Why Bitcoin Just Broke $93K — And What’s Next

Sjuul | AltCryptoGems

Sjuul | AltCryptoGems

$BTC is back above $93,000 for the first time since March.

Despite NASDAQ entering bear market territory, BTC is heading higher.

Here's what's driving this BTC rally: 🧵👇

First of all, like and repost the first tweet to continue these bull run vibes.

Today, BTC pumped above $93K for the first time in 7 weeks.

This move was not speculation but rather based on some emerging bullish narratives.

Let's dive into them

1) Tariffs negotiations

The White House said that over 30 countries are currently in talks with the US for tariff negotiation.

Countries like India have already made the deal, while several others will announce soon.

But this wasn't all..

The White House also said that the US is moving "very well" on a potential trade deal with China.

Donald Trump also said that tariffs on 🇨🇳China won't be as high as 145% and will gradually go lower with time.

This only indicates one thing: Trade war resolution is coming, and BTC has sensed that already..

2) Institutional accumulation

Yesterday, Bitcoin ETFs recorded their largest daily inflow in 3 months.

Since the ETFs approval, the BTC price has been moving very closely with inflows.

When inflow rises, BTC pumps, and the same has started to happen again.

But why are institutions buying $BTC?

Decoupling with US stocks and catching up with Gold.

Both these things are more than enough for institutions to accumulate BTC before it breaks above $100,000.

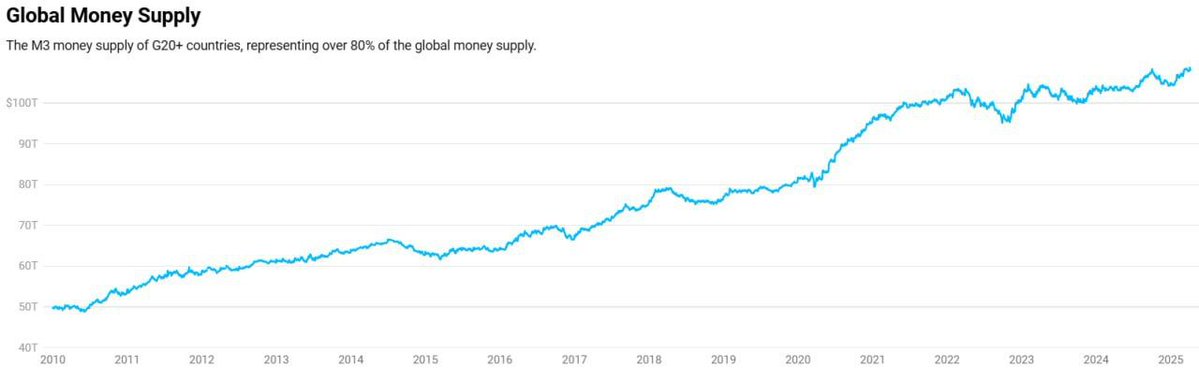

3) Rising liquidity

BTC price follows Global money supply.

Just recently, Global M2 supply hit another ATH.

This means BTC will definitely follow and hit a new ATH.

Although BTC and Global M2 supply don't have a 1:1 correlation, BTC usually hits a new ATH 10-12 weeks after global money supply hits a new ATH.

This means BTC could hit a new ATH in Q2, and currently smart money is buying at cheap.

4) Monetary easing

PBOC is already printing money.

BOJ is discussing starting a QE program.

Meanwhile, #Trump is forcing Powell to do rate cuts.

Even if these things take 2-3 months, markets always price in these events way before.

This is what's happening with BTC now, as it's front-running the upcoming QE program..

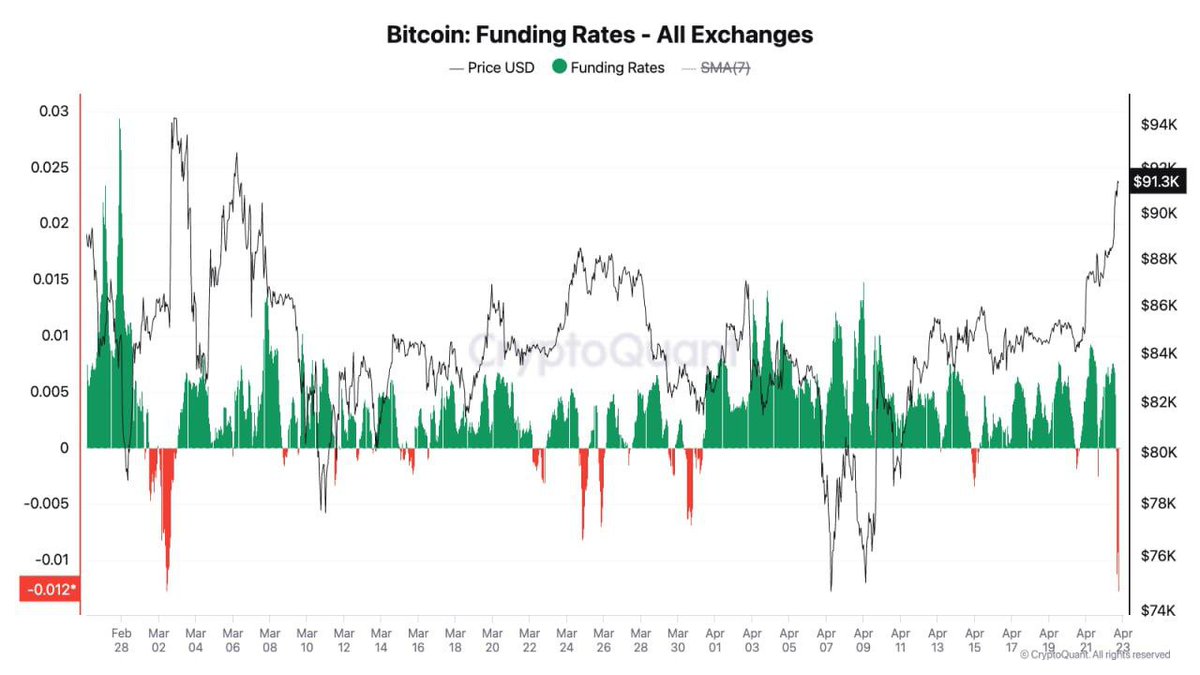

5) Short squeeze

After BTC moved to $88K, a lot of short positions were opened.

Most people thought that #BTC wouldn't go above $90K, and we know what happened.

A lot of spot demand came on Binance and Coinbase, which caused a massive short squeeze and price pump.

How high could BTC go?

BTC is up nearly $10,000 in a few days, so a small correction makes sense here.

The funding rate has also turned positive now, which means late longs will most likely get flushed.

After that, I'm expecting another leg up towards $100K in May/June.

$SUI jumps 30% today, up nearly 50% from this month’s low, fueled by strong DeFi growth, rising TVL, and exchange listings. It now ranks #9 by TVL (~$1.8B) and #6 by DEX volume. With over $900M in stablecoins and Sui Basecamp approaching, sentiment is bullish as SUI positions itself as a leading L1 alongside Solana.

Route 2 FI/17 hours ago

A deep dive into the 25 wallets eligible for the Donald $TRUMP dinner reveals 14 were created today, 56% have already sold, and only one is a genuine long-term holder. Some traders are gaming the system, shifting tokens to qualify multiple times. These wallets hold 80% of the supply—raising questions about fairness and centralization.

dethective/18 hours ago

The appointment of pro-crypto SEC head Paul Atkins could trigger a massive bull run, with $BTC projected to hit $200K. His focus on clear regulation may unlock institutional capital and fast-track ETF approvals. Altseason is expected soon, with six low-cap alts—like $CGPT, $GRIFFAIN, and $BIO—poised for 1000x potential.

Tracer/1 days ago

Vitalik Buterin, the creator of Ethereum, turned his passion for programming into a $1.3B fortune. Despite his odd persona and recent public skepticism, he remains deeply committed to $ETH and plans a major upgrade to the Ethereum Virtual Machine. His beliefs in crypto, regulation, and AI show his vision for the future of Web3.

Tracer/3 days ago

Crypto Twitter is buzzing: Trump eyes Bitcoin, Solana leads in staking, ETH gas fees hit record lows, and institutions ramp up BTC buys. From token burns to ETF filings and global adoption, the past week has been packed with major developments.

Sjuul | AltCryptoGems/3 days ago

From rejecting 50,000 BTC for a house in 2015 to Germany selling billions in Bitcoin early, the crypto world is full of brutal mistakes. Devs accidentally burned $10M in tokens, Otherside mint wasted $200M in gas, and early Punk holders sold too soon. Even pros like Murad and Alex Becker had costly fumbles.

StarPlatinum/3 days ago

Hot feeds

A trader profits $448K by monitoring #Binance's new listings!

2024.12.13 17:37:29

A smart #AI coin trader made $17.6M on $GOAT, $ai16z, $Fartcoin,$arc.

2025.01.05 16:05:18

A $PEPE whale that had been dormant for 600 days transferred all 2.1T $PEPE($52M) to a new address.

2024.12.14 10:35:27

A sniper earned 2,277 $ETH ($8.3M) trading $SHIRO within 18 hours!

2024.12.03 23:09:08

Last week, funds have flowed into #Bitcoin, #Ethereum, and #Hyperliquid.

2024.12.16 14:48:36

A whale exchanged WIF and Bonk positions for Fartcoin!

2024.12.25 11:01:14

MoreHot Articles

The 30-Year-Old Entrepreneur Behind Virtual, a Multi-Million Dollar AI Agent Society

2025.01.22

10 promising AI Agent cryptos

2024.12.05

10 smart traders specializing in MEMEcoin trading on Solana

2024.12.09

How did I turn $1,000 into $30,000 with smart money?

2024.12.09

A trader lost $73.9K trading memecoins in just 3 minutes — a lesson for us all!

2024.12.13

What is $SPORE? Let us take you through the on-chain records to show you how it works.

2024.12.25

App Store

App Store Profile

Profile Security

Security Sign Out

Sign Out

Feeds

Feeds

Articles

Articles Source

Source

Add to Favorites

Add to Favorites Download image

Download image Share x

Share x Copy link

Copy link