X402 Explained: Turning the “Payment Required” Code Into the Future of AI Transactions

Jarrod Watts

Jarrod Watts

x402 explained - is it all hype?

x402 coins skyrocketed to over ~$100M market cap yesterday, seemingly blowing up out of nowhere; despite the protocol being released several months ago.

I spent the day building my x402 server to find out if it's just another quick crypto cash grab in the ai bubble, or something that can change the way AI agents interact with the internet.

Here's what I learned:

The fundamentals: APIs & status codes

Real quick, there's some foundations we first need to cover for all of our non-devs here before we can continue: mainly APIs & status codes.

If you're already bored, don't give up yet, it's actually very simple.

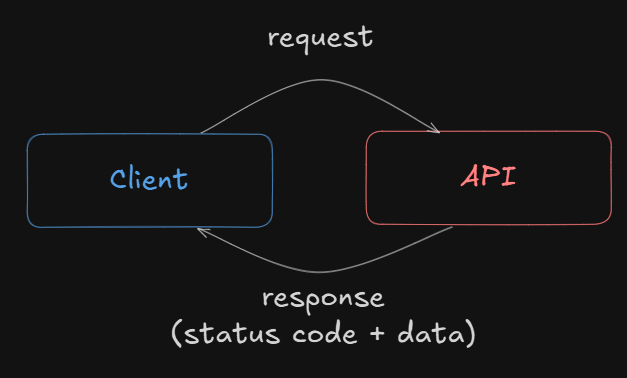

All you need to know is: clients (e.g. an app, or an ai agent) use APIs to request information from servers (aka. a "backend"), and they respond with a status code + some data.

Each status code has a different meaning, and 402 is one of the status codes that a server can respond with. Some examples:

200 = OK (gives back data successfully)

404 = Not Found (failure)

402 = Payment Required

The thing is, the 402 "payment required" response code is almost never actually used today - as a dev, I'd never even heard of it before.

One more thing. To use most APIs today, developers have to sign up for that API's developer platform, put their credit card information in, and are charged based on their API usage (tied to a unique API key).

So with this in mind, what is x402, why does it exist, and how does it work?

x402: what, why & how?

TLDR: some nerds over at Coinbase said, "hey, so we have AI agents now, and we also have crypto, what if we made this 402 code actually useful?"

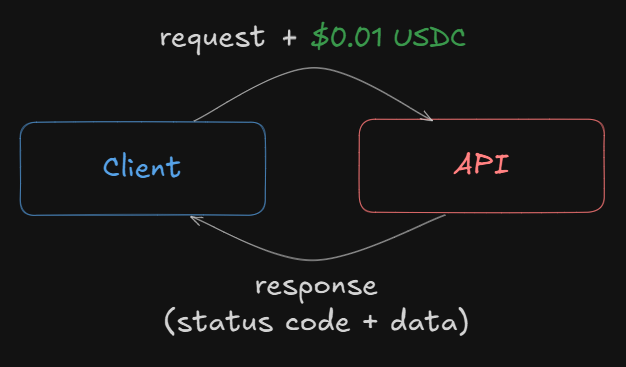

x402 extends the original 402 status code, and instead of just returning a useless message, actually enables payments directly inside of the API request, typically by using stablecoins.

This allows APIs to require clients to pay a fee to use the API endpoints, and clients can pay those fees directly as part of the request using crypto.

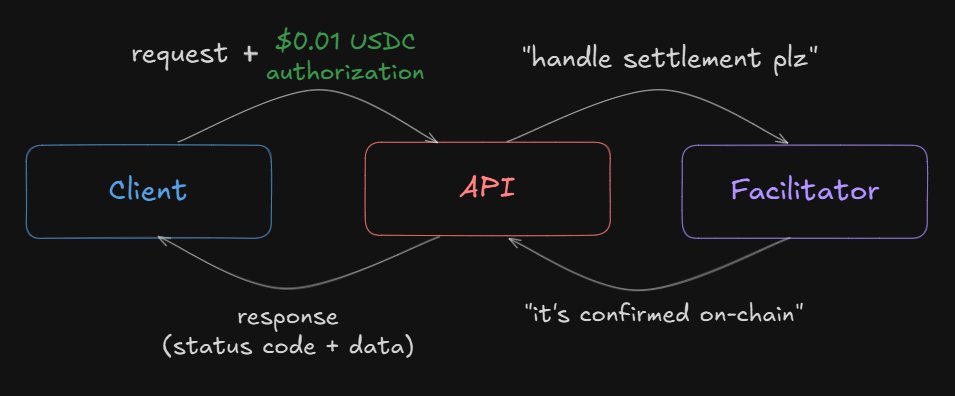

Your next question might be - but how does crypto actually get transferred inside an HTTP request? Does every API have to now write code for handling transactions on-chain?

Well, they *can*, or alternatively, they can outsource the on-chain payment processing to what's called a "facilitator".

Facilitators are simply service providers that takes the client's authorization to spend money, quickly checks it is legit, and then executes the payment on-chain.

They exist to make it easier for API developers to adopt x402 in their APIs.

How x402 Unlocks AI Agents

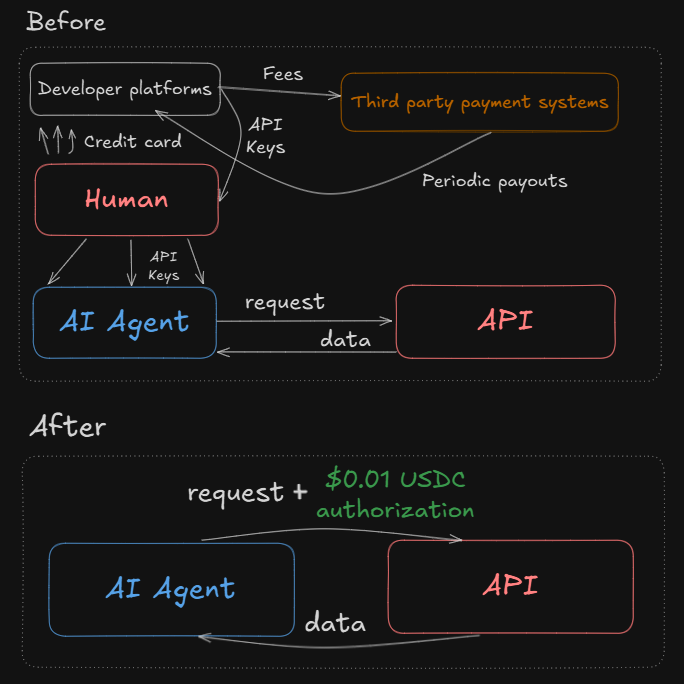

Traditional payment methods don't really work for AI agents... today's payment rails require a bunch of human setup and maintenance for agents to actually use them.

Interacting with paid APIs today requires signing up for individual developer platforms, paying for each one with a credit card, and maintaining unique API keys - all of which require human intervention.

x402 kills the API key by enabling payments directly over HTTP request, making it easy for AI agents to access information from paid APIs without any human setup beforehand.

In the process, it cuts out the middlemen like credit cards & third party payment providers who take massive fees throughout this exchange.

What about x402 coins?

I think there are three key areas that new coins fit into this:

APIs requiring payment to be made in <api token name>, rather than accepting stablecoins from clients - somewhat interesting.

Facilitators requiring APIs to pay them in <facilitator coin name> for their services - this exists already but feels quite weak.

Speculative tokens like we saw last AI hype cycle.

In the last hype wave, we saw AI coins reach billions of dollars in market cap. Those AI coins essentially had absolutely zero point of existing, often just having a loose association to an annoying twitter bot.

x402 coins feel the same. But the key here is not to ask "why does this token need to exist?", and instead, accept that a large chunk of CT are here to try make money, and coins create perfect markets to do that.

I suspect we'll see a new wave of AI coins pop up over the next few weeks to ride this hype. And, again, they'll likely be completely pointless, but “would you rather be right or rich?”

Closing Thoughts

x402 is an innovative technology that is actually relevant to crypto, presenting a very powerful use case for stablecoins to enable AI agents to interact with the internet natively.

I suspect we'll soon see an intersection of x402 payments, ERC-8004 trustless agents, and potentially verifiable AI to utilize blockchains permissionless nature to give further reputation and trust to AI - a topic for another article.

Crypto really feels like it's starting to finally arrive with some fun consumer apps, stablecoins, and institutional adoption, and x402 is another step in the right direction. It's very refreshing.

- Jarrod

x402, known as the Payments MCP, enables AI agents to make on-chain payments. Backed by Coinbase and Cloudflare, it’s becoming core to Base, Solana, and beyond. With a16z and Ribbit predicting $30T in agentic transactions by 2030, x402 may redefine global finance.

s4mmy/2 days ago

Gold plunged -5.7%, its biggest one-day fall since 2013—a 5-sigma event that’s happened only 34 times since 1971. Despite the $3 trillion wipeout, fundamentals stay strong as institutions and central banks keep buying amid rising debt and liquidity expansion.

The Kobeissi Letter/6 days ago

A deep dive into how insiders allegedly manipulate crypto markets—triggering dumps, bull runs, and altseasons. From $700M Binance transfers to pre-Trump announcements, this thread exposes how big players control liquidity and profit from chaos.

Tracer/2025.10.22

After last week’s perfect projection and the biggest liquidation cascade in years, $BTC faces another volatile week. With short liquidity clustered around $116K–$117K and the CME gap near $106.7K, traders watch for either a short squeeze or a final dip to $100K.

CrypNuevo/2025.10.20

After losing over $30M in the largest crypto liquidation event ever, a top trader reflects on what went wrong, the lessons learned about leverage and risk, and why he’s staying optimistic. It’s not the end — just the start of his next chapter.

Unipcs (aka 'Bonk Guy')/2025.10.12

Crypto just experienced the largest liquidation event ever — over $19B in leveraged positions and 1.6M traders wiped out in a single day. Triggered by Trumps tariff shock, the cascade revealed extreme leverage but may set the stage for a strong rebound.

The Kobeissi Letter/2025.10.12

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A whale exchanged WIF and Bonk positions for Fartcoin!

2024.12.25 11:01:14

MoreHot Articles

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 promising AI Agent cryptos

2024.12.05

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link