Trump vs. Powell: Fed Showdown Could Shake Crypto Markets

DanteX

DanteX

Jerome Powell will be FIRED in April

Rates will be cut by 2% on next FOMC meeting

Next target: $BTC - $150K, $ETH - $5K, $SOL - $500

Here's Trump's secret plan and when crypto will explode👇🧵

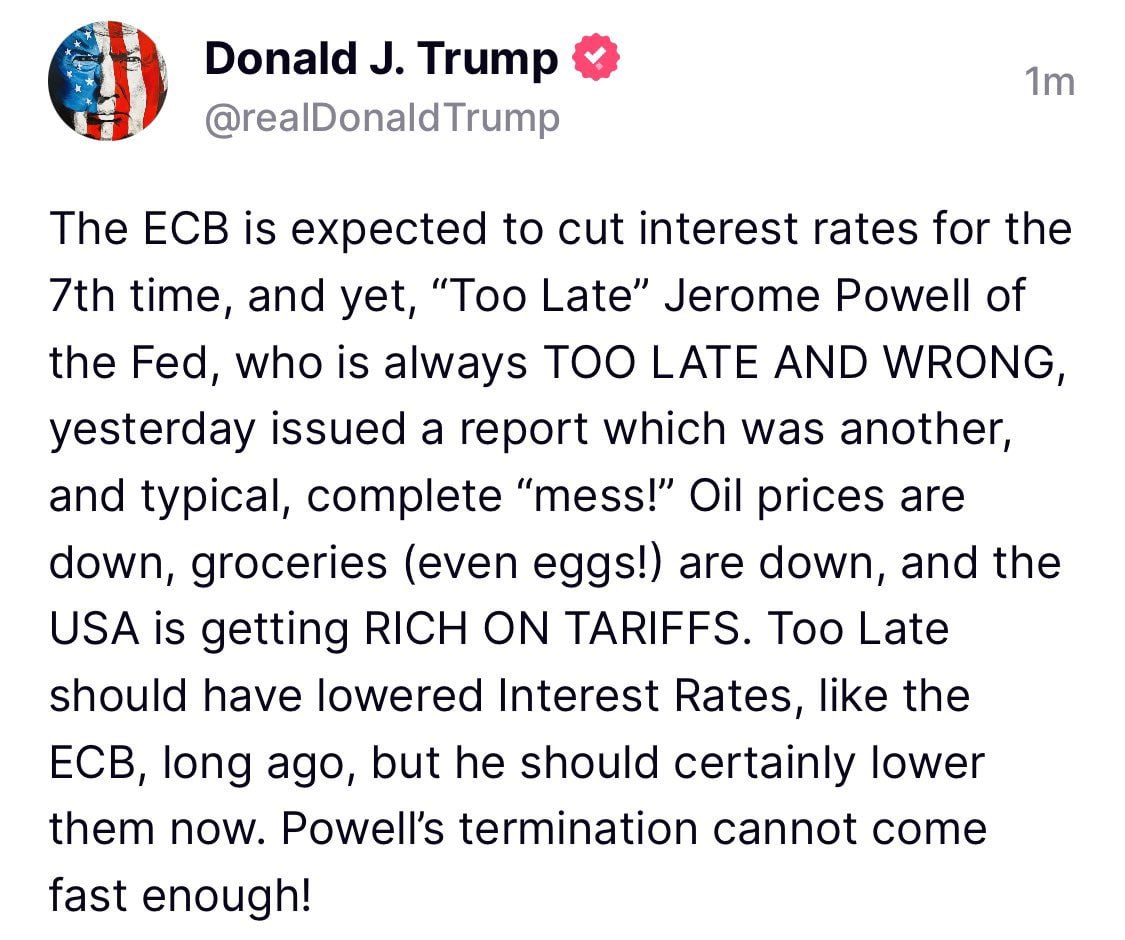

On April 17, Donald Trump called for the immediate dismissal of Federal Reserve Chair Jerome Powell, labeling him “consistently late” and unfit for the role

He criticized Powell for not cutting interest rates despite falling oil and food prices and referred to the Fed’s latest report as “a typical mess”

According to Trump, the Fed is acting too slowly and holding back the U.S. economy when conditions clearly call for easing

Trump pointed to the European Central Bank as a contrast, noting it has cut rates seven times since mid-2024

Meanwhile, the Fed has only made one 1% reduction in the same period and maintains rates at 4.25–4.5%

He believes this gap is putting the U.S. at a disadvantage in global markets and slowing job creation

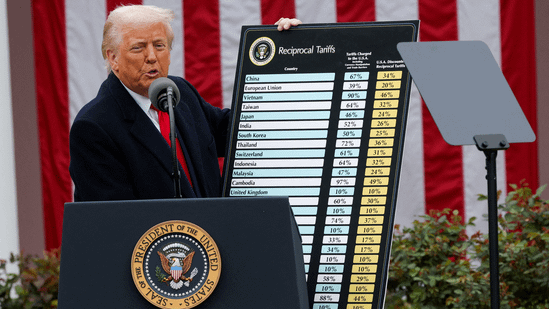

Trump claims that the U.S. is generating billions in revenue each week from tariffs imposed earlier this month

He argues this income offsets inflation risks and strengthens the economic case for rate cuts

For him, strong tariff-driven inflows plus declining consumer prices create a clear opportunity for monetary easing

On April 2, Trump announced tariffs between 10% and 49% on imports from 185 countries and up to 145% on Chinese goods

He described this as a strategy to defend domestic industries and rebalance trade flows

Critics warn the policy could drive up input costs and prompt retaliatory actions from key trade partners

Still, Trump insists these tariffs will stimulate manufacturing and make the U.S. more self-reliant

In response, Jerome Powell warned that the tariffs could increase inflationary pressure and disrupt economic growth

He said the Fed needs more data to assess how tariffs affect supply chains, pricing, and consumer confidence

Powell emphasized that monetary decisions must be based on long-term stability, not short-term political narratives

Powell reminded the public that the Federal Reserve operates independently and that the President lacks the authority to remove its chair

He declared he will not resign and intends to serve his full term, which ends in May 2026

He stressed that policy decisions will continue to be guided by economic indicators rather than political pressure

Nevertheless, Trump escalated the situation by filing a request to the Supreme Court on April 11

His aim is to gain legal power to dismiss the heads of independent agencies, including potentially the Fed chair

If approved, this could set a constitutional precedent and allow Trump to bypass traditional institutional limits

Trump’s conflict with Powell is not new - it dates back to 2018, when Trump himself appointed Powell

By 2019, Trump was already calling the Fed “the only problem” with the economy and blamed Powell for tightening too aggressively

Now, with Trump back in office, his pressure has become more direct and legally strategic

Market reaction to these developments has been mixed

Following Powell’s recent comments, the dollar dipped slightly while U.S. equity markets rose between 0.2% and 1.6%

Investors appear cautiously optimistic, but political interference remains a key source of uncertainty

The next Fed meeting on May 6–7 will be closely watched for any policy shifts or signals

Markets will look for clues on whether the Fed will proceed with rate cuts or maintain a cautious approach

The tone of the post-meeting statement could either ease tensions or further widen the divide with the White House

Treasury Secretary Scott Bessent confirmed that the Trump administration plans to begin identifying Powell’s potential successor this fall

This suggests that even without court approval, the White House is preparing to change Fed leadership after May 2026

But if the Supreme Court rules in Trump’s favor, that timeline could shift much sooner

Economists warn that undermining central bank independence could damage U.S. credibility and raise borrowing costs

A politically dominated Fed would lose market trust, making inflation control and crisis management far more difficult

These risks grow with every new attempt to subject the Fed to executive influence

Trump advocates for protectionism, low rates, and direct political control over economic levers

Powell stands for institutional stability, data-driven decisions, and inflation management

This is more than a personality clash - it’s a collision between two economic philosophies

In the short term, Powell may delay rate cuts to avoid the appearance of yielding to political pressure

In the long term, continued attacks from the White House could weaken the Fed’s authority and destabilize expectations

The outcome of this confrontation may redefine the balance between democratic institutions and market governance in the U.S.

Bitwise predicts 2026 will redefine crypto: Bitcoin breaks its four-year cycle, ETFs surpass 100 launches, Polymarket hits record highs, and institutional adoption accelerates. From stablecoin controversies to vault growth, the next era of crypto is set to unfold.

Ryan Rasmussen/1 days ago

United Stables has launched $U, a fully backed stablecoin on BNB Chain and Ethereum. Integrated with leading DeFi protocols, $U unifies major stablecoins into one liquidity layer and supports AI-driven, programmable payments for the next era of digital finance.

UTechStables/1 days ago

Crypto isn’t dying; it’s dissolving. The self-contained “crypto industry” built for degens is ending as blockchain tech quietly becomes infrastructure for finance, payments, and AI. The future belongs to builders solving real-world problems, not farming points.

Dougie/2 days ago

Bittensor isn’t just another crypto—it’s the market-based solution to AI’s “central planning” problem. Rooted in Coase, Hayek, and Mises’ theories, $TAO decentralizes intelligence production, cutting coordination costs and disrupting Big Tech’s AI monopoly.

Andy/4 days ago

Despite a rate cut and $40B in T-bill purchases, Bitcoin and stocks sold off as traders took profits. With expectations overextended, Powell’s cautious tone and Oracle’s weak earnings triggered a synchronized dump—driven by hype, not fundamentals.

Bull Theory/2025.12.12

Token sales are evolving fast in 2026 — from Continuous Clearing Auctions and exchange-integrated launchpads to regulated tranches and community vesting. As the market matures, quality, compliance, and real user adoption will define the next wave of winners.

Stacy Muur/2025.12.09

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

A whale exchanged WIF and Bonk positions for Fartcoin!

2024.12.25 11:01:14

MoreHot Articles

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 promising AI Agent cryptos

2024.12.05

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link