Auto-Deleveraging Explained: Why Perps Markets Sometimes “Kick You Off the Plane”

Doug Colkitt

Doug Colkitt

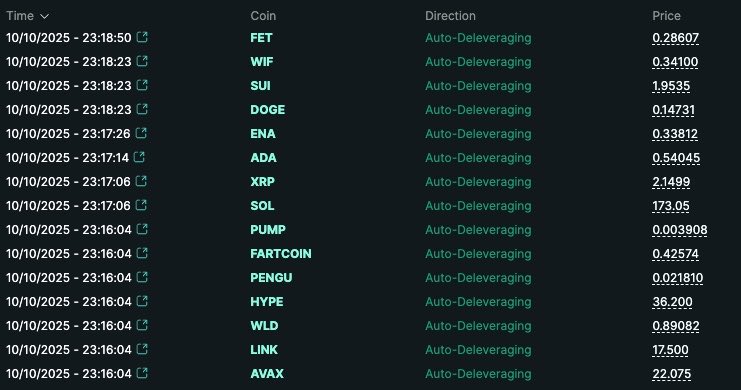

1/ Since a lot of people are waking up to see their perps positions closed and wondering what the hell “Auto-Deleveraging” means, here’s a quick and dirty primer.

What is ADL? How does it work? And why does it exist?

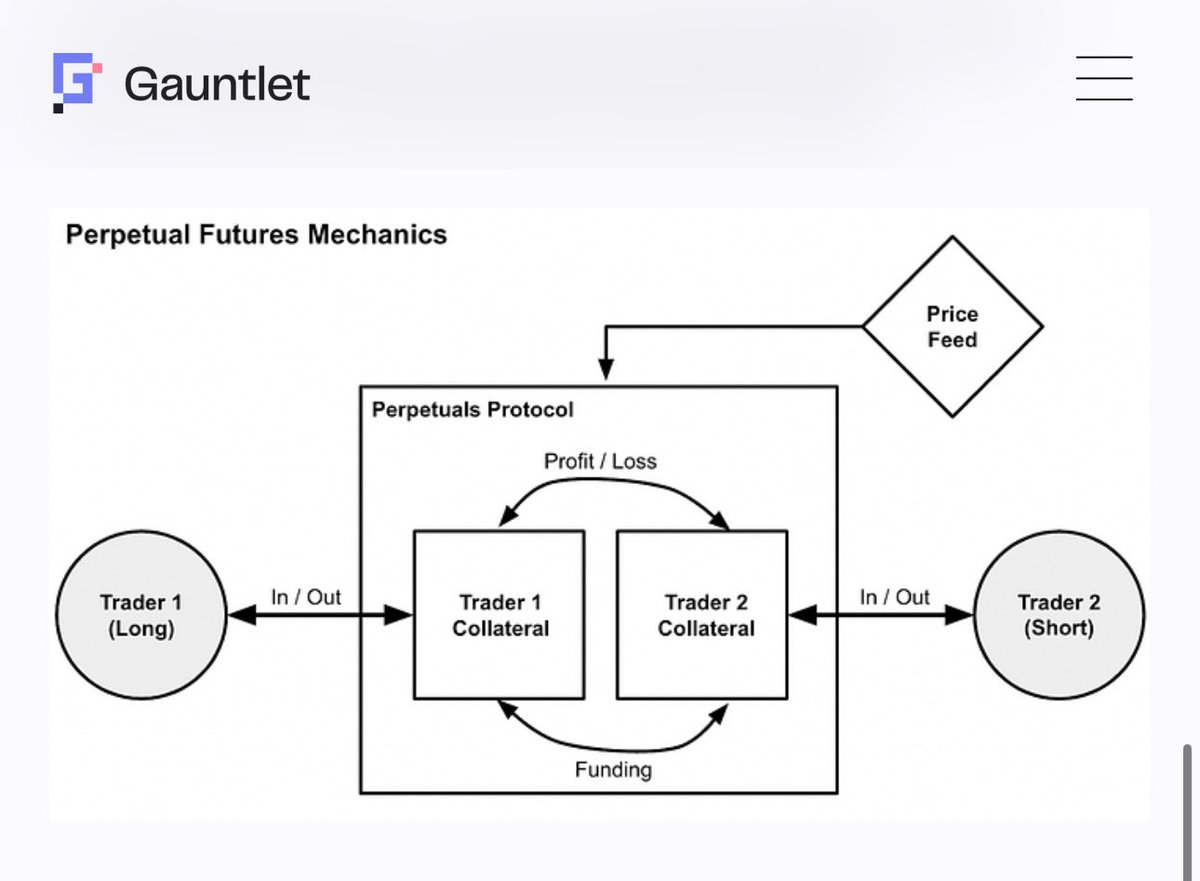

2/ First of all it’s helpful to zoom out and think about what a perp market is and what it does at a very abstract level.

When you have a perps market like BTC, a fun fact is there’s no actual BTC in that system at all. There’s just a big pile of cash sitting doing nothing.

3/ All a perps market (or any derivatives market for that matter) does is shuffle a big pile of cash around among its participants. It uses a set of rules engineered to create a synthetic BTC like instrument within a system that actually has no BTC

4/ The most important rule: There are longs and there are shorts, and longs have to exactly balance shorts. Or else it doesn’t work. And both put cash (in the form of margin) into the pile.

The pile then gets shuffled around depending on if the price of BTC goes up or down

5/ Along the way, the price of BTC moves too far and some participants lose all their cash. At that point, they’re kicked out (“liquidated”)

Remember longs can only win if shorts have money to lose (and vice versa). So no more money means you can’t play at the table anymore.

6/ And every short has to be exactly balanced by a solvent long. If a long in the system has no more money left to lose, then by definition that means a short on the other side has no more money left to gain. (And vice versa)

7/ So if a long is liquidated, exactly one of two things must happen. Either A) a new long position must enter the system, with fresh cash to refill the pile.

Or B) a short on the other side must close out to bring the system back into balance.

8/ In the happy path this all happens through normal market forces. Nobody has to be forced to do anything, as long as we find willing buyers at fair market prices.

In a normal liquidation this starts by using the same order book ordinary perps market trading happens on.

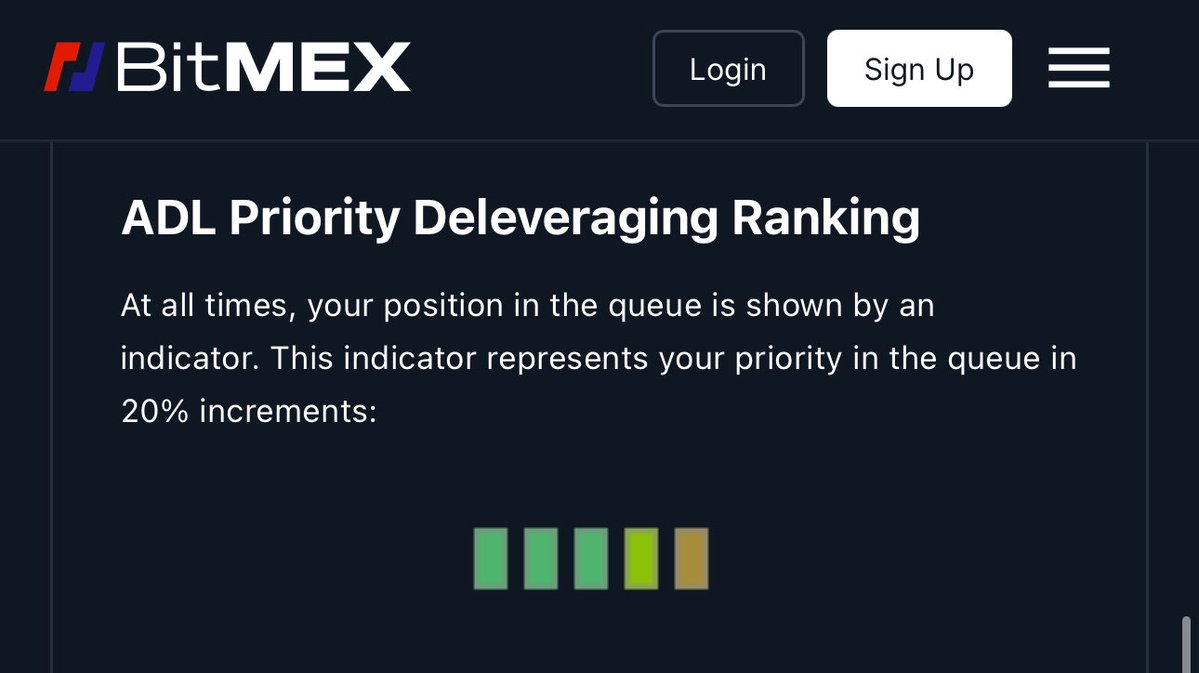

9/ In a healthy, liquid perps market this should be fine. A liquidated long gets sold into the book. The best bid in the order book fills it, and now that bid replaces the original as a new long in the system with fresh cash to top off the pile. Everybody’s happy.

10/ But sometimes there just isn’t enough liquidity in the book. Or at the very least enough liquidity to fill the trade without the original position losing more money than it has left.

That would be a problem, since it means not enough cash to go around for everyone else.

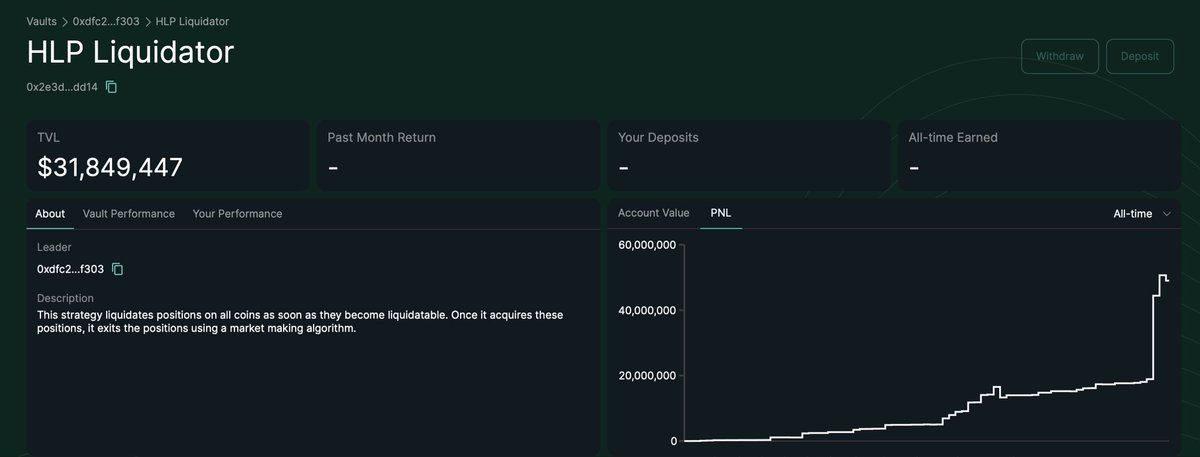

11/ Typically the next step in the waterfall is a “vault” or “insurance fund” that steps in. The vault is a special pool of capital supported by the exchange. It’s willing to step in and absorb the other side of liquidations during extraordinary liquidity events.

12/ And typically the vault tends to be quite profitable over time because it has the chance to buy at deep discounts and sell at high spikes. For example the Hyperliquid vault made about $40 million in an hour tonight.

13/ But the vault is not magic. It’s just one more participant in the broader system. Like anyone else it has to put cash in the pile, follow the same rules, and only has a finite amount or risk and capital it can contribute.

There has to be a final step in the waterfall.

14/ And that’s when we reach auto deleveraging. It’s the last resort and a (hopefully) rare occurrence because it involves forcing people out of their position instead of paying them.

It happens infrequently enough that even seasoned perps traders are often barely aware of it

15/ One way to think of it is like an overbooked airline flight. First use market forces to solve the overcrowding. The airline offers higher and higher bids for any passenger willing to take the night flight. But eventually if no one bites, someone has to be kicked off the plane

16/ If the longs are out of money, and no one is willing to come in and take their place, then the system has no choice but to send at least some shorts home and close their positions.

The process used to select who and at what price to close out varies a lot between exchanges

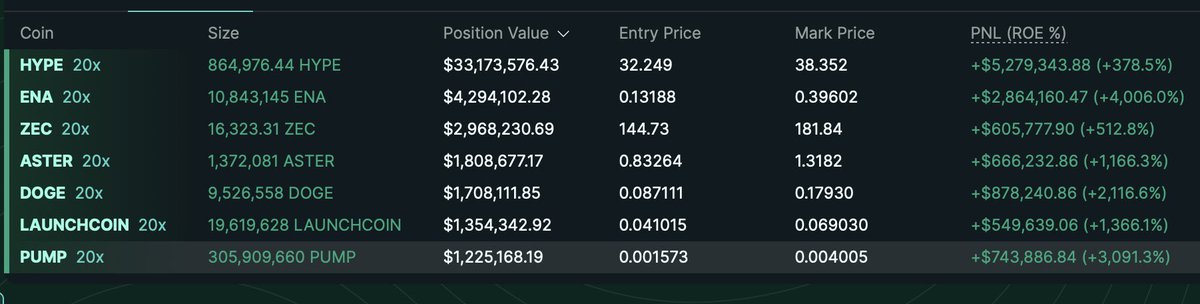

17/ Typically what happens is the ADL system will select positions on the winning side to close out using a ranking system based off 1) most profit; 2) leverage; and 3) size.

Ie the biggest, most profitable whales get sent home first.

18/ People naturally get upset at ADL because it feels unfair. You’re forced out of a position right when you’re winning the hardest. But it does need to exist at some level. No exchange no matter how great can guarantee you an infinite stream of losers on the other side.

19/ Think of it like being on a hot steak in poker. You show up to a casino and crush everyone at the table. And then you go to the next table and crush everyone there. And then the next table. Eventually everyone else at the casino runs out of chips. That’s ADL

20/ The beautiful thing about perps markets is they’re all zero sum, so the system can never be insolvent in the aggregate

There’s not even real BTC to lose value. Just a big boring pile of cash. Like thermodynamics, in the system as a whole, value is never created or destroyed

21/ ADL is kind of like reaching the end of the Truman Show. Perps markets build this very beautiful simulation of the underlying spot

But at the of the day it’s all imaginary. Most of the time we don’t have to think about it… but sometimes we hit the edge of the simulation

After losing over $30M in the largest crypto liquidation event ever, a top trader reflects on what went wrong, the lessons learned about leverage and risk, and why he’s staying optimistic. It’s not the end — just the start of his next chapter.

Unipcs (aka 'Bonk Guy')/24 hours ago

Crypto just experienced the largest liquidation event ever — over $19B in leveraged positions and 1.6M traders wiped out in a single day. Triggered by Trumps tariff shock, the cascade revealed extreme leverage but may set the stage for a strong rebound.

The Kobeissi Letter/2 days ago

Trump’s sudden cancellation of his China meeting and threat of “massive tariffs” wiped $1.2T from U.S. markets in minutes. But analysts argue this is a bargaining move — not the start of a trade war. With AI investment and rate cuts ahead, dips may be buying opportunities.

The Kobeissi Letter/2 days ago

Trump’s 100% China tariff announcement sparked a historic crypto crash — $1T wiped out, $20B+ liquidated, and whales profiting $200M. But history shows: every purge resets the market. Leverage flushed, panic peaked — the next leg may just be starting.

Bull Theory/2 days ago

Bitcoin’s surge to $125K masks growing macro fragility. Liquidity buffers are vanishing, insider selling is surging, and institutional cracks are widening. The report warns of a coming liquidity crunch — and a potential market reversal in Q4.

Doctor Profit/2025.10.06

The last stage of a bull market isn’t about chasing every pump — it’s about discipline. Scale out, focus on winners, stay liquid, and preserve capital. Wealth is built across cycles, not in one sprint.

cevo/2025.10.03

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A whale exchanged WIF and Bonk positions for Fartcoin!

2024.12.25 11:01:14

MoreHot Articles

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 promising AI Agent cryptos

2024.12.05

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link