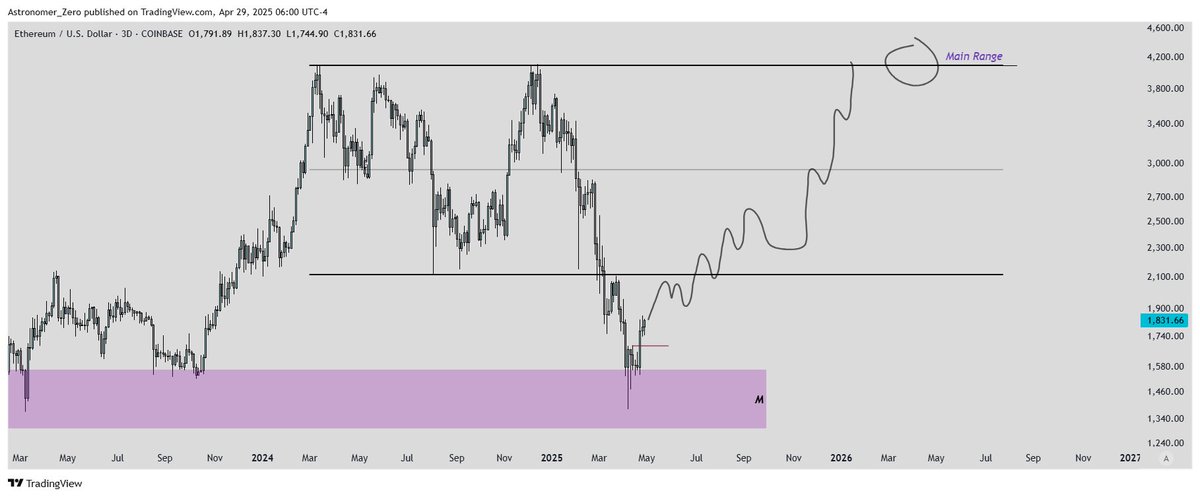

Calling the ETH Bottom: Opportunity in the $1.5K–$2K Range

Astronomer

Astronomer

And now, $ETH has bottomed, I bought more $ETH.

Alright, time for an $ETH analysis. It's been too long. But my interest faded at the time. Now I'm interested again at these prices (the glorious 1500-2000$ range).

We called the bottom on $BTC at the very day of the initial low, around 77k, which aged quite well. And after $BTC comes $ETH, that is true for tops, but also bottoms. So now, it's time to call the $ETH bottom and confirm it.

So aside from the $BTC bottom call being confirmed IMO, $ETH also has a clear range where it has performed a false breakdown into the most key initial breakout monthly POI. It also has very clear equal highs at 4000$ which are primed to get revisited.

Finally, we are in the speculative stages of the cycle, $BTC.D is topping out and $DXY has shown its weakness on the high timeframes all as discussed before, and you know my stance on $BTC and you know why I have a large long position (a breakout is coming).

So all things combined, a $BTC move up with a decreasing $BTC.D means that $ETH naturally takes up a larger share.

Sentiment is as bad as ever, and the fundamentals have been unchanged.

All things combined, this bottom call is very useful here. From a cyclical standpoint, $ETH is only up 2x from its stone cold cyclical bottom, yet we are already in the final year of the cycle.

That makes $ETH cheap at a late time, which is why these times maximize opportunity and why holding $ETH minimizes risk adjusted opportunity cost these days.

NFA, but this indeed is not a time to be bearish.

And I think this bottom call will age as well as our $BTC bottom call.

We will see.

Despite a rate cut and $40B in T-bill purchases, Bitcoin and stocks sold off as traders took profits. With expectations overextended, Powell’s cautious tone and Oracle’s weak earnings triggered a synchronized dump—driven by hype, not fundamentals.

Bull Theory/18 hours ago

Token sales are evolving fast in 2026 — from Continuous Clearing Auctions and exchange-integrated launchpads to regulated tranches and community vesting. As the market matures, quality, compliance, and real user adoption will define the next wave of winners.

Stacy Muur/4 days ago

After eight years in crypto, a once-idealistic builder admits the industry has devolved into a giant digital casino. Instead of decentralizing finance, it gamified speculation. Despite the profits, he feels he helped build a machine that exploits rather than innovates.

ken/5 days ago

Crypto analyst Murad returns with 116 data-backed reasons arguing the bull run is far from over. From strong ETF accumulation and stablecoin inflows to macro liquidity shifts, he predicts Bitcoin could stay in a multi-year uptrend through 2026.

TechFlow/2025.12.06

From BONK to TRUMP, 2024–25 was crypto’s most chaotic wealth engine. Airdrops, AI coins, and celebrity rugs fueled the memecoin supercycle before collapse. What began as freedom and fun ended as a PvP casino—proof that chaos built the culture.

Adam/2025.12.04

Coinbase Ventures outlines 2026’s top crypto frontiers: RWA perpetuals, prediction market terminals, unsecured onchain credit, privacy DeFi, and AI-robotics intersections. The next breakout startups will merge finance, AI, and onchain innovation.

Coinbase Ventures/2025.12.02

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

A whale exchanged WIF and Bonk positions for Fartcoin!

2024.12.25 11:01:14

MoreHot Articles

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 promising AI Agent cryptos

2024.12.05

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link