Before the 100x: How On-Chain Signals Exposed $WHITEWHALE Early

Cryptor

Cryptor

➥ How on-chain signals revealed $WHITEWHALE before the 100x

A deep dive into how multiple on-chain signals revealed $WHITEWHALE’s massive potential, showing accumulation, smart money flows, and supply dynamics before the 100x move.

Oct 13:

- More than two months ago, $WHITEWHALE launched on Pump.fun. It bonded and topped around ~80k MC, then died off.

- Price action was basically flat from Oct 13 to Dec 2. Another dead meme, right?

Dec 2:

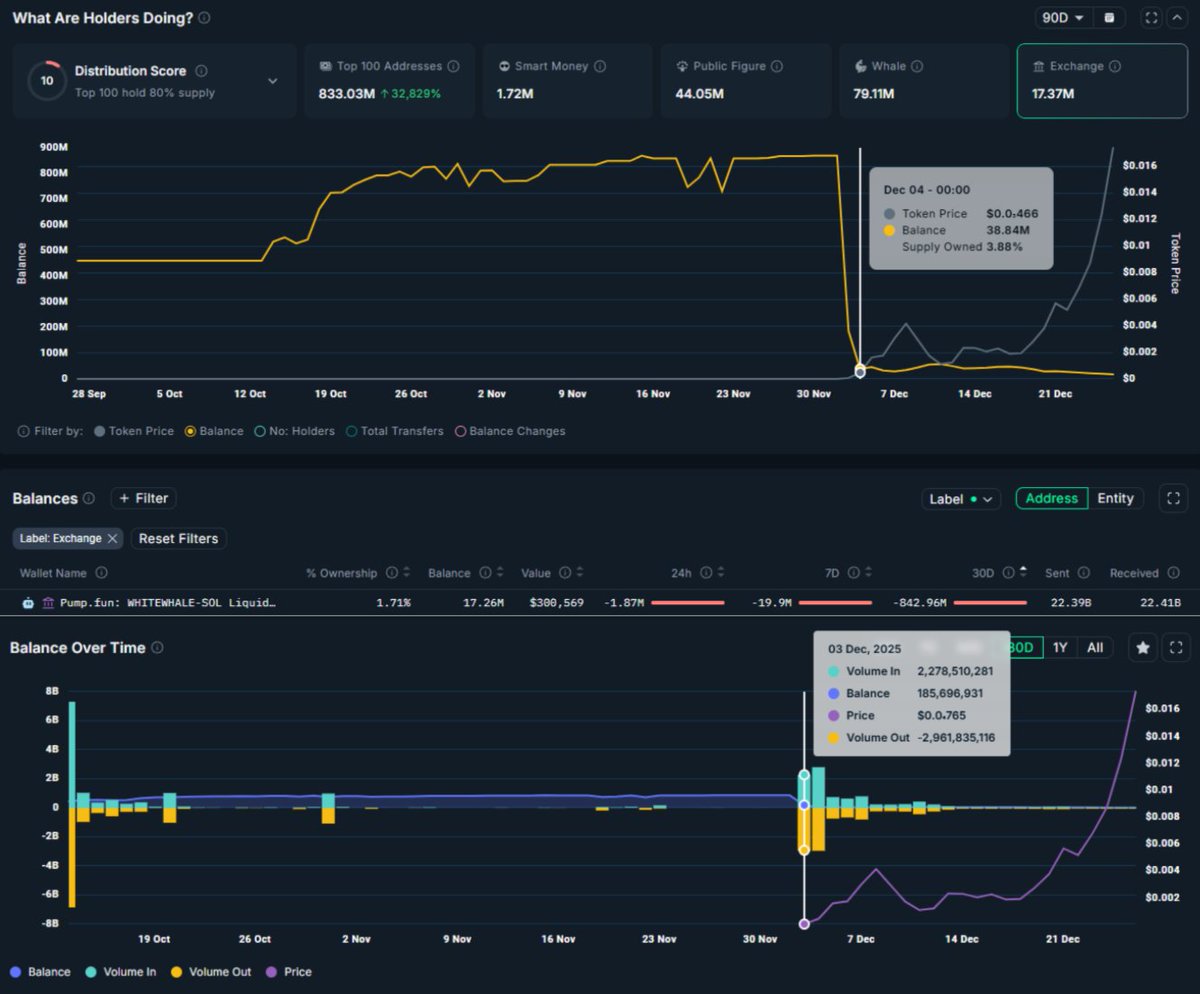

- Then on Dec 2, the supply held by the top 100 wallets suddenly dropped from 870M to 140M $WHITEWHALE, according to @nansen_ai.

- After checking the Exchange tab, it became clear the drop was mainly caused by a large outflow into the primary liquidity pool.

- TIP: When you see spikes like the above in top 100, this is ALWAYS a signal to investigate further. If you want to see what sudden changes in the top 100 can lead to, check my post on top 100 dynamics in the QRT below.

Dec 4:

- My first automated signal on my Discord server fired from multiple wallets I track (I am only showing one wallet in the screenshot, not sharing all the alpha here).

- Shortly after, I received a Smart Money inflow alert. Another followed an hour later, alongside a signal showing volume was increasing. On-chain boxes checked.

Dec 7:

- An official post from @TheWhiteWhaleV2 announced that he had taken over and CTO’d the meme (I am not diving into the drama that happened afterwards, this post is not about that).

Dec 8:

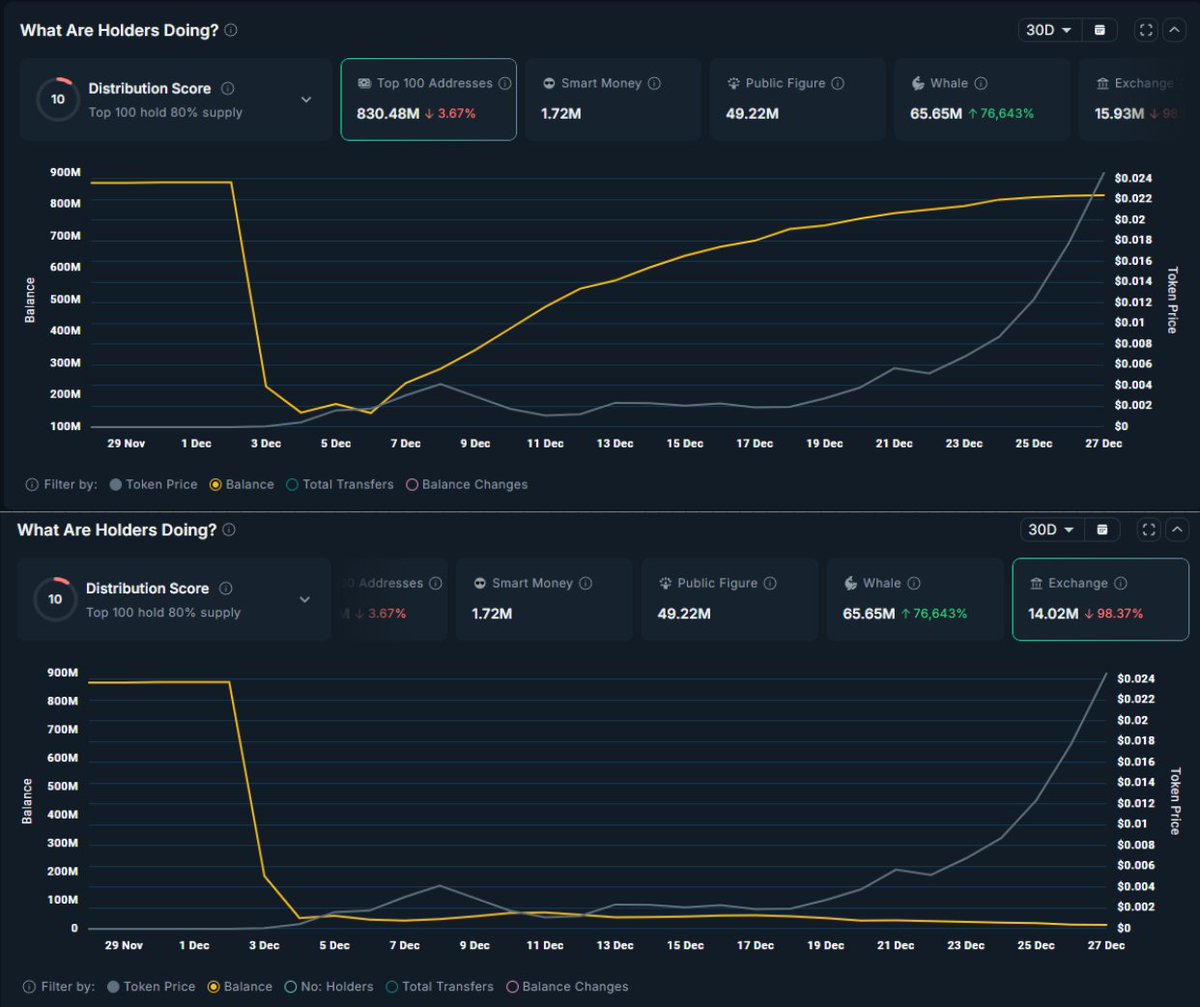

- From Dec 8 onward, the real top 100 holders, (thus excluding CEX/DEX wallets), increased their bags by over 80%, while exchange supply remained flat. I've been talking a lot about how important this is to pump a price.

- Beyond @TheWhiteWhaleV2 taking over, several other developments occurred. Examples include a treasury holding approximately $1M worth of crypto, roughly 35% of the $WHITEWHALE supply in the treasury as of now, multiple CEX listings, tokens locked until 2063, and giveaway campaigns and so on.

- I will not deep dive into these developments since this post focuses on on-chain analytics, but these factors clearly helped fuel momentum for @WhiteWhaleMeme.

Result:

A perfect supply squeeze combined with improving project fundamentals and community hype resulted in vertical price action that reached 100x from the first signal I received.

Conclusion:

Did I catch it? Damn, no. I am still testing the server and was on the road when the first signal came in on my phone.

On top of that, I had not yet checked the Top 100 versus Exchange data at that moment in time. But if I had and if I had fully studied the on-chain footprint and potential, I would have 100% aped this hard.

I am not saying this in hindsight because the price pumped. I am saying it because $WHITEWHALE checked every on-chain box I look out for:

- Wallets I track showed attention

- Smart Money involvement

- A bullish chart structure

- Volume expansion after the first signals

- Supply aggressively wihdrawn from the LP

- Project fundamentals and hype

- Flat exchange supply while top holders kept accumulating

All signals aligned. With a bit of luck, the bet would have been justified and the outcome proved it, like we see now.

At the very least, this gave me a clean on-chain setup to analyze and learn from. When the next opportunity comes, I will be ready. Because most of the pumps I've seen always follow the similar flows and pattern, which I have implemented in my overall framework.

The real value of on-chain signals is spotting conviction and positioning before the price action.

After years as a retail trading hub, BNB Chain is evolving into a rare ecosystem where retail users, institutions, and builders coexist. With RWAs, stablecoins, and real yield products expanding, 2026 positions BNB Chain as a key bridge between TradFi and crypto.

Biteye/4 days ago

This article dissects why Bitcoin’s latest bull cycle felt muted despite historic adoption. As ETFs, DATs, miners, and institutions reshaped liquidity, volatility collapsed, retail faded, and crypto-native capital sold into strength—marking BTC’s transition into a fully financialized asset.

DoveyWan/5 days ago

This article breaks down how a Polymarket bot exploits short-term mispricings without predicting direction. By asymmetrically buying YES and NO and keeping their combined cost below $1, traders can mathematically lock in profit on Polymarket—pure structure, no luck.

Jayden/7 days ago

The “Jesus Christ return” market on Polymarket isn’t about belief—it’s about structure. Low liquidity, recurring whale sell-offs, and attention cycles create repeatable 2–3 trades for those who buy panic and sell rebounds, year after year.

Dexter's Lab/2026.01.10

A deep dive into how trader “beachboy4” lost over $2M on Polymarket despite a 51% win rate. The analysis shows how overpaying for consensus, all-in bets, and ignoring probability-based risk management made losses inevitable.

Lookonchain/2026.01.05Original

A firsthand guide to swing trading built on extreme focus, volume analysis, and catalysts. By going all-in on one high-conviction stock at a time, this strategy shows how attention, patience, and discipline can outperform diversification.

Kevin Xu/2026.01.04

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

A whale exchanged WIF and Bonk positions for Fartcoin!

2024.12.25 11:01:14

MoreHot Articles

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

10 promising AI Agent cryptos

2024.12.05

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link