Why Altcoins Pump (or Dump) on Just $500K: It’s Not Market Cap, It’s Liquidity

cyclop

cyclop

Most think altszn needs billions. Nah

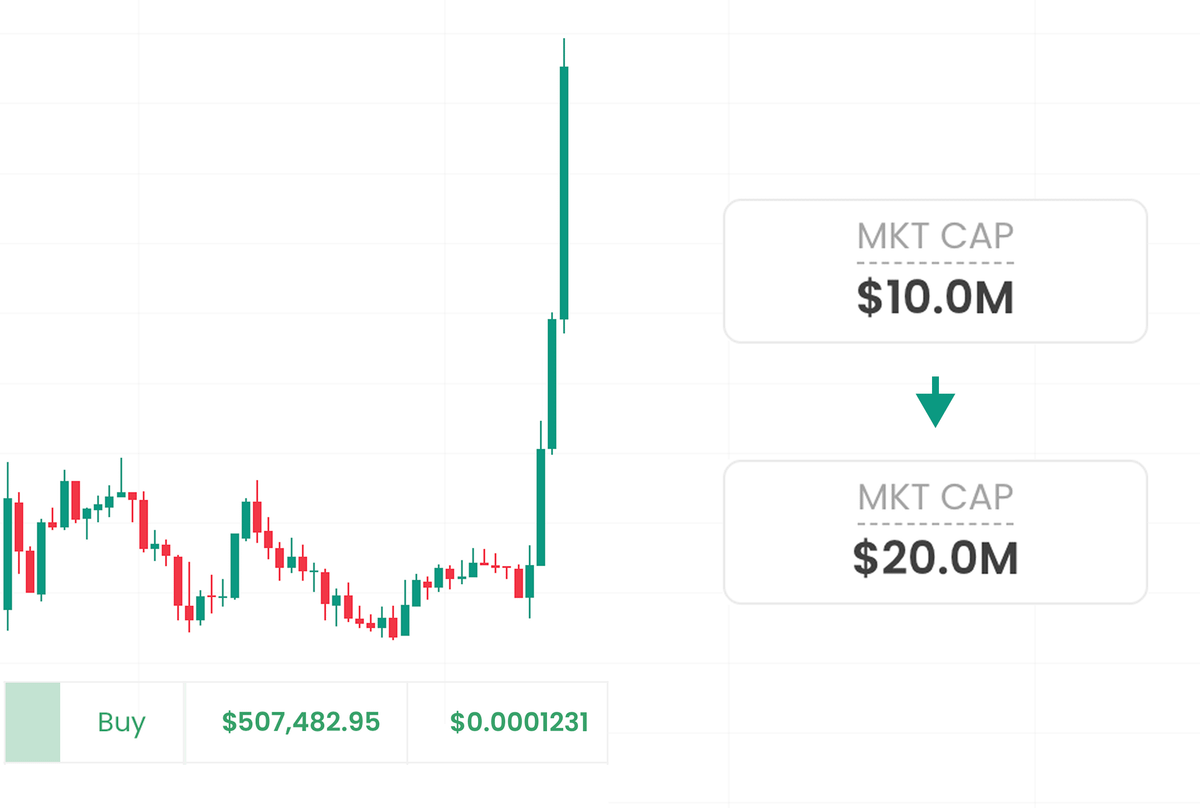

Imagine: $10M mc, price: $10

Think it takes $10M to hit $20?

Nope. Just $500k

To crash to $5? $200k

It’s not volume, it’s liquidity, and it changes everything

No one explains this. I'll

This 🧵 flip how u see alts 👇

➮ Doesn’t matter how long someone’s been in crypto – most still don’t get one thing:

✧ How liquidity really works

✧ And how much money it actually takes to pump or nuke a coin

If you are one of them?

It’ll cost you big (maybe it already has)

Let’s break it down 👇

2/➮ To understand how the growth of a particular coin, asset, or even stocks works, you need to look at the following:

- Market cap

- FDV

- Liquidity

- Vesting schedule

Now let's break each one down:

(1st part is more for beginners, for liquidity breakdown skip to tweet 6/)

3/➮ The easiest: Market Cap

✧ Market cap is the total value of a cryptocurrency's circulating coins/tokens, reflecting the market's perception of an asset's worth

✧ With Simple Words:

Market Cap = Current Token Price × Circulating Supply

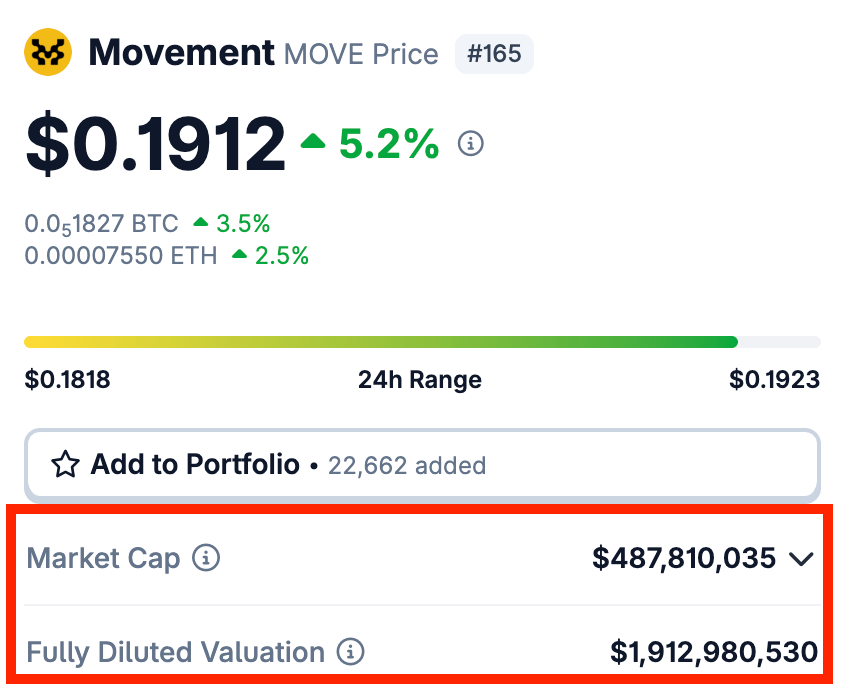

Many confuse market cap with FDV:

MC = circ. supply × price

FDV = total supply × price

This mistake gets newbies dumped on every unlock by VCs & early investors.

A 🧵 on how to avoid becoming exit liquidity in high FDV, low cap coins👇

https://x.com/nobrainflip/status/1731031522113900567

4/➮ What is price?

✧ It’s just what people pay right now - based on supply and demand

✧ But price alone means nothing

If a token has 1 trillion coins, even $0.000001 = $1M market cap.

To hit $1, it would need $1 * 1T = $1T market cap. That’s huge.

Forget about, look at mc

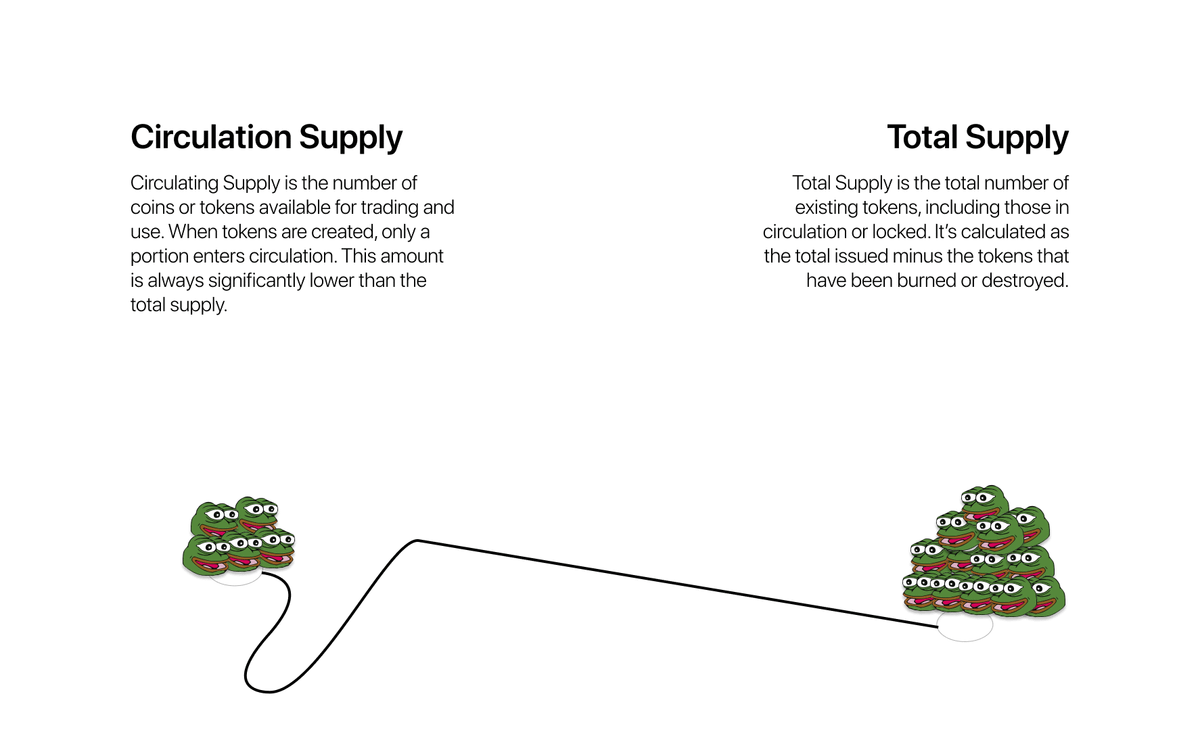

5/➮ What is Supply vs Circulating Supply?

✧ Supply = total coins that will ever exist

✧ Circulating Supply = what’s currently tradable

That’s why you must watch FDV & unlocks. Some tokens unlock 2× circ supply monthly.

MC might be $10M, but FDV is $200M - and new supply means incoming dumps.

Many miss this and get dumped on. Example: $APT launched with ~130M tokens in circulation, but total supply was 1B.

Every unlock added massive sell pressure.

Market cap looked “cheap” at $500M, but FDV was $4B+.

Always check unlock schedules - sometimes it seems you’re not early, but you’re exit liquidity.

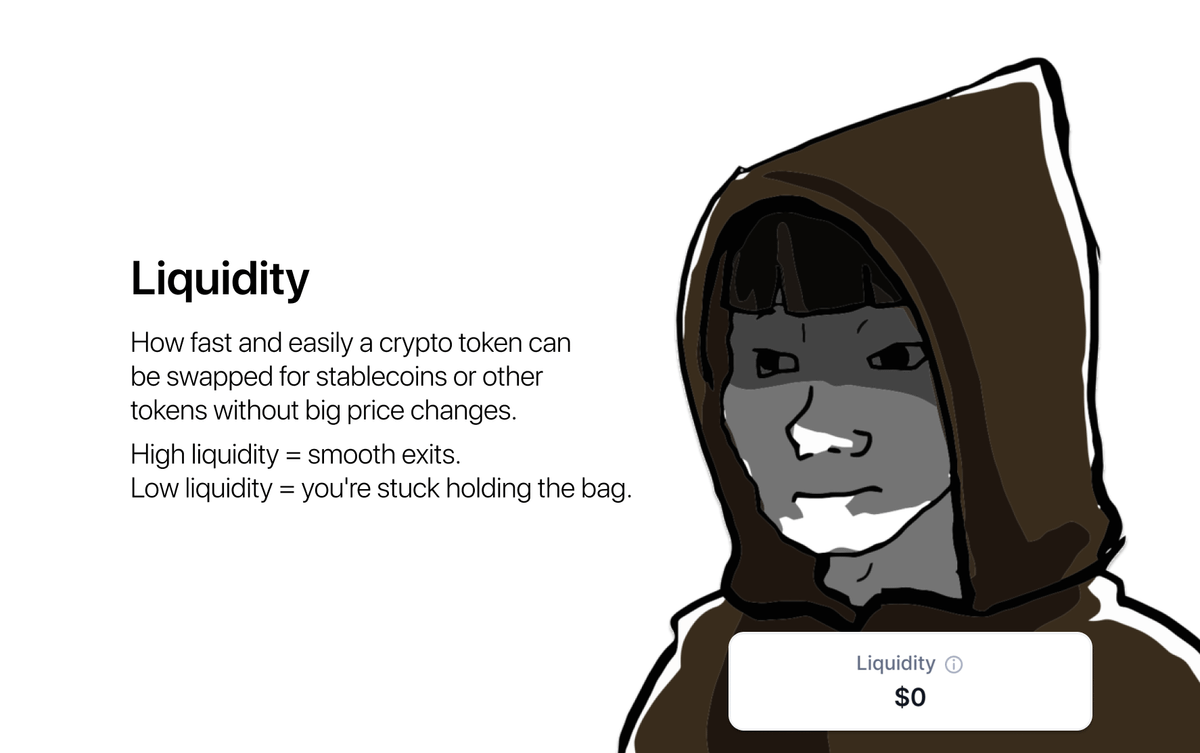

6/➮ That was the easy part. Now the fun begins: LIQUIDITY

For some reason, most people still think like this:

✧ Coin X is $1, supply is 1B → $1B market cap

✧ To 2x the price, it needs $1B in buys

But that’s not how it works - at all 👇

7/➮ At first, it sounds like simple and logical math, but what gets overlooked is liquidity

✧ Liquidity refers to the ability to quickly exchange a crypto at its current price without a significant loss in value

✧ Like a typical issue of large memecoins with 0 liquidity

8/➮ Liquidity is literally an essential part because:

✧ You can't sell more tokens than the available liquidity permits

✧ Which also means the following👇

✧ Imagine we have an X coin that is listed on only one, single DEX with only $30M available liquidity

9/➮ At the same time, the token price is $1 and market cap is $1B.

✧ But based on liquidity, it only takes ~$15M in buys to 2x coin X

✧ That kind of injection can double the price - no need to inject $1B

✧ Of course, that pump can be undone just as fast with $15M in sell pressure

But if holders don’t sell into the pump, the price can stay at 2x

Buy volume of $50M vs sell volume of $35M can double the price - it’s totally possible.

10/➮ But $1B mc with only $30M in real liquidity is already hard to grasp...

In Solana meme coins, the ratio is way more extreme.

A Solana meme with a $300M cap might only have $5M in liquidity.

From there? Do the math.

Buying or selling just 1% of supply can move price 2x in either direction.

That’s why memes fly.

But that doesn’t mean whales are actually cashing out at ATH.

Often, a big bagholder can’t exit near the top - every sell pushes price down hard.

That’s why consolidation phases are crucial - and why what goes up parabolically... usually comes down just as fast.

11/➮ A recent example: $JELLYJELLY had a $60M market cap - and dumped 50% from just $1.2M in sell pressure.

You can read more about it here - it’s a perfect case to help you truly understand how this works: https://x.com/degentradingLSD/status/1922712408042123399

12/➮ Exactly, this is how dozens of memecoin creators make daily profits through various schemes

✧ They list the memecoin on one or two DEXs with limited liquidity pools

✧ This way, they can strongly influence the price by creating different pump & dump schemes, etc

13/➮ So what does this all mean in practice?

Price movements aren’t driven by market cap logic - they’re driven by liquidity and flow. A token with low float and thin liquidity can 2x on hype with minimal buy pressure… but the same works in reverse.

What holds up over time? Projects with deep liquidity, gradual unlocks, strong communities, and real utility or demand.

Chasing low caps can bring fast gains - but without liquidity, you're always one sell away from a 50% nuke.

Despite a rate cut and $40B in T-bill purchases, Bitcoin and stocks sold off as traders took profits. With expectations overextended, Powell’s cautious tone and Oracle’s weak earnings triggered a synchronized dump—driven by hype, not fundamentals.

Bull Theory/18 hours ago

Token sales are evolving fast in 2026 — from Continuous Clearing Auctions and exchange-integrated launchpads to regulated tranches and community vesting. As the market matures, quality, compliance, and real user adoption will define the next wave of winners.

Stacy Muur/4 days ago

After eight years in crypto, a once-idealistic builder admits the industry has devolved into a giant digital casino. Instead of decentralizing finance, it gamified speculation. Despite the profits, he feels he helped build a machine that exploits rather than innovates.

ken/5 days ago

Crypto analyst Murad returns with 116 data-backed reasons arguing the bull run is far from over. From strong ETF accumulation and stablecoin inflows to macro liquidity shifts, he predicts Bitcoin could stay in a multi-year uptrend through 2026.

TechFlow/2025.12.06

From BONK to TRUMP, 2024–25 was crypto’s most chaotic wealth engine. Airdrops, AI coins, and celebrity rugs fueled the memecoin supercycle before collapse. What began as freedom and fun ended as a PvP casino—proof that chaos built the culture.

Adam/2025.12.04

Coinbase Ventures outlines 2026’s top crypto frontiers: RWA perpetuals, prediction market terminals, unsecured onchain credit, privacy DeFi, and AI-robotics intersections. The next breakout startups will merge finance, AI, and onchain innovation.

Coinbase Ventures/2025.12.02

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

A whale exchanged WIF and Bonk positions for Fartcoin!

2024.12.25 11:01:14

MoreHot Articles

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 promising AI Agent cryptos

2024.12.05

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link