Solanas Inflection Point: The Next Institutional Adoption Story

Pantera Capital

Pantera Capital

We believe Solana is approaching a major inflection point in its adoption—by consumers, fintechs, & institutions.

Blue-chip companies like Stripe & PayPal are starting to build on it.

The stories for Bitcoin and Ethereum have largely been told. Solana's is just beginning 👇

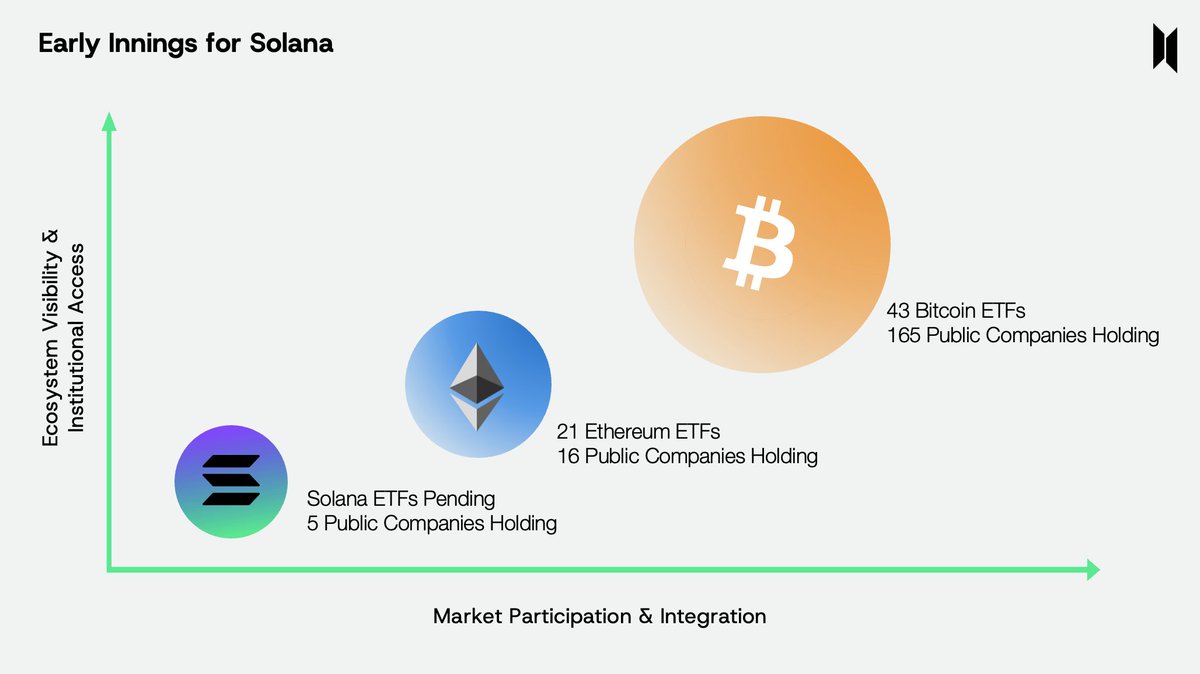

The ETF launches accelerated institutional adoption of BTC and ETH.

43 Bitcoin ETFs. 165 public companies hold BTC.

21 Ethereum ETFs. 16 public companies hold ETH.

Solana is still in its early days:

0 Solana ETFs. 5 public companies hold SOL.

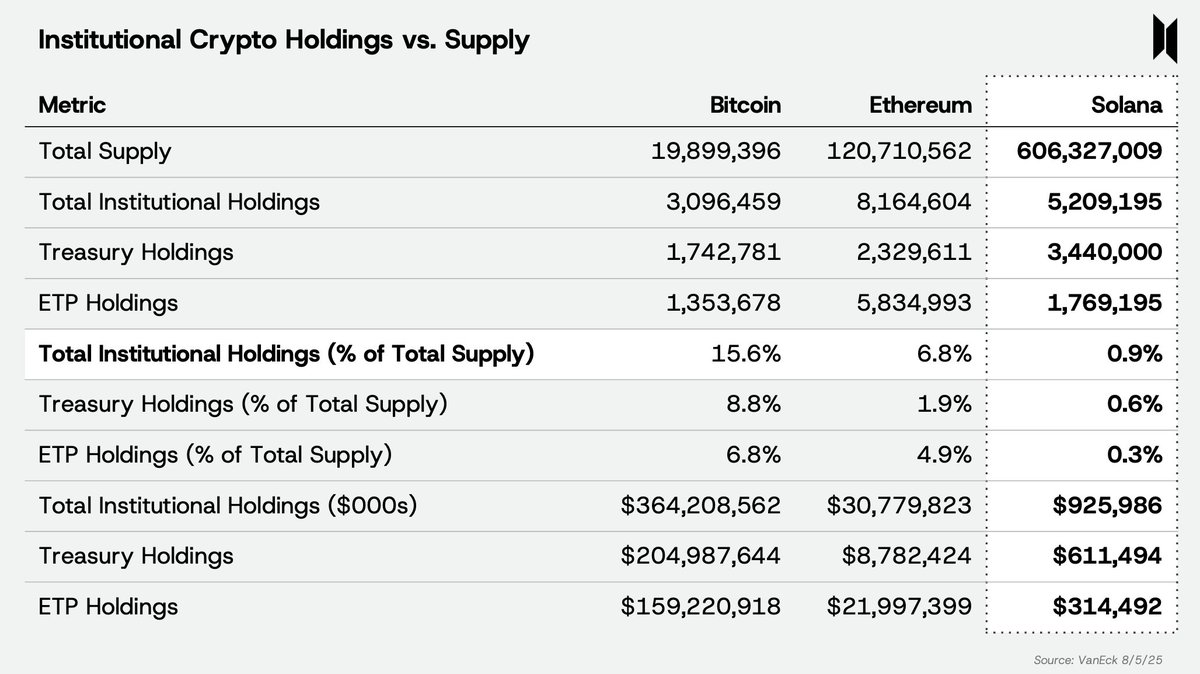

Institutions are currently under-allocated to SOL relative to BTC & ETH, holding less than 1% of the total supply—compared to 16% of BTC and 7% of ETH.

With a Solana ETF approval expected as early as Q4 2025, we believe Solana is next in line for its "institutional moment".

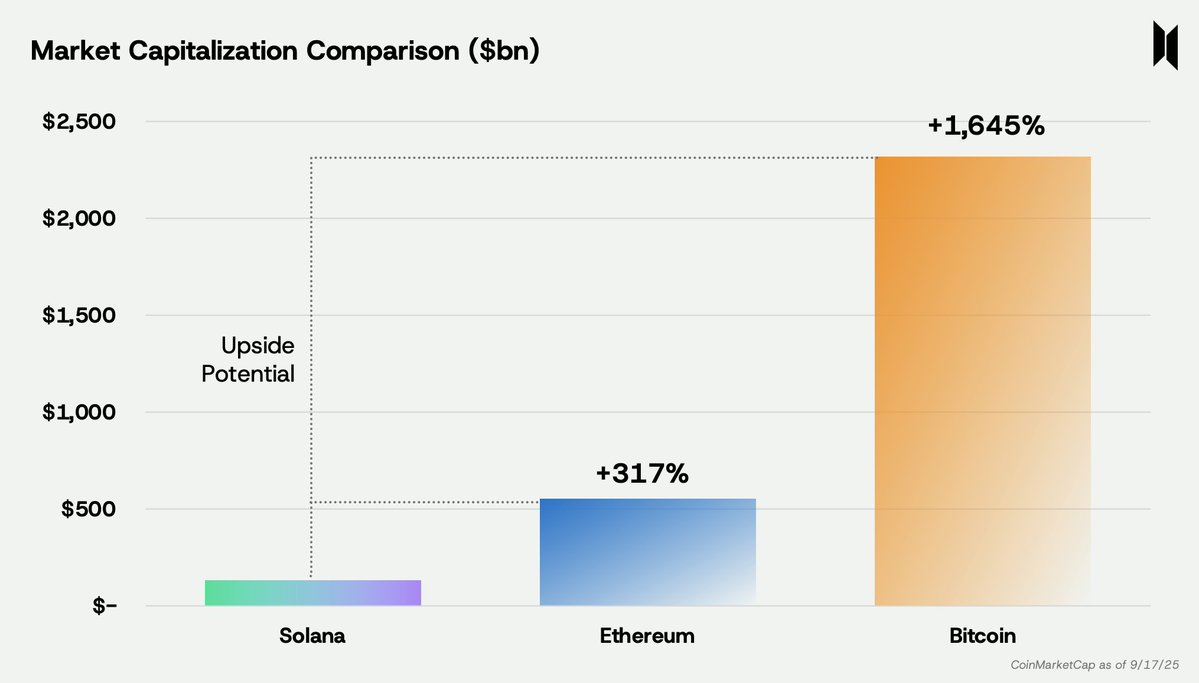

In terms of market capitalization, Solana is still just a fraction of Bitcoin (1/20th) and Ethereum (1/4th)—yet it leads both in key usage metrics.

We believe Solana’s adoption story is just beginning, offering greater asymmetric upside potential.

$ASTER is a new decentralized exchange designed to compete with Hyperliquid. The project is supported by YZi Labs, the rebranded entity of Binance Labs. Its core highlight is that because the token just launched and is only tradable on its own DEX, it presents a unique opportunity for early investors.

peely/2 days ago

The consensus among analysts is that upcoming Fed rate cuts will inject massive liquidity into the market, sparking a mega altseason. They predict Bitcoin could hit $150k+ and Ethereum $10k by late 2025, arguing that this setup is a familiar pattern from previous market cycles.

Lookonchain/3 days ago

This article argues that Bitcoins recent price action is not from weak demand, but a deliberate manipulation cycle by market makers. They use leveraged futures to create the illusion of weakness and liquidate retail traders, allowing them to accumulate at lower prices. The author argues this is a familiar pattern from past cycles, and this suppression will eventually lead to a massive parabolic run that breaks the cycle.

Ash Crypto/4 days ago

This report warns that Bitcoin is in a distribution phase, not an accumulation phase. The author points to a massive $13 billion whale sell-off and slowing ETF inflows, arguing that whales are using retail enthusiasm as exit liquidity. The report concludes with a firm prediction that a major downside move is coming, with a key liquidity zone for Bitcoin at $90K–$94K.

Doctor Profit/5 days ago

Arthur Hayes is best known as the former CEO of BitMex. However, he is also an influential and provocative essayist and crypto commentator who was convicted, then pardoned, for violating the Bank Secrecy Act

Arkham/2025.09.13

The author predicts that a new altseason is starting as money rotates into Ethereum and large-cap altcoins. To prepare, the author shares a personal portfolio of top picks across the DeFi, AI, and memecoin narratives, including $PEPE, $SOL, and $ENA. The strategy is to position now before the rally, with a plan to scale out of positions at new all-time highs.

Mister Crypto/2025.09.11

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A whale exchanged WIF and Bonk positions for Fartcoin!

2024.12.25 11:01:14

MoreHot Articles

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

10 promising AI Agent cryptos

2024.12.05

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link