. A clean break and retest above the 1D50EMA could offer a strong long entry.

CrypNuevo/1 days ago

Over 24 hours, the author manually bought every coin launched on Raydiums LaunchLab, investing $10 in each and selling after 1 hour. Despite finger cramps and meme overload, the final PnL was surprisingly positive—even in a weak market. The experiment shows that chaos, caffeine, and commitment can sometimes pay off in crypto.

Pix/3 days ago

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A whale exchanged WIF and Bonk positions for Fartcoin!

2024.12.25 11:01:14

MoreHot Articles

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 promising AI Agent cryptos

2024.12.05

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link