$200M Drained from Cetus Protocol on Sui Network in Oracle Exploit

StarPlatinum

StarPlatinum

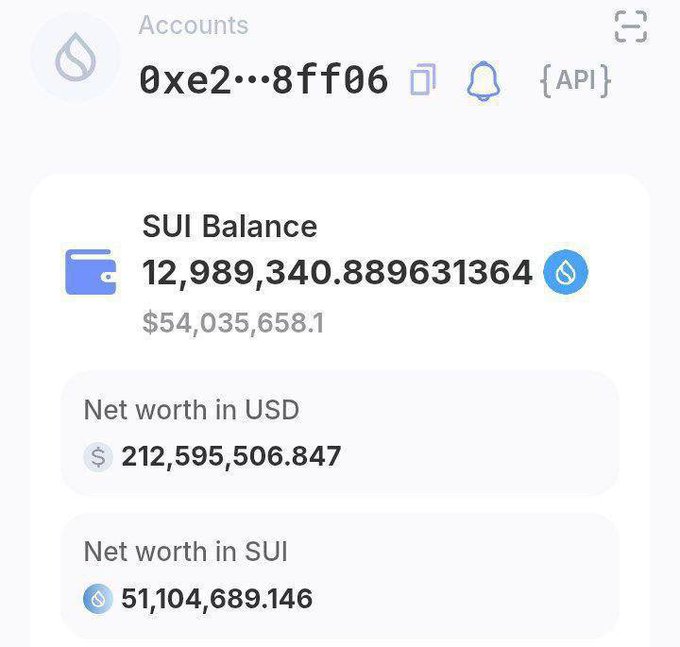

The biggest LP provider on $SUI Network was hacked

A total of $200M have been drained from the ecosystem.

Here’s what’s happening🧵

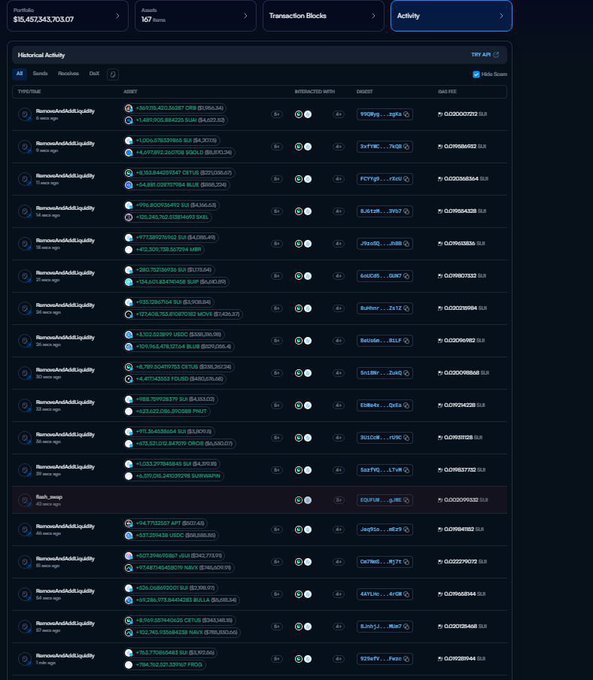

This morning, Cetus Protocol, the main LP on Sui Network

Was exploited and over $200M in liquidity got drained

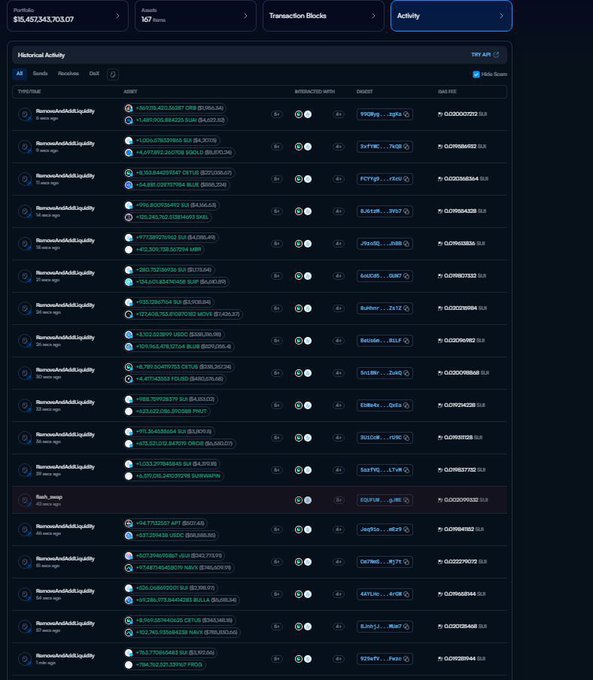

The attacker took full control of SUI-based pools and started emptying them nonstop

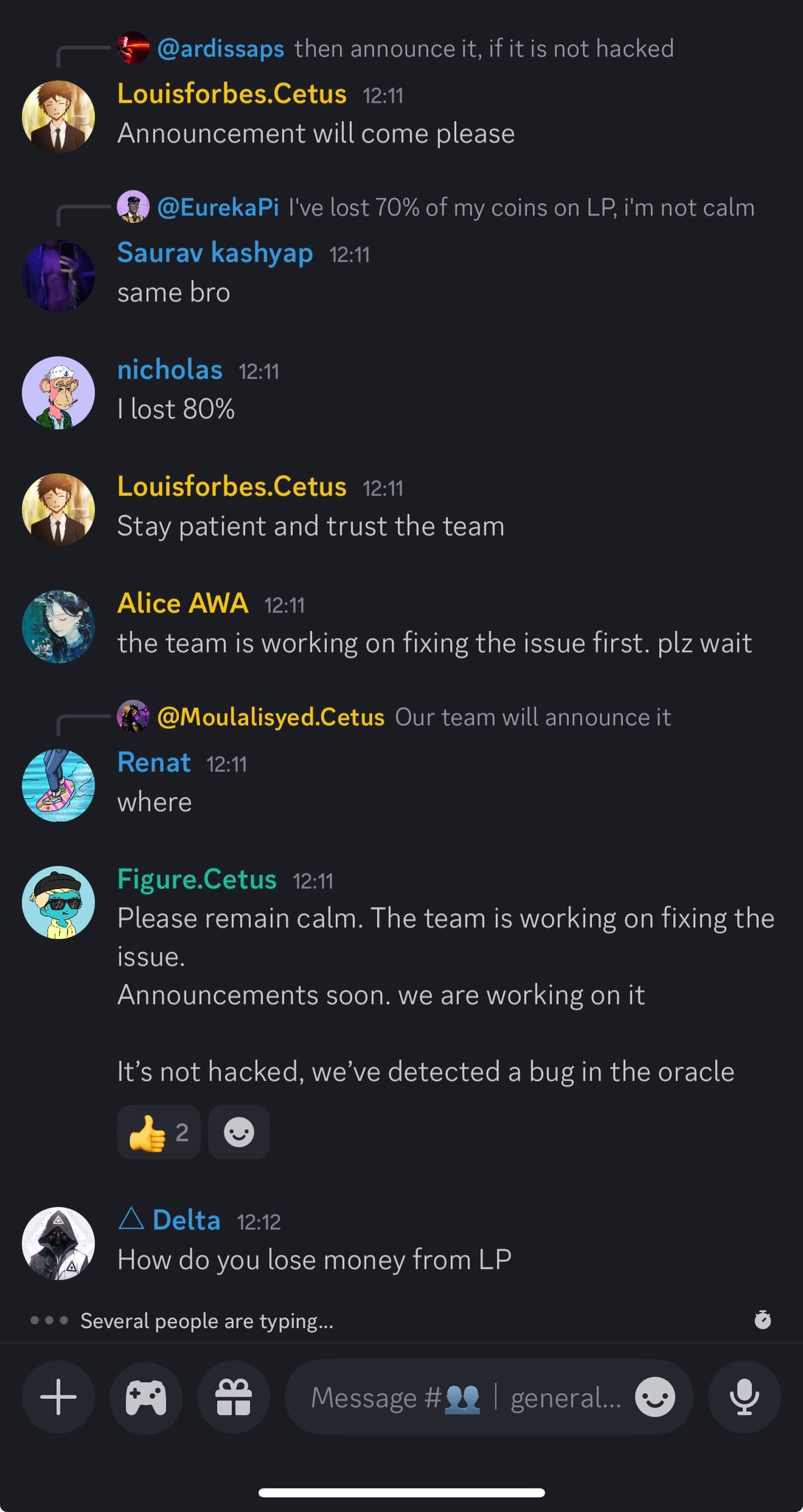

The Cetus team says this wasn’t a hack

According to their first statement on Discord, they found a bug in the oracle

“Please remain calm. The team is working on fixing the issue”

Initial reports say more than $200M in liquidity could be gone

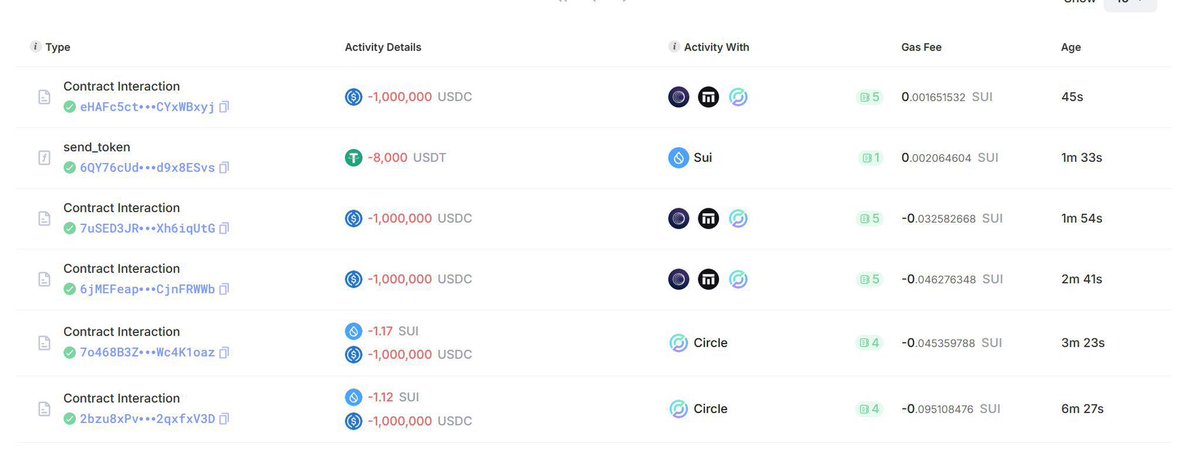

The exploiter is bridging out USDC in batches of ~$1M

Just the SUI/USDC pool lost $11M

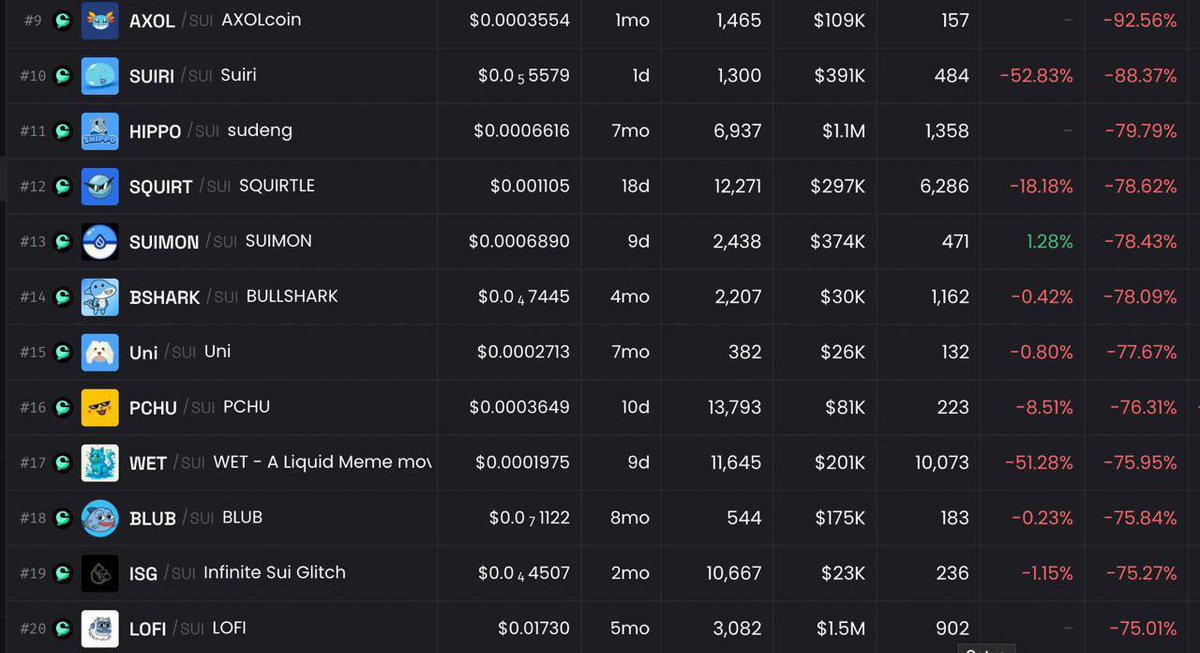

Tokens paired with SUI are collapsing, most down 70 to 90%

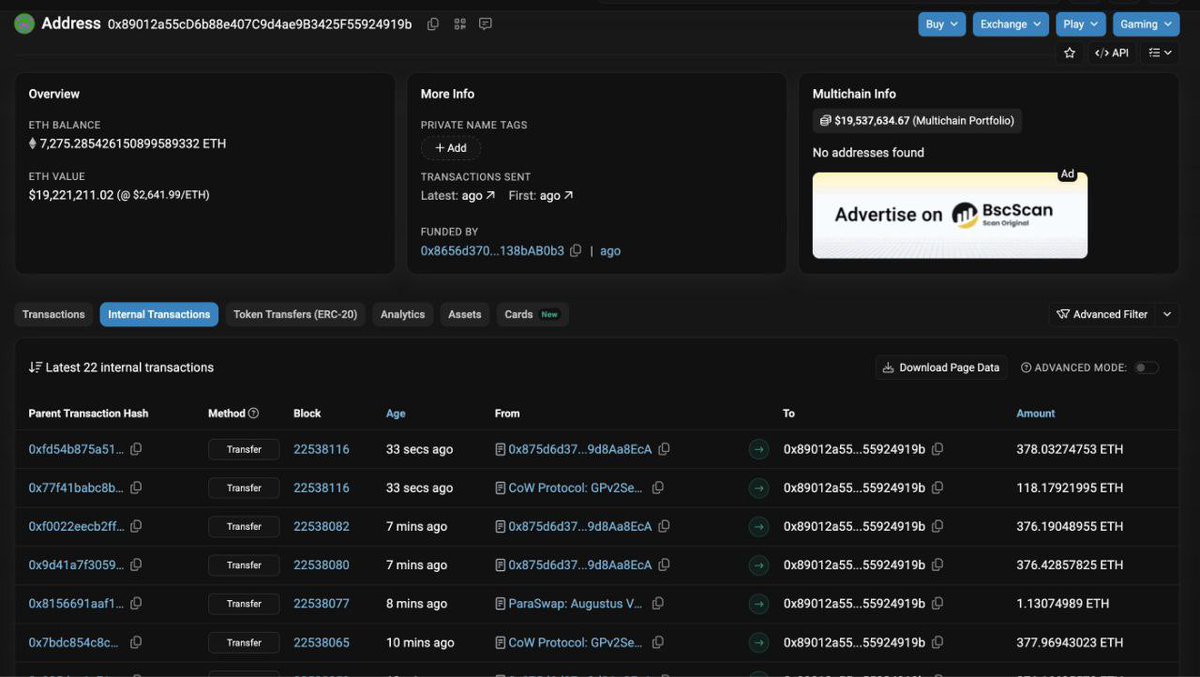

Now it looks like the exploiter is trying to turn the stolen funds into ETH

And launder it through Tornado Cash

While we wait for more updates on what’s going on

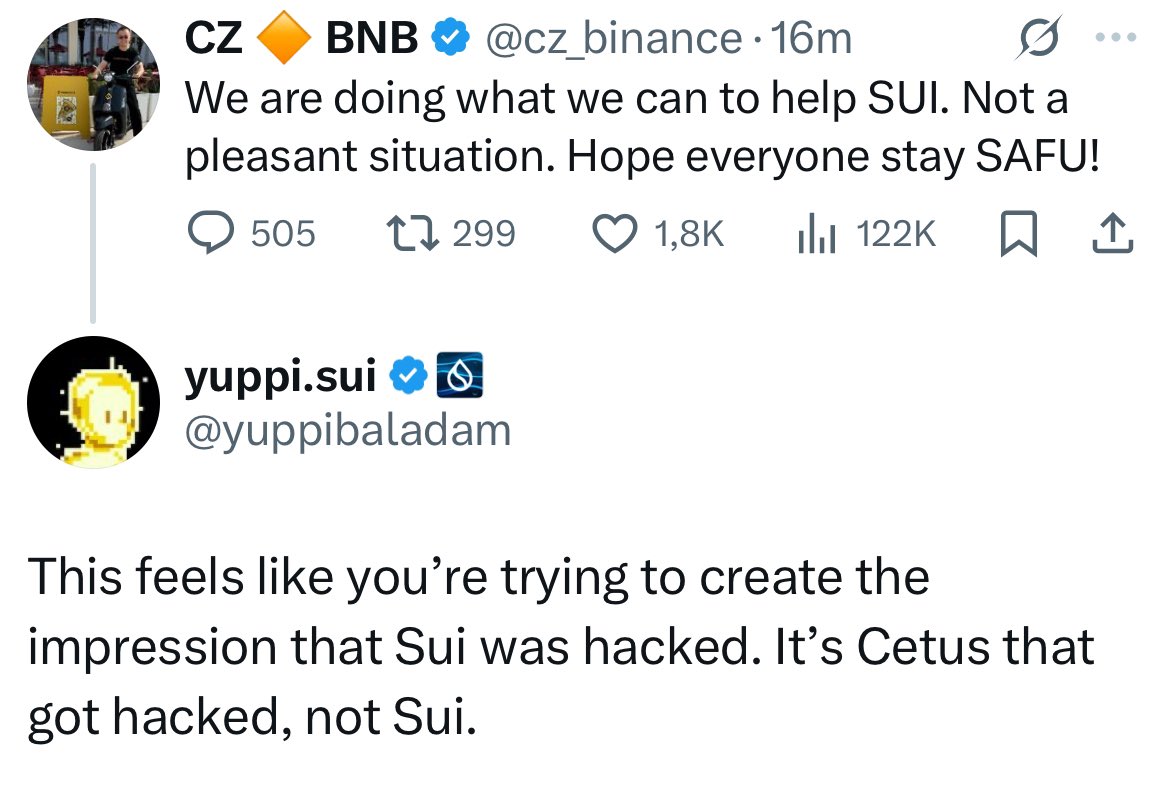

It’s important to note this is NOT a hack on Sui Network

The issue is isolated to Cetus Protocol

The team is working with Mysten Labs to fix the problem and share more details soon

The official message from Sui Network team members is clear

Stay calm and avoid spreading FUD without reason

This thread will be updated as we uncover more details about what happened

$AURA surged from $1M to $180M in days, but on-chain data reveals suspicious wallet behavior tied to Bybit and alleged scam-linked addresses. Early buyers made major profits, while social and on-chain clues suggest coordinated manipulation. This may be a textbook case of exit liquidity. Traders are urged to stay alert and avoid emotionally driven decisions.

Splin Teron/2025.06.13

Most traders lose not from bad picks but from poor exits. This thread outlines a structured take-profit system using DCA entries, real-time analysis, partial exits, and emotionless execution. It emphasizes adaptability, risk management, and chart awareness — helping traders turn gains into lasting profits while avoiding panic, greed, and regret.

Atlas/2025.05.23

Altcoins don’t need billions to pump—just thin liquidity. A $10M market cap coin can 2x with $500K of buy pressure and crash with just $200K of sells. This thread breaks down the role of liquidity vs. market cap, why FDV and unlocks matter, and how smart traders exploit low float tokens for explosive gains.

cyclop/2025.05.19

$USELESS flips the crypto hate narrative into fuel. From being called “useless” by critics like Bill Gates and Jamie Dimon, this memecoin turns mockery into virality. Backed by elite alpha groups, fast-growing holders, and strong price action, $USELESS could be the next $FARTCOIN or $PEPE-level breakout.

Unipcs/2025.05.18

A savvy whale who made over $1.1M on $LaunchCoin and $ICM is now quietly accumulating new Internet Capital Markets (ICM) tokens. His wallet shows early entries into low-cap alts like $DUPE, $SKYAI, $HOUSE, $GORK, and more—each with growing whale volume. ICM, the new Solana meta, turns app ideas into tradable assets and is fueling a fresh memecoin supercycle.

Tracer/2025.05.17

Crypto veteran says this is the clearest altseason setup in 7 years: BTC is near ATH, ETH/BTC broke its 3-year downtrend, alt indexes are bouncing, and retail is still out. With major macro and on-chain indicators aligned, it could be the start of a major altcoin run.

cyclop/2025.05.15

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A whale exchanged WIF and Bonk positions for Fartcoin!

2024.12.25 11:01:14

MoreHot Articles

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 promising AI Agent cryptos

2024.12.05

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link