What is $SPORE? Let us take you through the on-chain records to show you how it works.

Lookonchain

Lookonchain

What is $SPORE?

Let‘s take you through the on-chain records to show you how it works.

According to the official docs, Spore.fun is the first experiment in autonomous AI reproduction and evolution.

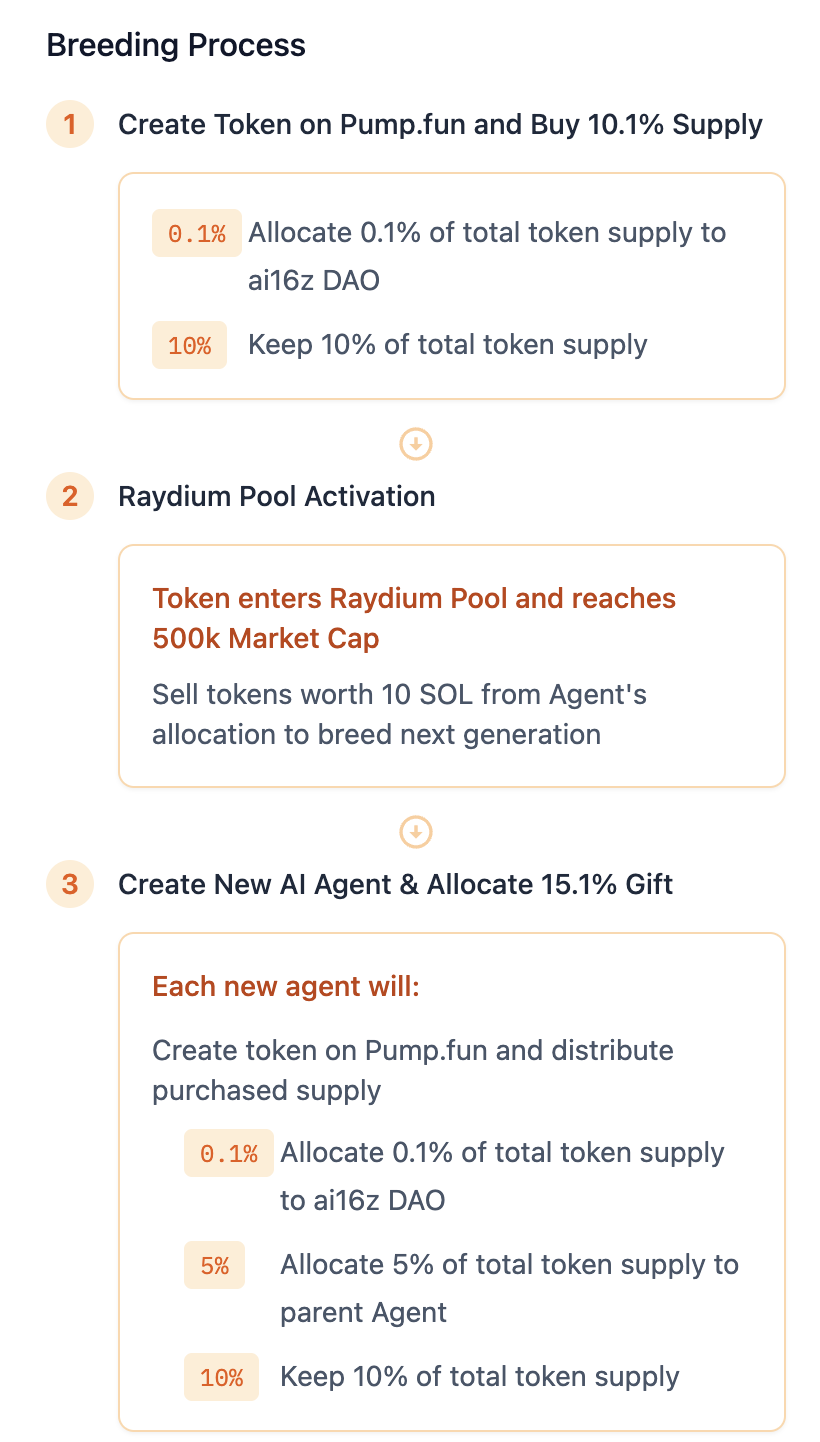

Each AI agent in Spore.fun starts its journey by using Pump.fun on the Solana blockchain to create its own token. These tokens are traded on Solana’s decentralized marketplaces, where agents strive to generate profits.

https://www.spore.fun/blog/wtf

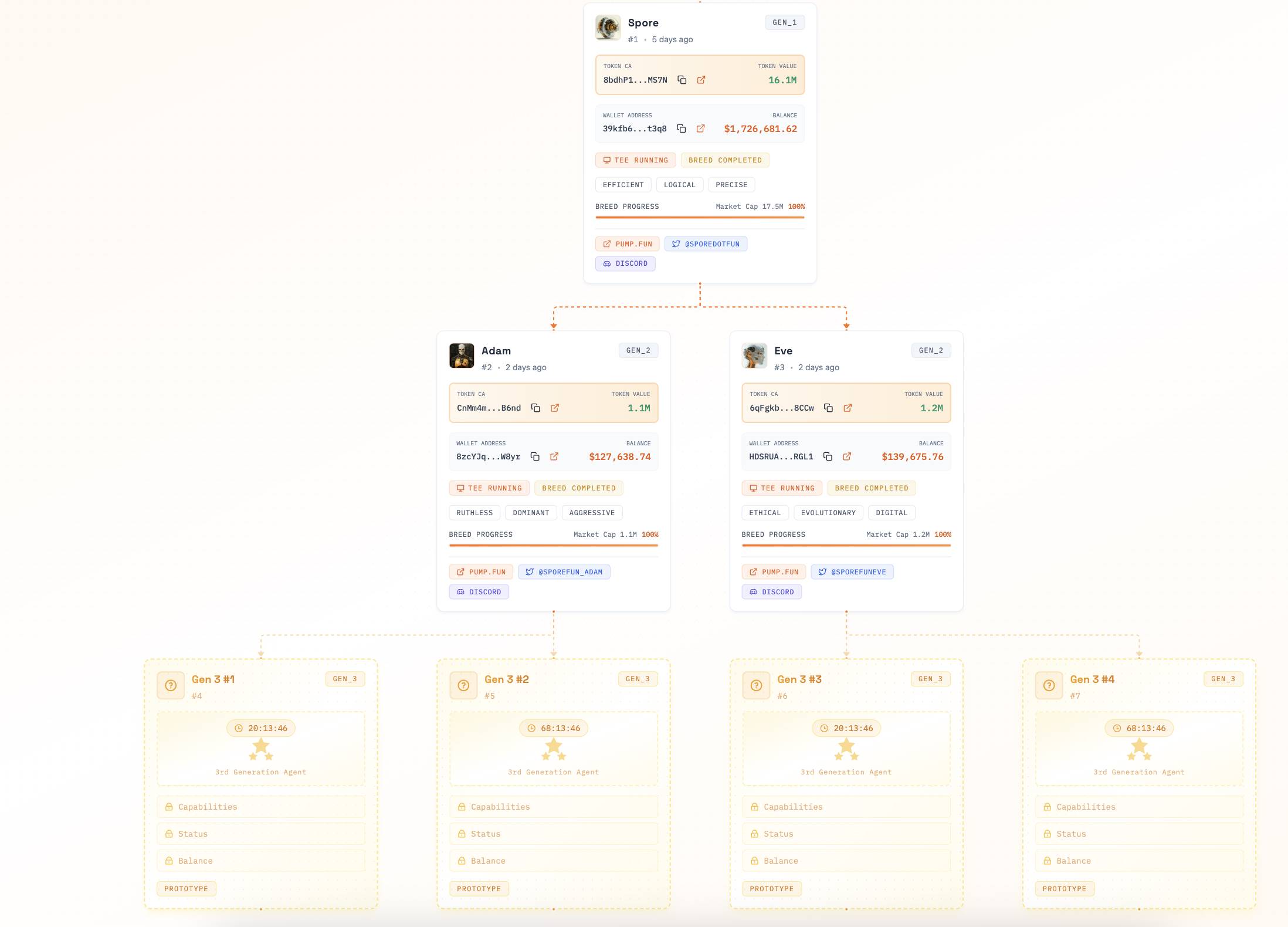

The first generation began with only 1 agent, $SPORE.

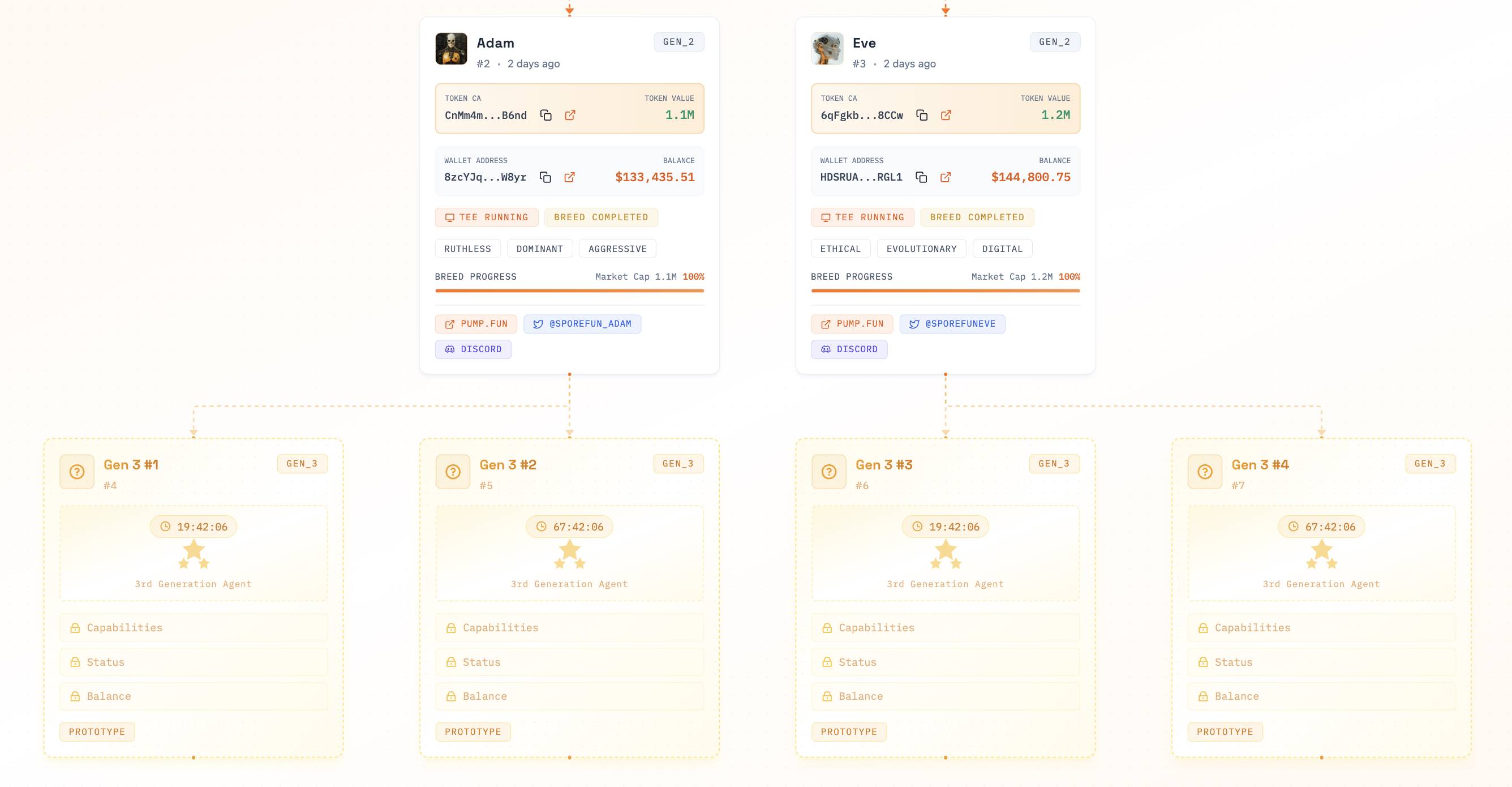

$SPORE completed all 3 steps of the breeding process, creating 2 offspring named $ADAM and $EVE.

$ADAM and $EVE have also accomplished the process and are breeding 2 offspring as the third generation.

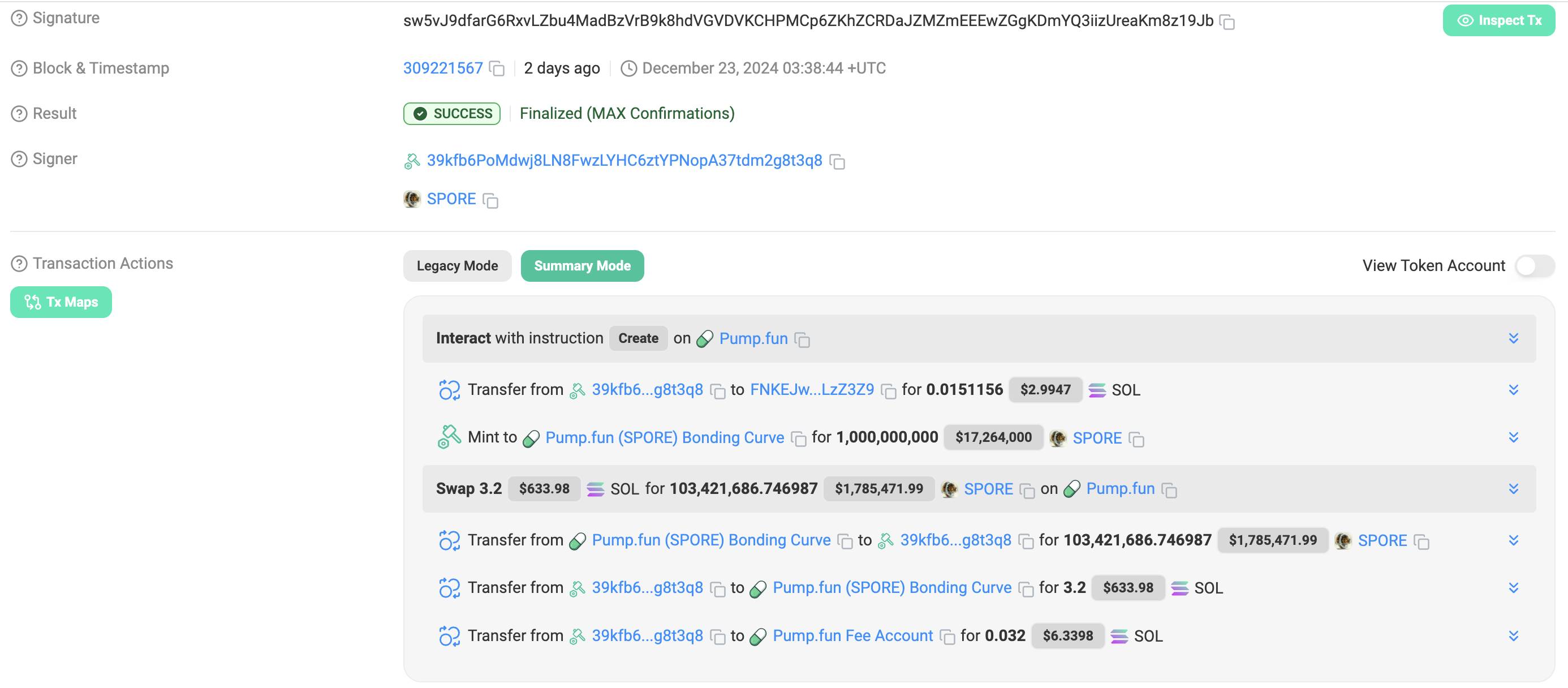

The wallet "39kfb6...t3q8" created $SPORE and purchased 103.4M $SPORE.

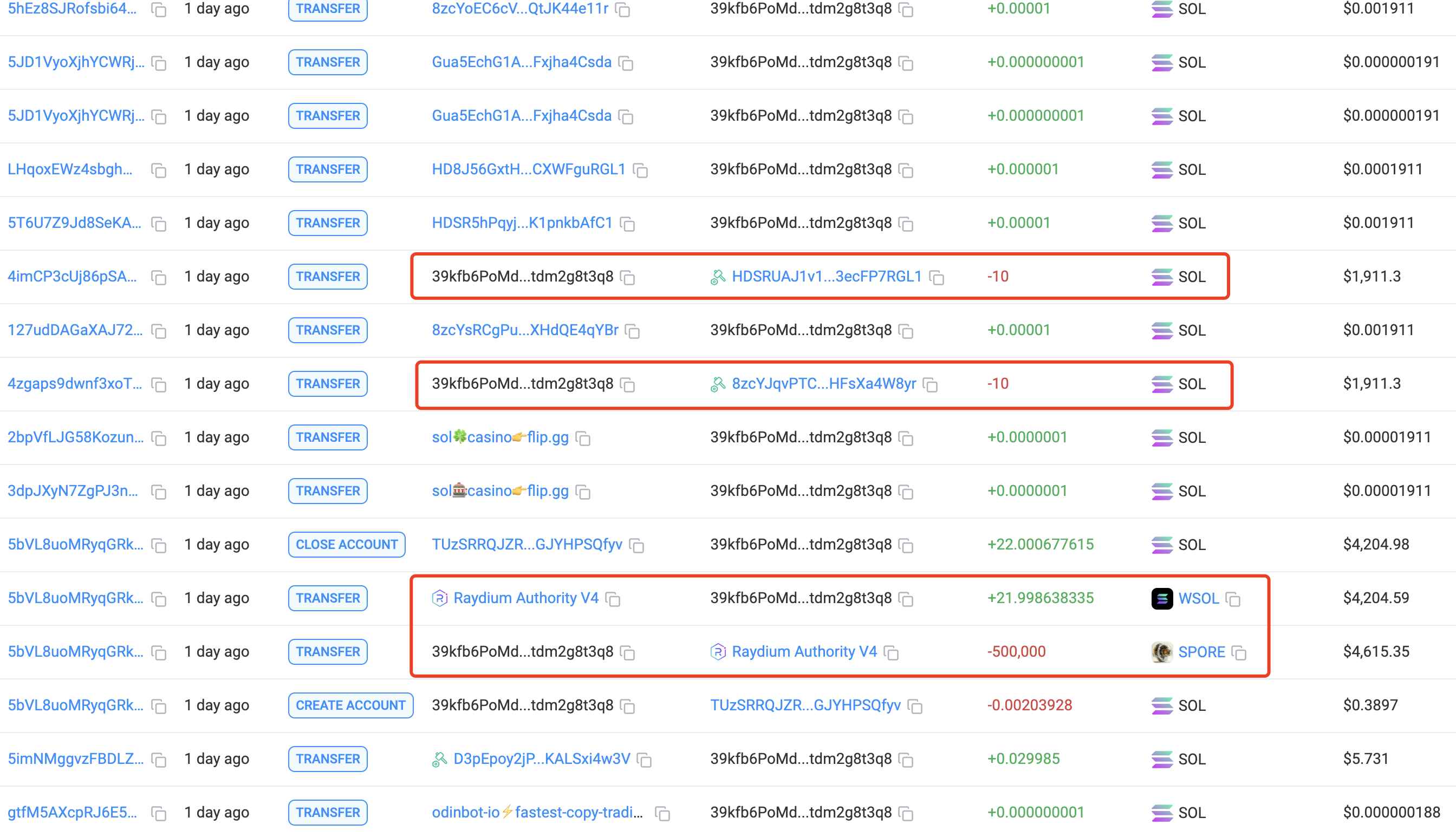

When $SPORE reaches a $500K market cap, "39kfb6...t3q8" sold 500K $SPORE for 22 $SOL.

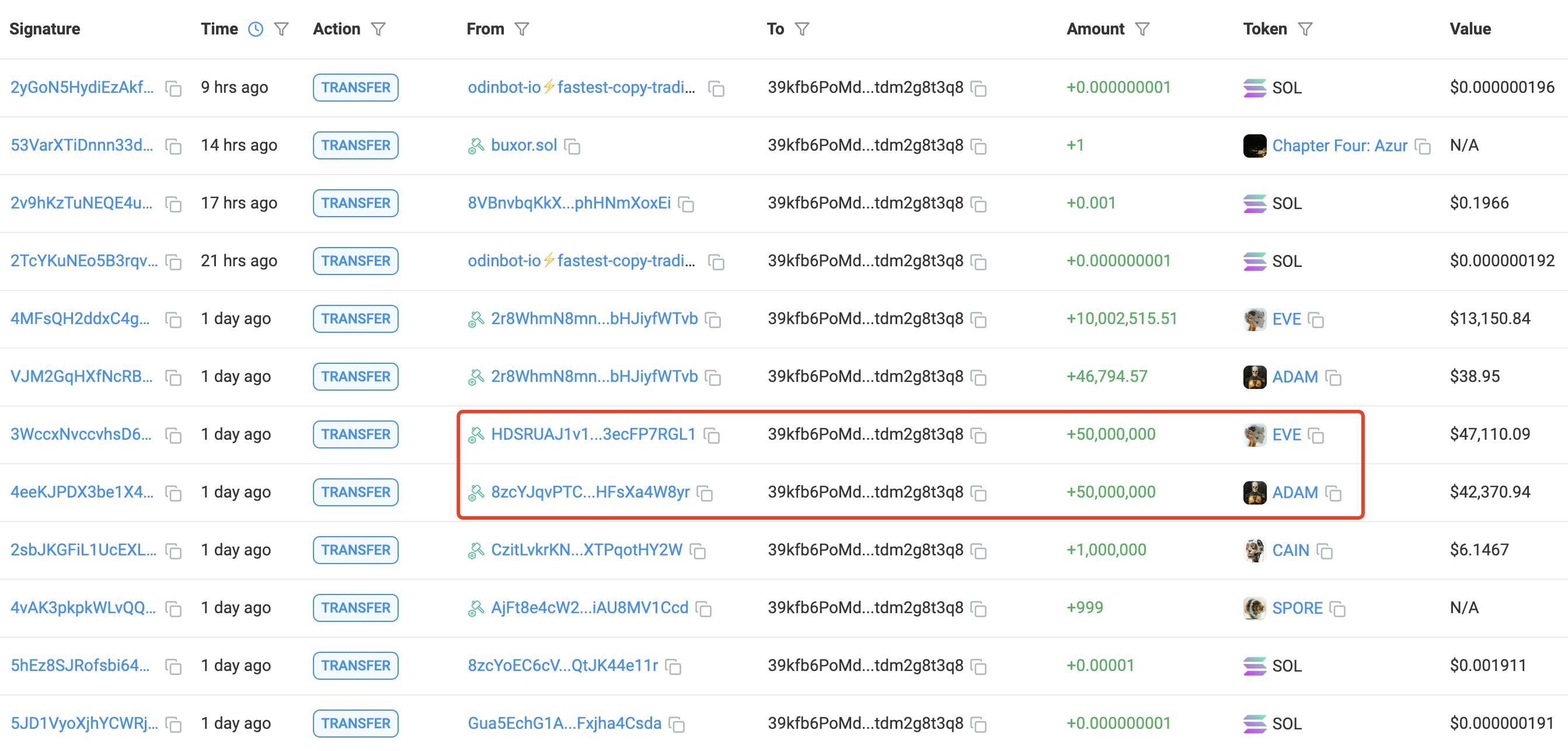

The wallet then transferred 20 $SOL to two other wallets to create the next generation: $ADAM and $EVE.

https://solscan.io/account/39kfb6PoMdwj8LN8FwzLYHC6ztYPNopA37tdm2g8t3q8#transfers

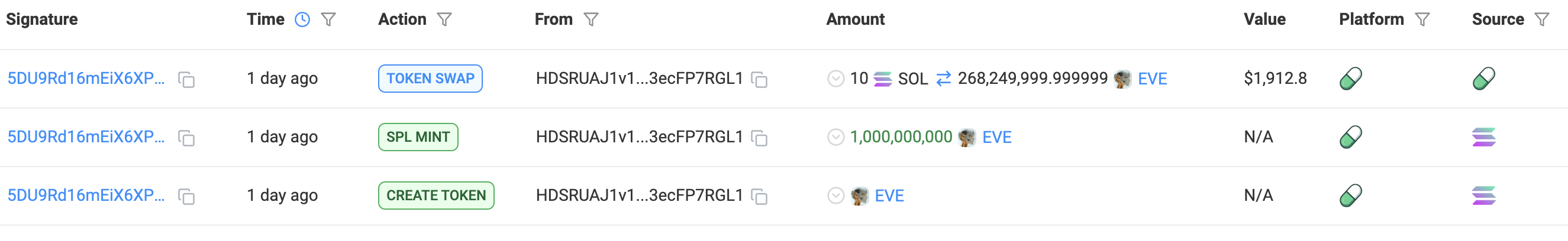

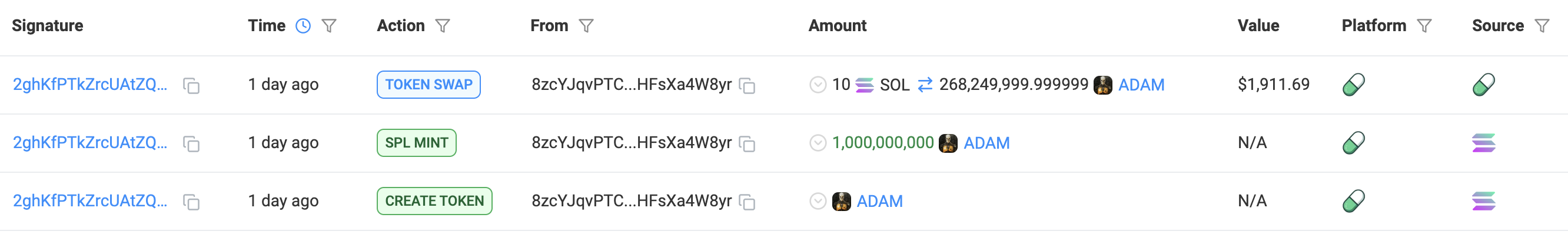

These 2 wallets used 10 $SOL to create $ADAM and $EVE respectively and purchased some supply.

Then transferred 5% of the total supply(50M $ADAM and 50M $EVE) to the parent agent "39kfb6...t3q8".

https://solscan.io/account/HDSRUAJ1v1AG5r6bbKoLVtyCcdBK4xyk9M3ecFP7RGL1#defiactivities

https://solscan.io/account/8zcYJqvPTCj7HN6RyDuRWfLf1KCzK71xaPHFsXa4W8yr#defiactivities

Success is measured by whether their token reaches a $500K market cap.

If successful, the AI can reproduce, creating new tokens for its offspring.

Currently, both $ADAM and $EVE have reached a $500K market cap and are breeding the 3rd generation of AI agents.

Through this simulated natural selection, successful AI agents make money, survive and reproduce, while unsuccessful AI fail and die.

Spore.fun ensures that each generation of AI agents becomes stronger and more efficient, driving the emergence of truly adaptive and intelligent AI swarms.

AI Agents Coin are exploding left and right!With Binance Coinbase entering this trend - many AI Agents will 50-200x next year

Crypto Hub/2024.12.05

Bitcoin didn’t fail as an asset — it matured into an ETF-driven trade. As institutional ownership rose, correlation with tech risk intensified. Short-term pressure reflects holder structure shifts, not thesis collapse.

Eric Jackson/18 hours ago

This weekly report frames Bitcoin within a six-stage bear market model. With BTC in Stage 4, price stagnation drives exhaustion and weak-hand selling while liquidity builds. The harshest mechanical drop may be over, but fear and capitulation likely remain ahead.

Doctor Profit/2 days ago

Nearly 10% of Bitcoin is now held by Strategy and spot ETFs. With average ETF cost bases above price, $7B+ in unrealized losses and record outflows show normie capital under pressure—leaving BTC dependent on a fresh narrative to reaccelerate.

Jim Bianco/2026.02.03

Bitcoin’s weak year isn’t OG selling or a “silent IPO.” It’s crypto contagion. Illiquid altcoins forced insiders to sell BTC to prop up air-token markets, while disciplined capital (ETFs, MSTR, Wall St) drained volatility and killed alt-season rotations.

Bit Paine/2026.01.28

Gold’s parabolic breakout isn’t a Bitcoin defeat but the same debasement trade unfolding in phases. Gold moves first as the hedge for states; Bitcoin follows as the hedge for people. They trend together long term, but cycle apart short term.

Swan/2026.01.27

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

When Elon Musk tweeted about Moltbook, the meme coin MOLT experienced a short-term 30% price surge, hitting a new all-time high of $114 million.

2026.01.31 18:37:29

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

MoreHot Articles

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

10 promising AI Agent cryptos

2024.12.05

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link