Trump Sparks $1.2T Market Selloff — But This Might Be the Dip to Buy

The Kobeissi Letter

The Kobeissi Letter

What just happened?

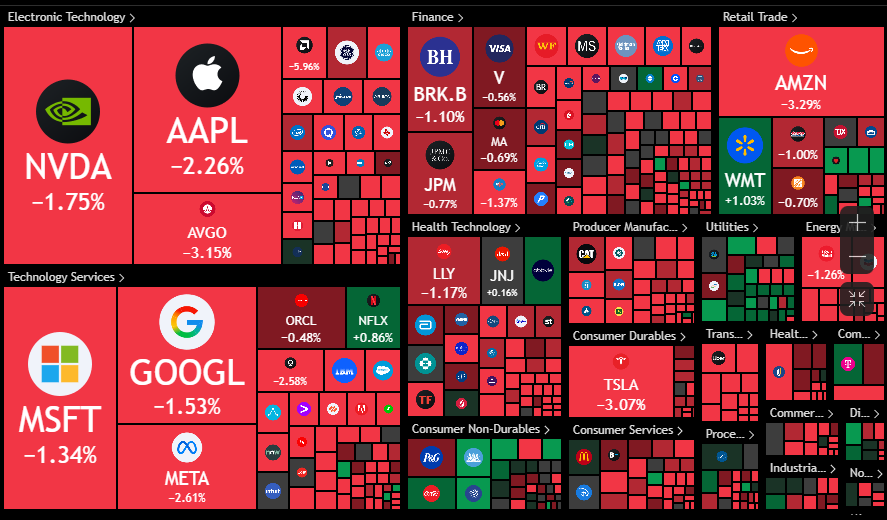

At 10:57 AM ET, President Trump canceled his meeting with China and said "massive" tariff increases are coming.

40 minutes later, the S&P 500 erased -$1.2 TRILLION of market cap.

Is this dip a BUYING opportunity? Let us explain.

(a thread)

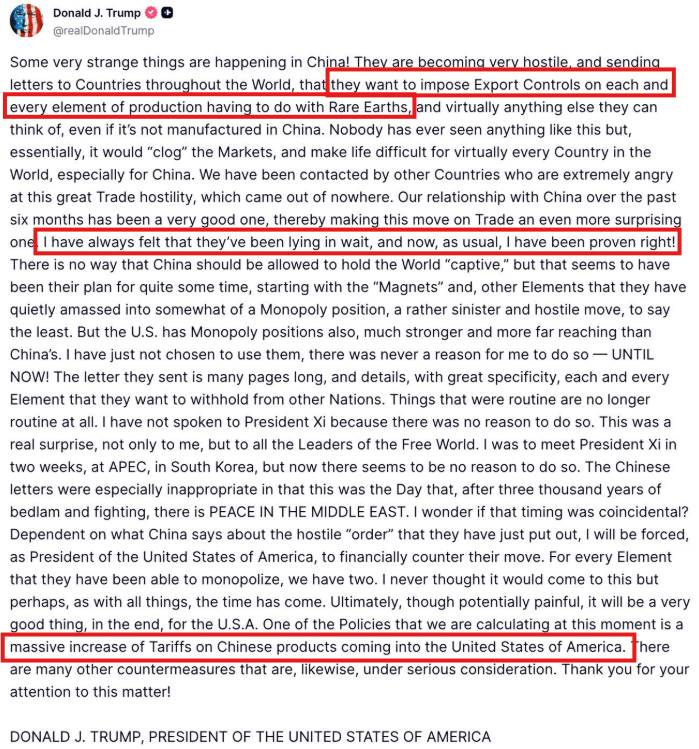

Here is the statement that President Trump posted today.

He accused China of "lying" and imposing export controls on rare earth metals.

Trump cancelled his meeting in 2 weeks with China's President Xi and said "massive" tariff increases are coming.

So, what does it all mean?

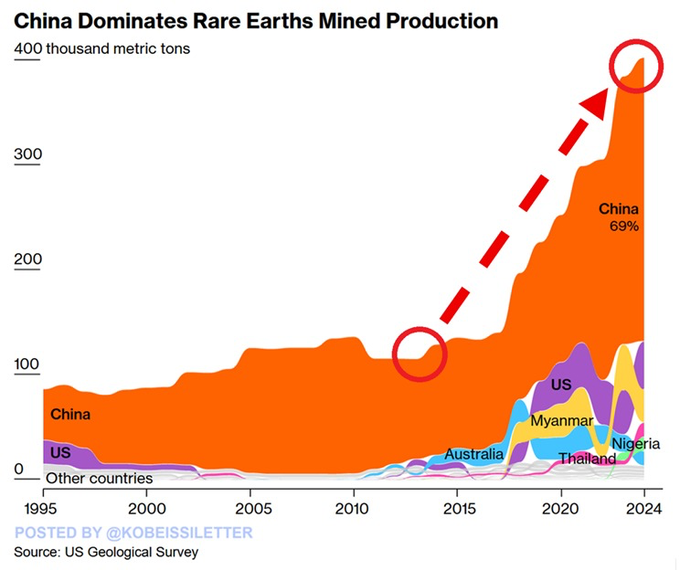

Rare earths have been very important for Trump.

Between a Ukraine deal and the US-China trade war, Trump has prioritized rare earths.

These metals are CRUCIAL for the production of weapons, chips, AI, and strategic leverage.

The US gets ~70% of its rare earths from China.

When the first US-China trade deal was signed on May 12th, rare earths were a critical component.

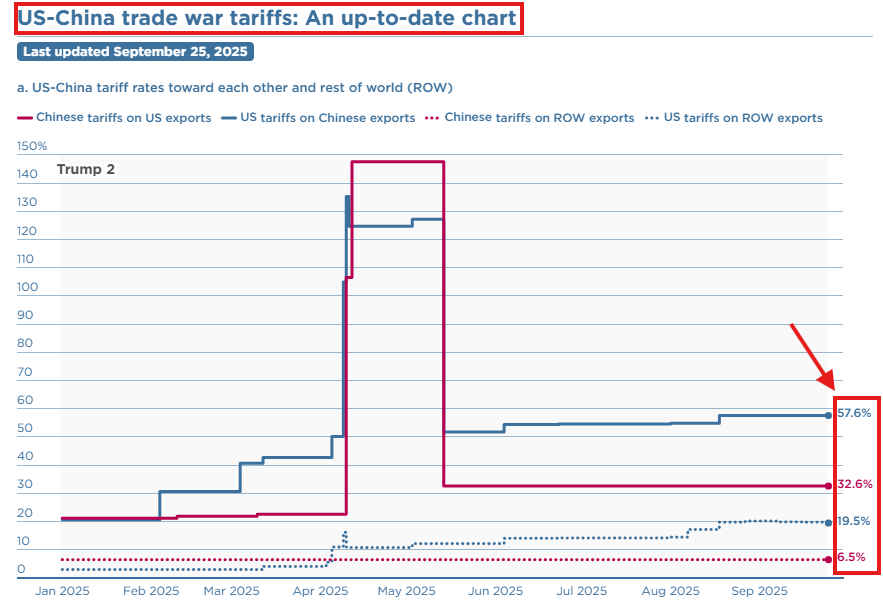

Now, President Trump claims that China is attempting to impose export controls on these metals.

The market collapsed on this headline on fears of the trade war returning.

But, we believe the market is in a VASTLY different situation now than in April 2025.

It is clear now more than ever that the trade deal is becoming largely focused on China.

We believe today's statement is a bargaining chip.

As a result, we think this dip will be BOUGHT.

It's also worth noting that most of the tariff news is priced-in.

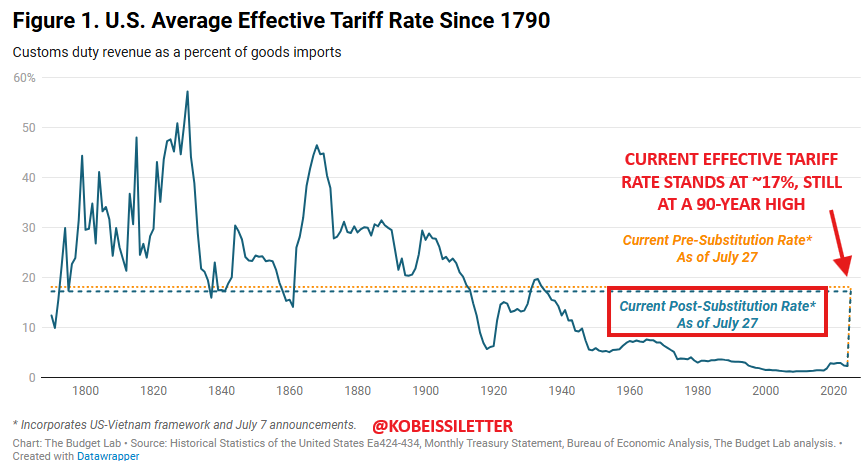

The US effective tariff rate still stands at 17.3%, the highest since 1935.

Markets have known this for months now and the rally was technically overbought.

We view today's Trump post as a "reason" to selloff.

Meanwhile, Fed rate cuts will resume as the labor market clearly deteriorates.

Underemployment is at 8.1%, the highest since 2021.

All while 60% of items in CPI inflation are now rising by at least 3%.

As we continue to reiterate, asset owners will continue to be rewarded.

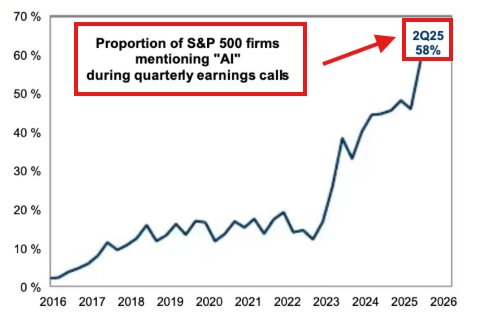

On top of this, the AI Revolution is accelerating at an unprecedented pace.

Magnificent 7 companies are investing over +$100B in CapEx PER QUARTER.

AI now accounts for ~40% of S&P 500 CapEx spend.

We believe fighting this unprecedented level of investment is dangerous.

Then, you have the USD rapidly declining, now down over -10% YTD.

This puts the USD on track for its worst annual performance since 1973.

As seen since 2021, nominal asset prices are strong in this macroeconomy backdrop.

Again, our view is that asset owners WILL be rewarded.

That said, we think the market will be taking a more "bumpy" road higher into year-end.

Trade war fears are resurfacing, Fed uncertainty remains, and the government is shut down.

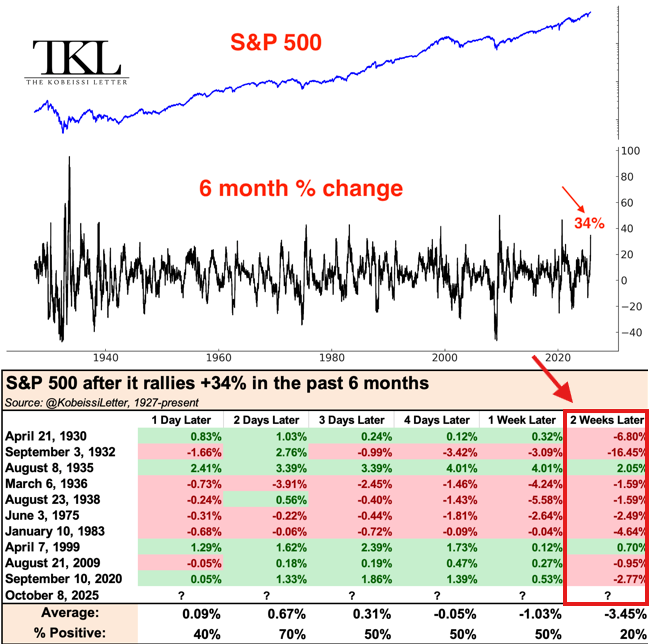

All while the S&P 500 is up +34% in 6 months, a move only seen 10 previous times since 1930.

Change is the only certainty in markets today - investors must adapt to it.

The macroeconomy is shifting and stocks, commodities, bonds, and crypto are investable.

Overall, we believe the return of a prolonged trade war is highly unlikely.

Tariff headlines are near-term noise amid the AI Revolution and rate cuts into inflation.

We believe asset owners will be rewarded.

After losing over $30M in the largest crypto liquidation event ever, a top trader reflects on what went wrong, the lessons learned about leverage and risk, and why he’s staying optimistic. It’s not the end — just the start of his next chapter.

Unipcs (aka 'Bonk Guy')/24 hours ago

Crypto just experienced the largest liquidation event ever — over $19B in leveraged positions and 1.6M traders wiped out in a single day. Triggered by Trumps tariff shock, the cascade revealed extreme leverage but may set the stage for a strong rebound.

The Kobeissi Letter/2 days ago

Trump’s 100% China tariff announcement sparked a historic crypto crash — $1T wiped out, $20B+ liquidated, and whales profiting $200M. But history shows: every purge resets the market. Leverage flushed, panic peaked — the next leg may just be starting.

Bull Theory/2 days ago

Many traders woke up to closed positions due to Auto-Deleveraging (ADL) — the last line of defense in perps markets when liquidity dries up. This thread breaks down how ADL works, why it’s triggered, and why even winning traders can get forced out.

Doug Colkitt/2 days ago

Bitcoin’s surge to $125K masks growing macro fragility. Liquidity buffers are vanishing, insider selling is surging, and institutional cracks are widening. The report warns of a coming liquidity crunch — and a potential market reversal in Q4.

Doctor Profit/2025.10.06

The last stage of a bull market isn’t about chasing every pump — it’s about discipline. Scale out, focus on winners, stay liquid, and preserve capital. Wealth is built across cycles, not in one sprint.

cevo/2025.10.03

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A whale exchanged WIF and Bonk positions for Fartcoin!

2024.12.25 11:01:14

MoreHot Articles

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 promising AI Agent cryptos

2024.12.05

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link