The 2026 Rotation Playbook: How 100 Still Happens in Crypto

cyclop

cyclop

The 2026 Playbook: how to make not 2x, but 100x on crypto this year.

I turned $8K into 7 figs in crypto over the last 2 years.

Most people think you can’t repeat that anymore - I disagree. I think now is the best time to start a $10K -> $1M run in a year (as insane as that sounds).

But why almost everyone got wrecked (and keeps getting wrecked) over the last 2 years?

(Fair warning - this article is long. Bookmark it now, so you want miss it, but don't skip it, it’ll probably change how you look at this market.)

Even if nobody says “altseason” out loud anymore, most people still have the same mindset:

They’re waiting for one giant wave where everything pumps, you buy a bag, and it carries you to riches.

hold forever

find “the one coin”

ignore rotations

pray the market rewards patience

That mindset made money when token supply was limited and narratives lasted months.

In 2024, it was usually a mistake. In 2025, it was a mistake most of the time. In 2026, it’s a guaranteed mistake.

Not because 100x is impossible.

Because the way you get 100x changed.

Part 1 - What changed since 2017-2021

1) The market got diluted into a token printer

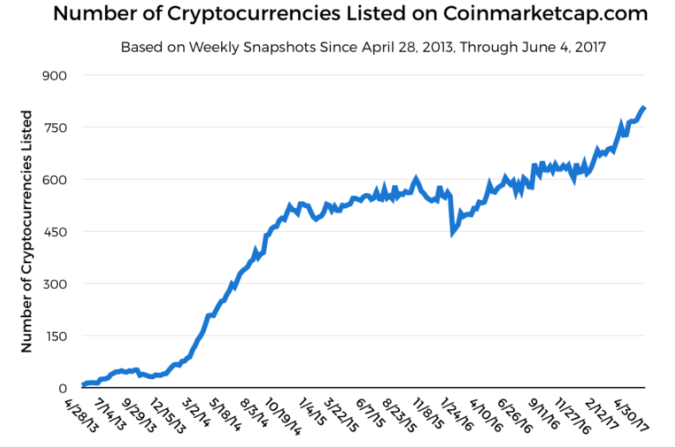

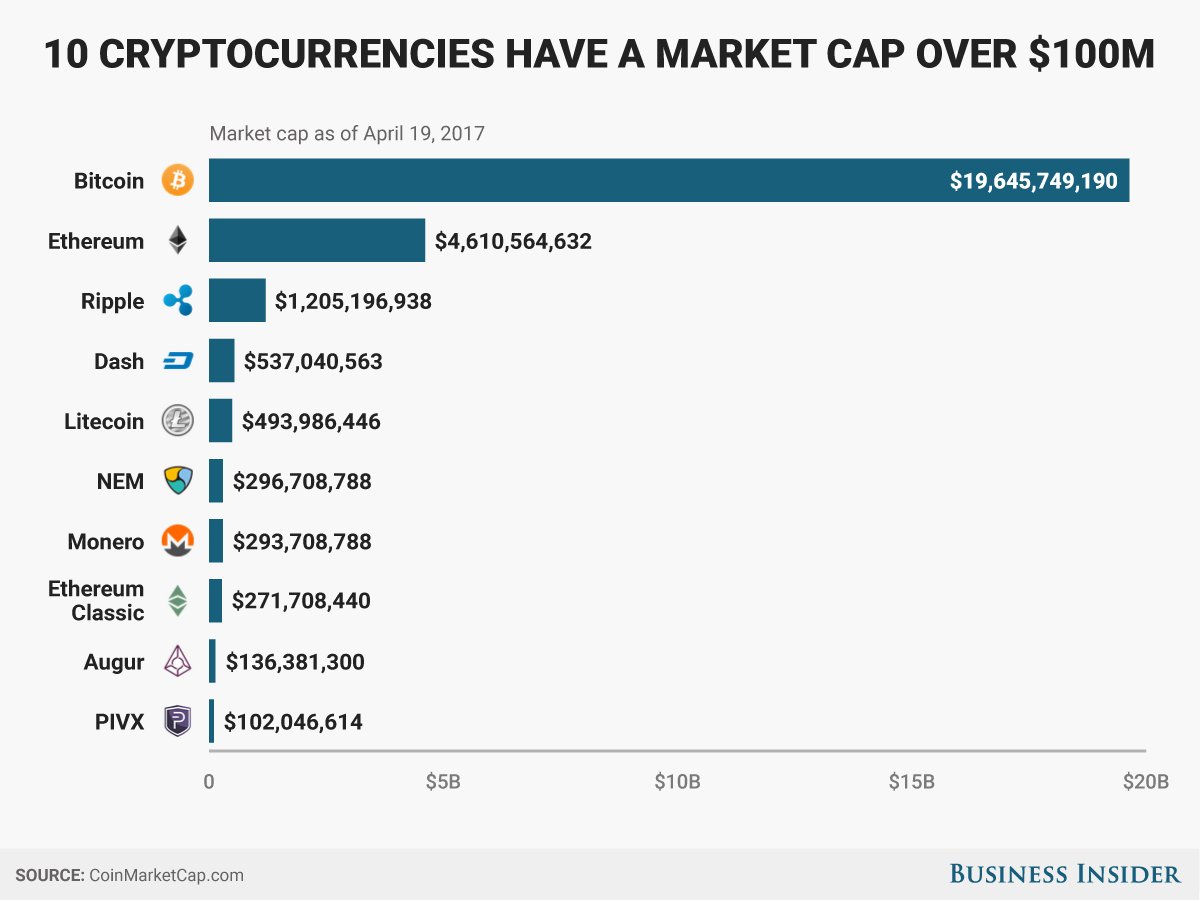

In early 2017, CoinMarketCap was tracking ~796 cryptocurrencies. That is not a typo - under 1,000. Back then, ~800 currencies felt like “a lot”. Today? CoinGecko measured ~5,300 new tokens per day in 2024

What that meant in practice

“Discovery” was real. There weren’t infinite alternatives.

If you got visible (CMC presence, exchange listing, basic narrative + some shilling), liquidity had fewer places to go, so it actually arrived.

People bought random stuff because the menu was small, and everyone was learning at the same time.

That’s why “just show up on CMC + get attention” worked as an edge in 2017-2021. There was a space for everybody.

2) The attention-to-supply ratio collapsed

Since 2021, the single most important thing that changed is this:

Attention didn’t scale. Token supply did.

Crypto got more users, sure.

But the number of coins exploded so much harder that every individual coin became worth less in terms of attention.

Crypto.com estimates:

106M crypto owners in Jan 2021

295M crypto owners by Dec 2021

580M crypto owners by Dec 2023

Supply (coins/projects)

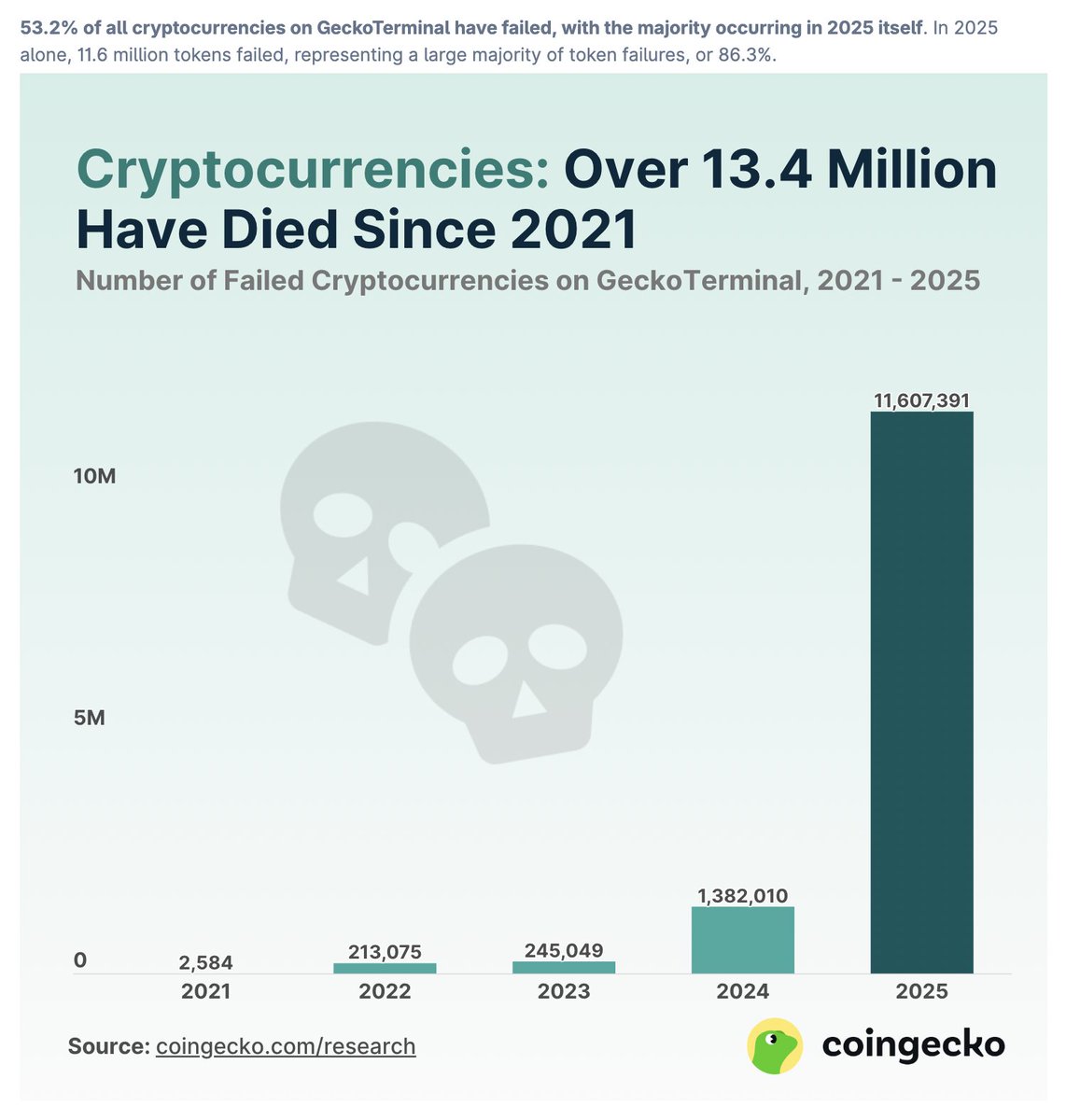

CoinGecko’s GeckoTerminal data shows:

428,383 projects in 2021

20,170,928 projects by 2025

Now the part that matters:

How diluted is the market, really?

In 2021, there was roughly 1 token per ~689 crypto owners.

By 2025, it became roughly 1 token per ~29 owners.

That’s about a 24x increase in supply-per-person in just a few years.

Translation:

Back then, attention had fewer places to go, so random coins could get discovered.

Now, every day you’re competing with an ocean of new tokens - so “just holding a bag and waiting” stopped being a strategy.

3) Even huge new launches are structurally designed to underperform

Old cycles had plenty of tokens that launched cheap, with real upside still in the market.

Now, the common pattern is:

high FDV at launch

low float

heavy unlocks

early holders looking for exit liquidity

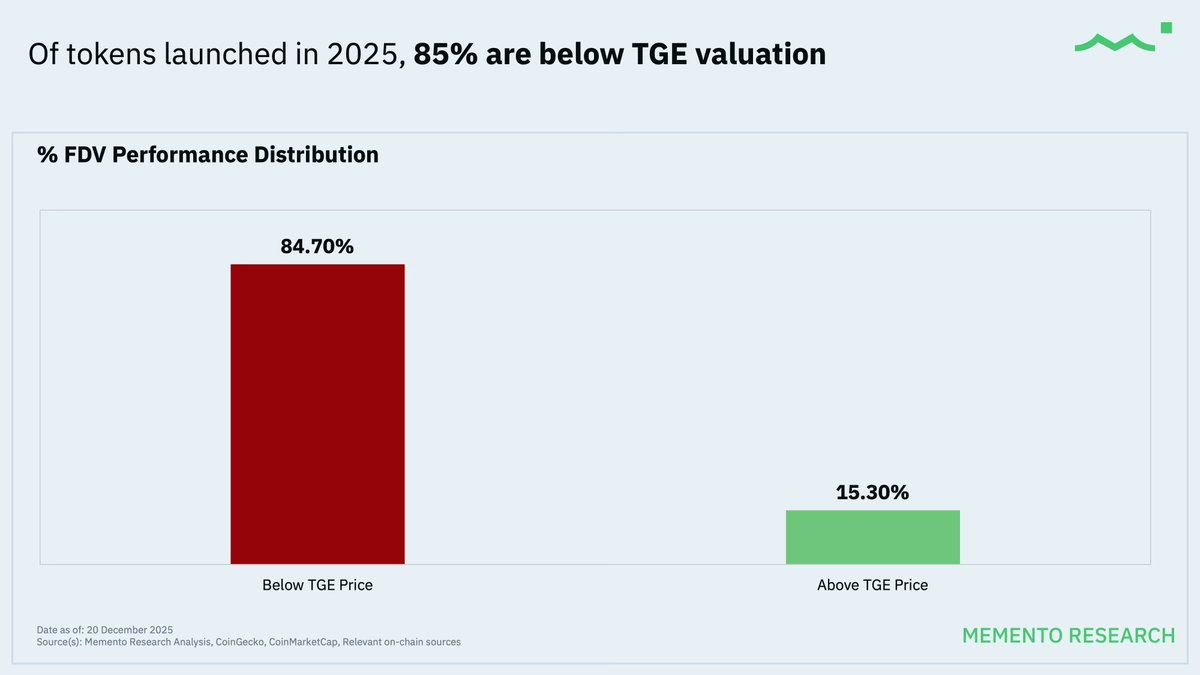

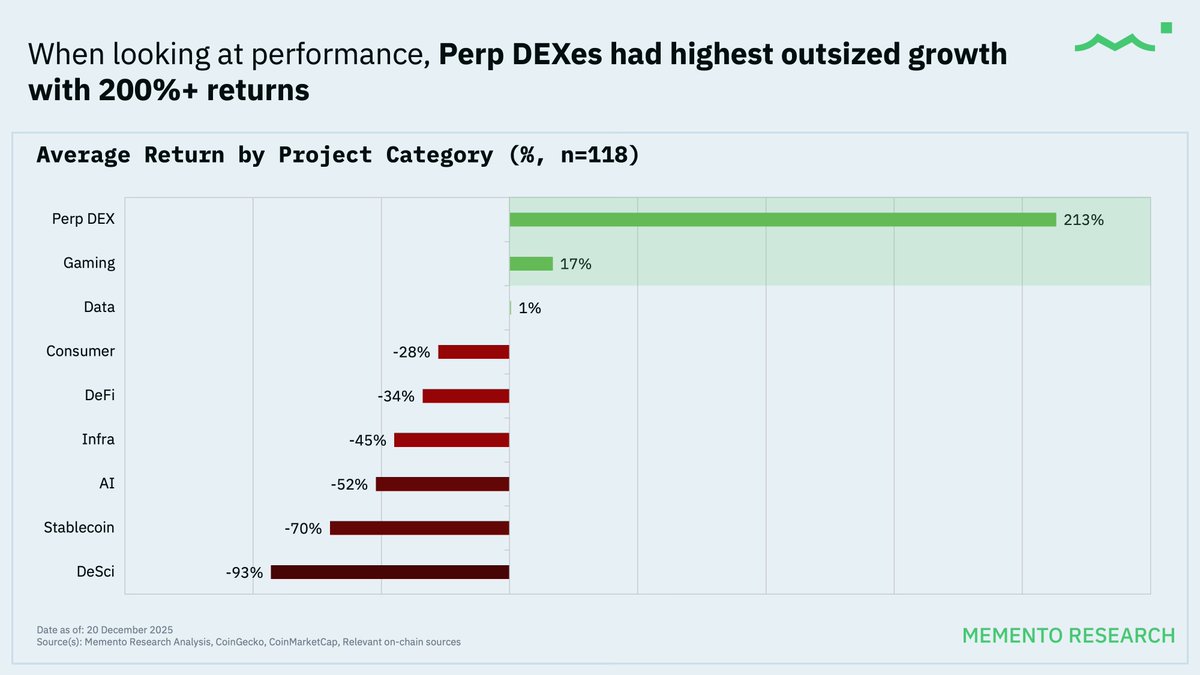

Memento Research tracked 118 big token launches in 2025

84.7% were below their TGE valuation

median performance: -71.1% FDV and -66.8% market cap from launch

This is why “just buy new listings” has been a graveyard strategy.

But here’s the twist:

Even in this diluted, brutal market - if you picked the right narrative early, you still made money. (more about this later)

Part 2 - Why small players get farmed by default paths

The “fair launch” illusion

Retail couldn’t trust VCs and buy these overvalued alts after TGE, so the market created a new product:

a casino where anyone can “buy early.” With no VCs and no overvaluation at tge.

@pumpdotfun arrived.

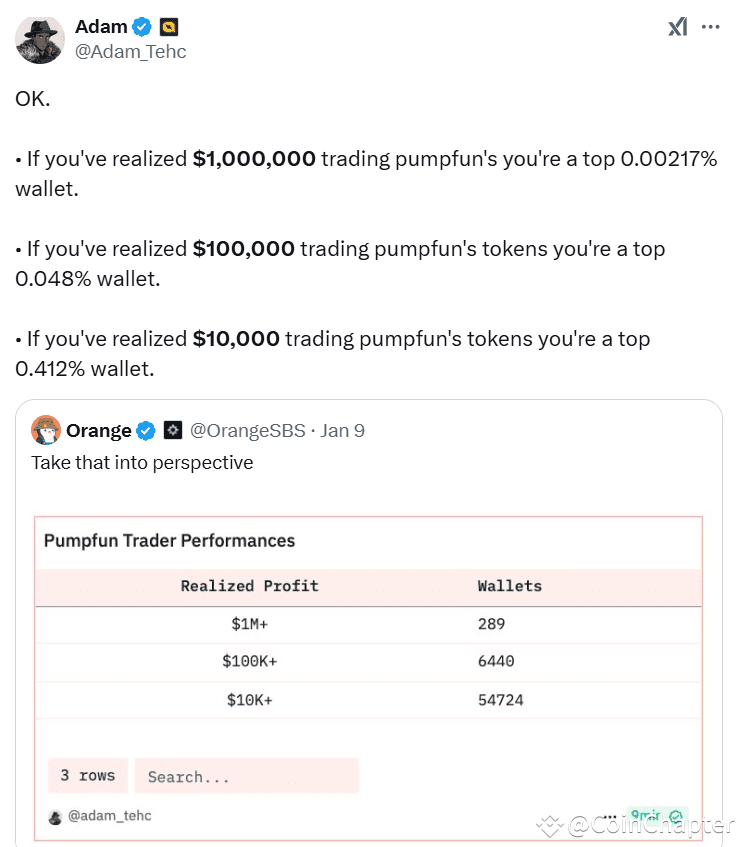

A bit of the data:

13.55M pumpfun wallet addresses

only 55,296 (0.4%) wallets have realized more than $10,000 profit

meaning 99.6% have not, 90%+ are down

So yes, a tiny group hits huge wins.

But the median outcome is donating liquidity to devs of tokens, their insider friends, paid KOLs, pumpfun devs, or just faster players and trading bots.

While users fight for scraps, the house prints.

pumpfun has collected >$935M in fees since launch

Same dynamic exists in prediction markets: analysis cited by Finance Magnates says 70%+ of Polymarket’s 1.7M trading addresses have realized losses.

If your plan is “I’ll be the exception,” you need an actual edge.

Otherwise, you are just variance with a negative distribution.

Part 3 - The 2026 thesis: rotations, not altseason

In a diluted market where most launches underperform, liquidity behaves differently:

liquidity concentrates

liquidity moves fast

liquidity needs a story

liquidity exits faster than you think

So the winning approach is not “pick alts.”

It’s:

identify the next rotation early

ride it

take profit into the next rotation

This is how 100x still happens:

not from one coin, but from stacked rotations + position sizing + exiting like a professional.

Part 4 - Proof: rotations were the only real way to win in 2023-2025

If you zoom out on the last 2-3 years, the pattern is obvious:

You didn’t win by “holding the one coin”.

You won by catching the right rotation early - then rotating again.

Rotation 1 - Airdrops (where I made my first six figures)

When I was still small, I wasn’t trying to trade better.

I was farming asymmetry - plays where upside doesn’t depend on bankroll.

Airdrops were exactly that. They paid for time, not for capital, so me and the guy with 6 figs portfolio were equal on that field.

I was doing the boring work when the market was dead and nobody cared - staying active, using protocols, everyone was out of the market, as BTC was at the bottom. Then the market woke up and everyone started farming.

By then the edge was gone.

That’s why it paid.

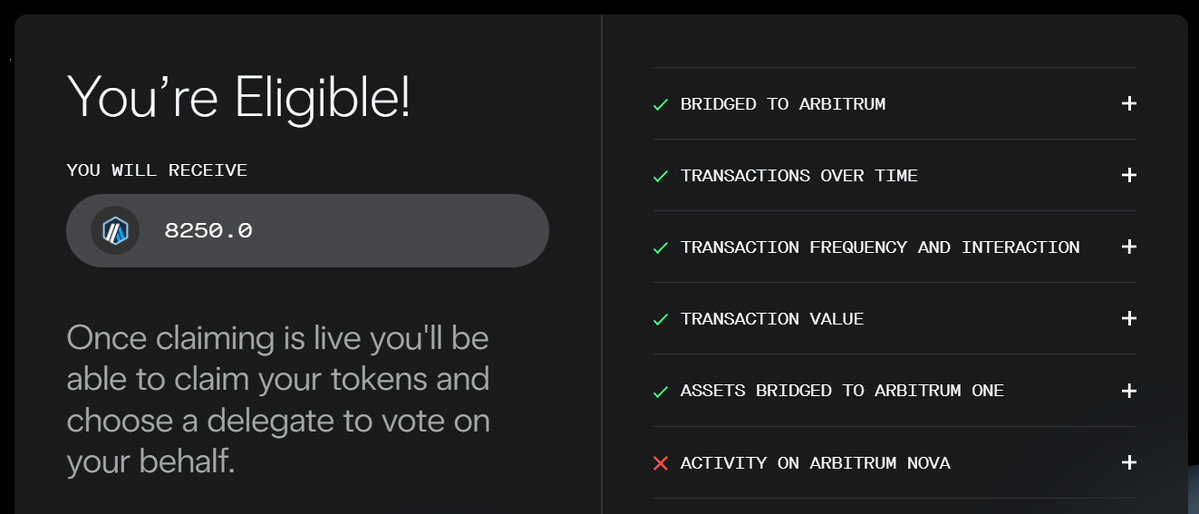

$ARB claim went live on March 23, 2023.

Optimism ran multiple airdrop rounds over time - the same rotation logic: early + consistent gets rewarded.

That’s how I got my first real capital - not from a miracle 100x hold, but from being early to the meta before it got crowded.

I started with $8k and I basically spent like $400 farming a few airdrops that ended up paying me 6 figures.

Rotation 2 - Early Solana memecoins (where I made my first 7 figs)

After airdrops (helicopter money), liquidity rotated into the casino. Easy come, easy go.

The market started asking for something new - and Solana memes showed up as the cleanest answer.

I spotted POPCAT around $2.5M market cap, and WIF around $30M. (Few months then they will reach $2B and $4B mc): 100-1000x

https://x.com/nobrainflip/status/1736522629807497342

I made it not because I’m some trading genius.

Because I was in the market 24/7, the market was dead, and these “new shiny Solana coins” were basically the only meta with real momentum.

There were <5 $1M+ MC coins, which is why winners were easy to identify if you were early.

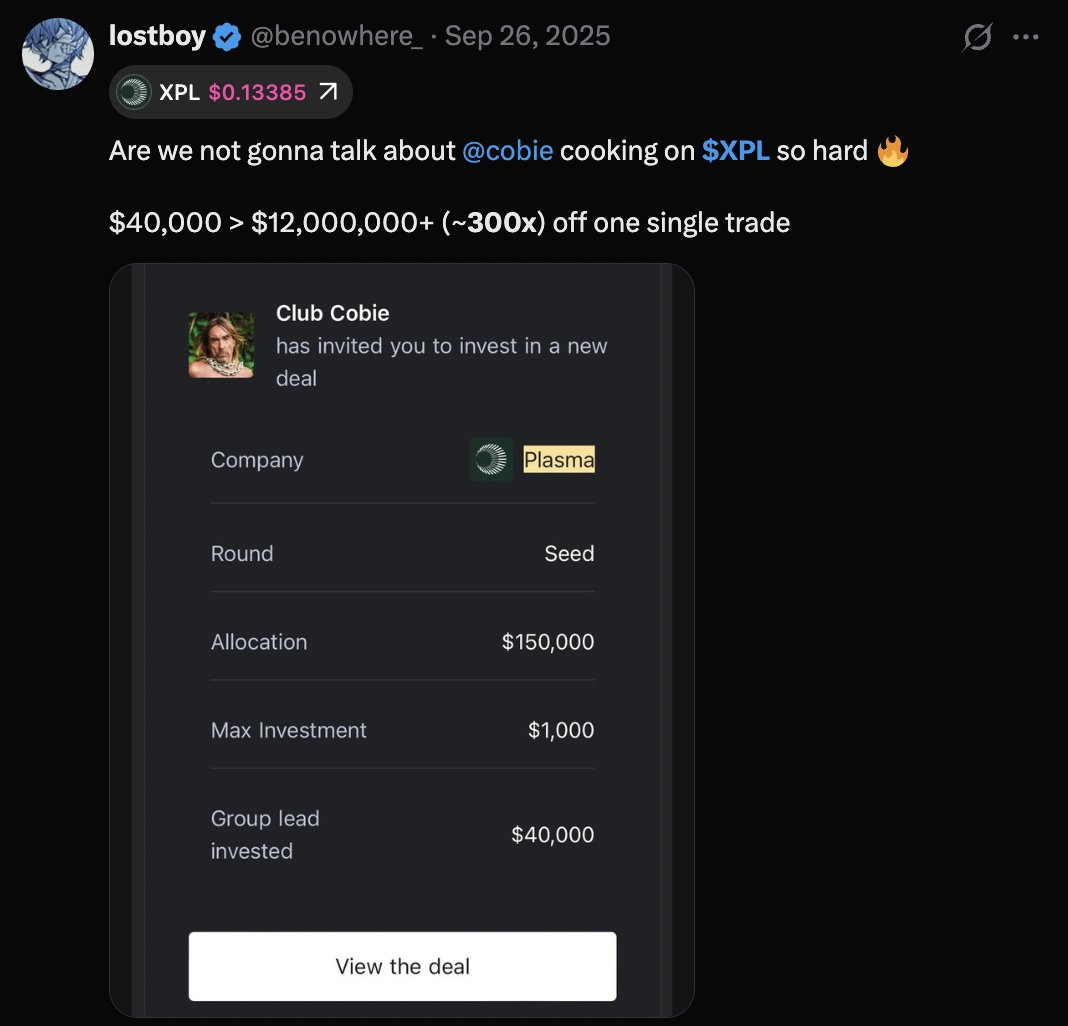

Rotation 3 - “Real revenue” became the new flex (HYPE as the template)

After the meme sugar rush, the market starts craving something else.

Not “utility in 2 years”. Not vibes.

Something you can explain in one sentence that sounds like a real business.

That’s why HYPE hit so hard.

It wasn’t just “a new token”.

It was the story:

real trading activity

real fees

and the token benefits directly (buybacks)

Whether you love or hate it, that’s what the market which is tired of casino and extraction has been rotating into: value capture you can see.

And you could’ve spotted this too, even without being “smart”:

when everyone gets tired of memes, they start paying for narratives that feel grown-up.

Rotation 4 - Then the meta moved one level up: “stop playing the casino, own the casino”

This is the funniest part about crypto.

People will gamble on 5,000 memes…

…and then randomly realize the only consistent winners are the platforms taking fees.

That’s where “house tokens” and “platform plays” start to shine.

Pump fun is the perfect example of the era:

users fight each other for scraps, bots farm everyone, and the house quietly prints every day.

That’s not a moral take, it’s just how these markets work.

And the rotation is always the same:

first you trade the coins

then you trade the platform that extracts from the coins

https://x.com/nobrainflip/status/1944333690324103675

Rotation 5 - When the market gets too degenerate, it swings back to “real-world” narratives

After a while, people get tired.

They start wanting narratives that can survive without pure hype:

stablecoins

payments

settlement rails

stuff that regular humans actually use

It’s boring on purpose.

And boring narratives usually win late, because they’re the only ones that don’t need constant new idiots to buy higher.

That’s why you saw more attention going into PayFi / stablecoin infra type stories later.

https://x.com/nobrainflip/status/1971252133346619852

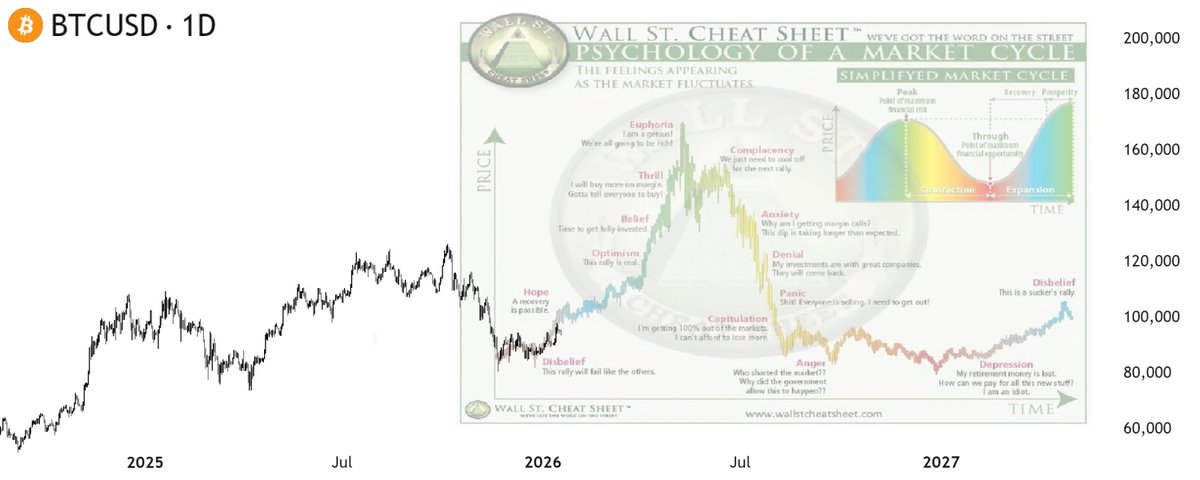

Part 4.5 - So what’s next?

First, let’s be honest about where we are.

BTC is around $91K-$93K right now, which sounds “bullish” on paper, but the vibe is the opposite.

We’re still roughly -25% off the Oct 2025 ATH (~$124.7K), and the market is mentally in bear mode.

Why? Because we just lived through the largest liquidation event most people have ever seen - ~$19B nuked in ~24 hours around Oct 10-11, 2025.

In a market like this, money concentrates into 1-2 directions that make sense right now, and everything else bleeds.

It’s the same way airdrops worked before the pump last cycle: the market was dead - but that one meta still printed if you were early.

So the job now is not “find 50 gems”.

It’s: find the few rotations that can run without retail, and work them harder than everyone else.

1) The current sentiment is: most coins are useless, especially L1/L2s

This is the dominant market mood:

Most tokens are pointless and eventually go to zero because they:

don’t have real utility

don’t generate real revenue

exist mainly as exit liquidity

And this hits L1/L2s the hardest.

Because you can’t keep doing the same thing forever:

raise at insane valuations, launch at insane FDVs, have 8 users, make $20/month, and still pretend you’re worth $15B.

(Starknet, zkSync, Aptos - you know the type.)

Will this sentiment ever flip? Maybe.

But I don’t even need to predict that.

Because the implication is obvious…

2) What the market wants next is a new model: real revenue + buybacks

After 3 years of extraction, people finally understand the hierarchy:

Creators

VCs

KOLs

Then bots/traders

Then everyone else buying late

So for most retail, the game has been negative EV:

you buy a token and pray you’re not the exit liquidity.

That’s why the market is now starving for tokens that act like businesses.

A simple model:

If a token is worth $1B and the protocol prints $800M/year in real revenue, and even 50% of that is used to buy back the token…

that asset has a floor. It can’t just “go to zero” unless revenue collapses.

This is literally the logic of value investing in equities:

when market mood is trash and everyone is scared, people stop buying dreams and start buying cashflows.

Average S&P P/E is ~16, top companies sit at 30-40.

Crypto should trade at lower multiples than stocks because the risk is higher and tech is newer - fine.

But the point stands:

in a fearful market, cashflow becomes the narrative.

So the next big rotation is:

real revenue

real value capture

ideally buybacks (because it’s simple and people can quote it in one line)

That’s where “serious” money rotates first.

3) Then helicopter money returns - and the casino returns

This is the part everyone forgets.

Value phases don’t last forever.

At some point, the market starts printing again:

something pumps hard, people get lucky, airdrops start hitting, some new wave puts money back in people’s hands.

And the second people feel rich again, the market flips from:

“show me revenue”

to

“show me the fastest 10x”

And that’s when the casino phase comes back.

Memes. NFTs. Whatever new stupidity gets invented. Doesn’t matter.

It’s always the same:

it has no value

but it gives insane multiples

and everyone wants fast money

Then it dumps.

And after the dump…

4) The market moves into the next extraction meta (ICOs, utility tokens, structured launches)

After the casino gets rugged, the market doesn’t instantly become “fundamental”.

It usually shifts into a more structured extraction model where people can spend money again, like:

ICOs / “public rounds”

points metas

“utility tokens”

launch mechanics where you pay for access and someone else sells later

So the cycle rhymes like this:

Value (revenue) -> helicopter money -> casino -> dump -> structured extraction -> repeat

The main takeaway (this is the whole article in one line)

Nothing grows forever in crypto.

What grows is whatever the market is emotionally hungry for at that moment.

So the way you win in 2026 is not holding and hoping.

It’s:

spot the rotation early -> ride it -> rotate before it becomes obvious.

Part 5 - How to actually make 100x in 2026 (without one magic coin)

100x in 2026 is not one trade.

It’s stacked rotations.

You win by compounding “correct phases”, not by praying you found the chosen token.

Here’s the system I use:

1) Pick 2 rotations max

One serious rotation (revenue/rails)

One aggressive rotation (casino/structured)

If you track 10 metas, you’ll be late to all of them.

2) Buy triggers, not vibes

Before I size up, I want clear triggers.

Examples:

fees/revenue trend up for weeks

users return without insane incentives

distribution turns on (integrations, major platforms, real attention)

narrative starts spreading but isn’t mainstream yet

No triggers - no entry.

3) Define invalidation before you enter

Most people don’t lose because they’re wrong.

They lose because they can’t exit.

Nobody ever went broke by taking profit, even $1. Remember that.

Your invalidation list should be boring:

usage collapses

revenue was fake

liquidity rotates away

tokenomics/unlocks start nuking price

If invalidation hits, you’re out. No debate.

4) Position sizing - the 3-layer stack

This is how you get upside without dying:

Beta (liquid leader of the rotation)

Pick-and-shovels (infra that wins either way)

Flyers (small caps that fit perfectly)

Only flyers = casino odds.

Only beta = capped upside.

5) Profit-taking is literally the edge

Rotations end faster than you think.

So:

scale out into strength

don’t marry midcaps

always know what you rotate into next

If you don’t have a next rotation, you round-trip.

Part 6 - The trap that deletes most people

The trap is thinking:

“if I just hold long enough, it has to go up.”

That worked when the market was small.

It doesn’t work now.

Because now:

supply is infinite

launches are priced to dump

and most tokens exist to extract from you

So if your plan is still:

buy random listings

hold midcaps “for the cycle”

chase whatever is trending

…you’re playing a distribution designed to farm you.

Rotations are the loophole.

Because rotations are how liquidity behaves now.

Weekly dashboard (how to stay early)

Every week I watch:

which sectors are actually growing fees

which apps have users returning

where volume and open interest are shifting

where liquidity incentives are being deployed

whether the narrative is still early or already “top 10 coins” content

Most people don’t miss narratives.

They show up after the narrative is obvious.

So in 2026, like every year before, the winners won’t be “right”.

They’ll be early - and they’ll rotate.

Davinci Jeremie urged people to buy $1 of Bitcoin in 2013 and became a symbol of early conviction. Years later, fame, lifestyle flexing, and token promotions sparked criticism. His journey reflects both crypto foresight and influencer-era controversy.

StarPlatinum/2 days ago

A sweeping narrative ties Jane Street to India’s expiry-day options case, alleged 10AM Bitcoin sell patterns, Terra’s collapse, and ETF plumbing. While none prove misconduct, critics argue a common structure: move spot, monetize derivatives, keep execution opaque.

Bull Theory/6 days ago

A controversial narrative links Jane Street, ETF mechanics, and Bitcoin’s price behavior, pointing to lawsuit allegations, 10AM volatility patterns, and derivative hedging dynamics. The discussion raises broader questions about liquidity, structure, and price discovery.

Justin Bechler/2026.02.26

A new federal lawsuit alleges Jane Street exploited non-public information tied to Terraform’s liquidity defenses, accelerating UST’s depeg and the Terra collapse. The firm denies the claims. The case may reignite debates on structure, design, and regulation.

Diana/2026.02.25

Mean reversion and on-chain models sit at levels historically linked to bottom formation after capitulation. Realized losses reached record USD values, while deviations from anchor models remain extreme. Price pain may be fading; patience remains key.

Checkmate/2026.02.25

Bitcoin didn’t fail as an asset — it matured into an ETF-driven trade. As institutional ownership rose, correlation with tech risk intensified. Short-term pressure reflects holder structure shifts, not thesis collapse.

Eric Jackson/2026.02.24

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

When Elon Musk tweeted about Moltbook, the meme coin MOLT experienced a short-term 30% price surge, hitting a new all-time high of $114 million.

2026.01.31 18:37:29

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

MoreHot Articles

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

10 promising AI Agent cryptos

2024.12.05

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link