The 10 Rules for Investing in Memecoins

Alex Mason

Alex Mason

Memecoins made me millions.

But only because I followed these 10 rules.

Here is the full list: 🧵

1. Picture Dogecoin or Shiba Inu—tokens that started as jokes but moved billions.

The memes are loud, but the mechanics matter.

If you understand what drives them, you stop chasing pumps—and start spotting them early:

2. Here’s the truth: Memecoins might start as jokes, but they follow real market rules.

Tokenomics, community strength, and timing drive the gains—or the collapse.

Ignore them, and you’re gambling. Understand them, and you’re early.

3. What separates a one-day chart spike from a long-term runner?

A loyal community, clear tokenomics, and some kind of vision—even if it’s wrapped in memes: ⏬

4 . Community is everything.

A loud, loyal group of holders can send a token flying—no utility needed:

Watch for active Telegrams, nonstop memes, and viral energy.

If the community’s obsessed, the chart usually follows.

5. Tokenomics decide who gets rich—and who gets dumped on.

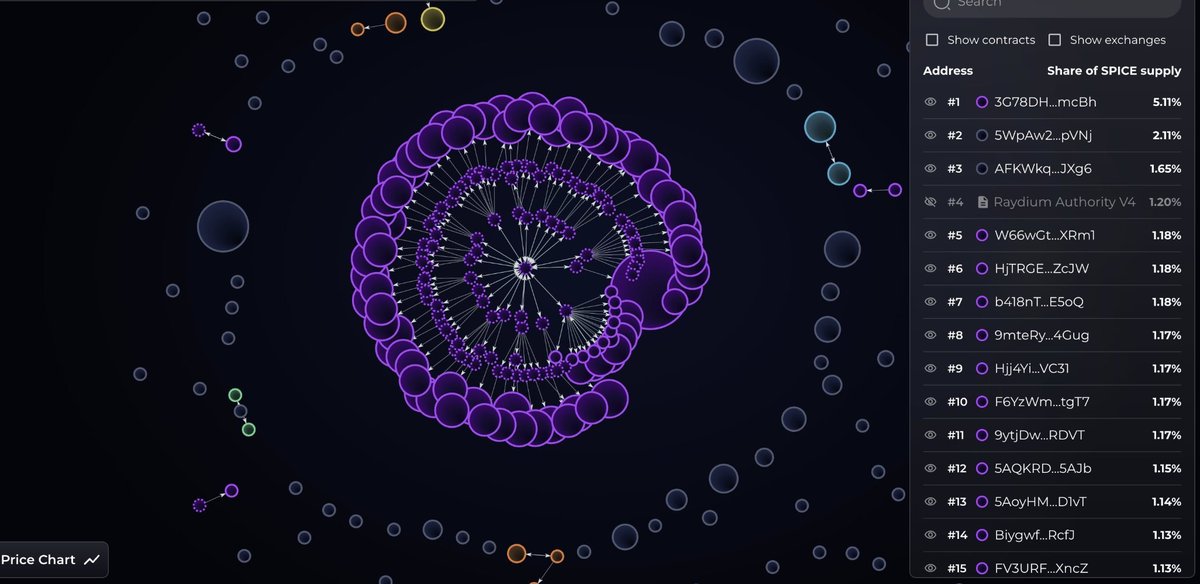

Check total supply, how tokens are distributed, and whether whales can nuke the chart.

If one wallet controls everything, you’re not early—you’re exit liquidity. This is where smart research pays off.

6. Memecoins live and die by the meme.

One viral post or influencer mention can light the fuse—but that spark fades fast if there’s nothing behind it.

Ride the wave, but always ask: is this just noise, or is something real brewing underneath?

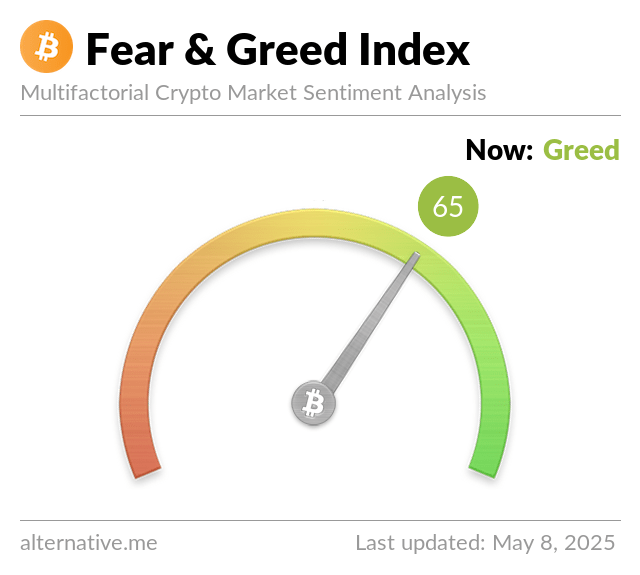

7. Timing is everything:

- Pay attention to Twitter chatter, meme velocity, and market mood.

- Too early, and you're stuck waiting.

- Too late, and you're exit liquidity.

Catch the wave—not the crash.

8. Due diligence is survival:

- Always verify contract addresses.

- Check if the devs are doxxed—or completely silent.

- Look at wallet distribution on Solscan, Etherscan, or BSCScan.

If it smells off or whales run the show, walk away. No meme is worth a rug.

9. Memecoins can 100x overnight—or nuke just as fast.

Set your entry and exit targets before you ape in. Treat every trade like it could go to zero.

If you can’t stomach the downside, you’re not ready for the upside.

10. For every Dogecoin that makes it, there are hundreds that vanish overnight.

Memecoins are pure high-risk, high-reward.

Never let FOMO drown out logic 👇

11. Follow a golden rule: never risk more than 10% of your bankroll on a single trade.

Protect your capital so you’ll always have firepower ready for the next opportunity.

From ICOs to NFTs to memes, every crypto cycle birthed an era where “dumb money” got rich fast. But after nine months of stagnation and no new wealth engine, the casino’s gone quiet. Without a new mania, CT isn’t bearish—it’s just bored.

IcoBeast.eth/3 days ago

By spotting illiquid Harmonix markets on Polymarket, I exploited rebalancing bots chasing USDC rewards. With just $100, I repeatedly trapped their auto-orders between bid-ask spreads—earning $1,500 in two hours, completely risk-free.

toto/5 days ago

Strategy Inc. controls 3.26% of all Bitcoin but faces a liquidity cliff. With $54M cash, $700M annual dividends, collapsing equity premiums, and potential MSCI index exclusion, it risks forced BTC sales that could shatter both its model and the market.

Shanaka Anslem Perera /5 days ago

In just five hours, the SP 500 erased $2T in market cap as Nvidia flipped from +6% to -3% despite record earnings. No headline caused it—extreme leverage, binary AI-driven sentiment, and record margin debt triggered a mechanical, fear-fueled reversal.

The Kobeissi Letter/2025.11.21

The implosion of Stream Finance’s xUSD and its contagion across DeFi wasn’t a hack—it was systemic failure. Recursive leverage, fake transparency, and circular dependencies revealed a harsh truth: DeFi’s “stable” yield is built on fragility and denial.

YQ/2025.11.20

Crypto got everything it asked for—ETFs, regulation, adoption—and prices still fell. The truth: most tokens trade at absurd multiples on casino-style revenue. Until real users and recurring value emerge, this isn’t a bull market—it’s a reality check.

Santiago R Santos/2025.11.19

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

A whale exchanged WIF and Bonk positions for Fartcoin!

2024.12.25 11:01:14

MoreHot Articles

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 promising AI Agent cryptos

2024.12.05

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link