Zcashs Revival: How ZEC Is Reclaiming Bitcoins Lost Cypherpunk Soul

Simon

Simon

If you told me 6 months ago that Zcash would start absorbing Bitcoin’s original use-case, I’d have laughed.

Today, I’m not so sure...

In fact, I believe a strong case can be made that BTC's original cypherpunk vision has been hijacked.

Not just because it has underperformed things like the $QQQ's, but because its role as a sovereign, censorship-resistant, private medium of wealth storage and transfer has been hollowed out...

For example,

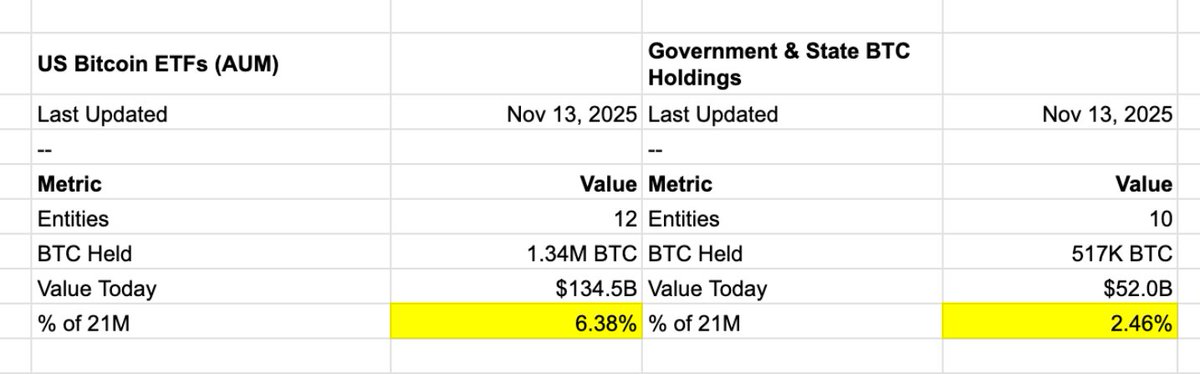

~9% of all BTC sits in US ETFs or government treasuries today; custodial, surveilled, fully transparent structures where individual sovereignty is basically zero.

At the same time, global financial surveillance is accelerating.

From EU stablecoin balance caps, eventual roll outs of CBDC’s across a range of jurisdictions and the very real possibility of a more interventionist, anti crypto “democratic socialist” US government.

What many no longer discuss is that Bitcoin actually had an opportunity to fix this over a decade ago...

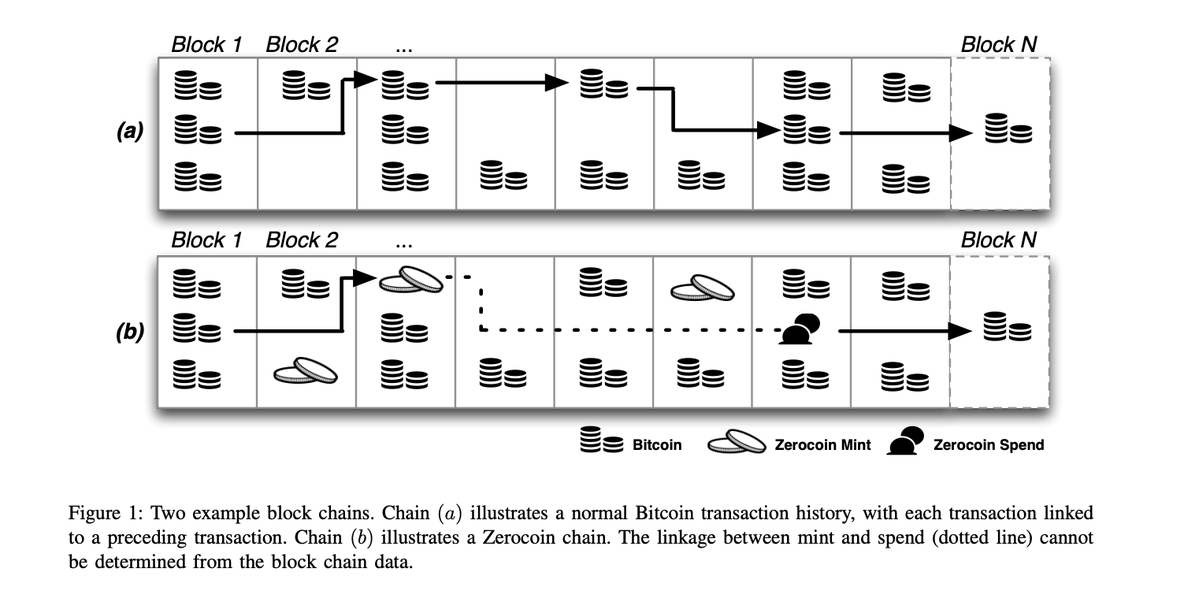

The Zerocoin proposal, a cryptographically sound privacy layer designed specifically for Bitcoin, was brought to the community in 2013.

It could have become Bitcoin’s native shielded transaction system or at least a sidechain that preserved the asset’s cypherpunk roots.

But Bitcoin Core rejected it.

Not because it didn’t work, but because the culture had already begun shifting toward “don’t change Bitcoin,” ossification, and risk-aversion.

The team behind Zerocoin eventually left and created Zcash, implementing the privacy Bitcoin refused to adopt.

Against that backdrop, Bitcoin has no credible way to shield balances or transaction flows.

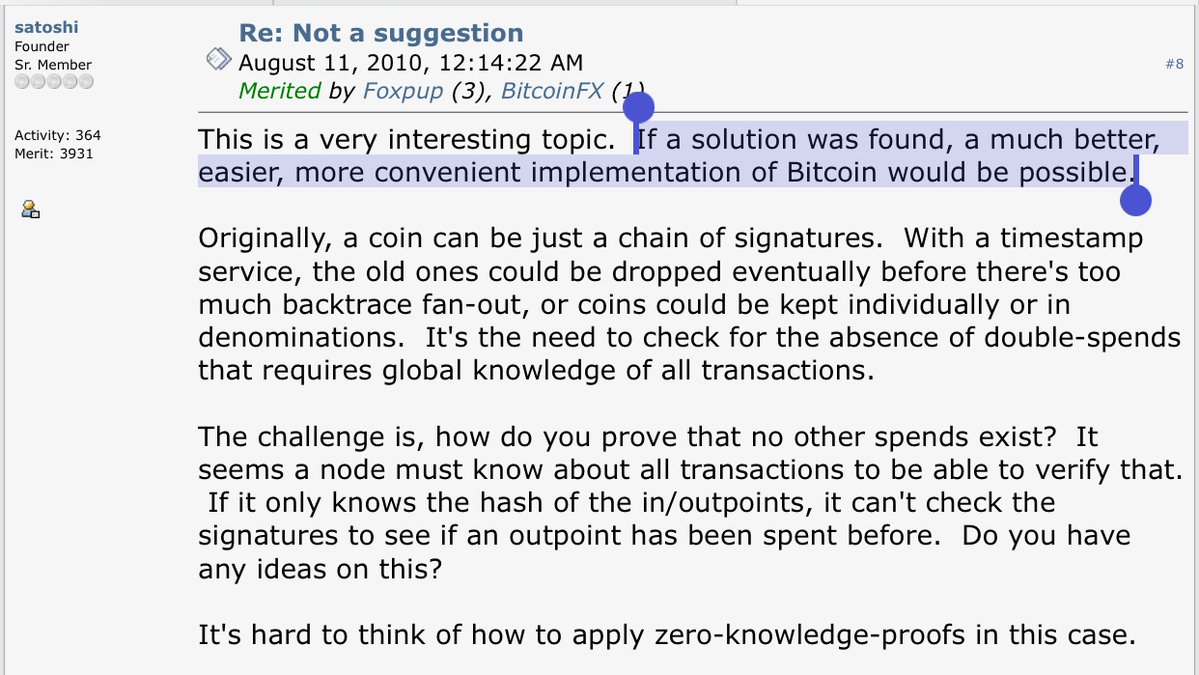

Even Satoshi openly acknowledged this limitation in 2010: “If a solution was found, a much better, easier, more convenient implementation of Bitcoin would be possible.”

He was talking specifically about privacy.

If you go back through Bitcointalk archives, it’s clear a lot of early Bitcoiners believed that if stronger cryptographic tools existed then, Bitcoin would’ve implemented them from day one.

That sentiment never fully went away, and as modern ZK proving systems have matured, it’s resurfaced in a very real way.

This is (IMO) one of the biggest drivers behind ZEC’s recent outperformance today.

But why ZEC then and not $XMR?

Monero is obfuscation, not encryption; so it is weaker from a technical POV.

Further, XMR's branding as a “darknet coin” permanently limits its mainstream legitimacy. Zcash, on the other hand, has consciously rebranded itself around freedom, sovereignty, and cryptographic integrity, not as the preferred currency of criminals...

/////

The larger, more recent and timely unlock for ZEC though, is less around its branding but more around recent advances in UX.

Last month, NEAR Intents fully integrated ZEC, rolling out Zashi Swaps.

This has helped enable native, shielded, cross-chain swaps directly onchain and on mobile (without having to use a CEX).This is the infrastructure ZEC never had.

And since its gone live, the market has reacted.

$ZEC has already gone from ~$78 to a peak of ~$800 before settling in the ~$500 range today, and on Near Intents it’s now out-voluming Bitcoin:

30D: $390M ZEC vs. $272M BTC

7D: $168M ZEC vs. $94M BTC

These flows tell a very clear story: since its become trivial for users to rotate their BTC into ZEC in a fully non-custodial, private way, they've begun doing it.

You can also see this playing out directly on-chain.

Since October 1st, nearly 1 million ZEC (+25%) has moved into shielded pools, almost all of it driven by a vertical explosion in the Orchard pool once intents + mobile UX went live.

Nearly 5M ZEC is now sitting in shielded pools.

Another important point: the Winklevoss twins have publicly thrown their support behind ZEC.

While it may be easy to write them off as low signal these days, them throwing their weight behind a new token is very significant.

People forget how instrumental they were to Bitcoin’s early breakout, they:

- were among the first major BTC whales (held ~1% of supply)

- helped shape the macro narrative in 2013

- provided early liquidity pipelines

- and they helped legitimize Bitcoin to institutions at a time when nobody else could.

In this sense, their backing isn’t symbolic but also signals to a very specific class of early adopters that ZEC is worth paying attention to.

Their alignment with the Trump administration also adds a non-trivial political dimension...

And it’s not just them. An increasing number of early BTC whales, have started to acknowledge that ZEC is picking up the values Bitcoin has slowly drifted away from.

You can feel that shift in tone if you track who’s resurfacing in the conversation

Finally, ZEC has also stood out because it’s been one of the only PvE assets since the October upgrade went live, not PvP like the rest of the space has felt.

Where most of crypto has been existing participants trading against each other (plus some ETF- and DAT-specific flows), ZEC has actually pulled in new capital:

- BTC holders rotating for privacy reasons

- off-chain capital looking for sovereignty guarantees

- and even Silicon Valley technologists who still believe in and want exposure to the original cypherpunk ethos.

When you put all of this together:

- institutional/government capture of BTC

- rising global surveillance

- Satoshi’s own comments about Bitcoin’s missing privacy layer

- Bitcoin core’s refusal to adopt Zerocoin or any credible privacy upgrade (forcing its creators to build Zcash instead)

- OG Bitcoiners revisiting the “what Bitcoin should have been” argument

- ZEC’s technical superiority over XMR

- the Zashi/Intents UX unlock

- volume flipping BTC

- shielded supply going parabolic

- major early Bitcoin figures (Winklevoss + others) now supporting ZEC

- ZEC being one of the few PvE assets this cycle

…it becomes difficult to ignore the possibility that $ZEC is stepping into the role Bitcoin abandoned, a store of value with privacy and sovereignty built in.

Davinci Jeremie urged people to buy $1 of Bitcoin in 2013 and became a symbol of early conviction. Years later, fame, lifestyle flexing, and token promotions sparked criticism. His journey reflects both crypto foresight and influencer-era controversy.

StarPlatinum/2 hours ago

A sweeping narrative ties Jane Street to India’s expiry-day options case, alleged 10AM Bitcoin sell patterns, Terra’s collapse, and ETF plumbing. While none prove misconduct, critics argue a common structure: move spot, monetize derivatives, keep execution opaque.

Bull Theory/4 days ago

A controversial narrative links Jane Street, ETF mechanics, and Bitcoin’s price behavior, pointing to lawsuit allegations, 10AM volatility patterns, and derivative hedging dynamics. The discussion raises broader questions about liquidity, structure, and price discovery.

Justin Bechler/6 days ago

A new federal lawsuit alleges Jane Street exploited non-public information tied to Terraform’s liquidity defenses, accelerating UST’s depeg and the Terra collapse. The firm denies the claims. The case may reignite debates on structure, design, and regulation.

Diana/6 days ago

Mean reversion and on-chain models sit at levels historically linked to bottom formation after capitulation. Realized losses reached record USD values, while deviations from anchor models remain extreme. Price pain may be fading; patience remains key.

Checkmate/6 days ago

Bitcoin didn’t fail as an asset — it matured into an ETF-driven trade. As institutional ownership rose, correlation with tech risk intensified. Short-term pressure reflects holder structure shifts, not thesis collapse.

Eric Jackson/2026.02.24

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

When Elon Musk tweeted about Moltbook, the meme coin MOLT experienced a short-term 30% price surge, hitting a new all-time high of $114 million.

2026.01.31 18:37:29

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

MoreHot Articles

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

10 promising AI Agent cryptos

2024.12.05

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link