Wiped Out, Not Broken: How I Lost $30M in the Biggest Crypto Liquidation Ever — and Why I’m Coming Back Stronger

Unipcs (aka 'Bonk Guy')

Unipcs (aka 'Bonk Guy')

Wiped Out, Not Broken” — How I Lost $30M in the Biggest Crypto Liquidation Ever

“The LORD gave, and the LORD hath taken away; blessed be the name of the LORD.”

— Job 1:21

The Brutal Reality

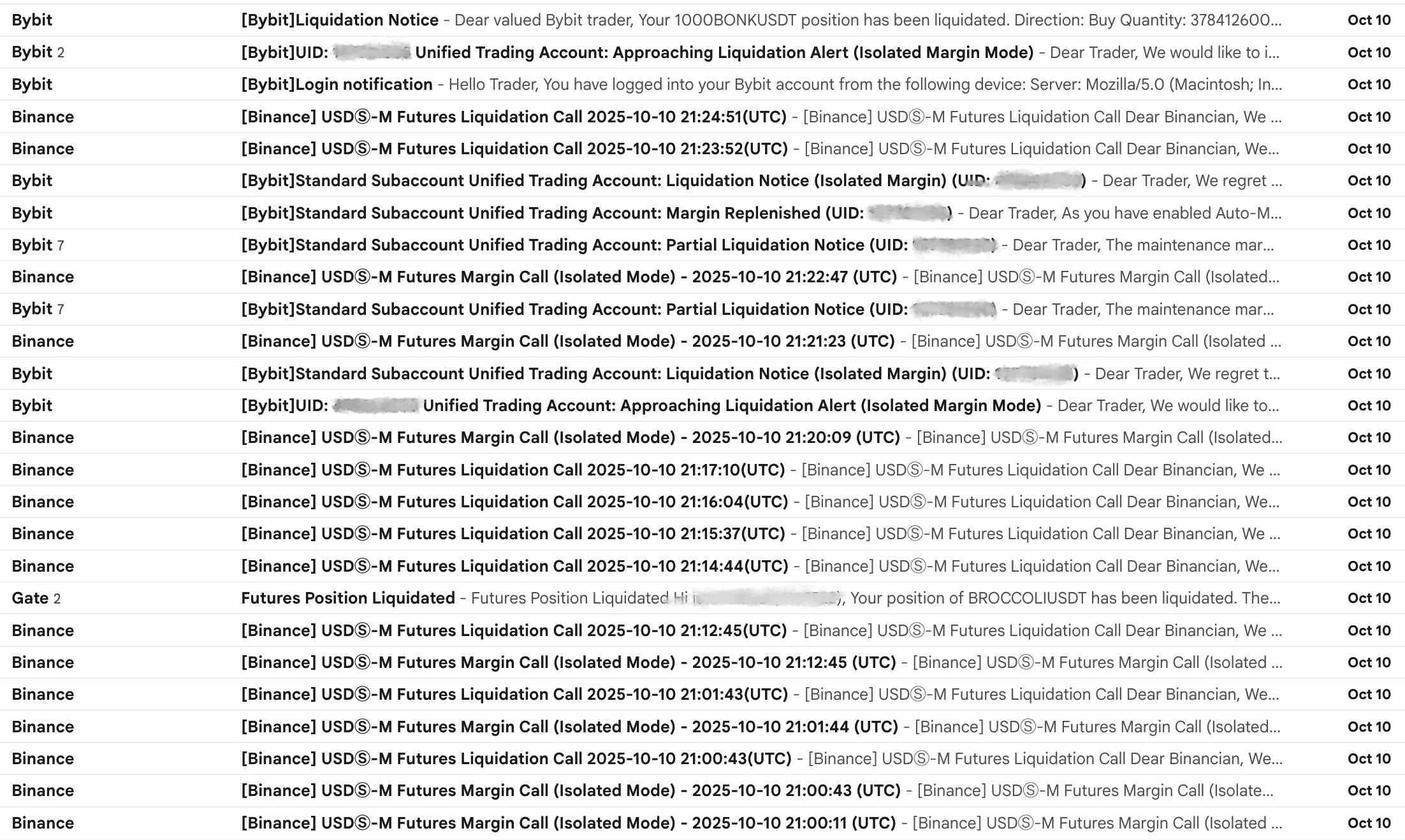

Yesterday’s liquidation event was the most brutal I’ve ever witnessed in my time in crypto.

I got completely wiped out — on every single perpetual position.

Eight figures gone.

Over $30 million+ at peak unrealized PnL, and still $15 million just before the liquidation cascade began.

Here’s what was wiped out:

$BONK

$FARTCOIN

$POPCAT

$PNUT

$CAT

$APEX

…and more

I also lost roughly 80% of my $ASTER position that was used as collateral on a DeFi lending protocol.

What’s Left and What Comes Next

I withdrew the remaining $1 million, fully liquidated it, and rotated into $BONK and $4, because I believe both now offer far better risk/reward:

$BONK – because I refuse to be the “Bonk guy” without BONK exposure. I still believe in its deca-billion-dollar potential and will continue adding over time, God willing.

$4 – because I’m still convinced the BNB season will last through this quarter, and $4 is the most asymmetric bet to play it.

Thankfully, most of my $USELESS holdings were in spot, not perps, so the losses there were minimal — aside from a few hundred thousand in unrealized PnL.

I remain absolutely convinced that $USELESS is the memecoin to watch for outperformance.

It’s a multi-billion-dollar idea currently trading for pennies, and I believe it will end the cycle as a top-5 memecoin — easily a 10x+ from here.

What Happened Yesterday?

Many are blaming Trump’s recent China tariff comments — but this wasn’t the first time this year.

Tariff headlines alone couldn’t have caused such a violent meltdown across nearly all altcoins and memecoins.

While $BTC and $ETH dropped ~13%, countless alts crashed 70–99% within minutes.

For example, $ATOM fell from $4 to $0.001 on Binance — a 99.9% crash in minutes.

No one could have reacted in time.

It’s also worth noting: this crash was exclusive to centralized exchanges (CEXs).

These tokens never reached such lows on DEXs.

That points strongly toward market maker or CEX-side liquidity failures as the real cause.

Why This Was Unprecedented

Exchange systems broke across the board:

Stop-losses failed, orders didn’t fill, margin couldn’t be added, and platforms froze within minutes.

The liquidation cascade happened so fast that almost nobody could react — not even seasoned traders.

I stepped away from my desk briefly, came back ten minutes later… and everything was gone.

It was worse than the COVID crash.

A true black swan event.

Accepting Responsibility

You can call it manipulation, unnatural, whatever — and you’d probably be right.

But as a trader, I can only focus on what I can control.

Blaming the system doesn’t help me grow.

I win if I make money trading; I lose if I lose money trading. End of story.

I’m sure we’ll hear more soon about what really happened that night — hopefully bringing closure for many.

Why I’m Writing This

I know this post will go viral.

Some people waited for this moment to say: “He was too greedy.”

Others will laugh and say: “I told you so.”

But I’m writing this for two reasons:

Transparency has always been central to the “Bonk guy” persona — so others can learn.

Some traders lost everything yesterday. If my story helps even one person hold on and find hope, it’s worth sharing.

No Sympathy Needed

Let me be clear:

I don’t need empathy.

I don’t need donations.

It was a massive loss — but I’m okay.

I’m in a good mental state.

I’ve always been detached from money and material things, which helps in times like this.

Lessons Learned

At its peak, my $BONK trade grew from $16K to an eight-figure PnL.

If I did it once, I can do it again.

Could I have predicted system-wide exchange failures that nuked 70–90% of alts in minutes? No.

Could I have managed risk better? Maybe.

But what’s done is done.

From here on, I’ll:

Rely less on leverage

Sharpen risk management

Build stronger protection against exchange-side risks

All that matters now is what happens next.

Still Bullish

I don’t believe the bull run is over.

I don’t believe the Q4 rally is gone.

I’m doubling down — with focus, conviction, and a bit of humor.

Every cycle brings new challenges and new chances.

This is mine.

And I intend to rise from it — not for validation, but for myself.

To Everyone Who Lost Everything

PERSIST.

SURVIVE.

DON’T GIVE UP.

If you need a break, take it.

If you’re struggling, seek help.

Take care of your health — it matters more than any chart.

Remember: these gains and losses are just numbers on a screen until realized.

You’ve made it before. You can make it again.

The most profitable part of the cycle is still ahead of us.

Final Thoughts

This event reminded me that no matter how prepared you think you are, you’re never completely shielded from systemic shocks —

but you can always control your response.

I’m rebuilding my framework with that truth in mind.

I’m once again an underdog.

But this is not the end of my story.

God willing.

Crypto just experienced the largest liquidation event ever — over $19B in leveraged positions and 1.6M traders wiped out in a single day. Triggered by Trumps tariff shock, the cascade revealed extreme leverage but may set the stage for a strong rebound.

The Kobeissi Letter/2 days ago

Trump’s sudden cancellation of his China meeting and threat of “massive tariffs” wiped $1.2T from U.S. markets in minutes. But analysts argue this is a bargaining move — not the start of a trade war. With AI investment and rate cuts ahead, dips may be buying opportunities.

The Kobeissi Letter/2 days ago

Trump’s 100% China tariff announcement sparked a historic crypto crash — $1T wiped out, $20B+ liquidated, and whales profiting $200M. But history shows: every purge resets the market. Leverage flushed, panic peaked — the next leg may just be starting.

Bull Theory/2 days ago

Many traders woke up to closed positions due to Auto-Deleveraging (ADL) — the last line of defense in perps markets when liquidity dries up. This thread breaks down how ADL works, why it’s triggered, and why even winning traders can get forced out.

Doug Colkitt/2 days ago

Bitcoin’s surge to $125K masks growing macro fragility. Liquidity buffers are vanishing, insider selling is surging, and institutional cracks are widening. The report warns of a coming liquidity crunch — and a potential market reversal in Q4.

Doctor Profit/7 days ago

The last stage of a bull market isn’t about chasing every pump — it’s about discipline. Scale out, focus on winners, stay liquid, and preserve capital. Wealth is built across cycles, not in one sprint.

cevo/2025.10.03

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A whale exchanged WIF and Bonk positions for Fartcoin!

2024.12.25 11:01:14

MoreHot Articles

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 promising AI Agent cryptos

2024.12.05

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link