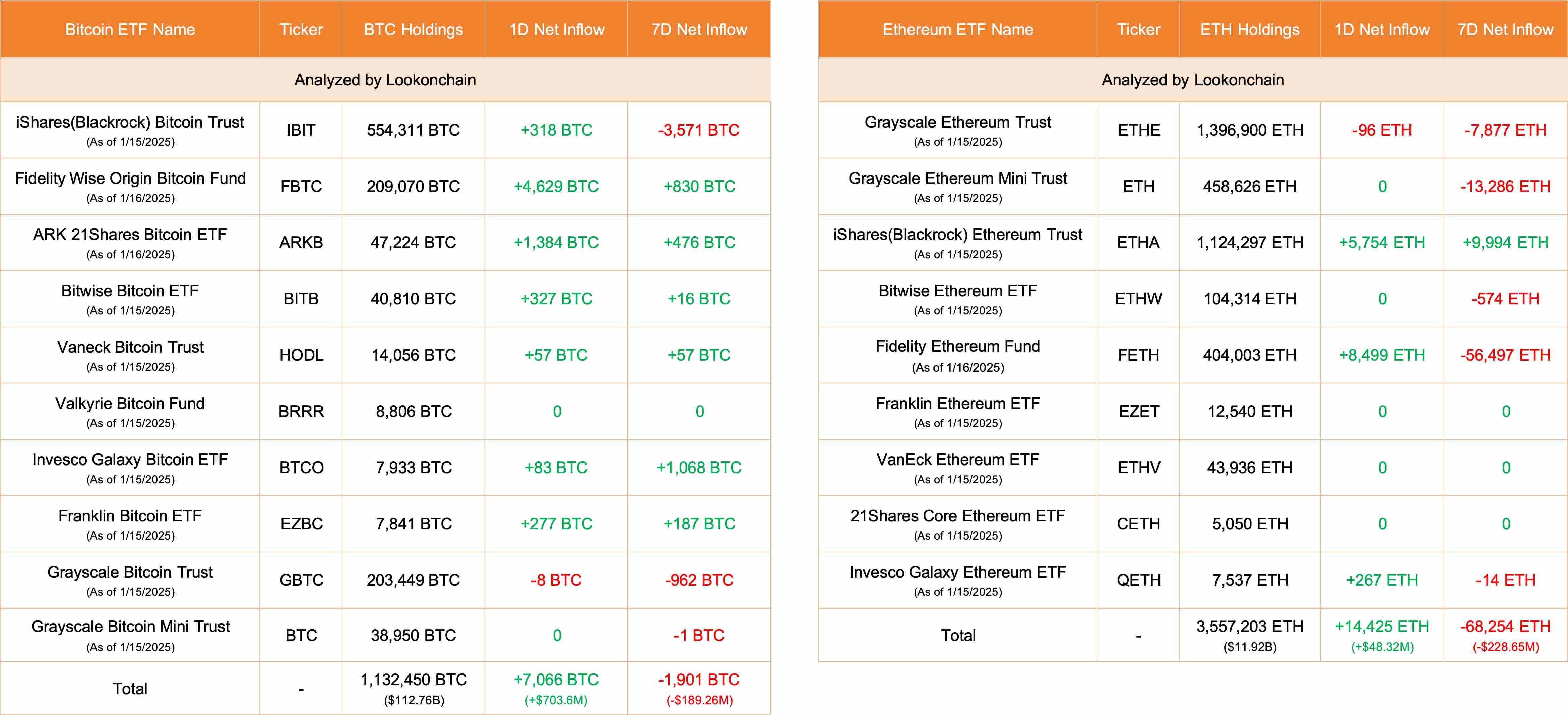

10 #Bitcoin ETFs inflows 7,066 $BTC(+$703.6M) and 9 #Ethereum ETFs inflows 14,425 $ETH(+$48.32M) yesterday.

2025.01.17 00:17:23

Jan 16 Update:

10 #Bitcoin ETFs

NetFlow: +7,066 $BTC(+$703.6M)🟢

#Fidelity inflows 4,629 $BTC($460.97M) and currently holds 209,070 $BTC($20.82B).

9 #Ethereum ETFs

NetFlow: +14,425 $ETH(+$48.32M)🟢

#Fidelity inflows 8,499 $ETH($28.47M) and currently holds 404,003 $ETH($1.35B).

https://x.com/lookonchain/status/1879542825521672397

Trump: Once the Iran War is over, the economy will immediately rebound

5 minutes ago

The European Commission has stated that Platform X has submitted a remediation plan for "Blue Label Certification," after X was fined 120 million euros by the European Union.

5 minutes ago

Institution: Oil Price Shock Could Boost Fed Inflation Outlook, Powell to Emphasize Patience

5 minutes ago

Market News: Explosion Heard in Dubai

5 minutes ago

U.S. March 1-Year Inflation Rate Expectation Initial Value 3.4%, Expectation 3.7%

5 minutes ago

A whale exchanged 4,480 XAUT for 10,242 ETH, worth approximately $21.92 million

5 minutes ago

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

When Elon Musk tweeted about Moltbook, the meme coin MOLT experienced a short-term 30% price surge, hitting a new all-time high of $114 million.

2026.01.31 18:37:29

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

MoreHot Articles

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

10 promising AI Agent cryptos

2024.12.05

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store

Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link