Before the 100x: How On-Chain Signals Exposed $WHITEWHALE Early

Cryptor

Cryptor

➥ How on-chain signals revealed $WHITEWHALE before the 100x

A deep dive into how multiple on-chain signals revealed $WHITEWHALE’s massive potential, showing accumulation, smart money flows, and supply dynamics before the 100x move.

Oct 13:

- More than two months ago, $WHITEWHALE launched on Pump.fun. It bonded and topped around ~80k MC, then died off.

- Price action was basically flat from Oct 13 to Dec 2. Another dead meme, right?

Dec 2:

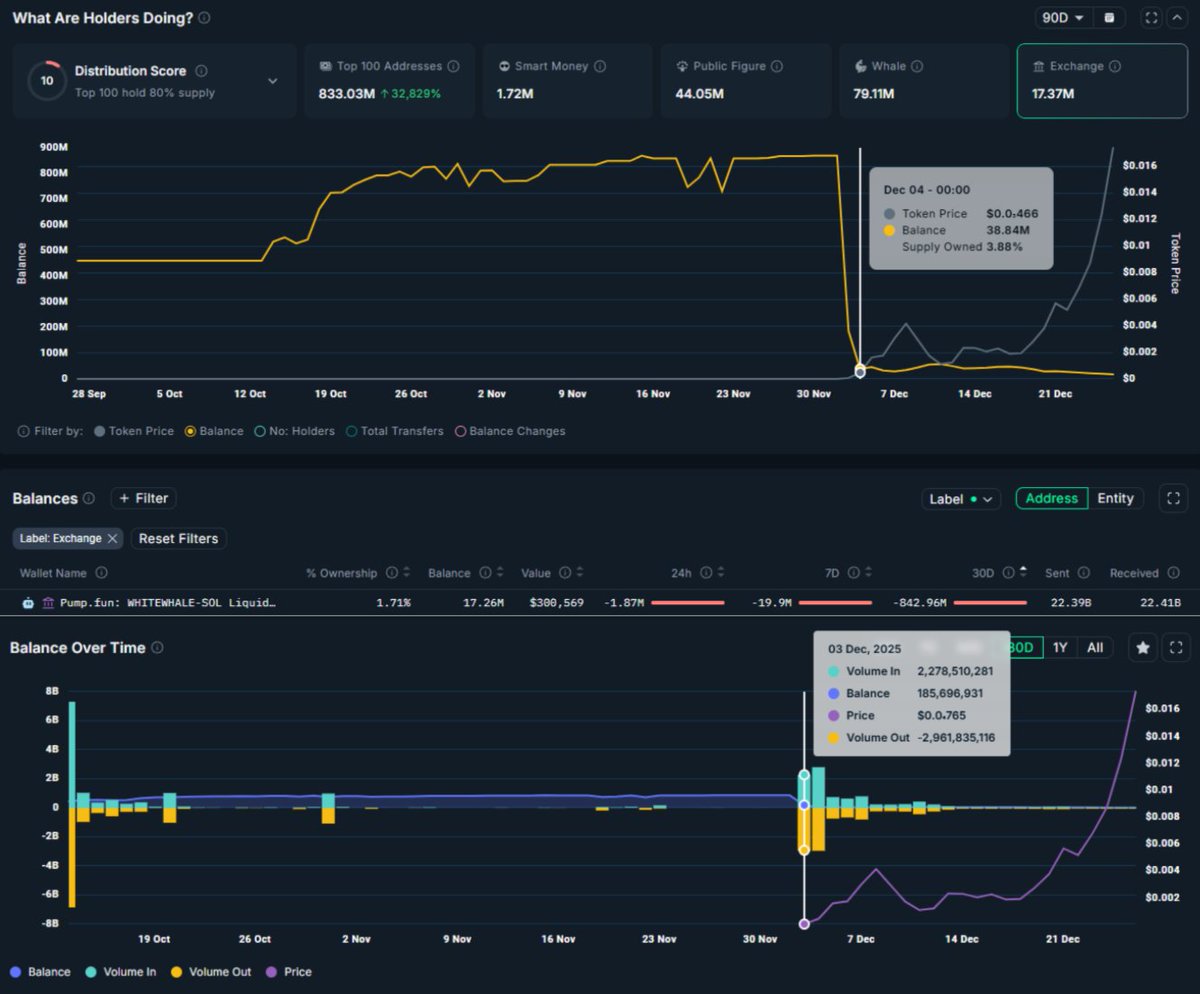

- Then on Dec 2, the supply held by the top 100 wallets suddenly dropped from 870M to 140M $WHITEWHALE, according to @nansen_ai.

- After checking the Exchange tab, it became clear the drop was mainly caused by a large outflow into the primary liquidity pool.

- TIP: When you see spikes like the above in top 100, this is ALWAYS a signal to investigate further. If you want to see what sudden changes in the top 100 can lead to, check my post on top 100 dynamics in the QRT below.

Dec 4:

- My first automated signal on my Discord server fired from multiple wallets I track (I am only showing one wallet in the screenshot, not sharing all the alpha here).

- Shortly after, I received a Smart Money inflow alert. Another followed an hour later, alongside a signal showing volume was increasing. On-chain boxes checked.

Dec 7:

- An official post from @TheWhiteWhaleV2 announced that he had taken over and CTO’d the meme (I am not diving into the drama that happened afterwards, this post is not about that).

Dec 8:

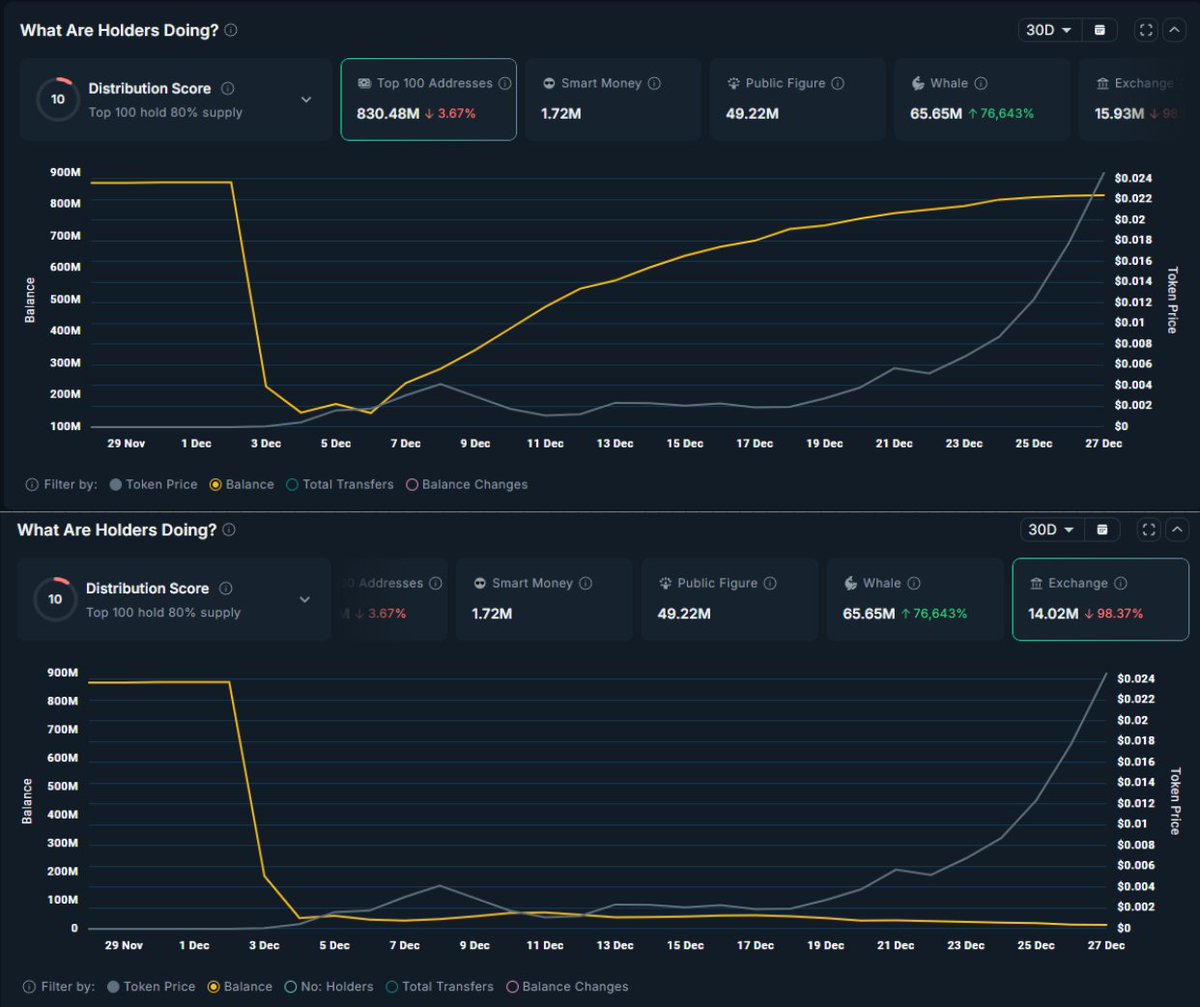

- From Dec 8 onward, the real top 100 holders, (thus excluding CEX/DEX wallets), increased their bags by over 80%, while exchange supply remained flat. I've been talking a lot about how important this is to pump a price.

- Beyond @TheWhiteWhaleV2 taking over, several other developments occurred. Examples include a treasury holding approximately $1M worth of crypto, roughly 35% of the $WHITEWHALE supply in the treasury as of now, multiple CEX listings, tokens locked until 2063, and giveaway campaigns and so on.

- I will not deep dive into these developments since this post focuses on on-chain analytics, but these factors clearly helped fuel momentum for @WhiteWhaleMeme.

Result:

A perfect supply squeeze combined with improving project fundamentals and community hype resulted in vertical price action that reached 100x from the first signal I received.

Conclusion:

Did I catch it? Damn, no. I am still testing the server and was on the road when the first signal came in on my phone.

On top of that, I had not yet checked the Top 100 versus Exchange data at that moment in time. But if I had and if I had fully studied the on-chain footprint and potential, I would have 100% aped this hard.

I am not saying this in hindsight because the price pumped. I am saying it because $WHITEWHALE checked every on-chain box I look out for:

- Wallets I track showed attention

- Smart Money involvement

- A bullish chart structure

- Volume expansion after the first signals

- Supply aggressively wihdrawn from the LP

- Project fundamentals and hype

- Flat exchange supply while top holders kept accumulating

All signals aligned. With a bit of luck, the bet would have been justified and the outcome proved it, like we see now.

At the very least, this gave me a clean on-chain setup to analyze and learn from. When the next opportunity comes, I will be ready. Because most of the pumps I've seen always follow the similar flows and pattern, which I have implemented in my overall framework.

The real value of on-chain signals is spotting conviction and positioning before the price action.

Bitcoin may enter a prolonged sideways phase between $57K and $87K as markets enter a relief period following a 52% drop from ATH. This consolidation could mirror the 2022 fractal, creating liquidity before a potential breakdown toward the $44K–$50K range.

Doctor Profit/1 days ago

Davinci Jeremie urged people to buy $1 of Bitcoin in 2013 and became a symbol of early conviction. Years later, fame, lifestyle flexing, and token promotions sparked criticism. His journey reflects both crypto foresight and influencer-era controversy.

StarPlatinum/7 days ago

A sweeping narrative ties Jane Street to India’s expiry-day options case, alleged 10AM Bitcoin sell patterns, Terra’s collapse, and ETF plumbing. While none prove misconduct, critics argue a common structure: move spot, monetize derivatives, keep execution opaque.

Bull Theory/2026.02.27

A controversial narrative links Jane Street, ETF mechanics, and Bitcoin’s price behavior, pointing to lawsuit allegations, 10AM volatility patterns, and derivative hedging dynamics. The discussion raises broader questions about liquidity, structure, and price discovery.

Justin Bechler/2026.02.26

A new federal lawsuit alleges Jane Street exploited non-public information tied to Terraform’s liquidity defenses, accelerating UST’s depeg and the Terra collapse. The firm denies the claims. The case may reignite debates on structure, design, and regulation.

Diana/2026.02.25

Mean reversion and on-chain models sit at levels historically linked to bottom formation after capitulation. Realized losses reached record USD values, while deviations from anchor models remain extreme. Price pain may be fading; patience remains key.

Checkmate/2026.02.25

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

When Elon Musk tweeted about Moltbook, the meme coin MOLT experienced a short-term 30% price surge, hitting a new all-time high of $114 million.

2026.01.31 18:37:29

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

MoreHot Articles

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

10 promising AI Agent cryptos

2024.12.05

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link