BNB Chain and Binance Alpha Synergy Thrives: BSC Accounts for 40% of Alpha Trading Volume with Weekly Surge of 122.5%

Lookonchain

Lookonchain

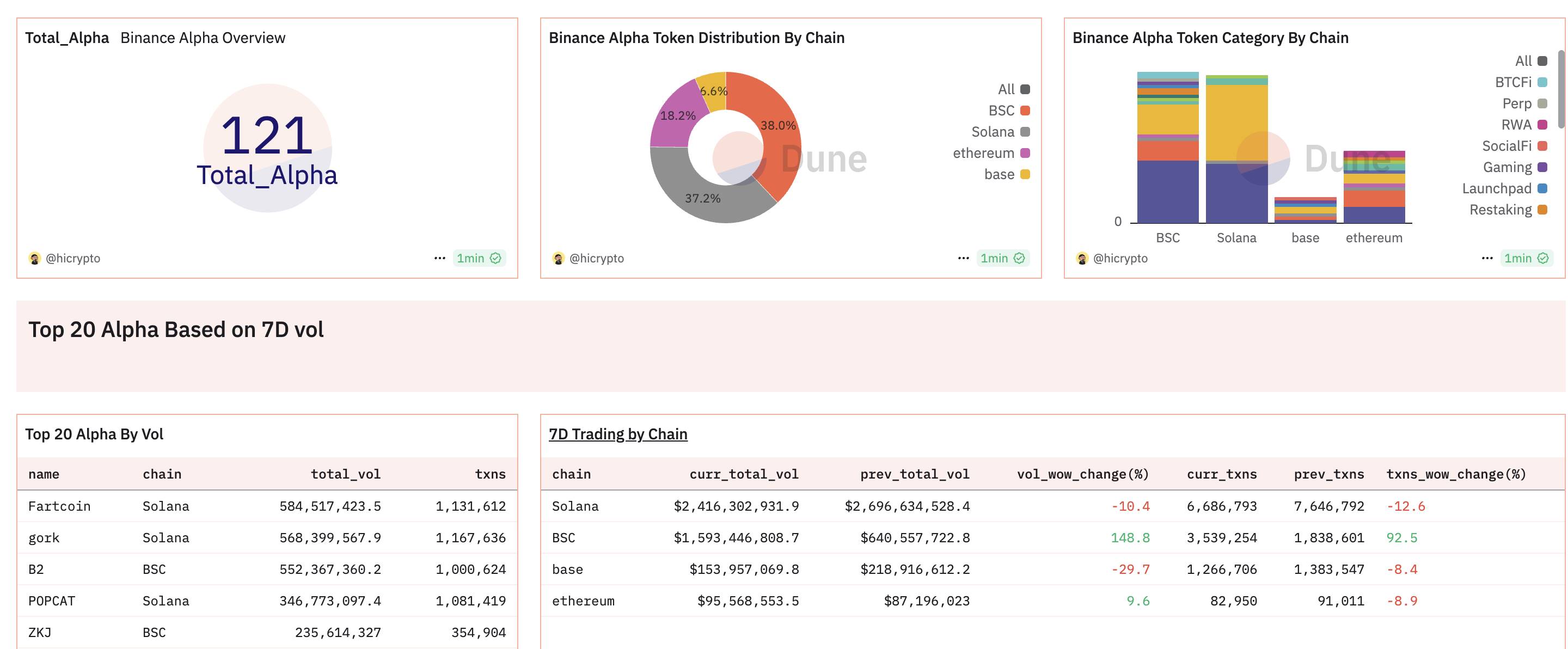

According to data from Dune and BscScan as of May 9, BNB Chain’s tokens in Binance Alpha has demonstrated remarkable growth:

Dominance in Alpha Projects: Over 70% of the 121 Alpha projects are BSC-based tokens, with 38% being BSC-native projects across trending sectors like AI, Meme, and DeFi.

Trading Volume Leadership: BSC tokens account for ~40% of total Alpha trading volume, with weekly trading volume surging 122.5% and weekly transaction value rising 78%, underscoring robust ecosystem momentum.

Key Highlights:

Top Alpha Tokens: Half of the top 20 Alpha tokens by 7-day trading volume are BSC-native.

User Growth Surge: Among the top 10 Alpha tokens by new active users, 90% are BSC-based, with 6 projects seeing over 20% new user adoption.

On-Chain Metrics: BSC added ~4.3 million new addresses last week, hitting 1 million+ daily new addresses for two consecutive days. Active addresses exceeded 2 million daily, while total unique addresses reached 552 million.

12 BSC projects have launched on Binance Spot via Alpha; Incentive Programs: The ongoing BSC Alpha Trading Competition offers rewards, with BSC token trading volumes double-counted toward Alpha Points for IDO eligibility. Binance also announced airdrops for holders of several BSC-native Meme tokens.

Powered by ultra-low gas fees (now 0.1 gwei), high throughput, and massive user base, BNB Chain has emerged as the go-to hub for project launches, user acquisition, and wealth creation. Its deep integration with Binance Wallet and the Alpha Program continues to drive cross-chain innovation and value capture.

Bitcoin’s surge to $125K masks growing macro fragility. Liquidity buffers are vanishing, insider selling is surging, and institutional cracks are widening. The report warns of a coming liquidity crunch — and a potential market reversal in Q4.

Doctor Profit/4 days ago

The last stage of a bull market isn’t about chasing every pump — it’s about discipline. Scale out, focus on winners, stay liquid, and preserve capital. Wealth is built across cycles, not in one sprint.

cevo/2025.10.03

Missed $ASTER, $XPL, or $APEX? Don’t worry—an airdrop renaissance is here. This guide breaks down the top 5 projects to farm, strategies to maximise points, and a system to spot future airdrops before the crowd.

Miles Deutscher/2025.09.30

BTC has already dropped 10% since the short call, targeting 106K in the near term before pushing towards 90–94K. Despite bullish distractions, markets show signs of stress—retail euphoria, insider selling, and global economic strain point to deeper downside.

Doctor Profit/2025.09.29

BTC is holding strong support, with R:R favoring longs unless $98K (1W50EMA) gets retested. Liquidations lean upside, with $106.9K a key liquidity zone. Sentiment is bearish, but setup favors recovery. Watching alts like $ASTER, $XPL, $APEX, $AVNT.

CrypNuevo/2025.09.29

BTC is approaching a pivotal Q4. Price action near EMA200/MA200 could set the stage for another leg higher, with targets at $117.5K–$125K. No cycle top yet, but history shows major moves often land in Oct–Dec. Watch $112K–$118.8K as critical levels.

Honey/2025.09.29

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A whale exchanged WIF and Bonk positions for Fartcoin!

2024.12.25 11:01:14

MoreHot Articles

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 promising AI Agent cryptos

2024.12.05

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link