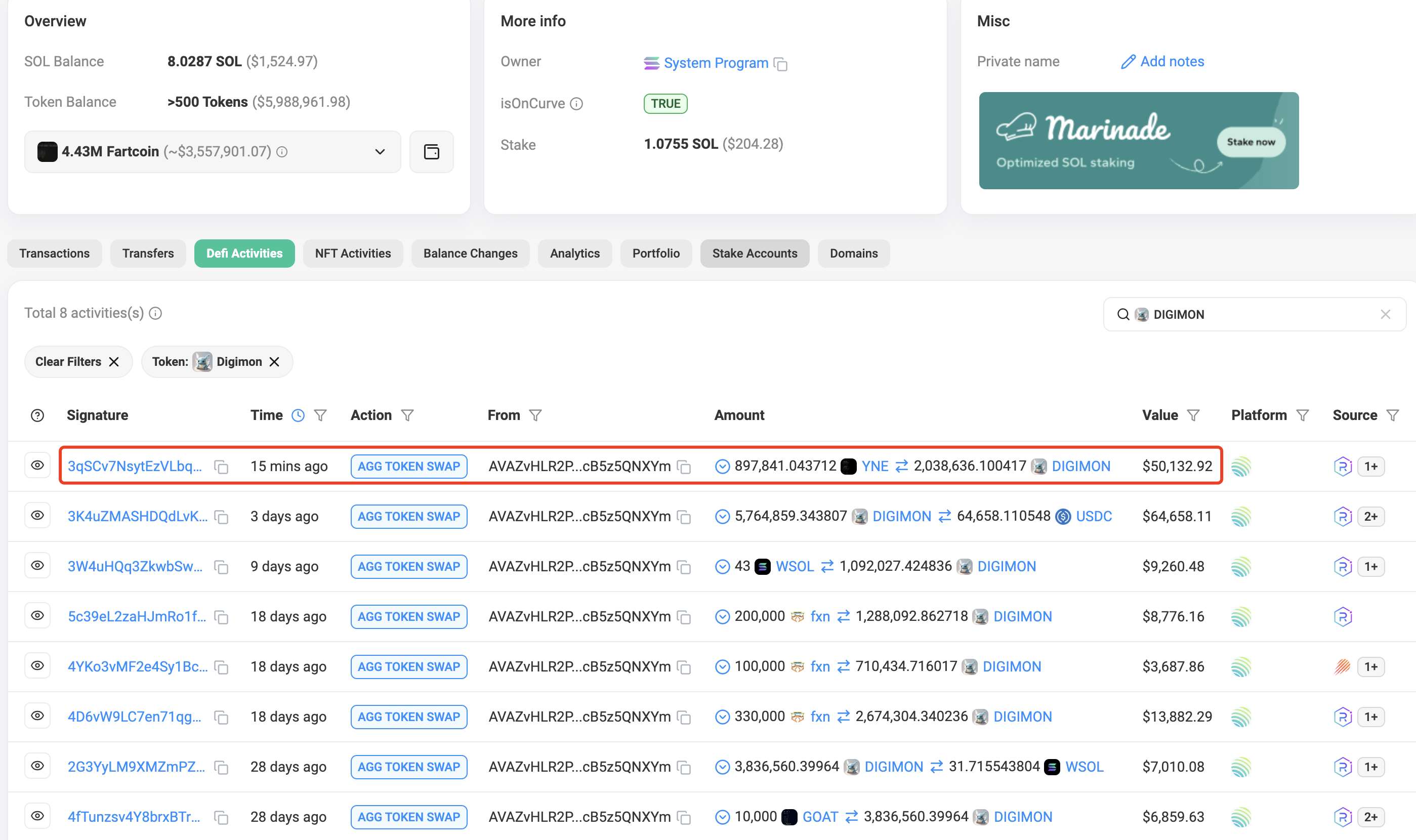

A wallet that was suspected by the community to belong to Ansem(@blknoiz06) bought 2.04M $DIGIMON($50K) again 15 minutes ago.

2025.01.13 01:23:17

A wallet that was suspected by the community to belong to Ansem(@blknoiz06) bought 2.04M $DIGIMON($50K) again 15 minutes ago.

Ansem had previously made ~$29K on $DIGIMON.

https://solscan.io/account/AVAZvHLR2PcWpDf8BXY4rVxNHYRBytycHkcB5z5QNXYm

MakerDAO Founder Longs Crude Oil, Takes Profit, Reallocates $2M

5 hours ago

Trump will hold a press conference at 5:30 PM Eastern Time

5 hours ago

Iran: US Continues Military Strikes, Hormuz Strait Security Cannot Be Restored

5 hours ago

Trump Considers Suppressing Energy Prices, Options Include Restricting U.S. Oil Exports

5 hours ago

「Buddy」 ETH Long Position Increased to $7.62 Million, Unrealized Gain of 40%

5 hours ago

Bhutan Government has transferred 175 BTC 2 hours ago, potentially for selling.

5 hours ago

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

When Elon Musk tweeted about Moltbook, the meme coin MOLT experienced a short-term 30% price surge, hitting a new all-time high of $114 million.

2026.01.31 18:37:29

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

MoreHot Articles

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

10 promising AI Agent cryptos

2024.12.05

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store

Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link