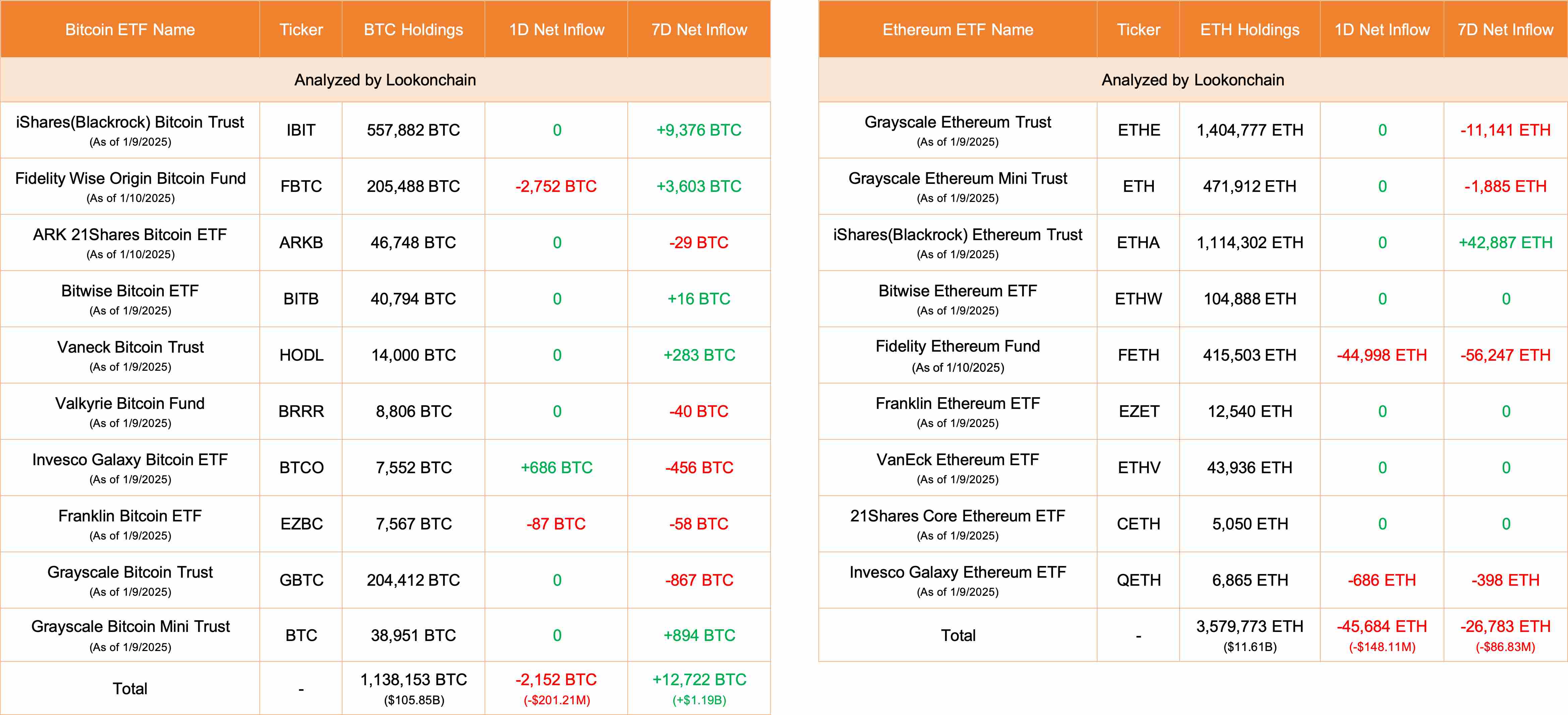

10 #Bitcoin ETFs outflows 2,152 $BTC(-$201.21M) and 9 #Ethereum ETFs outflows 45,684 $ETH(-$148.11M) yesterday.

2025.01.11 00:58:15

Jan 10 Update:

10 #Bitcoin ETFs

NetFlow: -2,152 $BTC(-$201.21M)🔴

#Fidelity outflows 2,752 $BTC($257.26M) and currently holds 205,488 $BTC($19.21B).

9 #Ethereum ETFs

NetFlow: -45,684 $ETH(-$148.11M)🔴

#Fidelity outflows 44,998 $ETH($145.88M) and currently holds 415,503 $ETH($1.35B).

https://x.com/lookonchain/status/1877370746105889201

U.S. March 1-Year Inflation Rate Expectation Initial Value 3.4%, Expectation 3.7%

5 minutes ago

A whale exchanged 4,480 XAUT for 10,242 ETH, worth approximately $21.92 million

5 minutes ago

WSJ: U.S. Military Considers Sending More Ships to the Middle East to Escort Tankers Through the Strait of Hormuz

5 minutes ago

TRUMP 24h Price Change Extends to 54%, Market Cap Reaches $2.419 Billion

5 minutes ago

A certain ETH whale with a long position of 120,000 coins now has a unrealized profit of nearly $26 million

5 minutes ago

U.S. Trade Representative: Tariff Refunds Should Be Distributed to Employees as Bonuses

5 minutes ago

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

When Elon Musk tweeted about Moltbook, the meme coin MOLT experienced a short-term 30% price surge, hitting a new all-time high of $114 million.

2026.01.31 18:37:29

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

MoreHot Articles

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

10 promising AI Agent cryptos

2024.12.05

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store

Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link