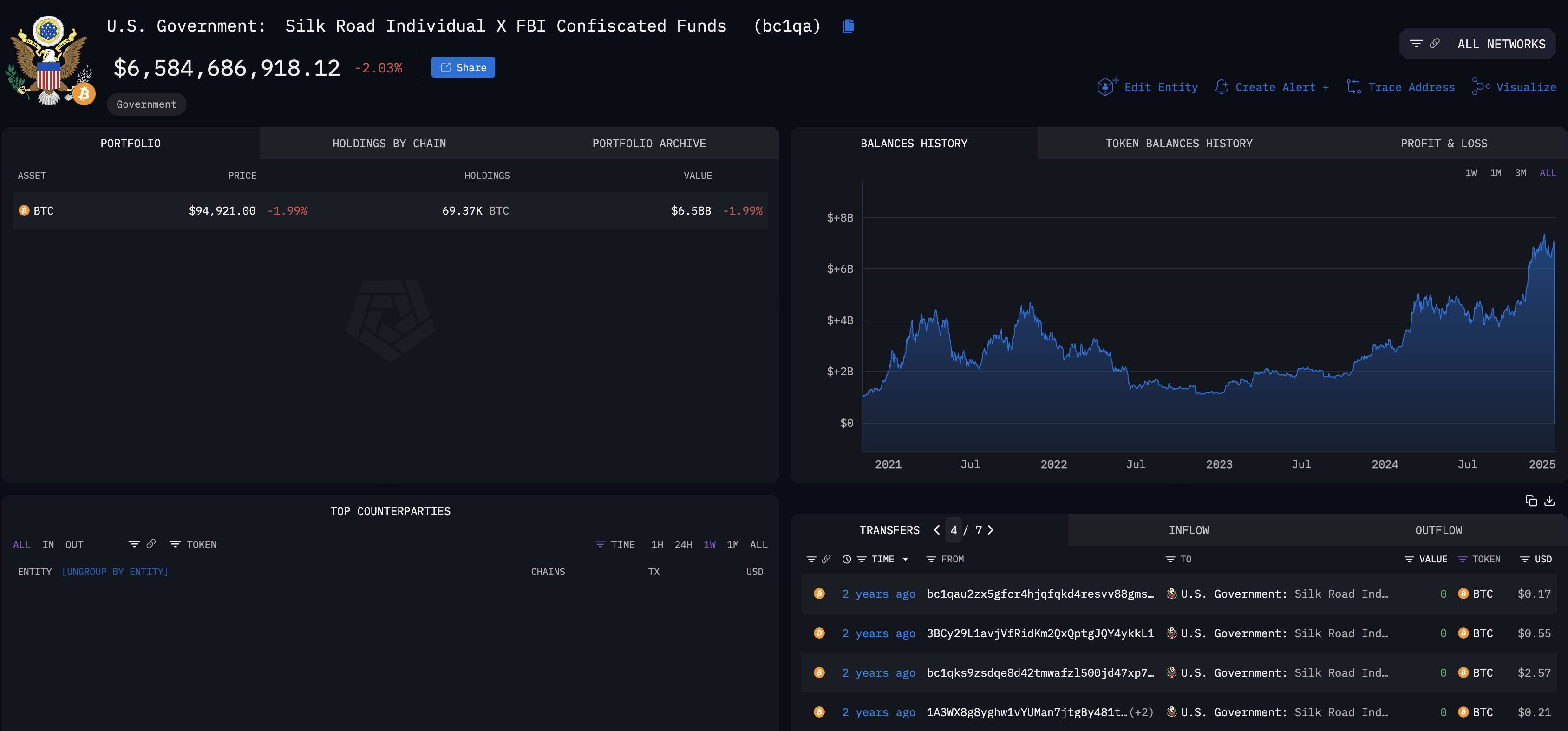

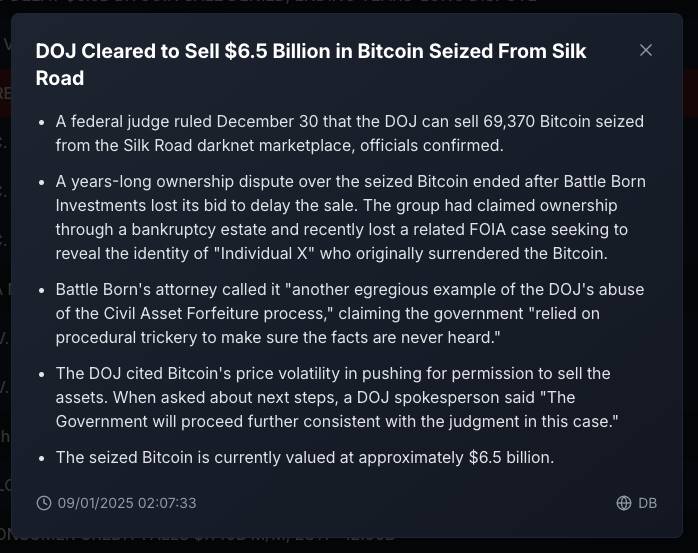

According to DB News, the DOJ is cleared to sell 69,370 $BTC($6.58B) confiscated from Silk Road.

2025.01.09 10:29:57

According to DB News, the 🇺🇸DOJ is cleared to sell 69,370 $BTC($6.58B) confiscated from Silk Road.

https://x.com/lookonchain/status/1843692654653256195

A Whale Sells 13,739 ETH, Worth Around $28.96 Million

10 minutes ago

Economists Predict Fed Will Cut Rates Twice This Year, Express Concern Over Wash

10 minutes ago

Viewpoint: Bitcoin's Short-Term Safe Haven Status Compromised Amid Oil Price Shock, Could Maintain or Drop to $50K-$58K

10 minutes ago

FT: Gulf oil producers have lost about $151 billion in energy revenue, with the Hormuz Strait nearly closed

10 minutes ago

Trump: Will Strike Iran Head-On in the Coming Week

10 minutes ago

Bitcoin Surges Past $72,000 Outperforming US Stocks, Futures Open Interest Rises to $107.6 Billion

10 minutes ago

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

When Elon Musk tweeted about Moltbook, the meme coin MOLT experienced a short-term 30% price surge, hitting a new all-time high of $114 million.

2026.01.31 18:37:29

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

MoreHot Articles

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

10 promising AI Agent cryptos

2024.12.05

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store

Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link