A trader turned $232 into over $1.1M on $mubarak—a 4,860x return!😱

1 days ago

A trader turned $232 into over $1.1M on $mubarak—a 4,860x return!😱

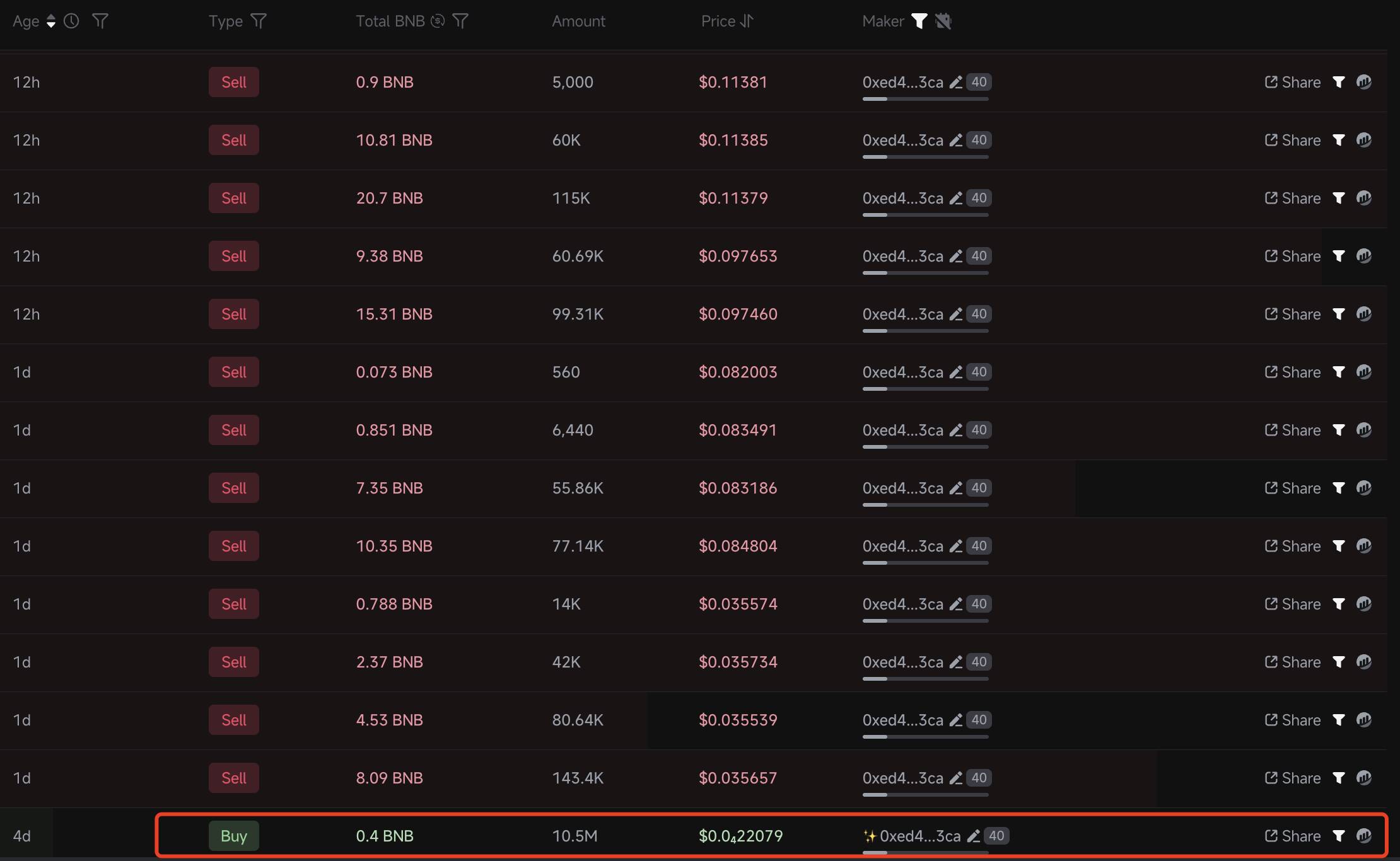

He spent only 0.4 $BNB($232) to buy 10.5M $mubarak and sold part of it for 576 $BNB($363.5K), leaving 5.16M $mubarak($764K) in 3 wallets.

Address:

https://gmgn.ai/bsc/address/lookonchain_0xed4476a3c94ee0938aa594c809bbfd59acc653ca

https://gmgn.ai/bsc/address/lookonchain_0x0fa1324b41374c6ec2c51a37557de675bda7f9dd

https://gmgn.ai/bsc/address/lookonchain_0xa2eee1ebff7071ac1a0af4b779df958b4113f3be

Cryptocurrency Prediction Platform Yeet Completes $7.75M Funding Round, Led by Dragonfly

13 minutes ago

Solana Mobile's second phone, Solana Seeker, is expected to start shipping in the summer of 2025.

13 minutes ago

A whale spent 971 WETH to buy 2.5 million VIRTUAL, experiencing an unrealized loss of $150,000.

13 minutes ago

Filecoin ecosystem liquidity mining protocol Glif airdropped 94 million tokens to eligible users, representing 9.4% of the total supply.

13 minutes ago

CME Solana Futures Trade Cool on Debut Day, ETF Approval May Struggle to Replicate Bitcoin Success

13 minutes ago

Justin Sun: TRX to Land on Solana

13 minutes ago

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A whale exchanged WIF and Bonk positions for Fartcoin!

2024.12.25 11:01:14

MoreHot Articles

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

10 promising AI Agent cryptos

2024.12.05

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

App Store

App Store

Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link