POPCATs Collapse Explained: Not a Flash Crash — A Precision Attack That Cost Hyperliquid $4.9M

BITWU.ETH

BITWU.ETH

Last night, $POPCAT suddenly plunged. At first glance, it looked like another routine liquidation cascade. But deeper analysis—on-chain flows, order book behavior, and liquidation paths—reveals something far more deliberate: a coordinated liquidity system attack.

And this might not be the first time — or the last.

In DeFi, risk often comes from where we least expect. Like last night’s ambush, your position can vanish in seconds, even if you did nothing wrong. In a hyper-transparent yet highly manipulable perpetual DEX environment, such events are almost inevitable.

1. Timeline: A Pre-Meditated Operation

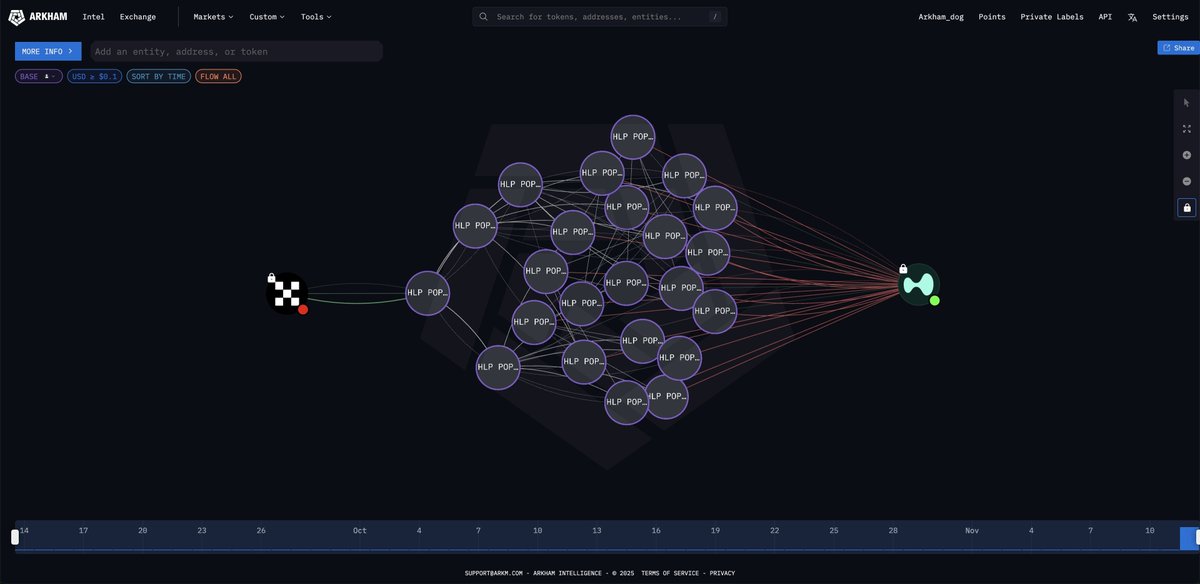

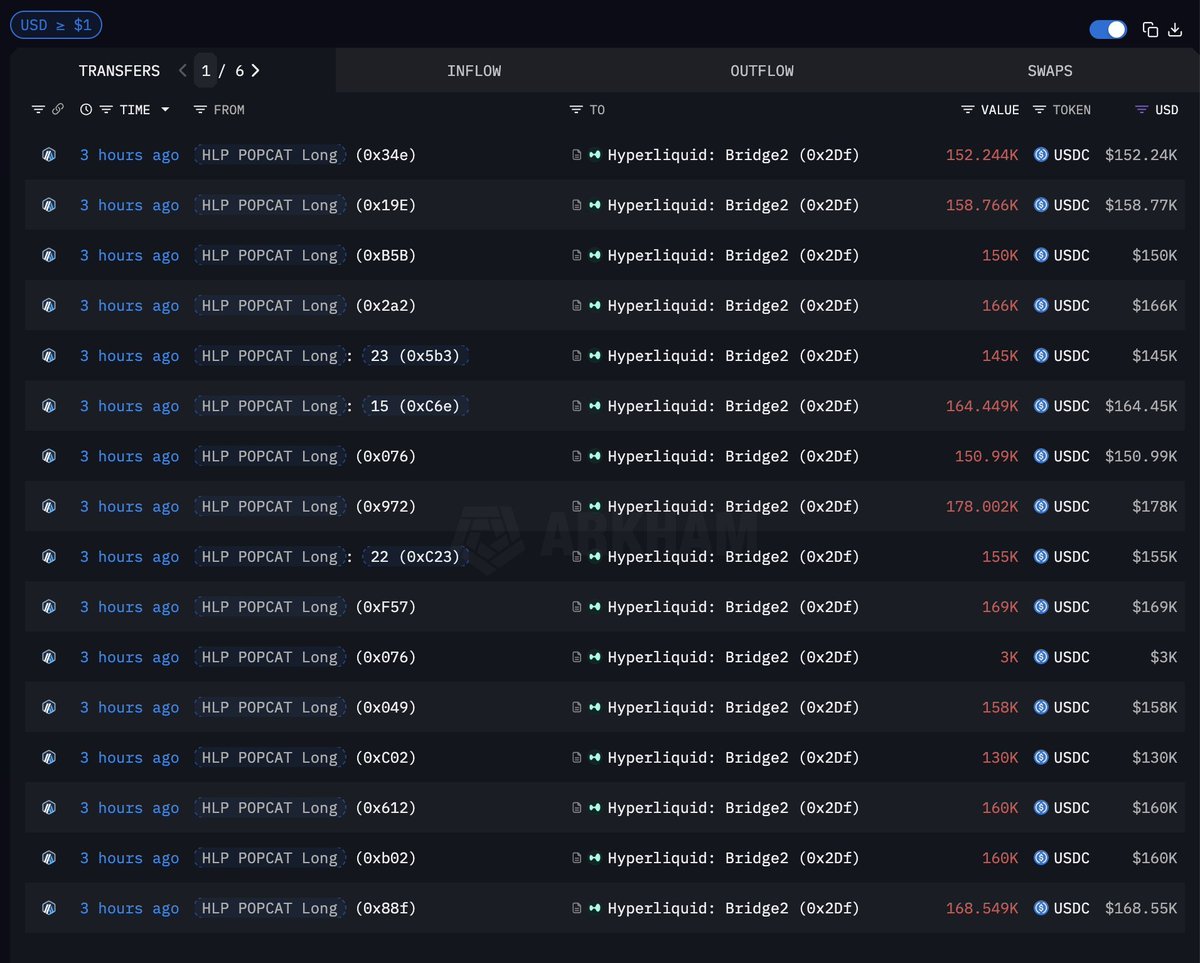

1️⃣ Capital & address preparation (13 hours before crash)

The attacker withdrew $3M USDC from OKX and split it into 19 addresses.

Purpose: evade risk controls and disguise total position size.

2️⃣ Building massive long exposure

He continuously opened longs on POPCAT via Hyperliquid (HL), growing exposure to $20M–$30M — enough to move the market.

3️⃣ Creating false depth: a $30M buy wall at $0.21

He placed an enormous buy wall to simulate organic demand, luring retail traders and algos into going long. The illusion of “strong support” strengthened confidence.

4️⃣ Retail and quant traders followed the bait, assuming smart money was accumulating.

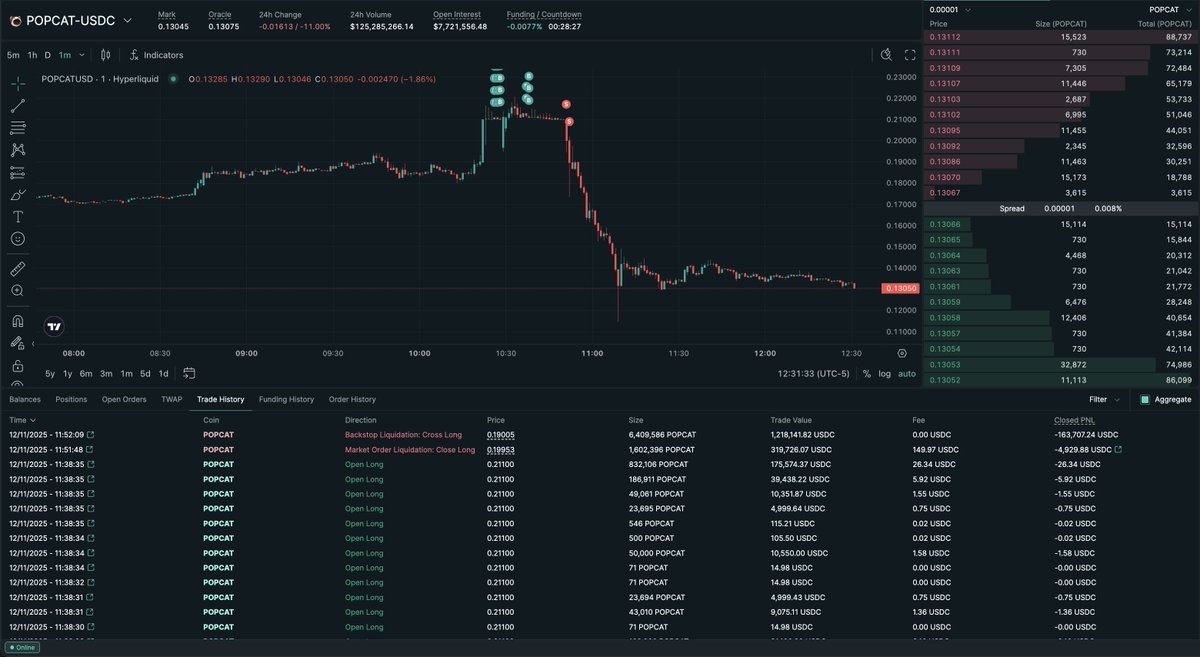

5️⃣ Instant buy wall removal → structural collapse

Without warning, he removed the wall. POPCAT’s thin liquidity couldn’t absorb the impact—price free-fell instantly.

6️⃣ Self-liquidation → collateral wiped

His own long positions were liquidated. The $3M collateral went to zero—intentionally.

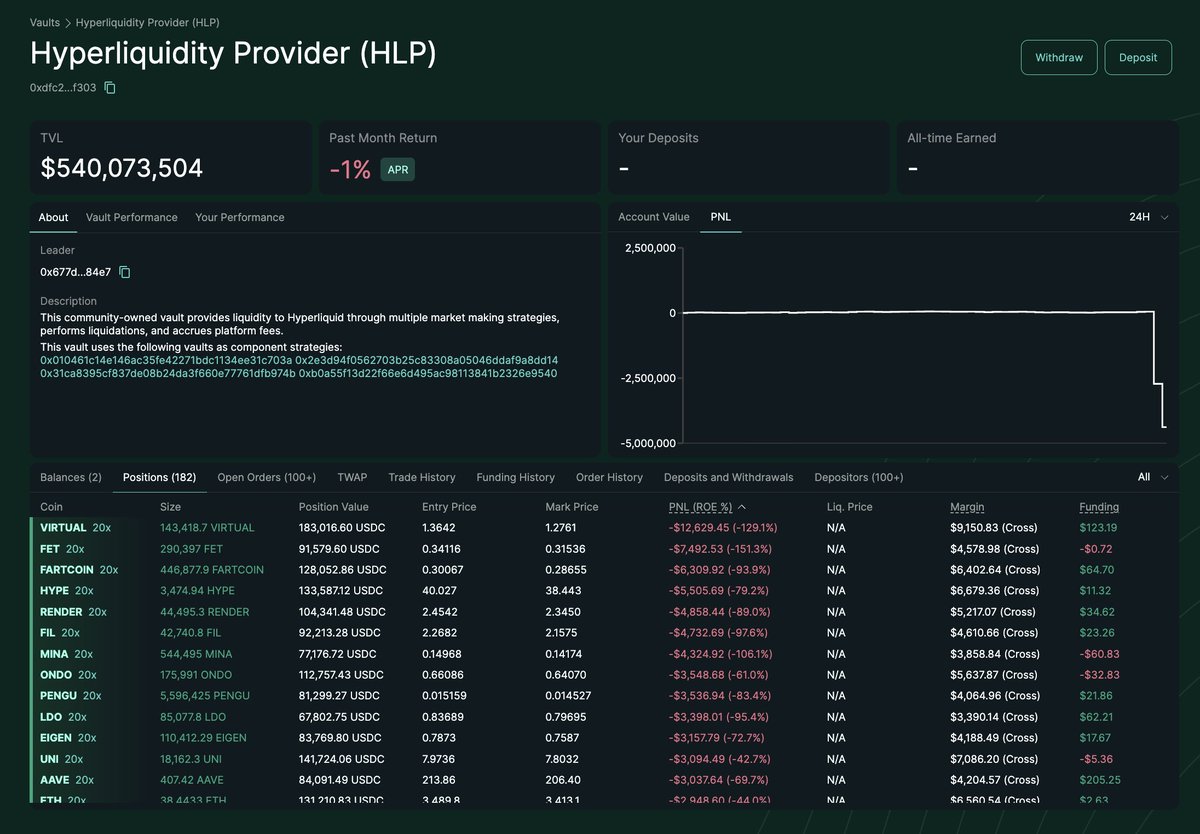

7️⃣ HLP (liquidity pool) absorbs bad debt → $4.9M loss

Because the attacker’s liquidation size far exceeded available depth, losses transferred to the protocol’s LP (HLP), which automatically absorbed the shortfall.

8️⃣ Hyperliquid intervened manually, closing residual risk.

9️⃣ The Arbitrum bridge was briefly paused (intra-exchange deposits/withdrawals unaffected).

In short:

He used real capital as bait, manipulated visual liquidity, exploited liquidation slippage, and forced the platform to eat the loss.

That’s the core vulnerability of perpetual DEXs.

2. Why This Wasn't a "Normal Liquidation"

Key clues:

19 split wallets → professional prep

Massive fake buy wall → intentional trap

Sudden removal triggering chain liquidations → deep mechanism knowledge

Zeroed collateral → planned sacrifice

Third major incident on HL → consistent pattern

This was not a trader gone wrong — it was a deliberate system-level arbitrage, using fake depth to trigger cascading liquidations and shift losses to LPs.

3. The Structural Weakness of Perp DEXs

The significance isn’t the $4.9M loss—it’s the revelation of a repeatable attack vector.

Decentralized perpetual protocols share the same structural flaw:

Low liquidity + High leverage + Orderbook dependency = Attack surface.

1️⃣ Low-liquidity assets (long-tail tokens like POPCAT) → cheap to manipulate.

2️⃣ High leverage (20–30x) → amplify small price moves exponentially.

3️⃣ Clearing relies on order book depth → manipulate depth, break liquidation path.

Combine all three, and the system becomes exploitable.

GMX, Drift, MUX, Vela, even early dydx—all have faced similar issues.

It takes only hundreds of thousands to trigger millions in losses, posing long-term risk across the Perp DEX sector.

4. Lessons and Takeaways

Perp DEXs like Hyperliquid exploded in popularity for transparency and on-chain fairness.

But transparency also means predictability, and predictability invites exploitation.

For traders:

Long-tail assets are easiest to manipulate.

On-chain buy/sell walls are never reliable.

Volatile markets attract manipulators.

Risk lies not only in price but in system design.

For LPs:

Perp DEX yield = counterpart risk.

Where leverage exists, bad debt will follow.

HLP/GLP/vLP = liquidation counterparties.

Extreme moves can impose asymmetric losses.

For the industry:

This will push protocols to:

Limit tradable assets

Redesign liquidation logic

Add anti-manipulation controls

Diversify oracle price feeds

Establish insurance or backstop funds

Restrict fake depth & rapid order withdrawals

Painful, but necessary. Every collapse forces the sector to evolve.

5. Final Thoughts: You Can’t Predict Risk, Only Yourself

POPCAT’s plunge was just one price move—but its design was surgical.

It reminds us that DeFi isn’t just tech—it’s a battlefield of incentives, systems, and human behavior.

The real danger isn’t market volatility. It’s when the system itself becomes the weapon.

You can’t predict where the next attack will come from—but you can know your limits.

Understand what you don’t understand. Avoid what you can’t measure.

Profit matters less than capital preservation.

Because in this market, if you don’t know where the yield—or the risk—comes from,

you are it.

From August 2020 to mid-2021 we built a mempool-watching sniping stack that turned crypto ignorance into $50M+. We chased Uniswap and Polkastarter listings, optimized latency (North Virginia nodes), invented looped buy contracts, scaled to 200 nodes, then conquered BSC—printing millions before stepping back.

CBB/2 days ago

Born from global festivals, RaveDAO fuses music, technology, and community into a decentralized ecosystem. With $RAVE, culture gains its own economy—powering governance, rewards, and real-world impact across chapters, artists, and fans worldwide.

RaveDAO/3 days ago

A $93M collapse at Stream Finance has exposed DeFi’s darkest flaw — unregulated “curators” managing billions in opaque vaults. As greed replaces transparency and trust shifts from code to humans, DeFi’s $8B ecosystem faces a systemic reckoning.

Blockbeats/6 days ago

Tom Lee’s Bitmine faces $1.3B in losses as Ethereum tumbles 30% from its peak, erasing months of corporate-fueled optimism. The firm’s “crypto balance sheet” experiment mirrors Bitcoin’s playbook but now tests whether institutional conviction can survive a bear market.

Bloomberg/2025.11.05

Many believe QE has started again, but the truth is more complex. QT continues until Dec 2025, the $50 B “injection” was a temporary repo loan, and history shows QE only begins after a true liquidity crisis. The cracks are forming—but the real storm hasn’t hit yet.

Doctor Profit/2025.11.04

FTX wasn’t truly insolvent — it was mismanaged, misrepresented, and dismantled. Court documents show the estate could have repaid all users in 2022 and grown to $136 B in value. Instead, asset fire sales, legal fees, and flawed leadership burned over $120 B in potential wealth.

Lookonchain/2025.10.31Original

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

A whale exchanged WIF and Bonk positions for Fartcoin!

2024.12.25 11:01:14

MoreHot Articles

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 promising AI Agent cryptos

2024.12.05

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link